Unofficial & Unauthorized - My Supplement to Whitneys Book (s)

Just getting through these books now. I waited for the Kindle Version so am behind others who got the hard copy.

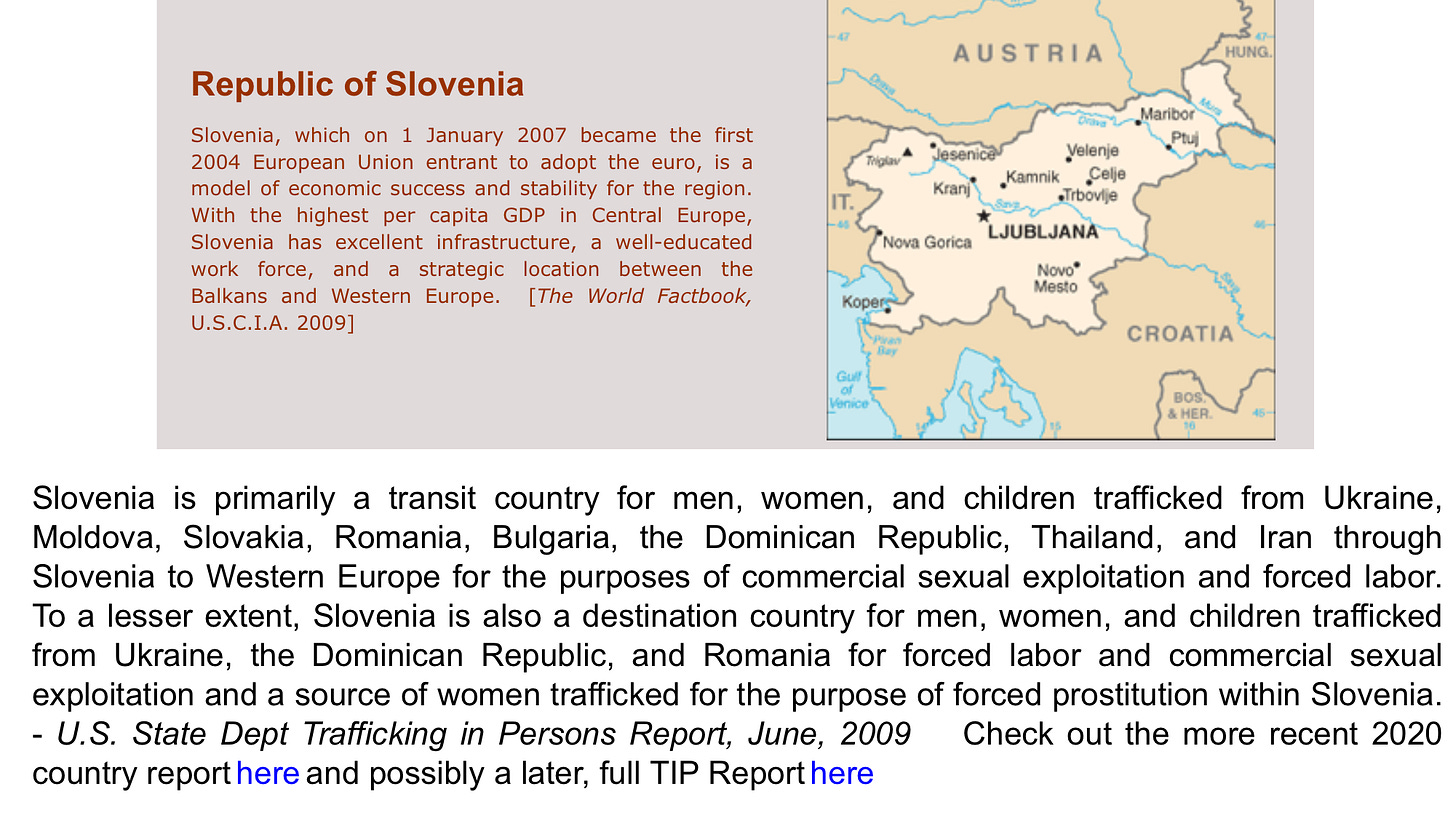

II

Its a great book(s), especially in its pre-Clinton White House era history and Epsteins history. Definitely a lot of interesting things, some of which she had written about before but with more detail. Its pretty dense in spots, lots of names, companies, organizations and many interlocking parts that really are a bit too much for many of our brains unless you are already familiar with many of them, and even then.

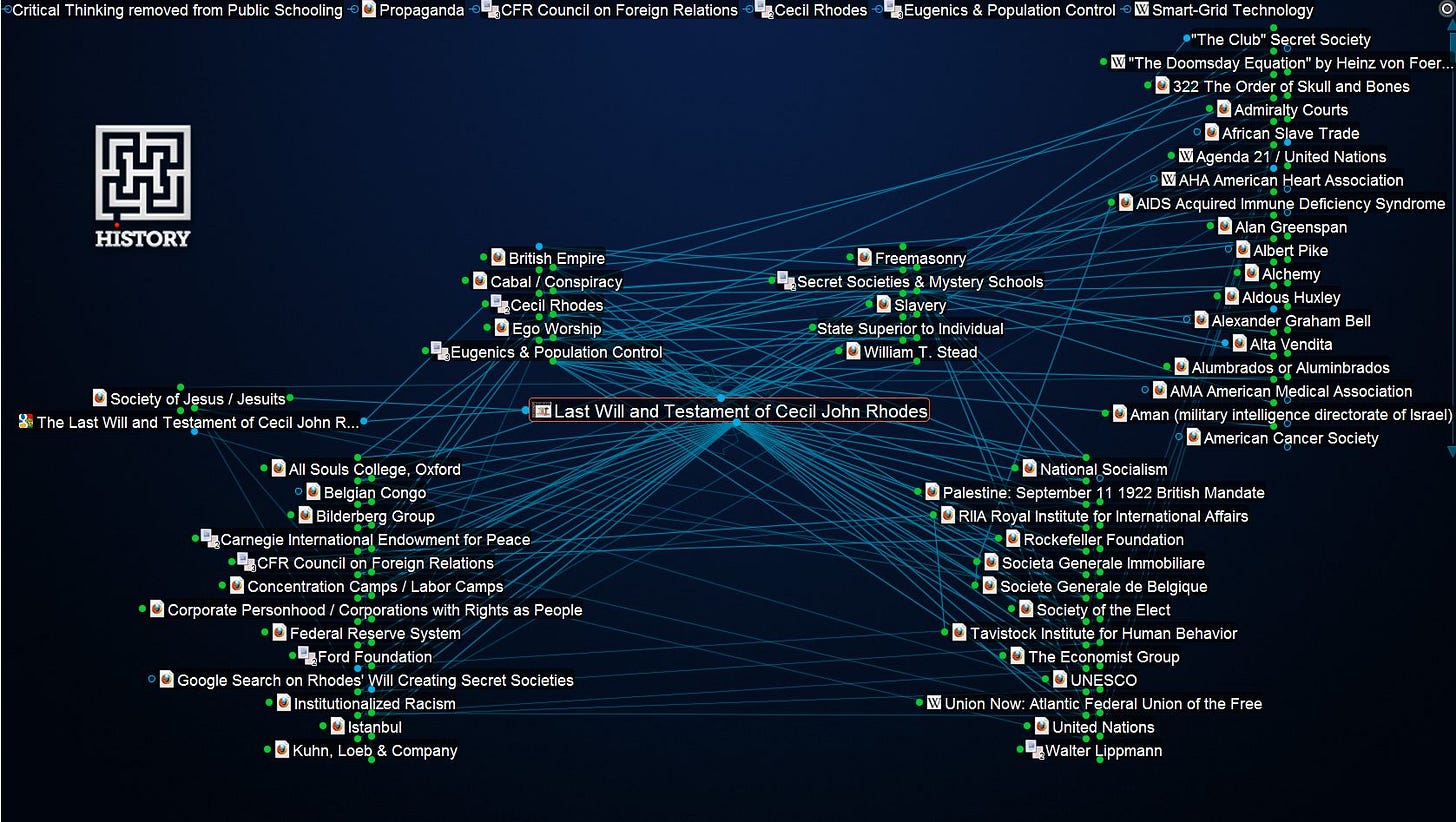

Whitney should get Richard Grove to put his “Brain” to work and then sell that as part of the books

The book uses Epstein as its center to narrate a thesis for the merging of organized crime, intelligence, MIC, finance and tech who use sex to blackmail rich and powerful people to make money and obtain power for the Elites . They use middle managers like Epstein to avoid getting their own hands dirty, and dispose of them when they become inconvenient or are threats.

Epstein is of course connected to many other players in this Corrupt Game, who all seem connected no more than 1-3 degrees of separation, guys like Trump , Adnan Khashoggi, Roy Cohn, Steve Hoffenberg, Trump, Bill Clinton, Leon Black, Mega Group -Wexner, Lauder, Fisher, Tisch, Bill Barr, James Riadi, Mark Middleton , Ron Brown, Jean Luc Brunel, the Maxwells, Douglas Leese, Richard Secord, Bill Gates, Edmond Safra, Theodore Shackley, Peter Thiel, Nicole Junkerman, Charlie Trie, Edgar Bronfman, Craig Spence, Jackson Stephens, Robert Keith Gray, Earl Brian, Rafi Eitan, Evelyne de Rothschild, Marc Rich. , Lew Wasserman, Robert Vesco , Edwin Wilson , Larry Summers and so many more.

However, probably because of a limitation of the books size, I feel there are some important gaps especially with regard to Trump, Russia, Taiwan Gate and even Epstein/Maxwells to a lesser extent.

Besides space , other explanations for these omissions could be oversight or they did not meet Whitneys sourcing standards. Fair enough.

Whitney asked a simple question on Twitter

The simple answer is the Left today seems all in with the so called Deep State and Big Techs Transhumanist Agenda. Why would they talk about a book exposing this. Their sponsors wont like it. Also, despite there being some cool new stuff on Clinton-Epstein what is mentioned about Trump has mostly all been reported by the Mainstream Media. So there is nothing in it for the lefts sponsored alternative media, and they risk exposing their audience to inconvenient facts .

And lets face it, the alternative media on both sides has been corrupted by money. If you want to make more money, you need to pick one side or the other because nobody wants to sponsor anyone not pushing one of the Elites agendas (and they control both sides as they are true Hegelians)

While there are many inconvenient facts in the book for the Neocon Right that taint Reagan and both Bushes, and of course the Intelligence Community, for the Trump Right the reports on Clinton-Epstein, Chinagate, and Clintons Iran-Contra drug running stories trump (no pun intended) what is is unflattering about Trump, most of which has been reported elsewhere. They will eat this up.

In any event, what I feel deserves more emphasis for a complete picture is that from the late 1980’s through the 2000’s, one of the biggest influences on Organized Crime and illicit money was the opening of the Former Soviet Union (FSU) . The Russian or Red Mafia came to the US in a big way thanks to the influx of immigration and increased travel to and from the region and open markets. Not to mention the Oligarchs (many of which were criminals) who with the help of Western Bankers and Regulators looking the other way were sending dirty money to the US and laundering it by purchasing expensive Real Estate and spending big in Casinos, and of course investing in legitimate companies and using them as a cover for their criminal or legal but nefarious activities

In addition, as America and the West were funneling billions to Asia, including to China by transferring production to China and buying the goods we no longer made here , and siphoning profits through middlemen and stashing them offshore thus evading taxes before laundering some it back to the US, billions more were returning thanks to the looting of Russia and the rest of the FSU , which fueled stock and real estate bubbles as well as organized crime, and which brought with it increased human sex trafficking and illegal drugs

To be fair this is touched on by Whitney, but perhaps got overwhelmed since the emphasis is more on Epstein and his connections to this world is not as well documented. At least, that was my sense.

