The Powers that Be (aka ELite, or just call them Demons or Satans spawn) have decided to grace us with a Financial Crisis. Like with COVID they have been planning this for awhile. Its not clear yet if this is just a warm up before they “Pull It”, but soon our Financial System will look like this

This will pave the way for CBDC, and Accelerate the Great Reset so they can Build Back Better

I’ll start by showing a few tweets before I get down to detailing whats behind my thinking to to warm you up

Iverson

Dowd

Me

Berenson-

Lets start with the present

On Friday, March 10, Silicon Valley Bank (SVB) collapsed and was taken over by federal regulators. SVB was the 16th largest bank in the country and its bankruptcy was the second largest in U.S. history, following Washington Mutual in 2008. Despite its size, SVB was not a “systemically important financial institution” (SIFI) as defined in the Dodd-Frank Act, which requires insolvent SIFIs to “bail in” the money of their creditors to recapitalize themselves.

. SVB held $27.7 billion in derivatives, no small sum, but it is only .05% of the $55,387 billion ($55.387 trillion) held by JPMorgan, the largest U.S. derivatives bank

2010 Dodd Frank Act, which eliminated taxpayer bailouts by requiring insolvent SIFIs to recapitalize themselves with the funds of their creditors. “Creditors” are defined to include depositors, but deposits under $250,000 are protected by FDIC insurance. However, the FDIC fund is sufficient to cover only about 2% of the $9.6 trillion in U.S. insured deposits. A nationwide crisis triggering bank runs across the country, as happened in the early 1930s, would wipe out the fund.

In 2002, mega-investor Warren Buffett wrote that derivatives were “financial weapons of mass destruction.” At that time, their total “notional” value (the value of the underlying assets from which the “derivatives” were “derived”) was estimated at $56 trillion. Investopedia reported in May 2022 that the derivatives bubble had reached an estimated $600 trillion according to the Bank for International Settlements (BIS), and that the total is often estimated at over $1 quadrillion. No one knows for sure, because most of the trades are done privately.

A total of 1,211 insured U.S. national and state commercial banks and savings associations held derivatives, but 88.6% of these were concentrated in only four large banks: J.P. Morgan Chase ($54.3 trillion), Goldman Sachs ($51 trillion), Citibank ($46 trillion), Bank of America ($21.6 trillion), followed by Wells Fargo ($12.2 trillion). A full list is here. Unlike in 2008-09, when the big derivative concerns were mortgage-backed securities and credit default swaps, today the largest and riskiest category is interest rate products.

In their basic form, derivatives are just bets – a giant casino in which players hedge against a variety of changes in market conditions (interest rates, exchange rates, defaults, etc.). They are sold as insurance against risk, which is passed off to the counterparty to the bet. But the risk is still there, and if the counterparty can’t pay, both parties lose.

The financial entities taking these bets typically hedge by betting both ways, and they are highly interconnected. If counterparties don’t get paid, they can’t pay their own counterparties, and the whole system can go down very quickly, a systemic risk called “the domino effect.”

Derivatives are largely a creation of the “shadow banking” system, a group of financial intermediaries that facilitates the creation of credit globally but whose members are not subject to regulatory oversight. The shadow banking system also includes unregulated activities by regulated institutions. It includes the repo market, which evolved as a sort of pawn shop for large institutional investors with more than $250,000 to deposit.

The repo market is a safe place for these lenders, including pension funds and the U.S. Treasury, to park their money and earn a bit of interest. But its safety is insured not by the FDIC but by sound collateral posted by the borrowers, preferably in the form of federal securities.

While it is true that banks create the money they lend simply by writing loans into the accounts of their borrowers, they still need liquidity to clear withdrawals; and for that they largely rely on the repo market, which has a daily turnover just in the U.S. of over $1 trillion.

British financial commentator Alasdair MacLeod observes that the derivatives market was built on cheap repo credit. But interest rates have shot up and credit is no longer cheap, even for financial institutions.

According to a December 2022 report by the BIS, $80 trillion in foreign exchange derivatives that are off-balance-sheet (documented only in the footnotes of bank reports) are about to reset (roll over at higher interest rates).

