To understand we must first review Money Creation, Inflation, Collusion, Monopoly, National Debt.

The coming Financial Collapse will end with most of us Owning Almost Nothing , and probably not being very happy about it.

This is quite long, too long for Email so don’t be shy about using the scroll button if you feel you know this stuff.

Also, I am not a Bankster or Guru in Economics, so forgive any mistakes, but this is what I understand to be correct.

Money Creation

Thomas Edison in a 1921 NYT article was quoted as below.

“.......under the old way any time we wish to add to the national wealth we are compelled to add to the national debt.

Now, that is what Henry Ford wants to prevent. He thinks it is stupid, and so do I, that for the loan of $30,000,000 of their own money the people of the iUnited States should be compelled to pay $66,000,000 — that is what it amounts to, with interest.

People who will not turn a shovelful of dirt nor contribute a pound of material will collect more money from the United States than will the people who supply the material and do the work. That is the terrible thing about interest. In all our great bond issues the interest is always greater than the principal. All of the great public works cost more than twice the actual cost, on that account. Under the present system of doing business we simply add 120 to 150 per cent, to the stated cost.

“But here is the point: If our nation can issue a dollar bond, it can issue a dollar bill. The element that makes the bond good makes the bill good. The difference between the bond and the bill is that the bond lets the money brokers collect twice the amount of the bond and an additional 20 per cent, whereas the currency pays nobody but those who directly contribute to Muscle Shoals in some useful way.

… if the Government issues currency, it provides itself with enough money to increase the national wealth at Muscles Shoals without disturbing the business of the rest of the country. And in doing this it increases its income without adding a penny to its debt.

It is absurd to say that our country can issue $30,000,000 in bonds and not $30,000,000 in currency. Both are promises to pay; but one promise fattens the usurer, and the other helps the people. If the currency issued by the Government were no good, then the bonds issued would be no good either. It is a terrible situation when the Government, to increase the national wealth, must go into debt and submit to ruinous interest charges at the hands of men who control the fictitious values of gold.

https://timesmachine.nytimes.com/timesmachine/1921/12/06/issue.html

Nobody listened so here we are today.

Lets start with some basics like what is money and how do we make it? Put simply our money is legal tender, that people exchange for goods and services and that we use to pay Caesar his tribute.

It can be anything, oyster shells, pearls, silver or gold coins, or paper printed by the US Treasury, all of which were or are legal tender, and crypto, the latter of which is not yet legal tender.

Whatever it is, you cant eat it and you cant have sex with it, all you can do is melt it, crush it, throw it, burn it or tear it. Some forms could be made into Jewlery so at least you could wear it. With crypto you cant do any of that, and you can only spend it if you have a device and internet connection.

For the most part they have little value except as a medium of exchange.

Our currency used to be backed by Gold. Now its backed by nothing but the credit worthiness of the Nation with its vast land, natural resources, intellectual property, agriculture , military, etc.

Some of our worst depressions and inflation occurred when we were on the Gold Standard and at the whim of increased new supplies (inflation) or shortages of gold (deflation) , but people seem to forget that and look at the day when the dollar was backed by Gold as the good old days.

We left Gold and Bretton Woods behind in 1971 , but at the time only other nations could exchange our dollars for gold at the agreed price ($35 per oz). Gold was illegal for individuals , thanks to FDR in 1933 when he confiscated our gold before devaluing the dollar against gold , and then making it illegal for individuals to own gold. They did it before so they can do it again (but not with Gold).

By 1975, Americans could again freely own and trade gold.

Today the only legal tender in the US is the USD. Its paper and coins are printed or minted by the US Treasury for the Federal Reserve in various denominations, but most people accept no bill with a denomination higher than $50, and most transactions are digital with each transaction costing a fee charged by a middle man like Master Card or Visa.

The amount of cash in circulation is only about 10% of the total money supply, and probably half of thats overseas, while most of the rest is held by banks , businesses and drug lords. Mostly the USD that exists resides on ledgers in electronic- digital form. If the power went out forever only cash and coins would remain, and the cash is not very durable, so save your quarters and dimes.

So how do we increase the money supply? Well, good question. The Federal Reserve, hence known as the Fed used to be able to do so by buying Treasuries directly, although they didn’t do it very often, but that ended in 1981. In 2019 they found another way to create bank money, albeit indirectly, which will be explained later.

The Federal Reserve mostly just created Reserve Money, hence the name. They buy Treasuries from Banks who purchased them after being issued by the Treasury Department, paying the banks with Reserve Money they created out of thin air. This money is used by Banks as their Reserves, in case depositors take out too much of their Bank Deposits. Only Banks have Reserve Money, most of which is kept in its Federal Reserve Bank account, so its not spent on Main Street.

The commercial banks are the Feds shareholders, and as mentioned the Fed holds their reserves, and the Fed also loans them reserves as needed.

The banks create digital money when they loan you money. More Reserves meant the Banks could make more Loans, which creates more Bank Deposits. Bank Deposits , unlike Reserves can get spent on Main Street and create inflation, unless they are mostly in the hands of the rich while the majority are cash starved.

From 1981-2020 pretty much the only USD Bank Money Creators were commercial banks.

