We know that they are lying, they know that they are lying, they even know that we know they are lying, we also know that they know we know they are lying too, they of course know that we certainly know they know we know they are lying too as well, but they are still lying. In our country, the lie has become not just moral category, but the pillar industry of this country.”

―Aleksandr Solzhenitsyn

So I covered the Bitcoin Bamboozle but I suspect Substack is limiting my reach here just as much or more ad Twitter

https://pete843.substack.com/p/the-bitcoin-bamboozle

Next up is the Tariffs. Its really hard to keep up with the lies, misinformation and Scams but it keeps me busy at least.

Trump on tax a couple of days ago during a speech in Las Vegas.

About 26 minutes in

How about just no tax, period?

[APPLAUSE]

You know, if the tariffs worked out like that, a thing like that could happen.

[MORE APPLAUSE]

Years ago, 1870 to 1913 we didn’t have an income tax. We had— what we had is tariffs. Where foreign countries came in, and they stole our jobs and they stole our companies, they stole our product, they ripped us off.

You know, they used to do a numbers— and then we went to tariff— a tariff system— the tariff system made so much money. It was when we were the richest, from 1870 to 1913.

Then we came in with the— brilliantly— we came in with the income tax, that we don’t want others to pay, let’s have our people pay.

And then you had the Depression in 1928-1929— I call it 1929 that was a bad time, but you didn’t have tariffs. The tariffs ended in 1913.

But— uh— it was the richest our country ever was…

We did have Tariffs after 1913. And you know what else we had before 1913? A corporate excise tax, a tax on corporate sales and not just profit. We didnt have a huge military and bases in every country or a national security state to pay for, and we had plenty of immigration fueling growth. It was a different world.

The Depression was caused in part because of the gold standard, tax cuts, immigration reduction , financial speculation due to lack of regulation followed by interest rate increases by the Fed to curb the speculation. It was worsened by Hoover then increasing tariffs after the 1929 crash.

https://en.m.wikipedia.org/wiki/Smoot%E2%80%93Hawley_Tariff_Act

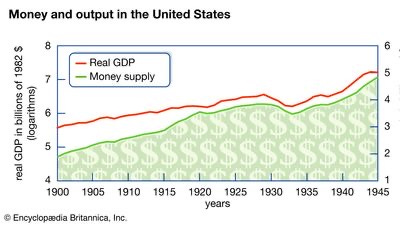

Some might question my inclusion of the Gold Standard but as you can see money supply growth did not keep pace with GDP growth in the 1920’s. When money supply is inadequate depressions happen. The Gold Standard limited the growth in money supply.

Some of our worst depressions happened while under the gold Standard even before the Fed

Panic of 1873 called the Long Depression and Great Depression until 1930's.

Panic of 1893-94 first to affect many. Think "Cross of Gold"

Panic of 1907-08 first to need some federal help 1913 brought FED

1921 Recession Spanish Flew killed 500,000, post WW1 slowdown

Great Depression 1929-39 as FED failed first big test

The Feds increase in interest rates also caused the 2007-2008 Great Recession.

Tariffs

Between 1934 and 1945, the executive branch negotiated over 32 bilateral trade liberalization agreements with other countries.

Between 1948 and 1994

General Agreement on Tariffs and Trade(GATT) members came together to negotiate mutually agreeable trade liberalization packages and reciprocal tariff rates

NAFTA reduced tariffs for trade with Mexico and Canada in 1993 and in 1994, the World Trade Organization (WTO) was established to help establish uniform tariff rates throughout the world

Currently 30% of all import goods are subject to tariffs in the United States

Anyways, we moved away from tariffs because tariffs work both ways. We tariff them they tariff us. Trumps NAFTA II introduced more tariff reductions with Canada and Mexico. His tariff increases on China led to China manufacturers moving production to Mexico and other countries not subject to tariffs.