Another time bomb in the news is Credit Suisse, a giant Swiss derivatives bank that was hit with an $88 billion run on its deposits by large institutional investors late in 2022. The bank was bailed out by the Swiss National Bank through swap lines with the U.S. Federal Reserve at 3.33% interest.

In the traditional banking system, the promise that the depositor can get his money back on demand is made credible by government-backed deposit insurance and access to central bank funding. The shadow banks needed their own variant of “demandable debt,” and they got it through the privilege of “super-priority” in bankruptcy

2005 safe harbor amendment to the bankruptcy law says that the collateral posted by insolvent borrowers for both repo loans and derivatives has “safe harbor” status exempting it from recovery by the bankruptcy court.

Safe harbor status grants the privilege of being excluded from mandatory stay, and basically all other restrictions. Safe harbor lenders, which at present include repos and derivative margins, can immediately repossess and resell pledged collateral.

This gives repos and derivatives extraordinary super-priority over all other claims, including tax and wage claims, deposits, real secured credit and insurance claims. [Emphasis added.]

Derivatives were granted “safe harbor” because allowing them to fail was also considered a systemic risk. It could trigger the “domino effect,” taking the whole system down.

Interest rate derivatives are particularly vulnerable in today’s high interest rate environment. From March 2022 to February 2023, the prime rate (the rate banks charge their best customers) shot up from 3.5% to 7.75%, a radical jump. Market analyst Stephanie Pomboy calls it an “interest rate shock.” It won’t really hit the market until variable-rate contracts reset, but $1 trillion in U.S. corporate contracts are due to reset this year, another trillion next year, and another trillion the year after that.

The U.S. economy survived much higher interest rates in the past, but at that time there were not hundreds of trillions of dollars worth of interest rate derivatives hanging over our financial system like a Sword of Damocles.

https://ellenbrown.com/2023/03/13/the-looming-quadrillion-dollar-derivatives-tsunami/

Nobody could have seen this coming, right?

The Federal Home Loan Bank of San Francisco had quietly been bailing it out – to the tune of $15 billion.... its primary regulator was the Federal Reserve Bank of San Francisco....the CEO of Silicon Valley Bank, Gregory Becker, was sitting on the Board of Directors of his regulator, the Federal Reserve

Interest rates spiked last Thursday and Friday to close at 4.60 percent for the U.S. Treasury’s two-year bonds. Bank depositors meanwhile were still being paid only 0.2 percent on their deposits. That has led to a steady withdrawal of funds from banks – and a corresponding decline in commercial bank balances with the Federal Reserve.

The Fed’s $9 trillion of QE (not counted as part of the budget deficit) fueled an asset-price inflation that made trillions of dollars for holders of financial assets – the One Percent with a generous spillover effect for the remaining members of the top Ten Percent

The cost of home ownership soared by capitalizing mortgages at falling interest rates into more highly debt-leveraged property. The U.S. economy experienced the largest bond-market boom in history as interest rates fell below 1 percent

Rising interest rates cause the prices of bonds already issued to fall – along with real estate and stock prices. That is what has been happening under the Fed’s fight against “inflation,” its euphemism for opposing rising employment and wage levels. Prices are plunging for bonds, and also for the capitalized value of packaged mortgages and other securities in which banks hold their assets on their balance sheet to back their deposits.

The result threatens to push down bank assets below their deposit liabilities, wiping out their net worth – their stockholder equity. This is what was threatened in 2008. It is what occurred in a more extreme way with S&Ls and savings banks in the 1980s, leading to their demise.

Just as the QE interest-rate decline aimed to bolster the banks, its reversal today must have the opposite effect. And if banks have made bad derivatives trades, they’re in trouble.

[over the past year QT has knocked off almost $700 million from their balance sheet]

Any bank has a problem of keeping its asset valuations higher than its deposit liabilities. When the Fed raises interest rates sharply enough to crash bond prices, the banking system’s asset structure weakens. That is the corner into which the Fed has painted the economy by QE.

financial markets were shaken up as bond prices declined when Fed Chairman Jerome Powell announced that he actually planned to raise interest rates even more than he earlier had targeted, in view of the rising employment making wage earners more uppity in their demands to at least keep up with the inflation caused by the U.S. sanctions against Russian energy and food and the actions by monopolies to raise prices “to anticipate the coming inflation.”