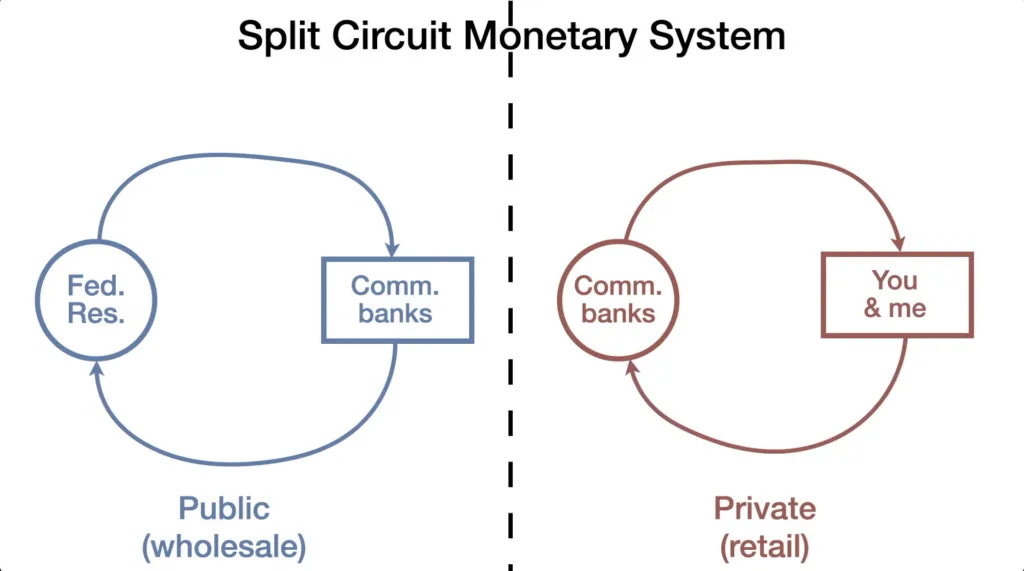

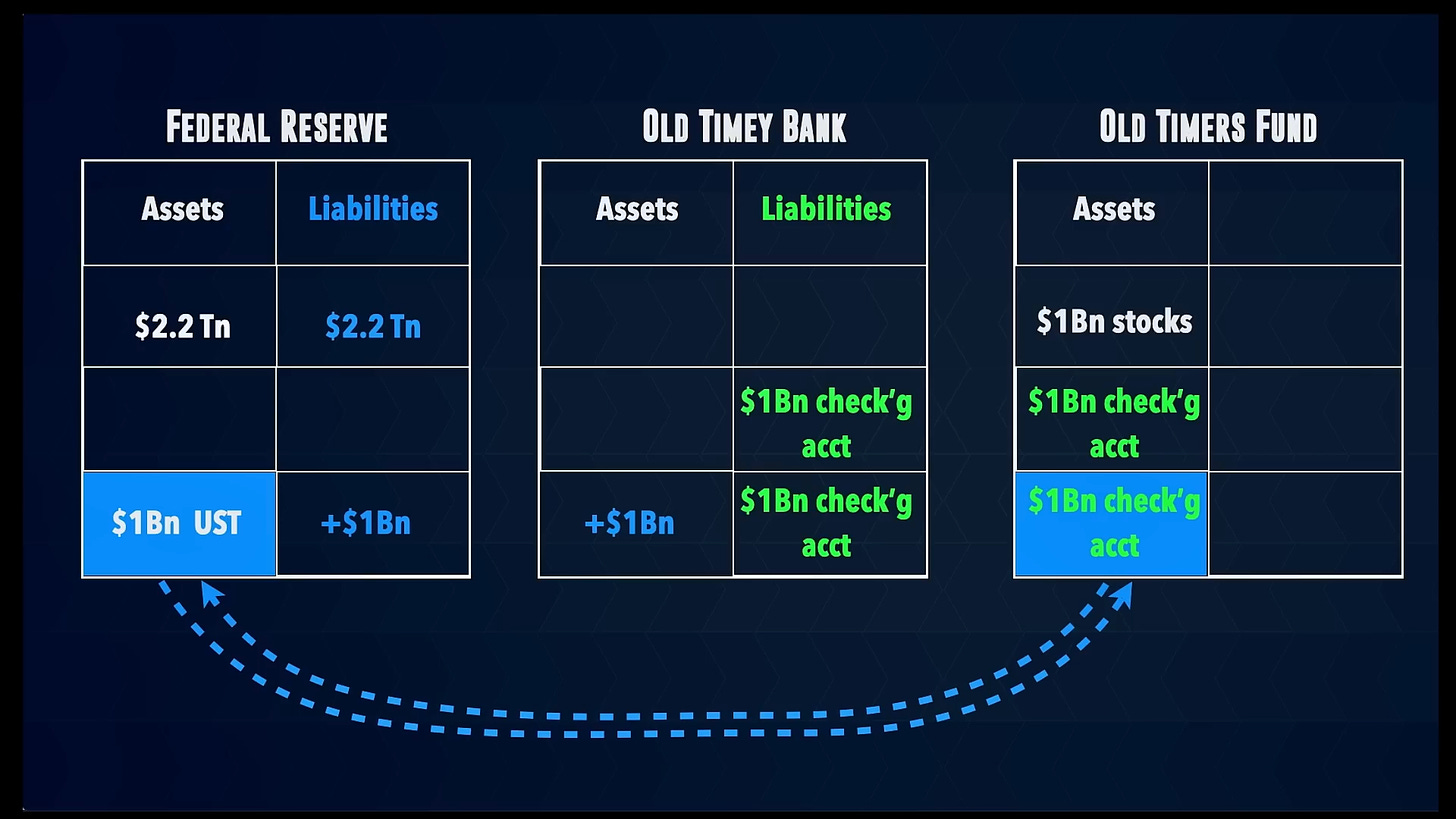

The above is from John Titus showing the Reserve Money Circuit on the left and what he calls the Retail (Bank Money ) Circuit on the right.