Chinas exports globally continued to rise despite US tariffs

Guess who pays the Trump tariffs? The US company who imported the goods and the pass the added cost on to the buyers of their product which ultimately you get to pay. It’s just a tax on you and its doubtful tariff reduction leads to significant shift of manufacturing to US because of high costs and the fact other countries will tariff US goods. Most large manufacturers sell to the global market. US only has 5% of the population although our share of imports is 13.5%

Also, we only import $3 trillion worth of goods, and our revenue from taxes is over $5 trillion. So a 10% tariff wont cover that. Do the math. Those figures talking about trillions coming from Tarrifs are over a 10 year period. Even fooled Googles AI

For those wanting to know a little bit more of the history of tariff’s and taxes and a possible solution read on, otherwise 再見🙂

History Lesson

The following was written around 2017 before tariffs became a hot topic.

The tariffs that were generating about $50 million annually (80-90% of all federal receipts) in the late 1850s proved woefully inadequate to finance the Union's 53.2 billion cost of prosecuting the Civil War.

That’s $80 billion in todays dollars, which is what we are collecting today.

In 1861, Treasury Secretary Salmon Chase persuaded Congress to establish the nation's first income tax in order to bolster the Union's finances. During the four years of fighting, Congress approved new levels for both tariffs and the income tax.

The federal government borrowed more than $2.6 billion to finance the war; it generated another $360 million from income taxes and $300 million from tariffs.

The income tax expired in 1872. Federal fiscal policy returned to what had been considered normal in the antebellum era.

From 1875 to 1890, tariffs consistently accounted for well over half of federal receipts. Meanwhile, total federal spending declined steadily, leading to the generation of sizable budget surpluses throughout the 1870s and 188os and the eventual calls for substantial tariff reform, i.e. reductions.

In December 1887, Democratic President Grover Cleveland sparked what congressmen themselves called "The Great Tariff Debate of 1888" by devoting much of his Annual Message to tariffs. It was a blistering attack on the overall level of tariffs, the inequitable nature of the levies imposed on various imported products and the damage that high tariffs did to the financial health of consumers and farmers.

The Democratic majority on the House Ways and Means Committee spent the next year crafting a bill that would reduce the average tariff by almost 30%.

The Republican-controlled

Senate Finance Committee proposed a different

bill that would actually raise most tariffs.

The debate that raged in Congress throughout 1888 reflected the two political parties' worldviews that tariffs were either essential to the protection of American manufacturers against foreign competition (Republican) or harmful to most consumers and farmers forced to pay higher prices for manufactured goods (Democratic).

The political deadlock seemed to be broken by the election of 1888 that saw Republicans win both the presidency and the control of both houses of Congress.

But the victors misinterpreted Americans feelings about the need for high tariffs. Benjamin Harrison actually lost the popular vote to incumbent Grover Cleveland; but the Republican became the 23rd President by winning a majority of votes in the Electoral College. From his position as the new chairman of the House Ways and Means Committee, Congressman William McKinley shepherded through Congress what became known as the McKinley Tariff Act of 1890; that bill raised the average duty on imports by about 45%.

The next two elections proved that the Republicans had overplayed their hand.

In November 1890, Democrats won back control of the House and gained seats in the Senate; in 1892, Cleveland re-claimed the presidency and Democrats re-gained control of both houses of Congress. Predictably, key legislators in the House and Senate crafted the Wilson-Gorman Tariff Act, which lowered tariffs to their pre-1890 levels and which President Cleveland signed in August 1894.

The lingering effects of the Panic of 1893 were instrumental in making the election of 1896 yet another realigning one in which Republicans took control of the presidency and both houses of Congress. Party leaders devoted their time to again addressing the tariff issue; by July 1897, President William McKinley was ready to sign the Dingley Act and, thereby, raise tariffs back towards their 1890 levels.

After winning re-election in 1900, the protectionist-minded McKinley found himself challenging the long-held Republican idea that American industry benefitted from the existence of a high wall of protective tariffs. Companies of all sizes were increasing their efforts to market their products to customers throughout Europe, South America and Asia. The President came to realize that high levels of tariffs were impeding those efforts.