Reuters reported on Friday that bank reserves at the Fed were plunging. That hardly is surprising, as banks are paying about 0.2 percent on deposits, while depositors can withdraw their money to buy two-year U.S. Treasury notes yielding 3.8 or almost 4 percent. No wonder well-to-do investors are running from the banks.

https://www.unz.com/mhudson/why-the-banking-system-is-breaking-up/

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 states in its preamble that it will “protect the American taxpayer by ending bailouts.” But it does this under Title II by imposing the losses of insolvent financial companies on their common and preferred stockholders, debtholders, and other unsecured creditors, through an “orderly resolution” plan known as a “bail-in.”

Depositors are classed as “creditors.” A general deposit is a loan made to a bank. This means that the bank is the general depositor’s debtor, but that the bank has legal title to the funds deposited; these funds may be commingled with the bank’s other funds. All the general depositor has is a general, unsecured claim against the bank …. The bank is free to use the deposit as it sees fit.

After 1933, the funds held at the Fed for settling transactions became simply data entries called “reserves,” which were created by the Fed and held by the banks in Fed accounts. Most of the circulating money supply is now created by private banks by writing loans as deposits into the accounts of their borrowers. But banks cannot create the reserves needed to clear withdrawals through the central bank. Those reserves must be acquired from the Fed, either directly or from another financial institution that has acquired them.

Until recently, depository banks could borrow from each other or the Fed at 0.25%. That rate has now gone up to 4.5-4.75%. The only cheap, readily available source of liquidity left to a bank today is its own pool of incoming deposits, from paychecks, credit card payments, mortgage payments and the like.

Traditionally, banks had to hold only about 10% of their deposits in reserve

. In March 2020, the Fed removed the reserve requirement altogether; but banks still need to hold enough reserves to meet withdrawals.

As announced on March 15, 2020, the Board reduced reserve requirement ratios to zero percent effective March 26, 2020. This action eliminated reserve requirements for all depository institutions.

https://www.federalreserve.gov/monetarypolicy/reservereq.htm

At least banks aren’t scrambling for deposits likely they were in the S&L Crisis. That would be a bad sign. Oh Wait.

Meanwhile, the banks clearly need our deposits, and today they are scrambling to compete for deposits and reserves.

According to a Feb. 7 article on Wall Street on Parade, Goldman Sachs is now offering an interest rate on its savings accounts that is 350 times the interest rate being offered by JPMorgan Chase and Bank of America.

As of May 2022, according to the most recent data from the Bank for International Settlements (BIS), the total notional amounts outstanding for contracts in the derivatives market was an estimated $600 trillion; and the total is often estimated at over $1 quadrillion.

Topping the list of U.S. derivatives banks are J.P. Morgan Chase ($54.3 trillion), Goldman Sachs ($51 trillion), Citibank ($46 trillion), Bank of America ($21.6 trillion), and Wells Fargo ($12.2 trillion).

But banks have plenty of assets to cover themselves, right?

..at the end of 2019, the market value of all publicly-traded equities (stocks) in the United States had reached $38.47 trillion. By June 30, 2021, despite an ongoing pandemic, the market value of all publicly-traded stocks had surged to $54.768 trillion, an increase of 42 percent. (See page 130, Line 29 at this link.)

At $54.768 trillion, the U.S. stock market was larger than the combined GDP of the United States, China, Japan, Germany, France, Italy, Spain, and the U.K., according to GDP data from the World Bank.

.....under Jerome Powell as Fed Chair, assets at commercial banks have exploded in just the past two and a quarter years, mushrooming from $17.8 trillion on January 22, 2020 to $22.6 trillion on May 4, 2022.

And thanks to the Fed’s history of rubber-stamping megabank mergers, as of December 31 of last year, just six bank holding companies (out of a total of 4,839 federally-insured commercial banks and savings associations) hold $13.699 trillion or 61 percent of all assets of all commercial banks.

....And not to put too fine a point on it, but those are the same six bank holding companies that control 89 percent of the $234 trillion in derivatives that have a habit of blowing up during every Fed rate-hiking cycle.

That comes out $700,000 per human American citizens (the Global Corporate citizens are off the hook). Lets hope that bubble doesn pop.

https://wallstreetonparade.com/2022/05/jerome-powells-fed-in-two-frightening-charts/

But we have insurance, right?

