Was SVB and the other banks (Signature and Silvergate ) sacrificed for a larger purpose? That purpose being to drive depositors from non -SIFI banks that to SIFI’s (Systemically Important Financial Institutes) who are TBTF in order to forestall the inevitable Derivative Implosion until CBDC is ready

The Derivative Bubble was discussed in my previous post.

For simplicity sake I will direct my focus on SVB which may have been the victim of an organized gang of Venture Capitalists starting a bank run not unlike Musk business partner and Binance CEO CZ starting a run on Bankman -Fried’s FTX

But who was behind this organized gang of Venture Capitalists, there has to be a leader, right? Lets summarize the situation at SVB first

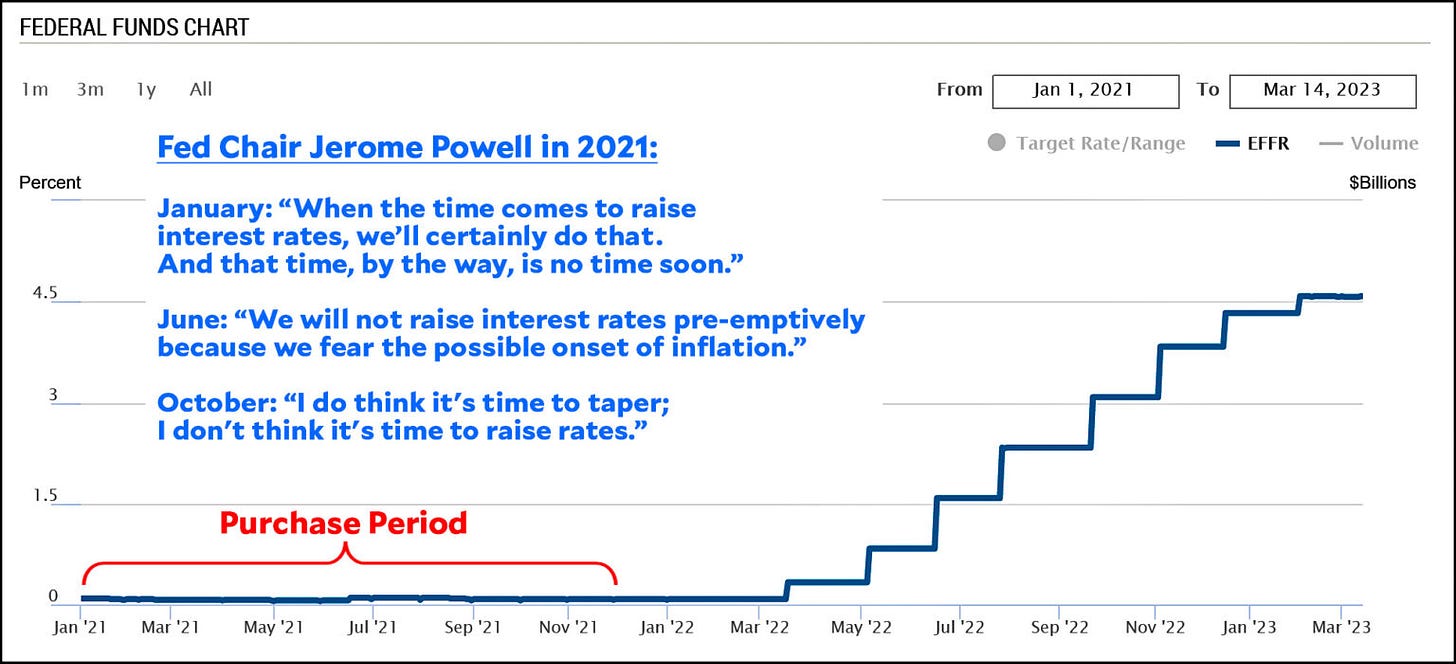

The bond portfolio. SVB had about $90 billion invested in long-dated treasury and mortgage bonds. This portfolio was vulnerable to interest rate risk, and SVB probably should have hedged that. However, keep in mind that nearly the entire portfolio was purchased in 2021:

At the time, there was little reason to think interest rate risk was high. There was certainly no reason to think that Jerome Powell would turn on a dime and not only raise rates, but raise them at an astronomical rate. And anyway, all of the bonds were marked as Hold to Maturity, which meant their losses never showed up on SVB's books and probably never would have.