So what I am going to do here is provide supplementary information that I feels adds to the picture Whitney painted (read the books)

In her books she mentions

In his article, shortly after introducing Epstein as an “immensely powerful New York property develop and financier,” Rosser states that Epstein “has made many millions out of his business links with the likes of Bill Gates, Donald Trump, and Ohio billionaire Leslie Wexner, whose trust he runs

Yet the big question is which business links with Trump made Epstein money? We read about how they were friends and palled around, went to the same parties and such, enjoyed the girls, flew on each others planes and all, and competed for the same property, but what business links with Trump made Epstein money?

Of course, Epstein like Trump was involved in Real Estate but we are not aware of them being involved in the same deals together. Indeed their breakup was due to competition to acquire the same property in Florida in 2004. Since the limits of Trumps dealings in the Financial World seems limited to borrowing money, its hard to see Epstein making money off Trumps debts or Trump being fool enough to invest in Epsteins scams. They did seem to have a common interest in Modeling, as we shall see. However, its unclear how Trump helped Epstein financially in this area.

The one thing Trump offered Epstein that probably enriched Epstein was increased access to a vast social network of very wealthy people. Fishing in the Trump pond of NYC Guppies was probably lucrative, plus Trumps mob links may have offered Epstein some protection and other opportunities. Just speculation on my part

Anyways, I am going to cover a lot of ground and I wont be able to answer that question definitively. We will probably never know for sure.

My hypothesis is that Epstein, Clinton and Trump were part of the so called “Enterprise”. Intelligence assets assigned to different business or political roles of the Enterprise’s different divisions. At times the tasks they were assigned interlocked with each other , at other times they did not.

There is one thing we know for sure, anyone operating at the level these three were , at least in the post-PROMIS World , were not operating under the radar. They could be brought down at anytime. If they pleased their taskmasters, they were free and could get approval for loans in large amounts or receive large donations. If they failed in anyway, they get busted, and if they know too much and are a threat they die.

Epstein was a threat to someone. As was Brunel. And Thomas Bowers (Trump and Epsteins Deutsche Bank banker) , Stephen Hoffenberger and Mark Middleton. All killed or suicided from 2019-2022. Since Epstein was already dead , guess who they were a threat to? I wont answer that. Maybe you can figure it out after reading Whitneys books and the rest of this.

I wont even dwell on the so called natural death of Adnan Khashoggi in 2017 and Iran Contra Whistleblower Bruce Hemmings 2021 death, after all they were old , but Adnans nephews (Jamal) assassination in 2018 was weird.

Al Arabiya reported that Khashoggi once tried to persuade bin Laden to quit violence. Khashoggi said: "I was very much surprised [in 1997] to see Osama turning into radicalism the way he did."Khashoggi was the only non-royal Saudi Arabian who knew of the royals' intimate dealing with al-Qaeda in the lead-up to the September 11 attacks. He dissociated himself from bin Laden following the attacks.

[Maybe Jamal knew something he shouldn’t have?]

Also, George Nader (connected to Lauder, Trump, Khashoggi) was arrested around the same time as Epstein and Ghislaine met the same fate a year later. It sure looks like someone was cleaning house

For now, Trump and Clinton (and Ghislaine) are not perceived as threats to their Elite backers, although that might change. Anyways, I digress

This is definitely too long for Email so click on Title to see the whole thing.

As some of the topics may not be of interest to all, I will list them here in the order they will be covered so you can scroll past to something more interesting

JEAN LUC BRUNEL

JOHN CASABLANCAS

PAOLO ZAMPOLLI

TRUMP MODELS

ADNON KHASHOGGI-MARCOS/40 WALL ST

RESORTS INTERNATIONAL-ROTHSCHILDS BAILOUT

TRUMPS EARLY MOSCOW TRIPS

PAN AM CONNECTION-HOFFENBERG-EPSTEIN-TRUMP

BILL BROWDER-MAXWELL-SAFRA-PREVEZON-TRUMP TOWER

TRUMP-CLINTON

FELIX SATER-MOGILEVICH-COHEN (not COHN)

BAYROCK-ARIF-SAPIR-CHABAD-LEVIEV

CARGOMETRIC-NSA OF CARGO-SCOTT BERGERSON-TERRAMAR, CFR

STANLEY POTTINGER

THOMAS BOWERS-DEUTSCHE BANK

BANK LEUMI

ROSEMARY VRABLIC (TRUMPS-KUSHNER’s BANKER

LARRY MIDDLETON-STEPHENS INC

CHINA -GATE OR TAIWAN -GATE OR BOTH

TRUMPS CHINESE SAVIOURS

TRUMPS NEWEST CHINESE BUSINESS PARTNER

TRUMPS “COCO CHOW (pet name for Elaine Chao)

GEORGE NADER

EPSTEIN -TRUMP BREAK UP-MORE RUSSIAN MONEY

WORLD COMMERCE CORPORATION-ATLANTIC COUNCIL-AIC-AIG

WILLIAM BARR- CLINTON-EPSTEIN-TRUMP

BROOKFIELD ASSET MANAGEMENT-BRONFMANS-KUSHNER

LARRY FINK-DONALD TRUMP

EPSTEIN-GIULIANI-ROSS-MNUCHIN-BLACK SIGHTING POST-CONVICTION

Note: Just because I link to something does not mean I agree with everything in the link, just what I posted.

Jean Luc Brunel.

Whitney does a great job covering Brunels -Epstein relationship and their use of Models.

Brunel started his Modeling career in Paris where there were no age of consent laws. Europe as a whole was pretty relaxed in this area where even countries with such laws had the age of consent at 14 or 16 years old. Even in the US a number of states like Massachusetts where the age of consent is 16. NY is one of those with 18 as the age of consent. Not that its ok for these old guys to be messing around with teenagers, legal or not.

However, IMO Whitney falls short in her coverage of Trump in this area

Sometime between 1995 and 1999, Brunel rented an apartment in Trump Tower, whose owner Donald Trump was still close to Epstein at that time and who also has had controversial ties to the modeling industry.

Thats it. The only reference an obscure hard to find book : Swaine, Henley, and Osborne, “Jean-Luc Brunel.”

So lets summarize

Jean-Luc Brunel-

An agent for Karin Model Management in 1975.

Founder of Next Model Management’ 1989

Bought Karin in 1995 which became MC2 in 2005

MC2 Model Management announced co-founder Brunel would be the agency procurer in 2012

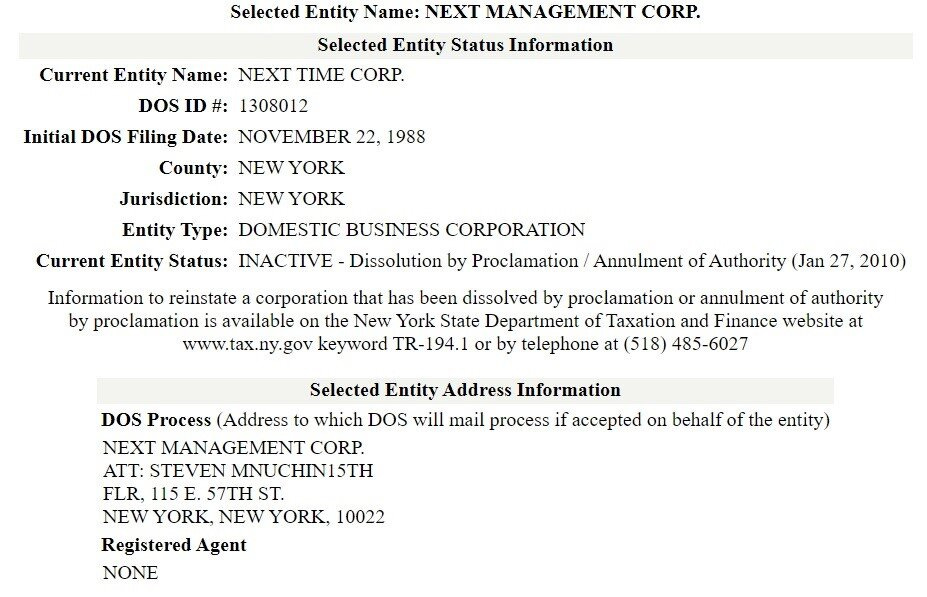

1988, one of Brunel’s wealthy friends, Steven Mnuchin – who would later become the Secretary of the Treasury under President Donald Trump , apparently helped Brunel set up one of his modeling companies. He denied this

Steven Mnuchin was the point of contact for ‘Next Management Corporation’ as the Department of State (DOS) process person. That means that anyone wishing to communicate with, or perhaps, sue, the corporation would have to contact Mnuchin. And, as with almost every other man connected to the fall-out of the Jeffrey Epstein and Ghislaine Maxwell child trafficking ring – Steven Mnuchin said he was “not clear” how he ended up in that role for the Brunel brothers and that he did not “recall” ever meeting either one of them.

In 1985, three years earlier, Mnuchin graduated from Yale University. While at univeristy, he was a member of America’s most secret society – the ‘Brotherhood of Death’. It is perhaps better known as ‘Skull & Bones’ – with draconian initiations for the 15 new members that are selected every year.

Mnuchin was working for Goldman Sachs in 1988, so perhaps him being a Department of State (DOS) process person was part of a service Goldman Sachs offered Next Management Corp, and Mnuchin’s name was used for many companies. I don’t know

John Casablancas

Whitney mentions Epstein trying to get into the modeling business

Around this time, in 2004, Epstein was seeking to gain his own foot-hold in the modeling industry as he attempted, but failed, to acquire the US branch of Elite Models.

Sarah Marks, “New York Branch of Elite is sold for £4.4m,” Evening Standard, August 25, 2004, Section D, p. 33.

From Whitneys Source

According to the New York Post, Miami-based Eddie Trump - no relation to billionaire Donald - outbid financier Jeffrey Epstein and ID Models boss Paolo Zampolli.

The sale does not affect the parent company in Switzerland or affiliated branches worldwide.

Elite, which was founded by John Casablancas in 1971, was credited with creating the supermodel cult of the 1980s when it represented Claudia Schiffer, Naomi Campbell, Cindy Crawford and Linda Evangelista.

https://www.thisismoney.co.uk/money/news/article-1507877/Elite-New-York-branch-sold.html

Paolo Zampolli and John Casablancas mentioned in the article were quite close to Trump who had set up his own modeling agency in 1999

Excerpts from the link below

In 1991-On the Spirit of New York, a large private yacht , a party was in flow. Scores of teenage girls in evening dresses and miniskirts, some as young as 14, danced under disco lights surrounded by a crowd of older men surrounding them.