In order to enable more international trade, McKinley suggested in a speech in September 1901 the need for a series of joint agreements among nations to reduce tariffs and eliminate unnecessary trade barriers. But he never got the chance to take concrete steps to pursue that idea since he was assassinated the very next day.

For most of the next seven years, the very activist President Theodore Roosevelt gave lip service to the idea of at least semi-free trade and supported selected reciprocity agreements. However, he did very little to address the tariff question in any fundamental manner.

Immediately upon taking office in March 1909, Roosevelt's chosen successor, William Howard Taft, called Congress into special session to address what he believed was another necessary effort at tariff revision. Taft held the traditional Republican view that high tariffs were necessary to protect the interests of the nation's manufacturers. But he also acknowledged that the need for high rates was steadily declining as those manufacturers continued to improve their

own efficiencies of production and distribution.

The President was content to let congressional leaders develop the details of the much-needed tariff revision. However, his sporadic comments during the five months it took those men to develop a bill only served to confuse the supporters of both protectionism and free trade. In August, President Taft signed the Payne-Aldrich Tariff Act, a compromise bill that lowered 650 tariff rates, raised 220 others and left 1,150 unchanged. It proved unsatisfactory to a large number of reform-minded Republicans and was a major reason why many of them deserted the party in the election of 1910. That intra-party split enabled Democrats to gain control of the House and make inroads into the Republican majority in the Senate.

Two years later, Democrats again benefitted from the split between Republican conservatives and progressives. Democrat Woodrow Wilson entered the White House in March 1913 with majorities in both houses of Congress. In October, he signed the Underwood-Simmons Act that lowered the general tariff level again—this time to one not seen in more than 75 years.

As noted earlier, the income tax that had been levied during the Civil War years expired in 1872. During the next decade, congressmen representing the Greenback movement and Labor Reform party made more than a dozen attempts to revive that tax.

They were repeatedly rebuffed by representatives from the industrial Northeast.

Throughout the 188os, a growing number of labor leaders, agrarian associations and social reformers became increasingly aware of the role that high tariffs and high excise taxes were playing in exacerbating the unequal distribution of wealth in America.

By the dawn of the new decade, they began to realize that a progressive income tax represented the most effective way to dissolve the apparent link between high tariffs and the monopoly powers enjoyed by the country's business elite. Imposing an income tax during a time of peace and prosperity still posed a challenge. But the changing times helped accelerate the desire for such a tax.

The Panic of 1893 saw an unprecedented number of bank closings and corporate failures, as well as record increases in unemployment and personal bankruptcies. It provided an excellent backdrop for the emerging consortium of the disaffected groups noted above to push their congressional representatives to impose a progressive income tax on the wealthy.

In addition to reducing tariffs, the Wilson-Gorman Act of August 1894 introduced a 2% federal tax on individual income. Members of both the Populist and Democratic parties supported the reduction in tarifis and the concomitant establishment of a graduated income tax with a relatively high exemption.

Taking these actions would not disrupt the level of federal revenue but would shift the balance of revenue-producers from the poor to the rich. The validity of that argument was never tested. In April 1895, the Supreme Court declared the tax to be an unapportioned direct one that violated several clauses of the US Constitution.

This particular version of an income tax might have died, but the idea for one certainly did not. Its supporters believed the Supreme Court had been mistaken in its ruling. Moreover, they saw the personal

income tax as not only an economic tool

to address some fiscal imbalances, but an ethical and moral way to raise government revenue while limiting the growing concentration of wealth.

In the 1896 campaign for the presidency, the Democratic standard-bearer William Jennings Bryan supported an income tax aimed primarily at the wealthiest Americans to replace the tariffs and excise taxes that were paid largely by the poorest citizens. Even after his defeat, the party leaders continued to push for an income tax.