As of September 2021, the FDIC had only $122 billion in its insurance fund, enough to cover just 1.27% percent of the $9.6 trillion in deposits that it insures. The FDIC also has a credit line with the Treasury for up to $100 billion, but that still brings the total to just over 2% of insured deposits.

https://www.federalreserve.gov/monetarypolicy/reservereq.htm

But our overall credit remains strong, after all, we do all kinds of stress tests and Pass with flying colors, just like we did all those Pandemic Exercises so we could be ready with plenty of masks and PPE.

Late Monday (3/13) the credit rating agency, Moody’s, downgraded the entire U.S. banking system outlook to negative from stable. (Let that sink in for a moment – a downgrade of the entire U.S. banking system.) The news of the Moody’s downgrade did not hit the wires until yesterday (3/14), which should have cratered the most vulnerable bank stocks. Instead, there was a highly suspicious short squeeze that fueled a big rally in the prices of publicly-traded banks.

[Ides of March is 15 March.It was notable in Rome as a deadline for settling debts]

That unwarranted optimism has now been reversed this morning (3/15) with Dow futures down more than 600 points just after 8:00 a.m. in New York; major banks in Europe temporarily halted from trading after steep selloffs; and troubled Swiss behemoth bank, Credit Suisse, down 24 percent to a new all time low of $1.74 in morning trade in Europe following multiple trading halts. For the systemic contagion posed by Credit Suisse, see our February 10 article: Credit Suisse Tanks Yesterday to $3.02; It’s Lost Over 90 Percent of Its Market Value Since 2007; It’s Not Alone.

The banking crisis of 2008 was widely covered by the media, which even went to court to get the Fed to come clean on the dollar amounts and names of the banks that received trillions of dollars in secret, cumulative loans from the Fed. (See our report last year: Mainstream Media Has Morphed from Battling the Fed in Court in 2008 to Groveling at its Feet Today.)

But because Congress failed to restore the Glass-Steagall Act after the 2008 financial crash – the worst since the Great Depression – the Fed was back to secretly bailing out the trading units of the behemoth depository banks in September 2019.

Mainstream media – across the board – censored this critical story. See our report: There’s a News Blackout on the Fed’s Naming of the Banks that Got Its Emergency Repo Loans; Some Journalists Appear to Be Under Gag Orders.

That censorship allowed Congress to kick the can down the road, leading to this even greater Banking Crisis 3.0 today.

So what happened on September 2019?

On September 17, 2019, the Fed began making trillions of dollars a month in emergency repo loans to 24 trading houses on Wall Street. The Fed released on a daily basis the dollar amounts it was loaning, but withheld the names of the specific banks and how much they had borrowed. This made it impossible for the public to see which Wall Street firms were experiencing the most severe credit crisis.

It was the first time the Fed had intervened in the repo market since the 2008 financial crash – the worst financial crisis since the Great Depression. The COVID-19 crisis remained months away. The first reported case of COVID-19 in the U.S. was not reported by the CDC until January 20, 2020 and the World Health Organization did not declare a pandemic until March 11, 2020.

Under the Dodd-Frank financial reform legislation of 2010, the Fed was legally required to release the names of the banks and the amounts they borrowed “on the last day of the eighth calendar quarter following the calendar quarter in which the covered transaction was conducted.” The New York Fed released the information for the third quarter of 2019 last Thursday, a day earlier than required. We reported on it the following day.

Those Fed revelations, that had been withheld from the American people for two years, should have made front page headlines in newspapers and on the digital front pages of every major business news outlet. Instead, there was a universal news blackout of the story at the largest business news outlets, including: Bloomberg News, the Wall Street Journal, the business section of the New York Times, the Financial Times, Dow Jones’ MarketWatch, and Reuters.

Could this critically important story have simply slipped by all of the dozens of investigative reporters and Fed watchers at these news outlets? Absolutely not. The Fed was required to release its repo loan data and names of the banks for the span of September 17 through September 30, 2019 at the end of the third quarter of this year.

We reported on what that information revealed on October 13. Because we were similarly stunned by the news blackout on that Fed release, out of courtesy we sent our story to the reporters covering the Fed for the major news outlets. Our article alerted each of these reporters that a much larger data release from the Fed, for the full fourth quarter of 2019, would be released on or about December 31.