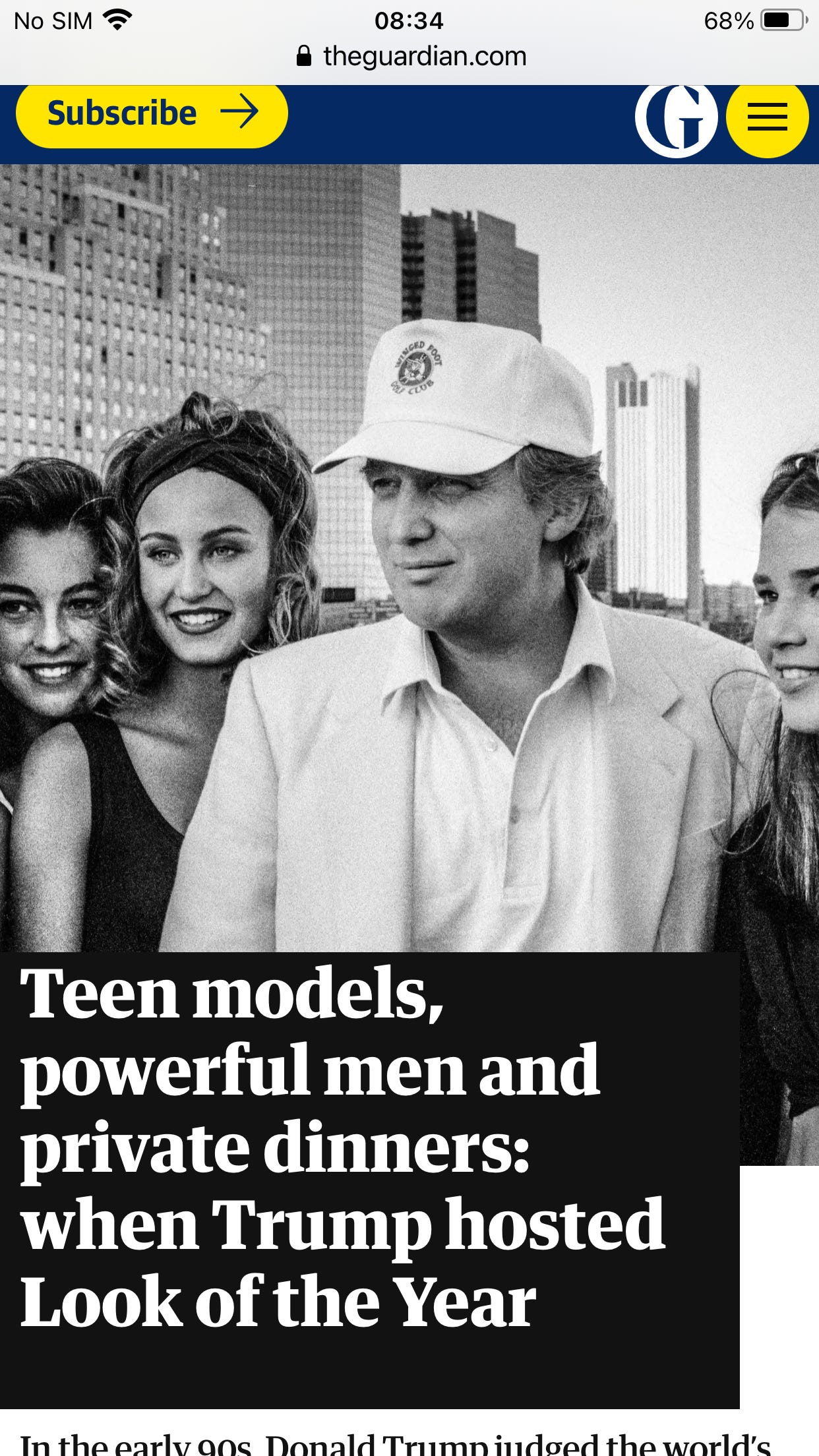

This was one of several events that Donald Trump, then 45, attended with a group of 58 aspiring young models that September. They had travelled from around the world to compete in Elite’s Look of the Year competition, an annual event that had been running since 1983 and was already credited with launching the careers of Cindy Crawford, Helena Christensen and Stephanie Seymour.

At stake was a life-changing prize: a $150,000 contract with the world’s then leading modelling agency, Elite Model Management, run by John Casablancas.

Casablancas was sued by a former Look of the Year contestant. According to the lawsuit, when she was 15 and Casablancas was 46, at Look of the Year 1988 in Japan, Casablancas said he was “falling in love” with her. At the end of the competition, the lawsuit states, “contestants drank and partied late into the evening” and Casablancas told the teenager to come to his hotel room.

There, Casablancas sexually abused the girl “several times over the evening”. The abuse allegedly continued the following year; when the girl became pregnant, Casablancas told her “she would be having an abortion”. The abortion was allegedly “arranged and paid for” by Elite.

Trump was closely involved in Casablancas’s competition. In 1991, he was a headline sponsor, throwing open the Plaza, his lavish, chateau-style hotel overlooking Central Park, transforming it into the main venue and accommodating the young models. He was also one of its 10 judges.

One of the judges in 1991, Gèrald Marie, raped one of the contestants when she was 13

In 1992, Trump hosted the competition again. One of the girls on the boat was Shawna Lee, then a 14-year-old from a small town outside Toronto. She recalls how the contestants were encouraged to parade downstairs, one by one, and dance for Trump, Casablancas and others.

Another contestant, who was 15 at the time, also remembers being asked to walk for Trump, Casablancas and other men on the boat in September 1992. She says an organiser told her that if she refused, she would be excluded from the competition.

“I knew in my gut it wasn’t right,” she recalls. “This wasn’t being judged or part of the competition – it was for their entertainment.”

While Elite’s official brochure stated that contestants were aged between 14 and 24, all of those the Guardian has spoken to, competing in both years, were aged between 14 and 19.

Over the last six months, the Guardian has spoken to several dozen former Look of the Year contestants, as well as industry insiders, and obtained 12 hours of previously unseen, behind-the-scenes footage. The stories we have heard suggest that Casablancas, and some of the men in his orbit, used the contest to engage in sexual relationships with vulnerable young models.

No such allegations have been levelled against Trump, who at the time was dating Marla Maples, the woman who in 1993 became his second wife.

It also appears that Epstein had a Casablancas connection during the 1990s. According to a lawsuit filed in the US three months ago, in 1990 Casablancas sent a teenage model for her first “casting call” at a residential address on New York’s Upper East Side, to meet a “photographer” who, it turned out, was Epstein. The lawsuit states that Epstein ordered the 15-year-old girl to undress before taking photographs of her, pushing her against a wall and sexually assaulting her.

For more on Casablancas and Brunel and their connections to Trump read this

Look of the Year was an event sponsored by Casanovas Elite Model.

Paola Zampolli

He founded ID Models in New York City in the mid 1997.

-The agency operated until 2008

Zampolli allegedly cultivated the career of Melania Knauss, whom he introduced to Trump at a party he hosted at the Kit Kat Club in the 1998 and secured Melania’s visa to the US. Says Melania—

“I have known Paolo Zampolli since 1995 when we first met at a modeling agency in Milan”

In 2008 Zampolli ended ID Modeling and formed a partnership with Trump and the Trump Organization as “Director of International Development”

Mr. Zampolli..... In 2013 he became, by appointment, the United Nations ambassador of Dominica, a country of which he is not a citizen. A Brazilian model, Amanda Ungaro, his wife of a decade and the mother of his young son, herself became ambassador of Grenada to the United Nations, also by appointment.

In his office, along with pictures of him posing with Mr. Clinton and Mr. Trump’s jet, there are hundreds of framed photographs of him with dignitaries. His passion now, he says, is sustaining the life aquatic. (“The ocean dies, we die.”)

He has started an organization, We Are the Oceans, the flags of which fly outside his house and whose scuba-themed pillows are on his oversize bed. In March, Page Six covered a gala of ambassadors and pouting socialites at his home that in part benefited an organization called Save Our Shark Coalition.

Zampolli once partnered with Ghislaine Maxwell on a save-the-oceans charity.

The initiative was the Sustainable Oceans Alliance, which sought to ensure the United Nations included oceans in its Sustainable Development Goals.

A 2013 news release on the website for TerraMar — which announced it was shuttering in the days after Epstein’s arrest — describes the alliance as a four-way partnership between TerraMar; another nonprofit called the Global Partnerships Forum; the late Stuart Beck, who served as “ambassador on oceans and seas” from the Pacific island nation of Palau; and a Trump friend, Paolo Zampolli, an Italian-born businessman who has served in diplomatic posts for Caribbean nations.

Before his diplomatic career, Zampolli co-founded a model management company and served as the Trump Organization’s director of international development. He has long been credited with introducing Trump to his third wife, Melania, though The New York Times reported this month that Epstein has also claimed credit for the introduction.

Zampolli said he was unaware of Maxwell’s connection to the Sustainable Oceans Alliance but that he does recall that Beck — who served on TerraMarr’s board in 2013 — brought Maxwell to the United Nations twice to discuss her oceans advocacy.

TerraMar sought to build social networks around ocean protection, issuing free “Ocean Passports” to anyone who pledged to support its goals, making them an “ocean citizen.”

https://www.politico.com/story/2019/07/21/jeffrey-epstein-trump-clinton-1424120

On December 22, 2020, Mr. Zampolli was announced as an appointee Member of the Board of Trustees of the John F. Kennedy Center for the Performing Arts by President Donald Trump

https://en.m.wikipedia.org/wiki/Paolo_Zampolli

Trump Models

-Trump Model Management NY later shortened to T Management was founded by Donald Trump in 1999

-Trump Modeling signed Trump’s the girlfriend now wife, Melania Knauss, to shoot for British GQ on his Trump plane

-At the time Trump crested his modeling company he was married to Marla Maples and dating model Melania

-Models who worked at Trump during the mid aughts reported problems- including uncomfortable living quarters and flouting immigration laws

-There are multiple public reports that the agency forced girls to work for slave wages

-Trump Modeling did not close it doors until 2017

https://www.businessinsider.com/former-trump-models-tell-their-story-2017-2?op=1

An interesting side note

Donald Trump announced he was opening a modeling agency, Trump Management Group, with Buti at the helm.

"I've made $5 billion because I bank on the right people," Trump told New Yorkmagazine. "And I think he's a terrific, unjustly accused guy. Restaurants, with all the unions and hamburgers you got to deal with, are not for him. But Tommaso loves women and women love him back. He's a natural to run a modeling agency."

The businessman was indicted by the United States Attorney's Office on federal charges of conspiracy, fraud and money laundering in December 2000 and arrested in Milan

https://www.newsweek.com/tommaso-buti-italian-businessman-pardoned-president-donald-trump-1562970

Tommaso Buti was pardoned by Trump in 2020

Adnon Khashoggi

Trump got many ideas for the Trump Tower from Adnon Khashoggi who threw many parties at his penthouse at the Olympic Tower in the early 80’s.

Trump’s yacht, the Trump Princess, had originally belonged to the Saudi arms dealer — the uncle of slain Washington Post contributor Jamal Khashoggi — and Maxwell’s yacht had originally belonged to one of Adnan’s brothers.

When the Marcoses were indicted in 1988 for allegedly diverting money from the Philippines, Khashoggi was charged with helping them cover up the building’s ownership. After Khashoggi and Imelda Marcos were acquitted, she walked on her knees through St. Patrick’s Cathedral, Bernstein recalled, and the arms dealer threw a lamb feast with belly dancing.

By 1993, the building was a “vertical ghost town” whose windows were dark while the rest of the Financial District glowed, the Associated Press reported. Kinson Properties, an arm of a Hong Kong-based footwear and real estate company, acquired it that year. Trump pounced when Kinson had trouble turning the building around, he wrote. He said he paid $1 million for the right to lease the building through 2059.

In 1982, 40 Wall Street was purchased by Joseph J. and Ralph E. Bernstein, who were discovered later to have been operating as a front behind dictatorial Philippines president Ferdinand E. Marcos. It was not the only building in Marcos’ portfolio of buildings in New York City: the Crown Building on 5th Avenue and the Herald Square shopping mall were among others likely using funds taken from the Philippine government treasury.