In 1898, House Democrats' proposal for an income tax of 3% on annual incomes over $2,000 ( about $320,000 in todays dollars) was soundly defeated.

In the midst of the emerging debate over the income tax, the federal government began to report increasingly larger deficits in each year from 1897 to 1899, even with the Dingley tariffs at historically high levels.

Restraining federal spending was difficult, largely due to the need to fund programs such as the expansion of the Navy and increases in veterans' pension benefits.

The Spanish American War of 1898 launched the beginning of Americas Imperialism

In the first several years of the 2oth century, members of the Republican party's growing progressive wing came to appreciate the need to consider new sources of revenue. Another financial panic in 1907 brought reduced economic activity, more corporate bankruptcies, high unemployment and new strains on the federal budget.

By 1909, congressional progressives had become sufficiently powerful to add an income tax rider to an early version of the Payne-Aldrich Tariff Act.

On separate occasions since winning the White House, President Taft had

voiced both support for and opposition to an income tax. He did not want to see another challenge to the Supreme Court over such a fundamental change in federal policy. Instead, he believed Congress should pass a constitutional amendment authorizing a tax on individuals' income before actually imposing such a levy.

Even while wrangling over what was to become the Payne-Aldrich Tarif Act noted ear-lier, in July 1909, Congress sent to the states this language for a proposed 16th Amendment:

"The Congress shall have the power to lay and collect taxes on incomes, from whatever source derived. without apportionment among the several States, and without regard to any census or enumeration."

Taft persuaded the conference committee crafting the final version of the tariff bill to replace the provision for an income tax on everyone with one taxing only the income of corporations. As noted earlier, he signed Payne-Aldrich in August.

When the 16th Amendment was proposed, conservative lawmakers in Congress doubted it would be ratified by the required number of 36 of the country's 48 states. Many failed to recognize the public's dissatisfaction with the complex and always-changing system of tariffs. Farmers in the South and West, and Progressives and Populists in other areas agreed with the traditional Democratic argument that tariffs unfairly taxed the poor and drove up prices for all consumers. President Theodore Roosevelt and his progressive Republican followers supported the amendment.

Legislators representing manufacturers, bankers and others involved in the country's expanding foreign trade recognized its role in supporting reductions in tariffs and other trade barriers. And government officials of both parties saw the tax as a way to insure the greater level of federal revenue they believed would be necessary to respond satisfactorily to the growing militarism of Germany and Japan.

All three candidates for President in 1912 supported the amendment. It was no surprise when Delaware acted in February 1913 to become the 36th state to vote for its ratification.

With that amendment now approved, Congress used a provision of the aforementioned Underwood-Simmons Act of October 1913 to impose a progressive individual income tax at rates ranging from 1% to 7%. Tax revenue started to flow to the individual US Treasury within the year.

Tariffs generated 95% of the US government's revenue in 1790. During the next 120 years, they rarely dipped below 60% of federal receipts. In 1915, following the passage of the 16th Amendment, tariffs contributed only 30% of those receipts.

During the subsequent 102 years they declined steadily as important sources of revenue; tariffs now account for less than 2% of all the funds the government receives. Meanwhile, the personal and corporate income taxes formally proposed in 1909 have recently been contributing more than 55% of revenue.

The so-called

"payroll tax" used to fund the Social Security and Medicare programs established in 1933 and 1965, respectively, provide another 35%. But that, as they say, is another story.

https://www.moaf.org/publications-collections/financial-history-magazine/129/_res/id=Attachments/index=0/From%20Tariffs%20to%20Taxes.pdf

Over the 50-year period between

1863 and 1913, excise taxes generated about 40% of federal revenue, and customs

duties generated 49%.

Excise taxes were paid by manufacturer but like tariffs these were passed on to the consumer by way of higher prices.

The excise tax was used not only as a revenue source, but also as a policy tool to regulate. An excise tax was levied in 1899 on opium manufactured in the United

States for smoking purposes — the goal was to discourage opium use and not to raise revenue.