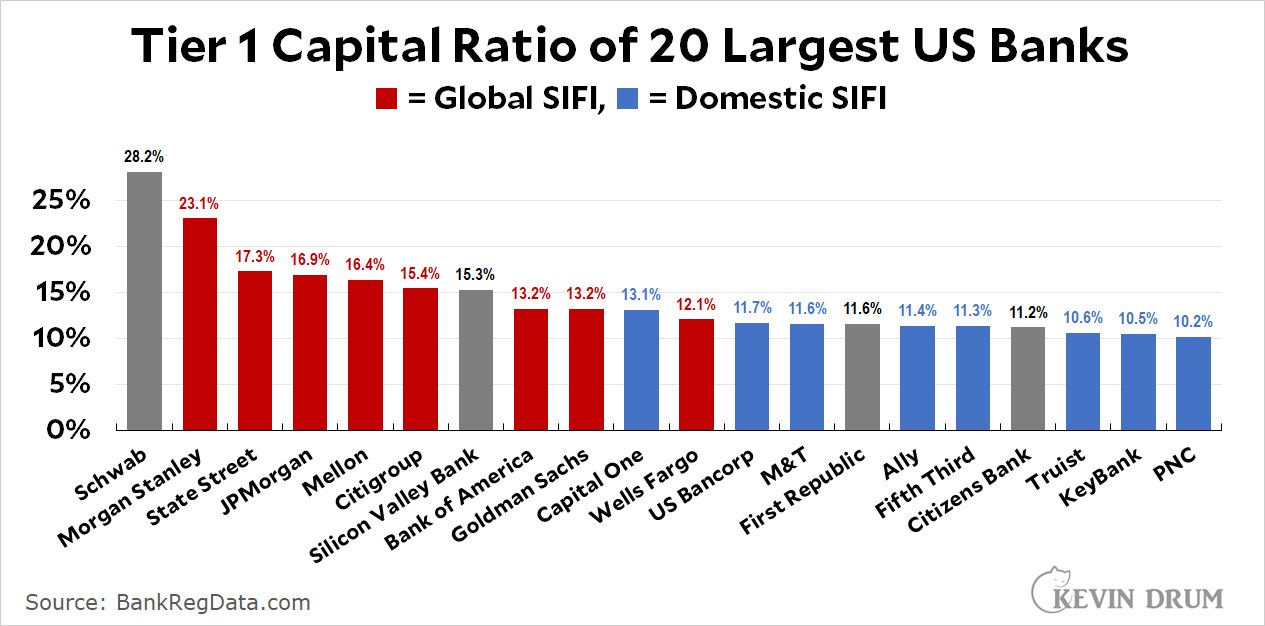

SVB was capitalized as strongly as a global SIFI and had plenty of liquidity. Their Tier 1 capital ratio was 15.3%; their CET1 capital ratio was 12.2%; and their leverage ratio was 8%. Those are way above anything required by regulators

SVB responded properly. In response to concern from Moody's about the worsening outlook for the tech sector, SVB consulted with Goldman Sachs and then announced that it would sell $20 billion of its assets at a $2 billion loss and then do a $2 billion capital raise to make up for the loss. ….Moody's downgraded SVB in response, but this was actually a vote of confidence. They had intended to downgrade SVB two notches, but after the restructuring plan was announced they limited the downgrade to one notch…..