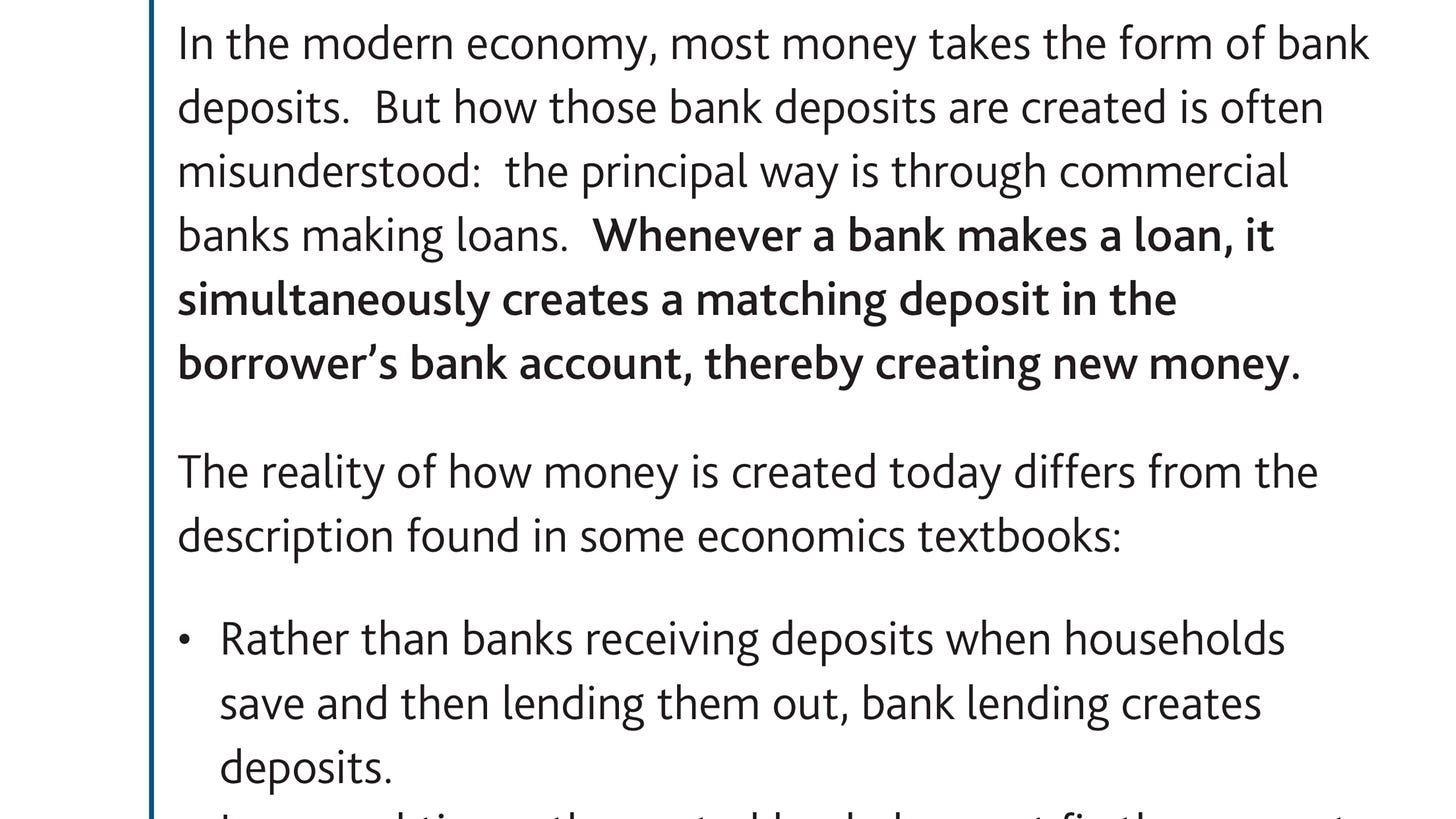

While the origin of money creation is more commonly known than it once was thanks to the Bank of Englands 2014 Confession , a surprising number of people still don’t know this.

Q: Wait a minute you say. Don’t the banks just loan out the deposits they already have?

A: No sir, deposits are their liability, they can only loan you assets.

Q: But what assets are they loaning me?

A: They don’t normally have the assets to loan because their assets must not be less than their liabilities.

Ok, I see you are getting mad but I am not playing with you, this is true, in order to make a loan of say $100,000 they credit your account with a $ 100,000 deposit. The deposit in your account is their liability, while simultaneously they create an asset named “Petes Loan” that is worth $100,000 on the asset side of their ledger.

Q: But where did the $100,000 come from?

A: Well, they created it by typing $100,000 in their computers ledger. Pretty cool, huh. Better yet, you now get to pay 8% interest out of money they created out of thin air, so by the time your loan is paid off in 30 years you actually pay $264,000, thanks to $164,000 in interest payments . Good deal for them.

Q: But who creates the money to pay off the interest?.

A: Ha ha. Nobody. So in a typical business cycle eventually there is not enough money to pay back the loans and some debtors default, allowing the banks or investors who hold the loan to seize the assets that were promised as collateral for the loan. Then they sell those assets when the economy improves , and banks then create more loans (money) for buyers to buy their new assets that some wont be able to pay , but since they must promise hard assets as collateral, when they default its not a big deal. The cycle just repeats all over again.

Its a really neat system. After each cycle more and more wealth is transferred to those who can create the money.

Q: But the amount of loans a bank can make is limited by their Cash Reserves (Vault and at Fed) , so they have to be careful as loans carry risk and so they , will police themselves. Right?

A. Well, not exactly, you see what they usually do is sell off your $100,000 loan to other investors and they get about $125,000 in cash (just picking this out of my arse, it could be lower) . Although they lose out on $139,000 in interest over the next 30 years they now have no more risk, and better yet, they can loan to some other sucker(s) $125,000, and then sell that. Whoopee . Wash, Rinse, Repeat.

Also…

. In March 2020, the Fed removed the reserve requirement altogether; but banks still need to hold enough deposits as reserves to meet withdrawals.

As announced on March 15, 2020, the Board reduced reserve requirement ratios to zero percent effective March 26, 2020. This action eliminated reserve requirements for all depository institutions.