The corporate excise tax in 1909 was justified by President Taft as “a long step toward that supervisory control of corporations which may prevent a further abuse of power.”

Total federal revenue averaged about 3% of GDP over this period, ranging from 6% by the end of the Civil War (with income tax) to less than 2% at the close of this period in 1913 (w/o income tax).

Today’s Federal Revenue is about 20% of GDP, with over 70% paid by individuals (income and payroll tax) and less than 25% by corporations ( corporate and payroll tax). Being an empire is expensive

The excise tax era closed with a proposal to amend the Constitution giving the

government the power to tax income; the 16th Amendment became effective on

February 25, 1913.

https://www.everycrsreport.com/reports/RL33665.html

Conclusion- Tariffs are not completely replacing Taxes, not even close. Higher Tariffs means inflation and they are not bringing many jobs back as manufacturers look for low wages, skilled and healthy labor force, few regulations , low taxes (remember, the states tax them as well) , growing population (w/o immigration out population will decline) and try to avoid countries which restrict their sales to other countries or might be subject to retaliatory tariffs by countries they wish to sell to. US only accounts for 13.2% of global imports. Evading US tariffs is not worth facing tariffs by countries buying 87% of global imports.

We could have kept our manufacturing base but Reagan through Bush Jr ended that. She gone baby, at least most of it. Ain’t coming back quickly unless living standards and wages drop drastically. That will take an Apocalyptic event, something Peter Thiels Founders Fund says we should hope for.

But all of this got me to thinking about an old idea called a Transaction tax.

https://econwpa.ub.uni-muenchen.de/econ-wp/pe/papers/0106/0106001.pdf

With all the talk about Bitcoin which has a transaction volume of only $100 billion a day globally, and about 30% of that is exchanging it with the USD. The US transacts about $ 3.5 trillion in USD every day, or $1.5 quadrillion. Most of our transactions go through the Fedwire

Checks $27 trillion, $74 billion

Cash $700 billion, $2 billion

ACH $92 trillion, $250 billion

Credit card $5 trillion $13 billion

Debit card $4.5 trillion $12 billion

Fedwire $1,130 trillion $ 3.1 trillion per day

Total- ~$1,260 trillion

https://www.frbservices.org/resources/financial-services/wires/volume-value-stats/monthly-stats.html

A 0.3% tax on each transaction split equally between buyer and seller generates $ 3.8 trillion in tax. You could eliminate all income and corporate tax which combined account for $3 trillion and wipe out half of the $1.5 trillion deficit to boot.

Or maybe we keep some income tax but only for those making over $300k per year and wipe out all the deficit

Why are we not considering this simple option? Of course, those who transact more $$$ pay more but they also are free of the income and profit tax.

As for paying off the debt, I see no need. The Fed should lower interest rates immediately. High Interest rates do not curb inflation we see today, they just cause recessions and depressions.

There are better ways to curb speculation, and a transaction tax is one of them. Collusion is another big factor that has to be addressed, but anyways, lower interest rates make the interest on the debt more serviceable.

Also, stop letting the Fed pay their shareholder banks interest on the Excess Reserves, this money gets deducted from the amount of interest paid on Treasuries held by the Fed that has to be returned to the Treasury Department ($230 billion in interest on Excess Reserves in 2023) . The Fed is keeping the Fed Fund rate high not to fight inflation but to pay off its banks.

The banks already receive up to 6% dividend on their shares. This amounted to $1.7 billion despite the Fed losing $114 billion. So you can see how the interest on the Excess Reserves benefits them. Those reserves were created by the Fed buying the bad subprime loans from banks and giving them Reserves. Now they give them interest to boot.

Seriously, you cant make this shit up. Maybe thats why people prefer the Lies and Myths. The Truth is a bit much to take. Better be almost blind like Mr Magoo, but he had better luck than you will have if Trump goes ahead with his Tariffs.

End

Excellent analysis, thank you Pete.