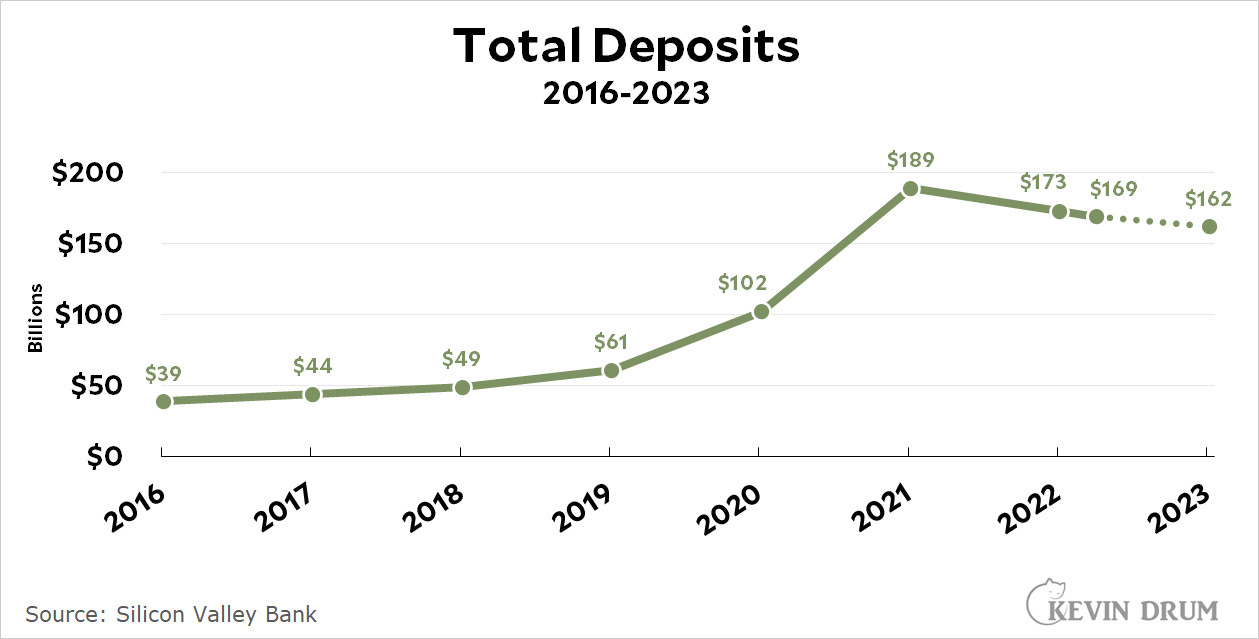

SVB really had only one problem: the pandemic had created a tech boom that saw the formation of hundreds of new startups. VC financing for all these startups flowed into SVB and spiked their deposit level from $61 billion to $189 billion.

In 2022, the tech boom went sour, and that meant no more startups and no more VC financing. As a result, existing startups had to pull money out of their SVB accounts to fund ongoing operations, and that led to a drop in deposits from $189 billion to $169 billion (as of March 8).

Founders Fund, the venture capital fund co-founded by Peter Thiel, advised its companies on the morning of March 9 to withdraw their money from SVB. Why? We don't know for sure because neither FF's management nor Thiel are talking about what motivated them……

Founders Fund is well known and influential, and news of what they had done spread around the Valley at light speed. Within a few hours, a $42 billion run had left SVB in ruins and the FDIC had taken over.

https://jabberwocking.com/silicon-valley-bank-was-fine-its-silicon-valley-thats-broken/

So Peter Thiel, a Bilderberger and former business partner of Musk, not to mention a big Trump supporter and major contractor of virtually every military , intelligence , and HHS agency is behind the SVB takedown. I will need to dwell on this further , but now I am interested, in the sense of how do you spell CONSPIRACY?

Lets move on now.

Of course, unlike FTX depositors, Silicon Valley Businesses and Venture Capitalists needed to be saved. The Fed learned how to do this during the last crisis, simply add a troubled banks deflated assets to its balance sheet at full value and give the bank or insurance company cash in return

This is absolutely no problem. The Fed can hold onto these assets until maturity and not lose a dime, as unlike other banks it can never run out of money and be forced to sell early like SVB had.