https://www.federalreserve.gov/monetarypolicy/reservereq.htm

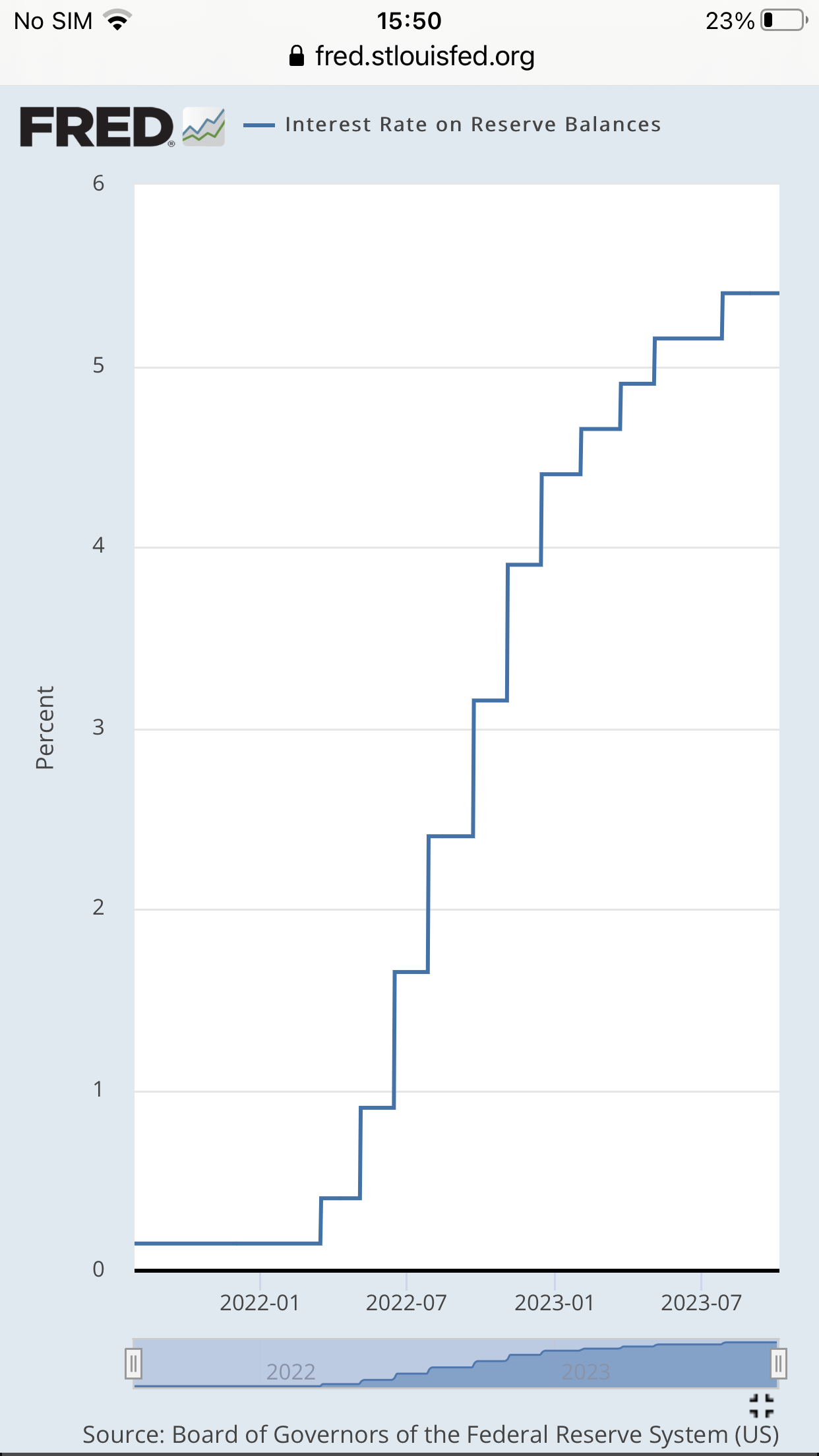

So there is essentially no limit on how much they can loan now. This also means the Bank Reserves on account at the Fed Reserve Bank are considered Excess Reserves and the Federal Reserve pays the banks, who are the shareholders of the Federal Reserve , interest on these reserves which the Fed created out of thin air, which is quite a lot of money today.

The interest the Federal Reserve pays, unlike the interest you pay to banks, is interest they receive from the Government for the Treasuries they hold , which they must return to the government, less operating expenses. One of their operating expenses is interest paid on Excess Reserves. The more they pay the less they return to the government. Pretty cool.

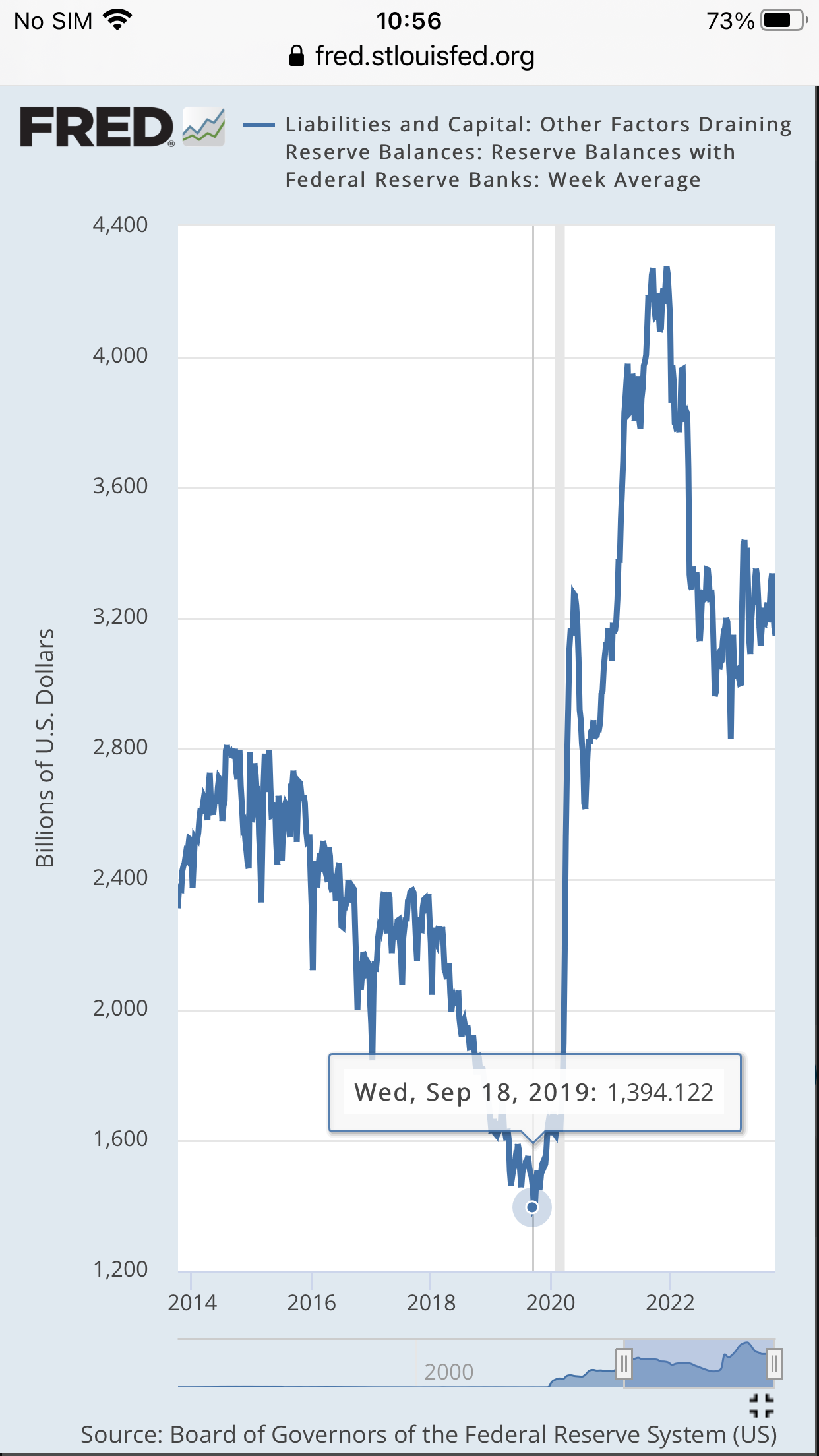

Since Reserve Balances are over $3 trillion dollars now the Fed is paying their shareholder banks $150 billion a year to hold their Reserves

Pretty Sweet.