Once Marcos was removed from leadership, his assets in the United States were frozen, which led to a contentious feud between the Bernstein brothers and the associate of an arms dealer, who both claimed ownership of the building

Financial companies like Deutsche Bank, Manufactures Hanover’s Trust Company, Toronto Dominion Bank, Loeb, Rhodes & Co., Bache & Co., White, Weld & Company have all been headquartered at 40 Wall Street. The U.S. Navy had offices inside during World War II. Other companies include Western Union and Westinghouse Electric Corporation.

[When the Marcoses were indicted in 1988 for allegedly diverting money from the Philippines, Khashoggi was charged with helping them cover up the building’s ownership.]

In 1995, Donald Trump purchased [the lease on] 40 Wall Street [from Hong Kong owned Kinson Properties] for a figure that is still debated. New York Times wrote at the time, it was less than $8 million. Trump wrote in his book, Never Give Up, and said on The Apprentice and CNBC he paid $1 million for it. “Even people who know very little about real estate can be duly impressed by that price,” he contends in his book, “I had been watching this building for decades, and I knew a lot about it before making my move.” The Federal Election Commission disclosure forms from 2015 show he has a debt of over $50 million on 40 Wall Street for the lease of the land.

Regardless, 40 Wall Street is considered his most successful real estate venture, transforming the declining skyscraper icon into a residential and office building. Trump representatives said at the time of the sale that $100 million would be spent in renovations following the purchase, and much of the surfaces have been gilded, but The Real Deal reported in 2012 that only $35 million was spent.

Resorts International - Rothschild Bailout

1987, Donald Trump purchased his first casino interests when he acquired 93 percent of the shares in Resorts International, which evolved from a CIA money-laundering front company set up by CIA chief Allen Dulles in the 1950’s. Resorts International has a sordid history that began in the early 1950’s when it evolved from a CIA and Mossad front company which had been established for the purpose of money laundering the profits from drug trafficking, gambling, and other illegal activities. The appropriation by the mafia of casinos like those operated by Resorts International was the result of a decision by the Meyer Lansky Syndicate to expand operations outside Las Vegas.

https://ordoabchao.ca/articles/donald-trump-chabad-lubavitch-oligarchs

1990-Trump found himself in financial trouble when his three casinos in Atlantic City were under foreclosure threat from lenders, but was bailed-out by senior managing director of N.M. Rothschild & Sons, Wilbur Ross, who Trump would later appoint as Secretary of Commerce. Ross, who is known as the “King of Bankruptcy,” specializes in leveraged buyouts of distressed businesses.

“We could have foreclosed [on the Trump Taj Mahal], and he would have been gone,” Ross told the paper last year. Trump was allowed to keep a 25-percent share of the Taj. The bondholders took half. And as the Post reported, “To outsiders it seemed Trump was still running the casino.”

https://nypost.com/2016/11/25/icahn-ross-saved-trump-brand-from-taj-mahal-casino-mess/

Evelyn de Rothschild.

. He was chairman of N.M. Rothschild & Sons the time of Trumps bail out by Wilbur Ross of N.M. Rothschild & Sons . He would go on to marry Lynn Forrester who is Epsteins pal and frequent Clinton White House visitor

As mentioned in Whitneys book the President of N.M. Rothschild & Sons Robert S. Pirie had in recent years helped James Goldsmith and Robert Maxwell hostile take over Crown Zellerbach and Macmillan Publishers respectively.

Wilbur Ross was the number 2 man behind Piries, specializing in friendly takeovers and known as the King of Bankruptcies dealing with many of the largest bankruptcies in history at the time

Ross would be appointed by Clinton to head the U.S.-Russia Investment Fund He would also be a partner in the takeover of the distressed Bank of Cyprus in 2014 where a lot of Russian Oligarchs parked their billions, and of course as mentioned would later become Trumps Secretary of Commerce.

For some reason Whitney did not mention N.M. Rothschilds role in Trumps bankruptcy in the book although she has mentioned it in interviews.

Trumps Earlier Moscow Trips

1987-After purchasing the mob-CIA connected Resorts International Trump took an all-expenses-paid jaunt to the Soviet Union in July to discuss building the Russians some luxury hotels. Two months after his return from Russia, Trump turned to Roger Stone, a Nixon-era dirty trickster then with the firm of Black, Manafort & Stone, for political advice.

Trump had met Stone and his colleague Paul Manafort through Roy Cohn. Under Stone’s tutelage, on September 1, 1987, just seven weeks after his return from Moscow, Trump suddenly went full steam ahead promoting his newly acquired foreign policy expertise, by paying nearly $ 100,000 for full-page ads in the Boston Globe, Washington Post, and New York Times calling for the United States to stop spending money to defend Japan and the Persian Gulf, “an area of only marginal significance to the U.S. for its oil supplies, but one upon which Japan and others are almost totally dependent.” He wrote. “. . . It’s time for us to end our vast deficits by making Japan and others who can afford it, pay. Our world protection is worth hundreds of billions of dollars to these countries and their stake in their protection is far greater than ours.”

https://newrepublic.com/article/150646/young-trump-went-russia

[Manafort would chair the Trump presidential campaign from June to August 2016]

1996- Trump’s trip to Moscow to allegedly negotiate for a Trump Tower Moscow

The Senate Intelligence Committee’s report on ‘collusion said On page 650 of this thousand-page doorstop of a report, that Trump went to a party at the Kempinski hotel on a visit to Moscow in 1996 and: ‘at the party, Trump may have begun a brief relationship with a Russian woman named XXXX XXXX.’ The name is of course redacted.

The report says that Trump may have met the woman again when she came to New York two years later. It quotes a Russian newspaper story as saying he welcomed a number of guests to an event in New York ‘among whom was the charming XXXX XXXX,

“Miss Moscow”…Trump recalled that two years ago, during his stay in Moscow, [she] was for him the most beautiful hostess of the capital, whose charms were not overshadowed even by Claudia Schiffer and Tina Turner, who lived in the same hotel. He recalled with pleasure the excellent company with which he spent time in Moscow.’

According to the Senate Intelligence Committee’s report, “Counterintelligence Threats and Vulnerabilities,” Leon Black was on the Trump trip, along with David Geovanis and Bennett LeBow, two men Black knew from his days as head of mergers and acquisitions at Drexel Burnham Lambert, the long defunct Wall Street investment bank.

Black came out of Drexel and Drexel attempted to entrap its clients with sex. Connie Bruck’s The Predators’ Ball described the famed annual bash for Drexel’s raiders. One part was when the heavy hitters were brought to a room full of enticingly beautiful women.

https://www.intelligence.senate.gov/sites/default/files/documents/report_volume5.pdf

Black and Epstein were pretty tight if memory serves correctly

Mr. Black knew Mr. Epstein for decades — in 1997 he made Mr. Epstein one of the original trustees of what is today called the Debra and Leon Black Foundation

https://www.nytimes.com/2020/10/12/business/leon-black-jeffrey-epstein.html

Pan Am Connection-Hoffenberg-Epstein-Trump

Mr. Trump's control of Resorts also throws into question the future of Pan American World Airways Inc., a company in which Resorts owns a 9 percent stake.

Pan Am, the financially troubled airline in which Resorts invested because of Mr. Crosby's fascination with aviation, is likely to attract other bidders. Wall Street sources said a handful of interested parties had already contacted Mr. Trump about the stake, currently worth about $56 million.

According to the sources, Mr. Trump will, in time, probably sell the Pan Am stock, either to another airline looking for a merger or to a party seeking control of Pan Am's attractive service operation.

In the last few months, at least one other airline company, AMR Inc., the parent of American Airlines, has expressed an interest in Pan Am, but merger talks were unsuccessful. The least likely outcome, airline analysts believe, would be for the hard-pressed Pan Am to repurchase the stock itself. 'Family Was Scared'

https://www.nytimes.com/1987/03/10/business/trump-buys-73-stake-in-resorts-for-79-million.html

Hmmm, and as soon as Trump acquires a 9% stake in Pan Am which he is probably looking to unload Hoffenberg and Epstein try to take over Pan Am. 1987 was a very interesting year

But in 1987, Towers began constructing one of the largest frauds in history. The scheme began when Towers acquired the parent of two insurance companies, Associated Life Insurance and United Fire. Then, Towers launched a takeover attempt against Pan Am, the once-proud but then-struggling airline.

To boost its chances, Towers told the SEC that it had an expert on its team: Epstein. Towers called him “a financial advisor who has been familiar with Pan Am for approximately six years” and was now advising Towers.

What neither regulators nor Pan Am knew was that, as Hoffenberg admitted later in court, Towers had begun devising a classic Ponzi scheme, named for a swindler who defrauded investors by moving money back and forth to create the false impression that profit was being made.

After acquiring the insurance companies, Towers began siphoning funds from them to make its bid for Pan Am look viable. Hoffenberg and Epstein also began pulling out hundreds of thousands of dollars for themselves, court documents show. Hoffenberg issued more than 50 checks from the insurance companies to pay his stepdaughter’s tuition, expenses on his private plane and monthly $25,000 checks to Epstein.

“I advanced money to Epstein perpetually because I thought this thing could work,” Hoffenberg said. “He could sell anything. People loved him.”

When the airline takeover failed, the insurance companies faltered.

https://www.washingtonpost.com/politics/final-evasion-for-30-years-prosecutors-and-victims-tried-to-hold-jeffrey-epstein-to-account-at-every-turn-he-slipped-away/2019/08/10/30bc947a-bb8a-11e9-a091-6a96e67d9cce_story.html

[Hoffenberg incidentally was represented in his trial by none other than Rudy Giuliani who would one day become Trumps attorney]

Bill Browder-Maxwell-Safra-Prevezon-Trump Tower

Bill Browder as many know is responsible for the 2012 Magnitsky Act which is the weapon (sanctions) that would be most used in the upcoming Cold War with Russia

https://www.washingtonpost.com/news/the-fix/wp/2017/07/14/the-magnitsky-act-explained/

Browder set up an investment fund for Robert Maxwell. With this job, Browder was directly responsible for part of Maxwell’s investments and he travelled extensively across the former communist bloc.

Maxwell’s investment bankers also included Salomon Brothers.

However, in November of 1991 Maxwell mysteriously died while vacationing off the Canary Islands. It soon turned out that Maxwell’s business empire sat on a mountain of debt he was unable to repay.. For Browder, having worked for Maxwell was toxic for his career. For a while he found that no other employer would touch him and he only managed to get a job in mid-1992 with Salomon Brothers, another scandal-prone investment bank.

This was the job that finally brought Bill Browder to Russia. While the bank was covering activities and deals in all of Eastern Europe, Browder declared himself “the investment banker in charge of Russia”.

To his astonishment, he found that the Russian government was selling about 30 percent of each of some 27,000 Russian companies for a sum total of $3 billion. After a few days in Moscow, Browder rushed back to Salomon Brothers to try to convince his bosses and colleagues that they were “giving money away for free in Russia.”

Buying vouchers was only the first step in the privatization process. Investors then had to exchange the vouchers for the actual shares of Russian firms. This was done at Russia’s unique voucher auctions.

Only a few months after Browder invested Salomon Brothers’ money in what he called, “the most undervalued shares that had ever been offered anywhere in history,” The Economist published an article titled, “Time to bet on Russia?” which triggered a wave of interest in Russian stocks among western investors. Browder’s $25 million portfolio soon appreciated to $125 million turning him into hero at Salomon.

One of Salomon’s clients was an Israeli billionaire Benny Steinmetz . He was so impressed with Browder that he offered to help bankroll his own investment management shop, bringing along a small group of investors, the most important among whom was the Syrian-Israeli banker Edmond Safra. This led to the birth of the Hermitage Fund in 1996 laundered it profits out of Russia through Cyprus

2016, June 9 , Donald Trump Jr. sent Kushner an email inviting him to a Trump Tower meeting on June 9, 2016 with several Russians associated with Russian oligarch Aras Agalarov, including attorney Natalia Veselnitskaya — who had represented Prevezon Holdings in a civil forfeiture case in the southern district of New York (SDNY).