Of course, it could have done this with SVB before they defaulted on their customers deposit withdrawal requests, but then they wouldn’t have accomplished what they wanted.

The resolution treatments of SVB and Signature Bank are unusual. The FDIC typically sells a large failing bank to a healthy bank and the purchasing bank takes possession of all of the failing bank’s deposit accounts — those insured as well as those with balances larger than the $250K insurance limit. Banks — even failing banks — typically have some market value because of their deposit franchise. According to an old banking adage, bank depositors are more likely to get divorced than to move their accounts to a different bank. Since deposits are a bank’s cheapest source of funding, banks value a large diversified depositor base

Its not like SVB was a mess, it still had plenty of value and certainly could have been sold, after all who wouldn’t want a bunch of rich depositors. They just needed a little liquidity to handle Thiels bank run.

But to save the SIFI’s, the banking industry must be consolidated to drive depositors to these TBTF banks. That means small and medium banks must merge with SIFI’s somehow.

This will make rolling out CBDC easier as only the SIFI’s will be able to make the transition quicker.

But how would such a merger work on such a massive scale with a handful of SIFI’s? Remember the Federal Reserve System acts as a Monopoly, its actually a Socialist Octopus. Each bank is a shareholder in one of 12 Federal Reserve Banks

Perhaps the answer lies here

Bank of America, Citigroup,. JPMorgan Chase, Wells Fargo, Goldman Sachs, Morgan Stanley, BNY-Mellon, PNC Bank, State Street, Truist and U.S. Bank to make uninsured deposits totaling $30 billion into First Republic Bank

March 16, 2023

Action by the largest U.S. banks reflects their confidence in the country’s banking system and helps ensure First Republic has the liquidity to continue serving its customers.

Bank of America, Citigroup, JPMorgan Chase and Wells Fargo announced today they are each making a $5 billion uninsured deposit into First Republic Bank.

Goldman Sachs and Morgan Stanley are each making an uninsured deposit of $2.5 billion

BNY-Mellon, PNC Bank, State Street, Truist and U.S. Bank are each making an uninsured deposit of $1 billion, for a total deposit from the eleven banks of $30 billion.

This action by America’s largest banks reflects their confidence in First Republic and in banks of all sizes, and it demonstrates their overall commitment to helping banks serve their customers and communities. Regional, midsize and small banks are critical to the health and functioning of our financial system.

https://www.zerohedge.com/markets/first-republic-bank-shares-crash-exploring-strategic-options

I don’t know what terms these banks are setting with First Republic but they are probably getting some access and control over First Republic. I suspect the Fed might be subsidizing this somehow, perhaps by accepting their long term treasuries and paying face value or through the discount window. I might be wrong on that.

Depository institutions may obtain liquidity against a wide range of collateral through the discount window, which remains open and available. In addition, the discount window will apply the same margins used for the securities eligible for the BTFP, further increasing lendable value at the window.

https://www.federalreserve.gov/newsevents/pressreleases/monetary20230312a.htm

In any event, CBDC can’t happen smoothly if at all if the Derivative Bomb goes off too early and Fed also has another problem though.

Despite the higher interest rates banks earn on their deposits, as part of a monopoly (shareholders in the Federal Reserve Bank), they don’t pass this on to depositors . So why would the wealthy bother to keep their money in a bank earning 0.2-0.6% when they can buy safe treasuries at 4.5%. Unlike banks, the Treasury is backed by the Fed will never go bankrupt. Its safer than FDIC insurance.