The data was posted at the New York Fed sometime before 1:23 p.m. ET last Thursday.

A little background information

In August 2019 Black Rock met with Central Banks around the world at Jackson Hole Wyoming to tell them

Their solution was to Go Direct with the Fed putting money into the banking system quickly and at low cost to cover overnight loans. These were the recipients over the next 3 months (of course the loans get paid back with new loans). The Fed’s repo loans stretched from September 17, 2019 through July 2, 2020

The same month as the Repo Market Crisis (Exercise ) the White House Council of Economic Advisors (CEA) finds that in a pandemic year, depending on the transmission efficiency and virulence of the particular pandemic virus, the economic damage would range from $413 billion to $3.79 trillion. Fatalities in the most serious scenario would exceed half a million people in the United States

https://edition.cnn.com/videos/business/2020/07/17/economist-cea-report-pandemic-warning-tomas-philipson.cnnbusiness

In January 2020 before Davos meeting and as COVID news was breaking out China BlackRock founder and CEO Larry Fink published a newsletter jumping aboard the sustainable climate investing train big time.

He wrote in a closely read letter that guides numerous corporations seeking investment from some of BlackRock’s $7 trillions, “Climate change has become a defining factor in companies’ long-term prospects.”

Citing recent climate protests, Fink states, “awareness is rapidly changing, and I believe we are on the edge of a fundamental reshaping of finance. The evidence on climate risk is compelling investors to reassess core assumptions about modern finance.”

Declaring that, “climate risk is investment risk,” Fink then asks an impossibly difficult question of how climate risks will impact entire economies. He has the answer, we learn. Referring to what he calls “a profound reassessment of risk and asset values” Fink tells us, “because capital markets pull future risk forward, we will see changes in capital allocation more quickly than we see changes to the climate itself.

In the near future – and sooner than most anticipate – there will be a significant reallocation of capital.”

Thats a pretty good prediction Larry. It all went right to the top starting in March.

Flash forward to March 2020. Excerpts from this article

https://wallstreetonparade.com/2020/06/blackrock-authored-the-bailout-plan-before-there-was-a-crisis-now-its-been-hired-by-three-central-banks-to-implement-the-plan/

The BlackRock plan calls for blurring the lines between government fiscal policy and central bank monetary policy – exactly what the U.S. Treasury and the Federal Reserve are doing today in the United States. BlackRock has now been hired by the Federal Reserve, the Bank of Canada, and Sweden’s central bank, Riksbank, to implement key features of the plan..

The authors wrote in the white paper that “in a downturn the only solution is for a more formal – and historically unusual – coordination of monetary and fiscal policy to provide effective stimulus.”

We now understand why, for the first time in history, the U.S. Congress handed over $454 billion of taxpayers’ money to the Fed, without any meaningful debate, to eat losses on toxic assets produced by the Wall Street banks it supervises. The Fed plans to leverage the $454 billion into a $4.54 trillionbailout plan, “going direct” with bailouts to the commercial paper market, money market funds, and a host of other markets.

The BlackRock plan further explains why, for the first time in history, the Fed has hired BlackRock to “go direct” and buy up $750 billion in both primary and secondary corporate bonds and bond ETFs (Exchange Traded Funds), a product of which BlackRock is one of the largest purveyors in the world.

Adding further outrage, the BlackRock-run program will get $75 billion of the $454 billion in taxpayers’ money to eat the losses on its corporate bond purchases, which will include its own ETFs, which the Fed is allowing it to buy in the program.

So lets flash forward to Janet Yellens annual report at the US Treasury

And whats her solution? More taxes and cuts in social benefits. Sounds like IMF Austerity measures we force on 3rd World Nations

Now heres Fed Chairman Powell

Powell acknowledged the debt -- currently $22.96 trillion -- "is growing meaningfully faster than the economy and that's by definition unsustainable over time."

[the number he quoted was pre-Pandemic

Today it’s

https://www.barrons.com/amp/news/current-us-debt-level-very-sustainable-fed-s-powell-01618428316

Maybe stop borrowing from anyone but the Federal Reserve who will return the interest and prevent them from inflating the money supply with non-productive loans. Or better yet, take this guys advice

Is the light bulb on yet?