This case involved the laundering of proceeds — some of which were transferred through Deutsche Bank — ripped off from the $230 million in Russian taxes Bill Browder allegedly paid on his Hermitage company.

The email subject of the proposed Trump Tower meeting — cc’d to Paul Manafort — was “Russia – Clinton – Confidential.” Kushner originally omitted mention of this now infamous meeting on his security clearance form.

Lost in the hoopla over the June 9 Trump Tower meeting is the Prevezon association.

In 2015, Kushner and his family business, Kushner Cos., bought a portion of the building from Russian real estate billionaire Lev Leviev for $295M, The Guardian reports. The transaction first came up due to the $285M Kushner borrowed from Deutsche Bank to complete the transaction. Deutsche Bank and two companies tied to Leviev, Africa Israel Investments and Prevezon, have all recently been the subject of money laundering investigations.

A laundering case against Prevezon led by then-U.S. Attorney Preet Bharara abruptly ended in May, two months after Trump fired Bharara, with a $6M sweet heart settlement that raised eyebrows.

Trump-Clinton

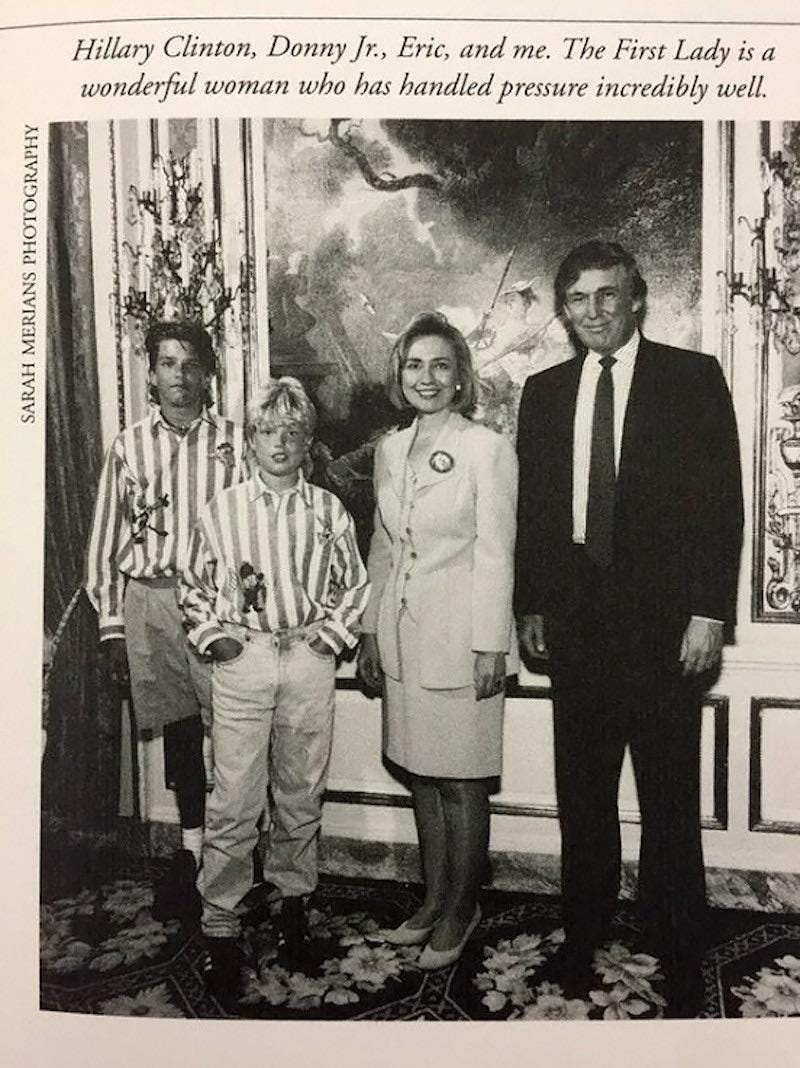

During the period Epstein was running in and out of the White House and palling around with the Clintons Trump was on very good terms with both

Donald Trump was for the Clintons before he was against them

Hillary Clinton took a seat in the front pew at the Episcopal Church of Bethesda-by-the-Sea in Palm Beach, Florida, one of 450 guests on the balmy Saturday night in January 2005 when Donald Trump tied the knot with Melania Knauss, his third (and current) wife. At the reception that followed, Bill Clinton joined his wife, the former first lady who was then serving Trump’s home state of New York in the Senate.

Trump now says Clinton had “no choice” but to attend his wedding because he donated money to her campaign

There was the September 1999 interview with New York Times columnist Maureen Dowd, in which Trump remarked that Clinton would have gone down in history “as a great president” if not for the Lewinsky scandal, which admittedly had been handled “disgracefully.”

In a CNN interview in 2007, he said that Clinton, then running for president for the first time, was a “terrific” person who “would do a good job” cutting a nuclear deal with Iran because she “always surrounded herself with very good people.”

On Tuesday, BuzzFeed reported on an archived web page of a blog post on TrumpUniversity.com in March 2008 in which Trump wrote that Clinton would “make a great president or vice-president.”

After declining to enter the presidential race in 2012, Trump told Fox News’ Greta Van Susteren that Clinton had done a great job as secretary of state.

“Hillary Clinton I think is a terrific woman,” he said. “I am biased because I have known her for years. I live in New York. She lives in New York. I really like her and her husband both a lot. I think she really works hard. And I think, again, she’s given an agenda, it is not all of her, but I think she really works hard and I think she does a good job. I like her.”

“I just like her,” Trump remarked, adding the same of the former president. “I like her husband. Her husband made a speech on Monday and was very well received. He is — he is a really good guy, and she’s a really good person and woman.”

Trump sounded a similar note in an October 2013 interview with Larry King, who asked Trump if he thought the former secretary of state would run for the White House a second time, pointing out that she is a “fellow New Yorker.”

“Yeah, and I know her very well. They’re members of my club, and I like both of them very much, and he was with you one time and he said he likes me,” Trump said, adding, “and I do like him.”

https://www.politico.com/story/2015/12/donald-trump-hillary-bill-clinton-relationship-217191

Felix Sater-Semion Mogilevich-Cohen

So we all know Trump and Epstein were pals or at least close acquaintances going back to 1987 and had mutual friends like the billionaire arms dealer Adnan Khashoggi whom Trump bought his yacht from. They had a falling out around 2004 before Epstein got charged with diddling little girls, allegedly over a dispute over a piece of property both wanted to buy.

This is stuff we all know. We also know the guy Trump appointed as his Secretary of Labor (Acosta) was the guy who gave Epstein his sweet heart deal because he was told Epstein belonged to intelligence. Epstein reportedly bragged at one time he was CIA