😂😂😂

So anyways, thats how pretty much all the money has been created since 1981, and mostly before that too. But something changed in 2019-2020

From John Titus

You might recall the Fed’s 2019 Jackson Hole meeting, where BlackRock (through ultra prestigious co-authors Stanley Fischer and Philipp Hildebrand) presented a paper entitled, “Dealing with the Next Downturn.” In it the authors describe a plan for, well, dealing with the next downturn, which, well, just happened to occur the very next month in the repo market.

They called the plan Going Direct

Luckily, the Fed was armed with BlackRock’s highly prestigious plan and put it to use to the letter throughout the 2020 Pandemic!

I made a lengthy video that walked through the Fed’s implementation of BlackRock’s plan over the ensuing $5T that the Fed added to retail bank deposits (a fact that the caste system faithful refuse to discuss to this day), which mirrored the Fed’s creation of $5T in reserves. That video is called, “Larry and Carsten’s Excellent Pandemic.”

Basically what the Fed started doing in March 2020 at scale was buying assets from Non-Banks using the Commercial Banks as intermediaries, this allowed them to not only increase their balance sheets (Assets and Reserves) but also Retail Deposits, money that is also created out of thin air , something that before 2020 was only done by Commercial Bank Loans

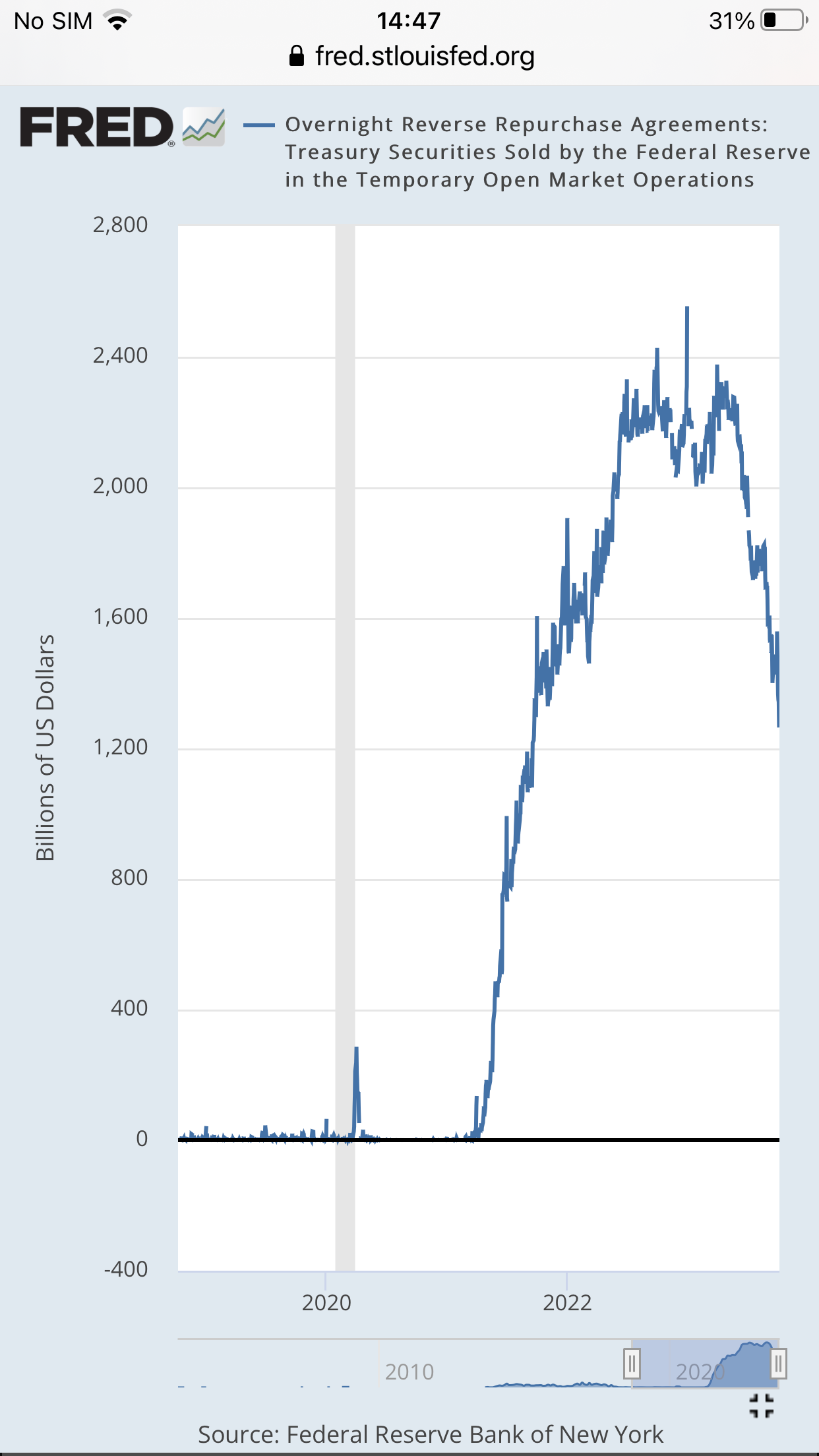

Technically they gave themselves the ability to do this in 2013, but did not do so very much. They did so with something called the Reverse Repurchase Agreements

The great concern among the Federal Reserve's leaders was that, with the world awash in dollars they had created, they wouldn't be able to raise rates even when they felt they needed to.