So its seems to me the Fed will either need to roll back interest rates, or SIFI’s will need to offer much higher interest rates on deposits, perhaps limited to big uninsured accounts, to keep big depositors from fleeing to greener pastures

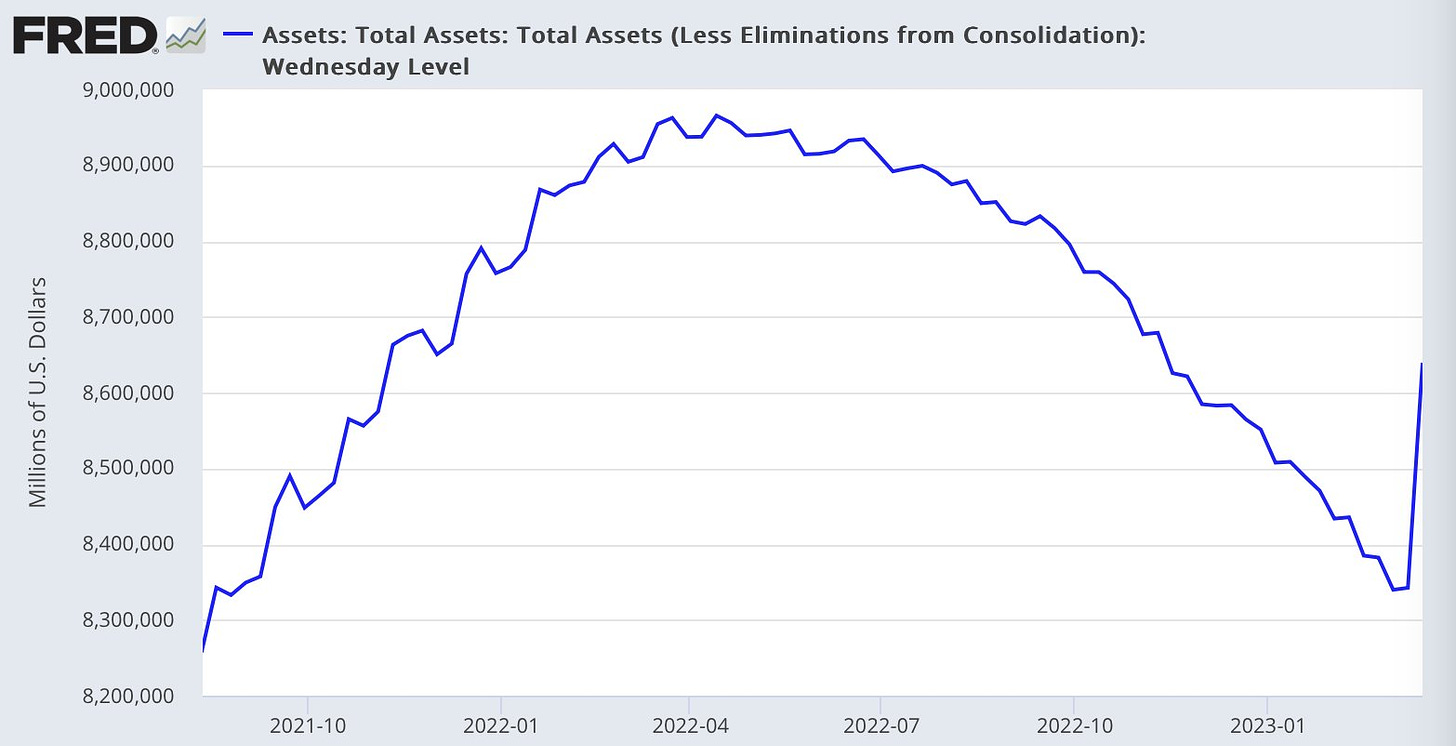

Furthermore, the Fed will need to increase liquidity. They have already started

Looks like QT is over after reducing its balance sheet almost $700 billion.

Eventually they get to the point where they set off the Derivative Bomb. Depositors get a 50-80% haircut thanks to the 2010 Dodd-Frank Act allowing SIFI’s to do so (discussed in my last post), and force them to take whats left as CBDC which be available to those with a valid Digital ID with DNA confirmed human identity .

Something like that

Very good analysis. You may have addressed this in another post, but I have not read any articles discussing how big depositors use a bank’s cash management services to earn money on their excess deposits. Those funds are usually swept out of the account and invested in overnight fed funds, then redeposited the next morning. Cash is never idle, and this is sold to depositors as the upside of keeping uninsured deposits in a bank.