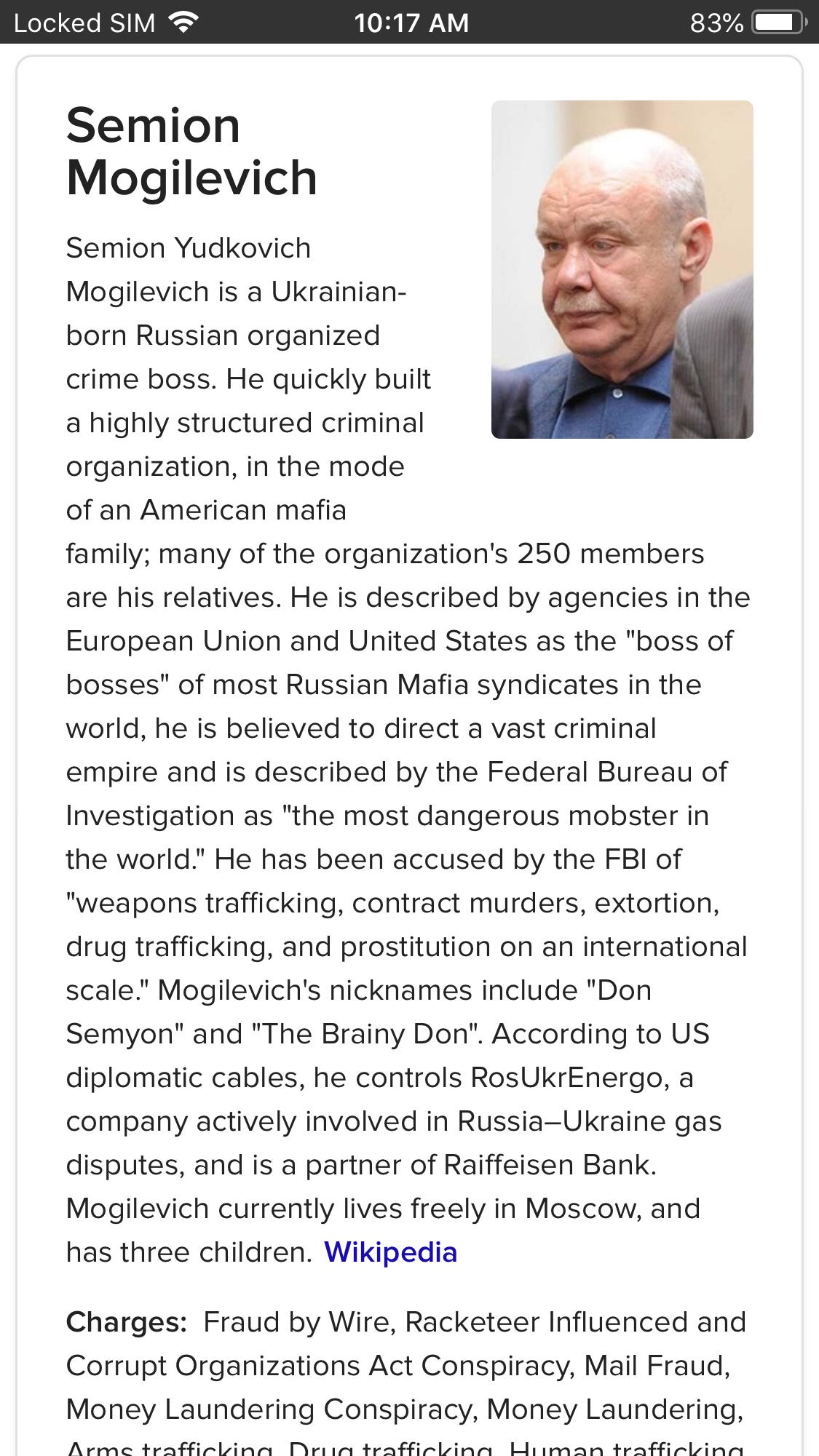

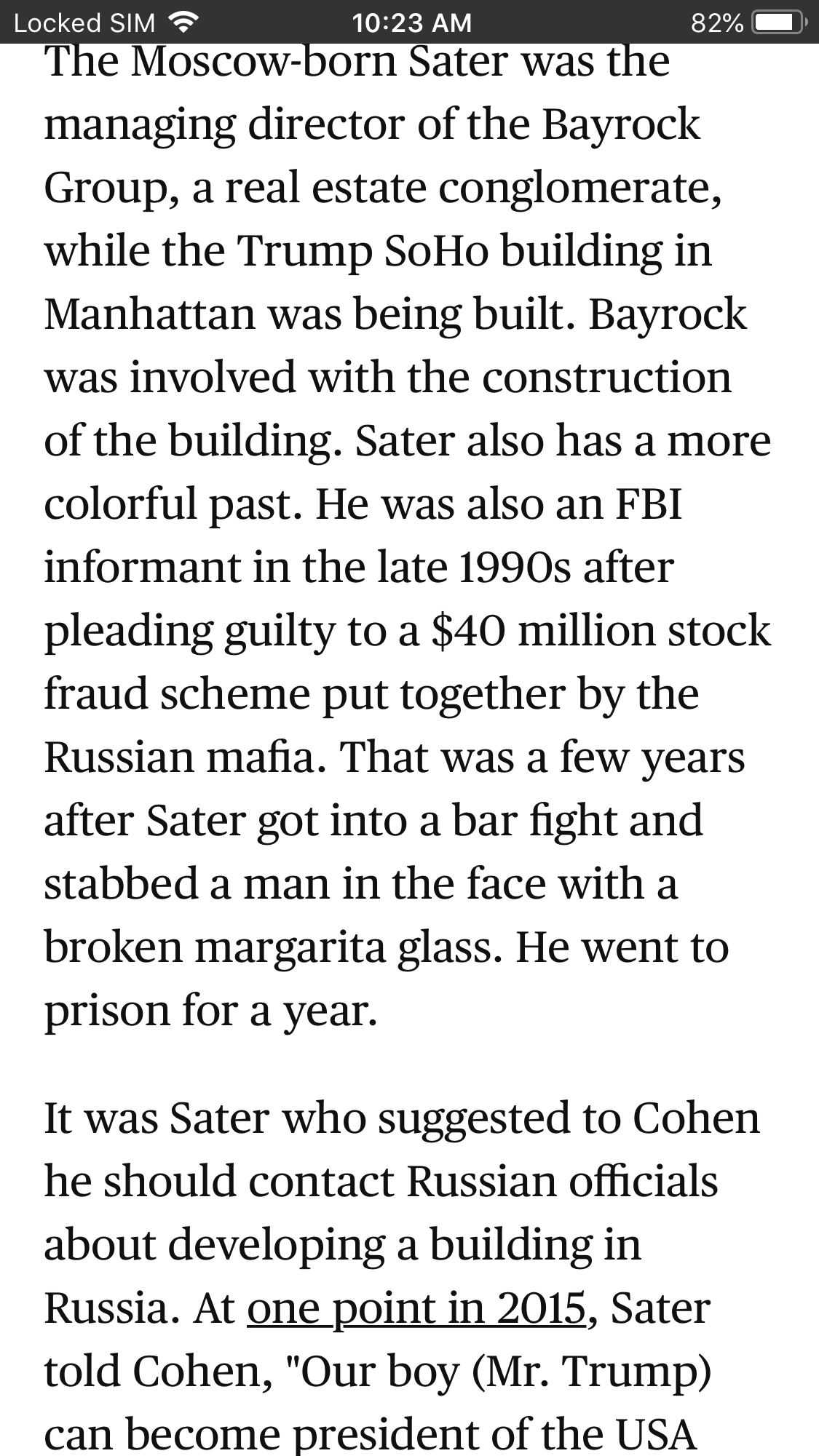

In this period (2004-2008) after breaking up with Epstein Trump began partnering with another Intelligence Asset at Bayrock. A fellow by the name of Felix Sater, who is the son of a guy who allegedly worked for a Russian Mafia crime boss, a Ukrainian Born dude named Semion Mogilevich mentioned quite a bit in Whitneys book)

However Sater was also pals with Trumps former lawyer Cohen (2006-2018) as they grew up together. In return for helping out FBI and other Intelligence Agencies in the Former Soviet Union and tracking down Stinger Missiles he stayed out of jail for Stock Fraud that he was charged with.

https://en.m.wikipedia.org/wiki/Felix_Sater

Bayrock-Arif-Sapir-Sater-Chabad-Leviev

Bayrock, the company that Donald Trump teamed up with to build his Trump Soho project. There were three main actors in that enterprise. One was convicted mob associate and murky FBI informant Felix Sater.

Another was Tevfik Arif, a shady man with likely Russian intelligence connections who was once was arrested by the Turks on Mustafa Kamal Ataturk’s yacht and “charged with running an international underage prostitution ring.”

The third was the late Tamir Sapir, another man with ties to Russian intelligence.

Interestingly, all these men have connections to the Chabad movement.

Felix Sater was honored as Man of the Year in 2014 by the Port Washington Chabad house. The same Chabad house’s website lists Tevfik Arif, who is not Jewish, “among its top 13 benefactors.”

But it’s Tamir Sapir who links Trump back directly to Russian Oligarch Lev Leviev.

…the late billionaire Tamir Sapir, was born in the Soviet state of Georgia and arrived in 1976 in New York, where he opened an electronics store in the Flatiron district that, according to the New York Times, catered largely to KGB agents.

Trump has called Sapir “a great friend.” In December 2007, he hosted the wedding of Sapir’s daughter, Zina, at Mar-a-Lago. The event featured performances by Lionel Ritchie and the Pussycat Dolls. The groom, Rotem Rosen, was the CEO of the American branch of Africa Israel, the Putin oligarch Leviev’s holding company.

Five months later, in early June 2008, Zina Sapir and Rosen held a bris for their newborn son. Invitations to the bris described Rosen as Leviev’s “right-hand man.” By then, Leviev had become the single largest funder of Chabad worldwide, and he personally arranged for the bris to take place at Schneerson’s grave, Chabad’s most holy site.

Lev Leviev is so close to Putin that he was one of two oligarchs tapped to help him gain control of the leadership of the Russian Jewish community back when he assumed power.

https://washingtonmonthly.com/2018/04/17/michael-cohen-gets-a-special-visit/

And then there’s this:

In May 2015, a month before Trump officially entered the Republican presidential primary, Kushner bought a majority stake in the old New York Times building on West 43rd Street from Leviev for $295 million.

The transaction first came up due to the $285M Kushner borrowed from Deutsche Bank to complete the transaction. Deutsche Bank and two companies tied to Leviev, Africa Israel Investments and Prevezon, have all recently been the subject of money laundering investigations. A laundering case against Prevezon led by then-U.S. Attorney Preet Bharara abruptly ended in May, two months after Trump fired Bharara, with a $6M settlement that raised eyebrows.

You can read this from David Livingstone for more detail

https://ordoabchao.ca/articles/donald-trump-chabad-lubavitch-oligarchs

Here is more on Chabad Lubavitch

NOTE: just to be clear, Trumps Russian Links are to Oligarchs and Organized Crime. Not Putin. I do not buy that Trump is a Russian Agent for Putin as some of my links suggest. I do believe he is and was a US Intelligent asset, like Clinton, Epstein and Felix Sater

Cargometric-NSA of Cargo, Scott Borgerson-TerraMar, CFR

Borgerson had married Maxwell, who turned 60 on Christmas Day, in 2016, but they kept it a secret from almost everyone — even the British media heiress’ own devoted family.

The secret marriage only emerged in court papers in 2020 when Borgerson tried to get his wife freed with a $28.5 million bail package.

https://nypost.com/2022/01/03/ghislaine-maxwells-husband-scott-borgerson-dumped-her-for-yoga-teacher/

Scott Borgerson founded CargoMetrics which has been called the NSA of Global Trade.

It seems very likely it is an intelligence front, and likely associated with MOSSAD given Ghislaine Maxwell’s relationship with Borgerson, as well as the financial backing received by Israeli shipping magnate Idan Ofer

https://www.haaretz.com/israel-news/business/israels-idan-ofer-backs-hedge-fund-1.5392395

First, a bit of an overview

CargoMetrics, a start-up investment firm, is not your typical money manager or hedge fund. It was originally set up to supply information on cargo shipping to commodities traders, among others. Now it links satellite signals, historical shipping data and proprietary analytics for its own trading in commodities, currencies and equity index futures.

CargoMetrics was one of the first maritime data analytics companies to seize the potential of the global Automatic Identification System. Ships transmit AIS signals via very high frequency (VHF) radio to receiver devices on other ships or land. Since 2004, large vessels with gross tonnage of 300 or more are required to flash AIS positioning signals every few seconds to avoid collisions. That allows CargoMetrics to pay satellite companies for access to the signals gleaned from 500 miles above the water. The firm uses historical data to identify cargo and aggregation of cargo flow, and then applies sophisticated analysis of financial market correlations to identify buying and selling opportunities.

With his degrees in hand, Borgerson applied for a fellowship at the Council on Foreign Relations. During the application process he met Edward Morse, now global head of commodities research at Citigroup. Morse was on the CFR selection committee in 2007 and recommended Borgerson as a fellow.

Morse introduced Borgerson to commodities, and to trading terms like “contango” and “backwardation.”

He came to me in 2009, after he had been turned down by 17 VCs, was maxed out on his credit card, was married and had a newborn son,” says Beardsworth, who was reviewing the Department of Homeland Security as part of the Obama administration’s transition team.

Beardsworth came to the rescue, not only committing to invest a small amount but introducing his friend to Doug Doan. A West Point graduate and Washington-based angel investor, Doan took to Borgerson right away

Borgerson had already begun to contemplate converting CargoMetrics from an information provider into a money manager; he saw the potential to extract powerful trade signals from its technology rather than share it with other market participants for a fee.

Manzi, a fellow Fletcher School grad who had mentored Borgerson since the company’s early days, put up more money (making CargoMetrics one of his single largest investments) and introduced him to a powerful group of wealthy investors. Separately, the CFR’s Morse suggested that Borgerson meet with Daniel Freifeld, founder of Washington-based Callaway Capital Management and a former senior adviser on Eurasian energy at the U.S. Department of State. Impressed by Borgerson’s “intellectual honesty, vigor and more than four years of historical data,” Freifeld brought the idea to a billionaire third-party investor, who took his advice and became one of CargoMetrics’ largest backers. “I would not have suggested the investment if CargoMetrics had not done the hard part first,” adds Freifeld, declining to name the investor.

A chance encounter in the fall of 2012 gave the CargoMetrics team its first taste of real Wall Street trading. Attending an Arctic Imperative conference in Alaska, Borgerson met the CIO of a large investment firm, whom he declines to name.

[Many believe this was David Rubenstein, CEO of Carlyle Group]

When Borgerson confided his ambition and that CargoMetrics had developed algorithms to trade on its shipping data once it was legally structured to do so, the CIO suggested CargoMetrics provide the analytical models for a separate portfolio the money manager would trade. Live trading using CargoMetrics’ models began in December 2012.

Manzi brought in longtime banker Gerald Rosenfeld in 2013 to craft and negotiate the move to make CargoMetrics a limited liability investment firm. Rosenfeld acted in a personal role rather than in his position as vice chairman of Lazard and full-time professor and trustee of the New York University School of Law. The whole process took a year and a half. During that time Blackstone checked in as an investor.

Unlike the Rothschilds 200 years ago, only a small percentage of the trades that CargoMetrics makes relate to beating official government data. Most simply are aimed at identifying mispricings in the market, using the firm’s real-time shipping data and proprietary algorithms.

At a whiteboard in his conference room, Borgerson sketches out CargoMetrics’ general formula. He draws a “maritime matrix” of three dynamic data sets: geography (Malacca, Brazil, Australia, China, Europe and the U.S.), metrics (ship counts, cargo mass and volume, ship speed and port congestion) and tradable factors (Brent crude versus WTI, as well as mining equities, commodity macro and Asian economic activity).

Using satellite data with hundreds of millions of ship positions, CargoMetrics makes trillions of calculations to determine individual cargoes onboard the ships and then to aggregate the cargo flows and compare them with historical shipping data. All that leads to the final comparisons with historical financial market data to find mispricings.