Their solution was a tool that has now swelled to massive size and is making banks angry, as they see it as a major factor in their loss of deposits

The "overnight reverse repurchase agreement facility" (ON RRP) enables money market mutual funds to accept vast sums of investors' money and pay their customers higher interest rates than banks typically do.

Which is one reason Money Market Funds have exploded

But lets get back to the REPO market.

First of all, what is it?

Short for repurchase agreements , where financial firms trade debt for cash with each other. Those with excess cash can make some money while those who need cash to cover large withdrawals are willing to pay a bit extra.

One firm sells securities to a second institution and agrees to purchase back those assets for a higher price by a certain date, typically overnight. The contract those two parties draw up is known as a repo. Essentially, it’s a short-term collateralized loan.

On the flip side, as just mentioned, when the Fed sells a security to a counterparty and then agrees to buy back that security, it’s a transaction known as a “reverse repo.”

Q: what happened with the REPO Market

A: Well……

In September, 2019 the free market suddenly wanted to price repo loans at 10 percent thanks to JP Morgan .JP Morgan took liquidity (130 billion) out of the system to fund share buybacks and dividends.

That’s when the New York Fed jumped in with both feet with a pile of money

Hedge funds were the ones in dire need of liquidity, not commercial banks. The hedge funds had opened record levels of over-leveraged positions; they need the extra liquidity or they won’t be able to cover positions with excessive leverage

Note: If enough Hedge Funds Collapse the Derivates used to hedge against risk get called and pop the $ Quadrillion Derivative Bubble. The major banks have a large exposure to derivatives

The Fed implemented BlackRocks “Going Direct” plan (good timing Larry) and began funneling a cumulative total of $6.6 trillion to some of the 24 trading houses on Wall Street that are known as its “primary dealers.” The giant sum has been sluiced to Wall Street in the form of repurchase agreement (repo) loans without any details being provided to the elected representatives in Congress as to which firms are getting the money or what it’s being ultimately used for. The stock market set new highs since the program launched leading some veteran market watchers to believe the Fed is fueling a Ponzi-like rally in stocks.

So JP Morgan forced the central bank to fund hedge funds and keep their over-leveraged positions open. As long as these hedge funds have access to liquidity, the extended bull market will likely continue. In other words, the Fed (through hedge funds) helped drive up the price of JP Morgan shares.

A trading unit of JPMorgan Chase borrowed $6.19 trillionfrom the Fed’s repo loan program from September 17, 2019 through March 31, 2020. (Those are cumulative, term-adjusted figures.) A significant chunk of that money was borrowed at interest rates as low as 0.10 percent. The loans were collateralized with mostly treasury securities and agency mortgage-backed securities (MBS).

https://wallstreetonparade.com/2022/04/while-jpmorgan-chase-was-getting-trillions-of-dollars-in-loans-at-almost-zero-percent-interest-from-the-fed-it-was-charging-americans-hit-by-the-pandemic-17-percent-on-their-credit-cards/