Now, what about these interest rates to fight inflation, were they needed?

As I wrote last year, no.

They call it Conscious parallelism (aka tactical pricing) . This refers to businesses changing their prices to reflect the prices of competitors within a market without colluding or communicating with competitors. Thats the story to give collusion legal cover.

One of the weapons the Globalists are using to lower the Wests living standards as part of the WEF Great Reset is to reduce carbon emissions via reduction in consumption is “Economic”. Inflation is the bullet

Most people have never heard of the Business Round Table. Set up in 1973 (same time as TLC and WEF). Its members are leading global corporations in America, many of them WEF members

In order to set off the Inflation bomb and get a million businesses and consumers to go along, its quite simple.

First off create inflation expectation. Thats simple with the MSM. Create isolated supply shortages to support the narrative

Then a couple of the leading companies increase prices blaming supply lines or energy prices (which are manipulated by Wall Street Futures traders)

Conscious Parallelism does the rest.

Consumers expect inflation, so accept them and start stocking up on goods expecting even higher prices. This creates excess demand which spurs more increases.

Business owners expect higher cost of doing business and increased cost of materials so want to stay ahead of the game and raise prices

Some businesses simply get greedy and raise prices beyond what is needed so as to maximize profits. This is especially prevalent in Industries where only a few companies control most of the market share. One raises prices and the others follow in lockstep. Conscious Parallelism they say, I say Collusion. One is legal, one is not.

Its like a stampede. We set off a couple of the bigger cattle and they all start running in same direction (higher prices)

However, unlike in the Volcker years you wont see the same degree of higher interest rates on savings and loans. Too much debt. The system would crash. Larry Finks “Going Direct” will allow the Fed to keep money relatively cheap.

So big business will be able to continue to borrow money cheap and roll over existing loans. Asset prices will climb even faster.

Win-Win.

The only one going to feel the pain is the middle class and working class, and the welfare class/retirees. Wages and COLA’s for benefits wont keep pace. They will burn through their savings, consume less, and be receptive to conditional UBI (comply with mandates)

Some of you will believe the increase in the money supply is responsible for the cost of a hamburger on main street. I got to break the news. That new money created is in the hands of the 0.1 % and is in the clouds.

It never sees Main Street although the robots they buy to control you or take your jobs will soon be running Main Street and start to Replace Policemen and many working class jobs

Much of that money is destined to lock up resources in the Global South . These resources are needed to build the Digital Gulag. See this to understand why these resources are so important to them.

Ok, but who am I, just a nobody. Lets see what Michael Hudson has to say about Inflation

The Federal Reserve has hardly spent any money into the economy at all.

It’s printing trillions and trillions of dollars, more money, more essential credit than ever before, but all of this credit has gone into the stock market and the bond market and the packaged loan market.

It’s all gone for assets that the 1 percent of the economy hold. It has financed asset price inflation, not domestic inflation. The domestic inflation is something that comes not from an increase in the money supply, but from supply shortages.

And this is a result of the neoliberal management philosophy that corporations have. In order to increase their reported profits, they have cut costs wherever they could. And one way they found of cutting costs is to minimize inventories.

80 years ago, every company would have enough inventory on hand so that if there was an interruption in its imports, in its raw materials, in the supplies that it needs, it has enough to get by.

But the corporate managers said let’s have something called just-in-time inventory. That is, if we need a part, we’re not trying to order it six months in advance and hold it in a warehouse; we’ll just pay for it that day and order it.

And all of the companies together in the United States thought, the economy is going to shrink, we don’t need any inventories, because everybody is going to be poor.

They thought they were going to be poor, because they were making the economy poor, by predatory practices that they were following.

They were getting rich by impoverishing the economy. They thought the economy couldn’t buy what they produce, so they didn’t need any inventories. Well, all of a sudden, they ran out; they depleted all of the inventories.

And there were huge, huge orders, [placed] in China, in Asia, in Japan, in Korea, for electronics exports, for chips, for everything else.

And now you see, the price of shipping has multiplied tenfold. It costs 10 times as much to ship a container from China to New York today than it did a year ago.

So what is happening is a shortage from just the neoliberal, really socially incompetent management of American corporations.