If CargoMetrics observes an appreciable decline in export shipping activity in South Africa, for example, its trading models will determine whether that is a significant early-warning sign by considering that information alongside other factors, such as interest rates. If CargoMetrics believes a decline in the rand is forthcoming, it might short it against a basket of other currencies.

“This is like a heat map showing opportunity,” Borgerson says, noting that CargoMetrics is not trading physical commodities. “We are agnostic on whether to be long or short, and let the computers spot where there is a mispricing and liquidity in the markets.” He sums up his simple, but still less than revealing, process by writing on the whiteboard “Collect, Compute, Trade.”

https://www.institutionalinvestor.com/article/b14z9qvl205nh2/cargometrics-cracks-the-code-on-shipping-data

In 2012, Scott Borgerson appeared at an event he later described as pivotal for him: a conference held in Alaska under the banner of an initiative called Arctic Imperative (a precursor to the Arctic Circle initiative). It was the second in a two-year series of the gatherings, and [Alice] Rogoff (Carlyle Group- David Rubenstein’s wife) was the driving force behind it.

Borgerson credited a meeting with an unnamed CIO of “a large investment firm,” which he declined to identify, at the 2012 Arctic Imperative conference in Alaska, with kickstarting an experiment in using CargoMetrics’ data trove to drive quantitative trading decisions.

(There’s no direct proof of this, but looking over the record of attendance at the 2011 and 2012 conferences, it appears that the CIO Borgerson was most likely to have met would have been Carlyle’s. David Rubenstein himself took an interest in and participated in the Arctic Imperative conferences.)

That data-to-trading experiment was a real-world proof of concept for the quant fund Borgerson had begun to envision in the first couple of years after taking CargoMetrics live as the “NSA of global trade.” As the Institutional Investor story observes, that was a major shift in emphasis for the company. (For one thing, it meant buying out the original venture capital investors, who had bought in on the starting premise of focusing on the data product.)

After the “large investment firm” came on board, says Institutional Investor, “Live trading using CargoMetrics’ models began in December 2012.” Over the next year and a half, CargoMetrics geared up to begin operating a fund, something that required support from outside investors. Blackstone became one of them; meanwhile, another investor which had already taken interest in Borgerson’s quant-fund plan for CargoMetrics was Callaway Capital Management, a Washington, D.C.-based investment firm started by Daniel Freifeld.

Freifeld had been a senior adviser on Eurasian energy issues to Secretary of State Hillary Clinton, after being an adviser to the Hillary campaign in 2007-08. The picture of Borgerson as a semi-anonymous maverick data-monger starts to fade a bit as these various facts emerge.

Borgerson may not have known the Clintons or Obama’s top administration officials, but the people who ran in their orbit knew Borgerson.

Borgerson was developing his quant-fund plan with the help of such connected people between 2011 and 2013. And that’s when he and Ghislaine Maxwell ran into each other through their shared interest in the Arctic.

Interesting that the collision occurred when Borgerson’s company entered the field of serious fund management.

Maxwell accompanied Stuart Beck, a 2013 TerraMar board member, to two United Nations meetings to discuss the project. Maxwell presented at the Arctic Circle Assembly in Reykjavik Iceland in 2013.

Scott Borgerson, listed on TerraMar's board of directors for 2013, appeared with Maxwell at the Arctic Circle conference.

In June 2014, Maxwell and Borgerson spoke at an event in Washington, DC sponsored by the Council on Foreign Relations, titled “Governing the Ocean Commons: Growing Challenges, New Approaches”.

What exactly makes Maxwell an expert on the high seas, other then her association with sex trafficking and Little St. James Island, and traveling on her Fathers Yacht

Borgerson's company raised nearly $23 million from investors, including former Google CEO Eric Schmidt. Schmidt led a $10 million funding round for CargoMetrics in August 2017. Cargo Metrics has business ties with Maersk Tankers, FedNav, Western Bulk and True Freight.

In addition to Eric Schmidt from Google, other prominent investors include Howard Morgan, co-founder of quant investing giant Renaissance Technologies; famed hedge fund manager Paul Tudor Jones; Israeli shipping magnate Idan Ofer; and shipping services leader Clarksons PLC.

As mentioned CargoMetrics is also backed by Blackstone, the hedge fund. Blackstone also owns a significant stake in Engineer's Gate, the hedge fund which has significant connections to... Jeffrey Epstein .

Engineers Gate founder Glenn Russell Dubin retired from the hedge fund in January 2020. Glenn Dubin’s name was revealed in a sealed deposition that relates to the Jeffrey Epstein sex scandals.

https://www.swfinstitute.org/news/77509/cppib-exits-engineers-gate-hedge-fund-investment

Its interesting to note Scott Borgersons overlapped with Jeffrey Epsteins time at CFR. Here is a CFR publication authored by Scott in 2009, Epstein’s last year at CFR. Ghislaine sets up TerraMar a couple of years later

https://www.cfr.org/report/national-interest-and-law-sea

Stanley Pottinger

He is the Father of Matt Pottinger.

Matt was Deputy National Security Adviser in Trumps NSC at the time COVID was breaking out. According to Deborah Birx he was instrumental in pushing many of the COVID policies we hate so much like testing, masks, lockdowns, etc. he was also the one who lobbied for Birx to head the White House Coronavirus Response

After divorcing Matts Mother in 1975 Stanley began a 9 year affair with Gloria Steinem who has known ties to the CIA

In 1980, the FBI put a wiretap in the Gulf Capital Corp. when Pottinger recommended a man named Cyrus Hashemi be used to carry a message to Khomeini, NBC reported.

Pottinger, who headed the Justice Department's civil rights division under Ford and Nixon, was Hashemi's lawyer after leaving government service.

But federal officials say the wiretap recorded Pottinger advising Hashemi on arms shipments, NBC said. They say Hashemi was Khomeini's arms broker in New York.

'The government says Pottinger ... was heard on hidden microphones giving advice on how to make military shipments to Iran through dummy companies in other countries,' NBC said.

'Federal authorities say that military supplies, disguised under phony invoices, were flown to Zurich, Switzerland, then shipped to Teheran' by the T and T Trading Company located in Basel, Switzerland, NBC said.

https://www.upi.com/Archives/1984/05/25/Stanley-Pottinger-head-of-the-Justice-Departments-Civil-Rights/3173454305600/

Stanley was reported to be a CIA operative and, in fact, was reported to be Hashemi's CIA controller for many of these purposes. The story that was going around-and this was broadcast and published in a number of places-is that Stanley Pottinger was named as an unindicted co-conspirator i and narrowly escaped indictment because the FBI had lost the wiretaps, and the overhears of Pottinger which apparently the Justice Department claims were necessary to indict him were lost, therefore he couldn't be indicted.

Shortly thereafter in 1984 Stanley Pottinger and Gloria Steinems relationship fizzled. Stanleys cover was blown, and Gloria moved on

A bit more on this character Pottinger was conspiring with from wikipedia

In mid-1985 Hashemi was partnered with Adnan Khashoggi in "World Trade Group", "a joint venture ... that was seeking to trade farm equipment, oil and military weapons with Iran."Roy Furmark was also involved.

In June 1985 Hashemi approached William Casey with a new arms-for-hostages plan.The Los Angeles Times reported in 1988 that "according to newly declassified CIA and State Department memos, Hashemi approached then-CIA Director William J. Casey with an arms-for-hostages plan of his own that was strikingly similar to the one that would soon be embraced by the White House as its secret Iran arms initiative." A June 1985 CIA memo documented a call regarding a potential arms-for-hostages deal from Hashemi to Shaheen. The Times said in 1988 it had discovered that Hashemi was meeting with Adnan Khashoggi and Manucher Ghorbanifar, and that Hashemi's efforts to arrange a deal collapsed in August 1985 due to Kashoggi's competing efforts to arrange US access to Ghorbanifar via Robert McFarlane.

Hashemi died suddenly in 1986 shortly before Iran-Contra scandal was exposed. The man suspected of being behind the leak was Admiral Arthur Stanley Moreau who served as assistant to the Chairman of the Joint Chiefs of Staff. A month after the news broke Moreau died of a heart attack at age 55. Cant blame Pfizer for that but the CIA had their ways even then (not that I have proof they were behind it)

But I digress

Lets flash forward

Stanley Pottinger had a law firm.

From wikipedia we see

Stanley Pottinger represented more than 20 survivors of Jeffrey Epstein's sexual abuse.

https://en.m.wikipedia.org/wiki/John_Stanley_Pottinger

Lets dig deeper

Stan Pottinger is a partner for Edwards Pottinger, a Florida-New York law firm. The firm focuses on civil litigation with special attention to sex abuse cases; mediation; press and media matters; and healthcare law.

After his government service, Mr. Pottinger practiced law at Troy, Malin & Pottinger, a Los Angeles, Washington, Paris-based law firm. Following a few years of investment banking, he established Pottinger Media Group LLC (PMG), a New York firm which acted as agent and consultant on literary and press matters. PMG also established Velocity Press, a private publishing company.

https://www.epllc.com/attorneys/stan-pottinger/

Interesting, focusing on sex abuse cases and invested in Media/Publishing companies. CIA has been known to invest in Media/Publishing Companies. Now why would a presumably still CIA Agent be interested in handling Sex Abuse Cases?

I’ll try to guess. For those of you who are familiar with what Epstein was doing you know he was allegedly running a blackmail operation for one or more intelligence agencies. Video rich and powerful people diddling kids that he arranged for them and then those he gave it to would use it to get money or influence their actions in areas of interest. But in such operations you run the risk of the kids growing up and blowing the whistle on what you are doing. That happened with Epstein.

What happens next is you run the risk of criminal prosecution and civil action that can expose some very important people. If you can control the Justice System with puppet AG’s like Acosta you can keep the case from going to court some of the time. But what about the times you can’t keep it out of court. Well, then you want to make sure you have lawyers representing the victims who will settle or at least a judge you own that hears the case and keeps important evidence off the record (we may have seen that in Ghislaines trial)

What I am suggesting is that it was Stanley Pottingers purpose in going after these Epstein victims cases. Indeed every case he handled to conclusion got settled and did not go to court

Now some of you might wonder why there have been no indictment of the Johns diddling these kids despite having it all on tape. Here is my hypothesis. These tapes are now in the possession of the FBI, not the Mossad or the CIA who no doubt burned some of them for their own purposes but some of these Johns are assets that still have value. They don’t want to burn them all.

The ones they did burn, shaking them down for money , can be burned again, but by someone else , maybe someone like Stanley Pottinger.

This story by the NYT will give you an idea of what I am talking about. But don’t buy the narrative without question that Kessler was a fraud and the tapes don’t exist. Maybe thats true but consider that maybe is a deception and Kessler delivered the goods.

One more thought. In January 2020 it was reported a record number of CEO’s resigned.

Related? I dont know

Mr. Edwards, who did not respond to interview requests, had a law firm called Edwards Pottinger, and he soon referred Kessler to his New York partner. Silver-haired and 79, Mr. Pottinger had been a senior civil-rights official in the Nixon and Ford administrations, but he also dabbled in investment banking and wrote best-selling medical thrillers. He was perhaps best known for having dated Gloria Steinem and Kathie Lee Gifford.........

After an initial discussion with Kessler in Washington, Mr. Pottinger briefed Mr. Boies — whose firm was also active in representing accusers in the Epstein case — about the sensational claims.....

In his conversations with Mr. Pottinger and, later, Mr. Boies, Kessler said his videos featured numerous powerful men who were already linked to Mr. Epstein: Ehud Barak, the former Israeli prime minister; Alan Dershowitz, a constitutional lawyer; Prince Andrew; three billionaires; and a prominent chief executive.....