Black Rock owns 6% of JP Morgan

You cant make this stuff up

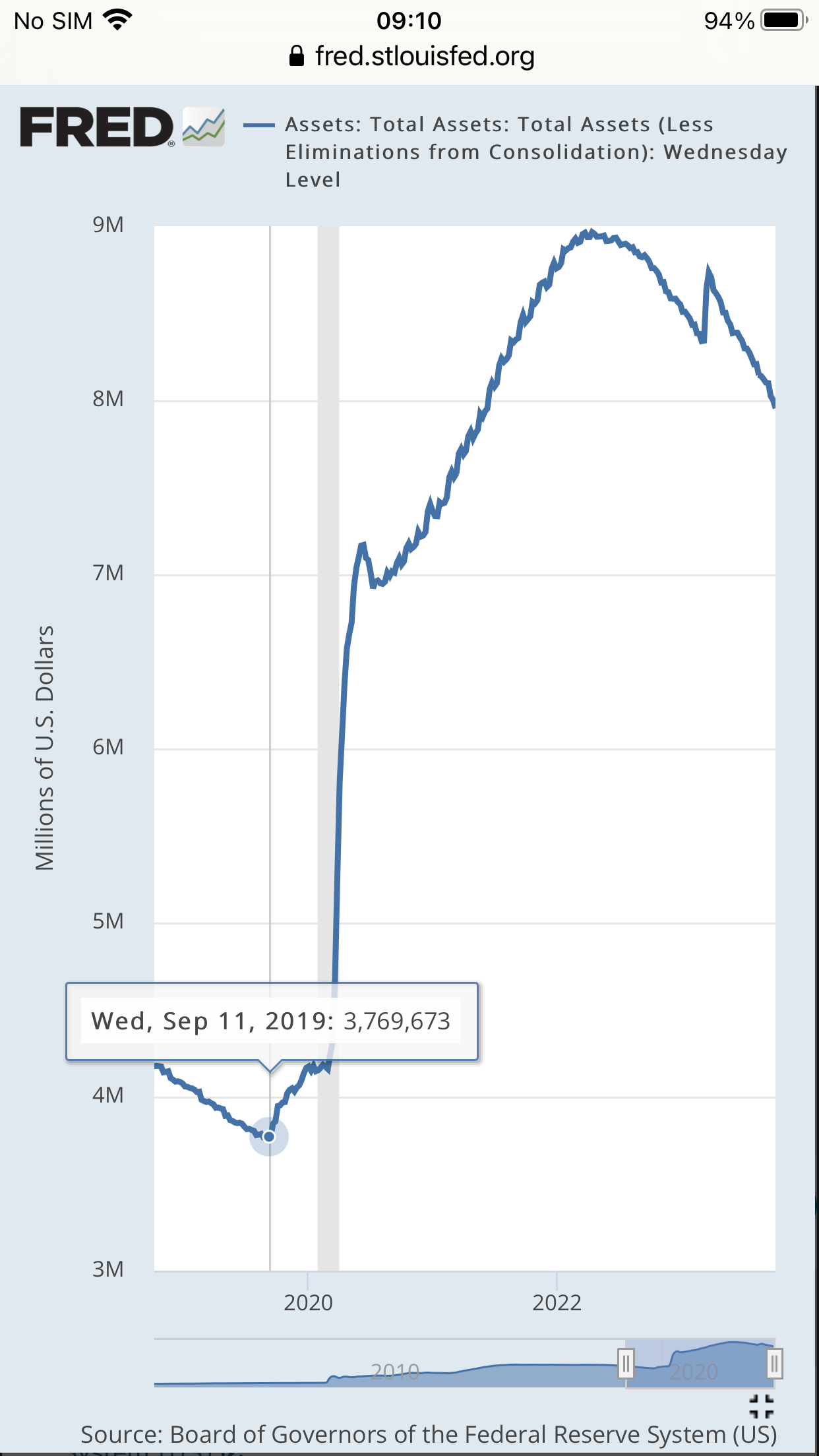

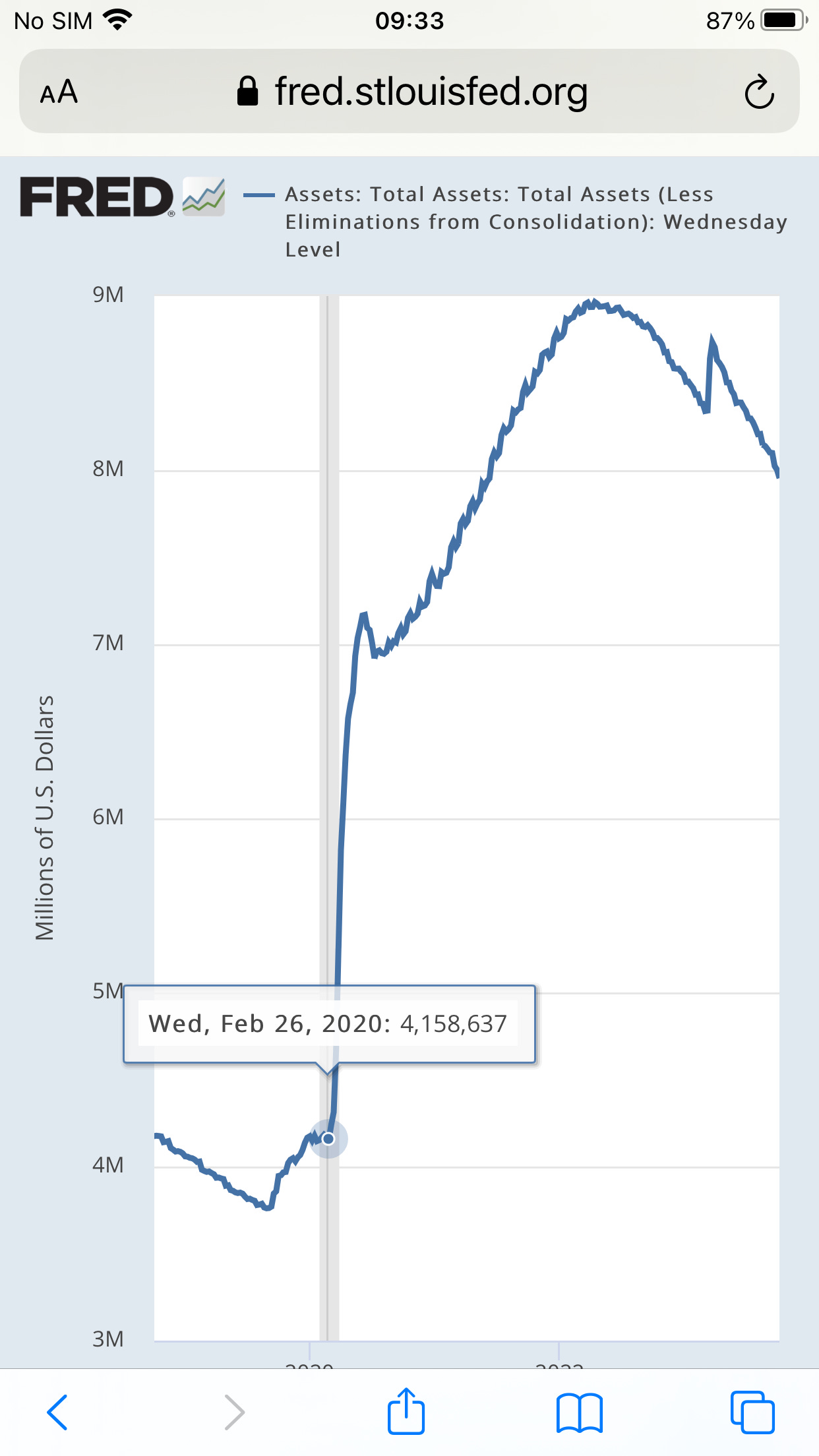

Feds Assets Inflation

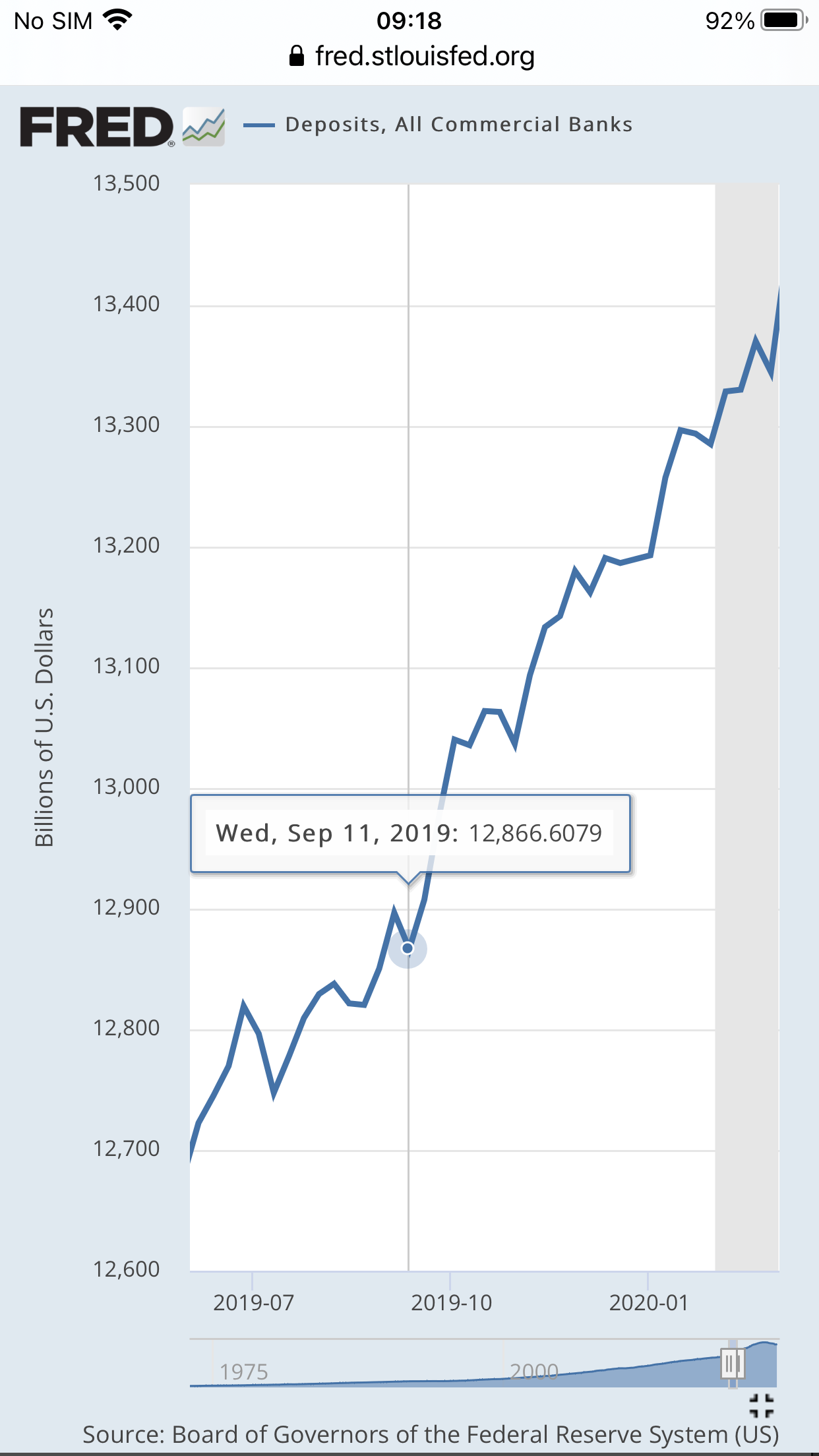