[Note:I disagree on incompetence. I think the supply shortages/inflation are part of the WEF plan (at the top corporations are members of the WEF and are interlocked with each other) to demolish the economies of the West for a Great Reset and BBB]

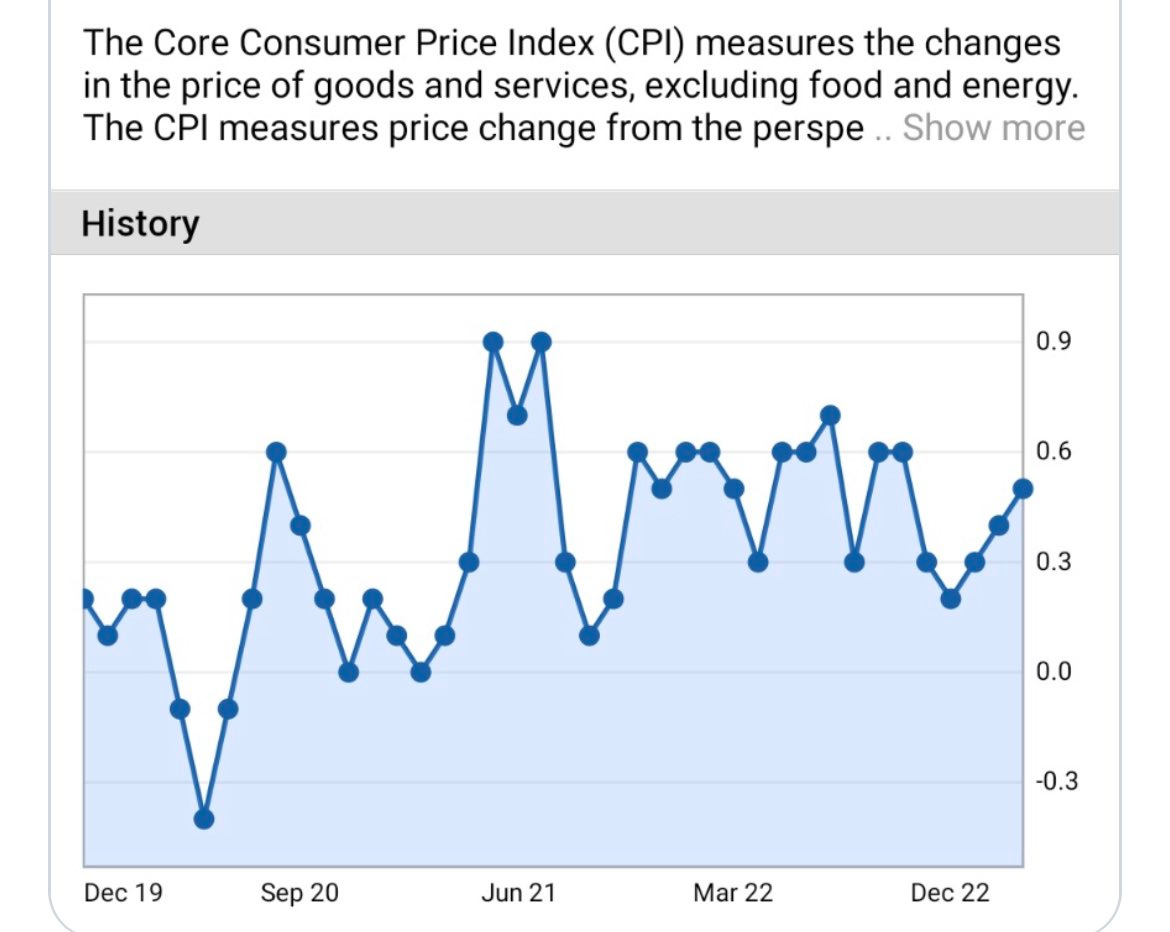

Still not convinced? Here is core inflation,

Hardly noticeable. Our inflation is caused by energy and food cartels . As you know, cartels are price makers. The US regulators have turned a blind eye to collusion over the last 20 years by calling collusion conscious parallelism. But people spend most of their money on energy and food and of course interest payments on their debt (credit card, mortgages, student loans, auto loans). The rich hardly feel this inflation and corporate cartels simply pass on the higher cost of doing business (interest and inflation) to consumers.

Thats all I got on this for now.