Mr. Pottinger and Mr. Boies have known each other for years, a friendship forged on bike trips in France and Italy. In legal circles, Mr. Boies was royalty: He was the one who fought for presidential candidate Al Gore before the Supreme Court, took on Microsoft in a landmark antitrust case, and helped obtain the right for gays and lesbians to get married in California.

But then Mr. Boies got involved with the blood-testing start-up Theranos. As the company was being revealed as a fraud, he tried to bully whistle-blowers into not speaking to a Wall Street Journal reporter, and he was criticized for possible conflicts of interest when he joined the company’s board in 2015.

Two years later, Mr. Boies helped his longtime client Harvey Weinstein hire private investigators who intimidated sources and trailed reporters for The Times and The New Yorker — even though Mr. Boies’s firm had worked for The Times on other matters. (The Times fired his firm

By 2019, Mr. Boies, 78, was representing a number of Mr. Epstein’s alleged victims. They got his services pro bono, and he got the chance to burnish his legacy. When Mr. Pottinger contacted him about Kessler, he was intrigued.

On Sept. 9, Mr. Boies greeted Kessler at the offices of his law firm, Boies Schiller Flexner, in a gleaming new skyscraper at Hudson Yards on Manhattan’s West Side......

Kessler claimed that a technology executive had introduced him to Mr. Epstein, who in 2012 hired Kessler to set up encrypted servers to preserve his extensive digital archives. With Mr. Epstein dead, Kessler boasted to the lawyers, he had unfettered access to the material. He said the volume of videos was overwhelming: more than a decade of round-the-clock footage from dozens of cameras......

Mr. Boies and Mr. Pottinger had decades of legal experience and considered themselves experts at assessing witnesses’ credibility. While they couldn’t be sure, they thought Kessler was probably legit.......

According to excerpts viewed by The Times, Mr. Pottinger and Kessler discussed a plan to disseminate some of the informant’s materials — starting with the supposed footage of Mr. Barak. The Israeli election was barely a week away, and Mr. Barak was challenging Prime Minister Benjamin Netanyahu. The purported images of Mr. Barak might be able to sway the election — and fetch a high price. ........

[Conspiracy to interfere in a foreign election. Who do they think they are? The CIA?]

Can you share your contact that would be purchasing,” Kessler asked.

“Sheldon Adelson,” Mr. Pottinger answered.

Mr. Adelson, a billionaire casino magnate in Las Vegas, had founded one of Israel’s largest newspapers, and it was an enthusiastic booster of Mr. Netanyahu. Mr. Pottinger wrote that he and Mr. Boies hoped to fly to Nevada to meet with Mr. Adelson to discuss the images.

“Do you believe that adelson has the pull to insure this will hurt his bid for election?” Kessler asked the next morning.

Mr. Pottinger reassured him. “There is no question that Adelson has the capacity to air the truth about EB if he wants to,” he said, using Mr. Barak’s initials. He said he planned to discuss the matter with Mr. Boies that evening.

Mr. Boies confirmed that they discussed sharing the photo with Mr. Adelson but said the plan was never executed.

[Sidney Aldeson was one of Trumps biggest financial supporter]

The men whom Kessler claimed to have on tape were together worth many billions. Some of their public relations teams had spent months trying to tamp down media coverage of their connections to Mr. Epstein. Imagine how much they might pay to make incriminating videos vanish.

You might think that lawyers representing abuse victims would want to publicly expose such information to bolster their clients’ claims. But that is not how the legal industry always works. Often, keeping things quiet is good business.

One of the revelations of the #MeToo era has been that victims’ lawyers often brokered secret deals in which alleged abusers paid to keep their accusers quiet and the allegations out of the public sphere. Lawyers can pocket at least a third of such settlements, profiting off a system that masks misconduct and allows men to abuse again.

Mr. Boies and Mr. Pottinger said in interviews that they were looking into creating a charity to help victims of sexual abuse. It would be bankrolled by private legal settlements with the men on the videos.

[charities are a great way of avoiding taxes on the income]

Mr. Boies acknowledged that Kessler might get paid. “If we were able to use this to help our victims recover money, we would treat him generously,” he said in September. He said that his firm would not get a cut of any settlements.

Such agreements would have made it less likely that videos involving the men became public. “Generally what settlements are about is getting peace,” Mr. Boies said.

Mr. Pottinger told Kessler that the charity he was setting up would be called the Astria Foundation — a name he later said his girlfriend came up with, in a nod to Astraea, the Greek goddess of innocence and justice. “We need to get it funded by abusers,” Mr. Pottinger texted, noting in another message that “these are wealthy wrongdoers.”

Mr. Pottinger asked Kessler to start compiling incriminating materials on a specific group of men......

The lawyers held out hope of getting Kessler’s materials. But weeks passed, and nothing arrived. At one point, Mr. Pottinger volunteered to meet Kessler anywhere — including Ljubljana, the capital of Slovenia.

[seems a strange place to want to meet]

Mr. Boies had concluded that Kessler was probably a con man: “I think that he was a fraudster who was just trying to set things up.” And he argued that Kessler had baited Mr. Pottinger into writing things that looked more nefarious than they really were. He acknowledged that Mr. Pottinger had used “loose language” in some of his messages that risked creating the impression that the lawyers were plotting to monetize evidence of abuse.

Several days later, Mr. Boies returned for another interview and was more critical of Mr. Pottinger, especially the hypothetical plans that he had described to Kessler. “Having looked at all that stuff in context, I would not have said that,” he said. How did Mr. Boies feel about Mr. Pottinger invoking his name in messages to Kessler? “I don’t like it,” he said.

But Mr. Boies stopped short of blaming Mr. Pottinger for the whole mess. “I’m being cautious not to throw him under the bus more than I believe is accurate,” he said. His longtime P.R. adviser, Dawn Schneider, who had been pushing for a more forceful denunciation, dropped her pen, threw up her arms and buried her head in her hands.

https://www.nytimes.com/2019/11/30/business/david-boies-pottinger-jeffrey-epstein-videos.html

Boies and Pottinger discussed using the promised videos in litigation or to try to extract settlements from the men in the videos, with the money going to a charitable foundation, the New York Times alleged. The settlements would remain private.

When Kessler asked Pottinger to provide some hypotheticals to explain how money could be collected from those depicted in the videos, Pottinger provided two examples, according to the article.

In one hypothetical, Pottinger said the money would be split among his clients and the foundation. Up to 40% of the money would go toward attorney fees.

In the second hypothetical, the lawyers would ask the men on videotape to hire them and make a contribution to a nonprofit as part of the retainer. Hiring the lawyers would prevent the men from being sued.

https://www.abajournal.com/news/article/man-who-claimed-to-have-epstein-sex-tapes-duped-david-boies

It just sounds very fishy. I mean if it was just a hoax or a con why did they make such a big deal of it by publishing it big on NYT. There is a hidden purpose behind this story IMO. Maybe its just them covering their asses or its their way of letting the Johns know they are coming for them but not to worry so long as they pay up.

And last but not least here is another Epstein connection to Trump matters

Judge Bruce Reinhart’s wife Carolyn Bell is an Assistant U.S. Attorney, who was appointed by Gov. Rick Scott.

Judge Bruce Reinhart is a popular American magistrate Judge. Judge Bruce Reinhart came to the limelight after he Represented Jeffrey Epstein’s Pilots And Secretary. Now Judge Bruce Reinhart is popular as the Judge who signed off on the FBI raid on Donald Trump’s Mar-a-Lago mansion and donated $2,000 to Barack Obama’s campaign. Previously Judge Bruce Reinhart has represented several employees of the billionaire pedophile.

https://wikinewspedia.com/judge-bruce-reinhart-wiki/

Thomas Bowers-Deutsche Bank

Thomas Bowers, head of the firm’s Private Wealth Management Division was discovered hanging from a rope in his New York home before Thanksgiving (2019), just as FBI agents were hoping to interview him about the loans he’d approved to Epstein and his various shell companies. Epstein had followed Bowers to Deutsche Bank in 2013, where – despite his allegedly defaulting on some $25 million in loans from Citigroup – Bowers securedfurther high-risk loans and credit lines for the convicted sex offender.

Bower was the boss of Jared Kushners and Donald Trumps personal banker at Deutsche (Rosemary Vrablic) and handled Epsteins business personally. Trump/Kushners received over 600 million dollars in loans in recent years when nobody wanted anything to with Trump or Kushners convicted felon Dad (Charles)

Side note: Deutsche Banks headquarters in NY following the destruction of its former building on 9/11 was the same address as Trumps grand fathers barber shop in 1905

Bank Leumi (Israeli Bank)

Mentioned a couple of times in Whitneys book related to Diamond Trading and Israel,

Rosemary Vrablic

had enrolled in Bank Leumi’s credit-training program in the 1980’s which launched her banking career. This bank served wealthy Russians and happened to be a hub for tax evasion and would be busted for not doing enough to combat money laundering. This is where Vrablic would learn the ropes.

The Kushners were among her earliest customers . They happened to have a long-running relationship with Bank Leumi the Israeli lender where Vrablic began her career .

Deutsche Bank-Overview

Deutsche Bank has an estimated $320 million in loans on 3 properties: data from Trump's June 2017 financial disclosure form and estimate based on full loan amounts reported in the news .

After Trumps bankruptcies few banks would do business with Trump by Deutsche Bank came to the rescue time and time against despite defaults on loans with Deutsche Bank

Besides Deutsche Bank , a company named Ladder Capital Finance issued $282 million in loans to Trump on 4 properties. In Feb 2017 the Related Companies bought $80 million in Ladder stock. Stephen Ross, chairman & founder of Related Companies, has been a client of Rosemary Vrablic a senior banker at Deutsche Bank, who counts Trump and Jared Kushner as customers

Deutsche's Rosemary Vrablic arranged loans for Trump & prior to election, Deutsche funded $285 million for Jared Kushner to refinance loan on part of former NYT building bought from Putins fav oligarch Lev Leviev whose company AFI was involved in Prevezon $ laundering case

Rosemary Vrablic started in banking in the mid 80’s with Israeli Bank Leumi where the Kushners were customers. Her boss at Deutsche Bank handled Epsteins account which he had brought over from JP morgan after they stopped doing business with Epstein in 2012

Deutsche Bank is being sued by investors over their questionable loans to wealthy and suspect clients. The Judge hearing the case had her husband and son shot by a former member of Kroll Associates who was based in Moscow in the late 90’s.

Many don’t recall but Deutsche Bank handled the Puts that were placed shortly before 9/11 with a former Kroll Associate working for the CIA, and Kroll in charge of WTC security

Deutsche Bank has allegedly been a huge money launderer for Russian and FSU oligarchs. The recent FinCEN leaks involve more than $2 trillion USD worth of flagged transactions from 1999 to 2017.

Much of that laundered money was ploughed into luxury real estate

The majority of the transactions come from Deutsche Bank which had more than half the $2 Trillion-dollar sum of the FinCEN Files. The main focus is on Russian and Ukrainian oligarchs.

Larry Middleton-Stephens Inc

Having more than one event chair is not unique in the world of philanthropy, but the Middletons, founders of Middleton Heat & Air, bring a lifetime’s worth of teamwork to this year’s gala, which will support emergency and trauma services in honor of first responders.

“We believe the Arkansas Children’s Foundation requested all three serve as co-chairs because members of their team had witnessed the closeness and strength of our working relationship that we enjoy as siblings, friends and business partners,” Larry says.

“The bond that we enjoy today is a result of us learning at a young age that life was better when we faced challenges as a team.”