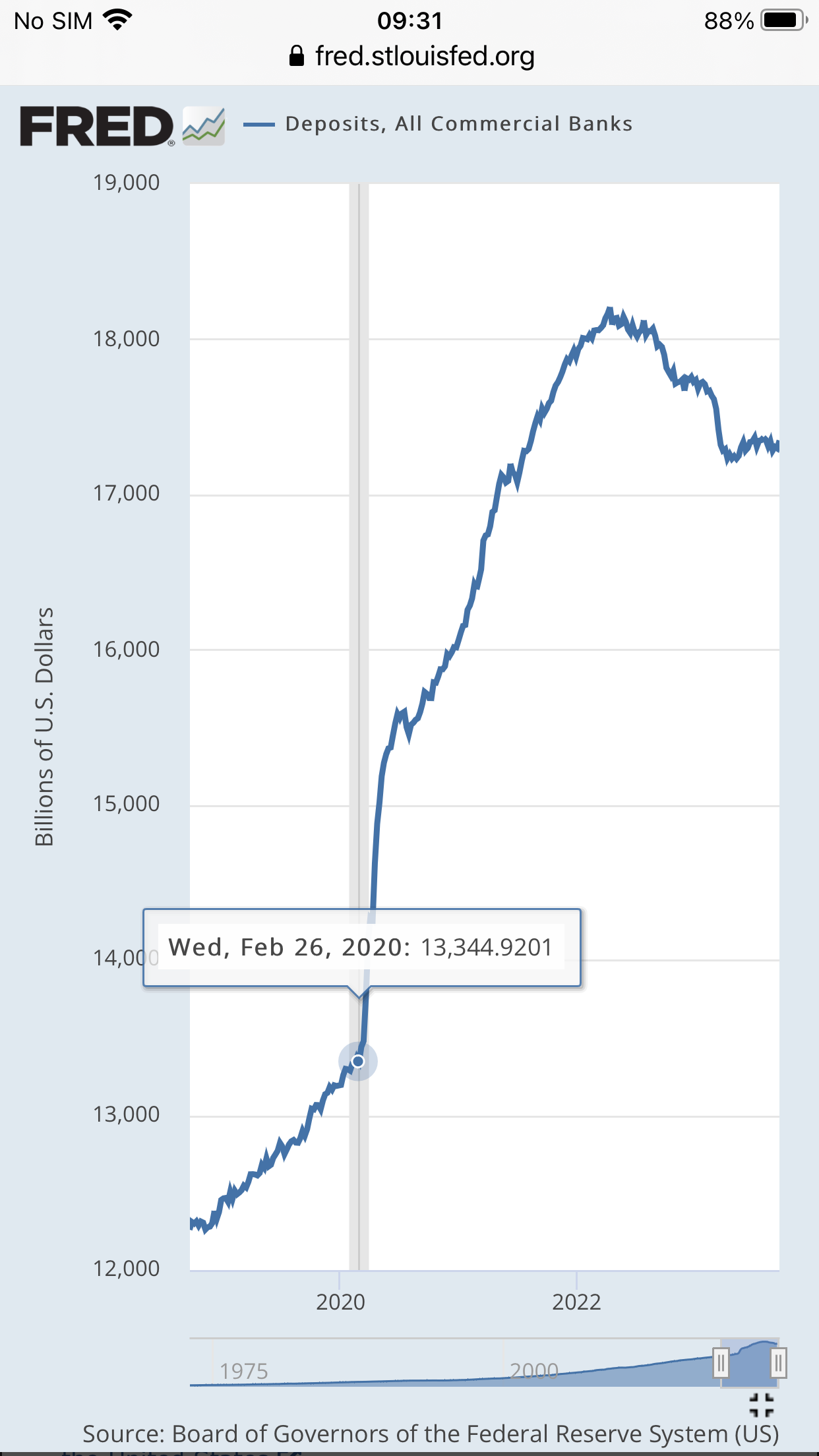

Bank Deposits

As you can see this did not translate into much of an increase in bank deposits in 2019, so this was primarily a test of their ability to inflate the banks reserve balanced quickly.

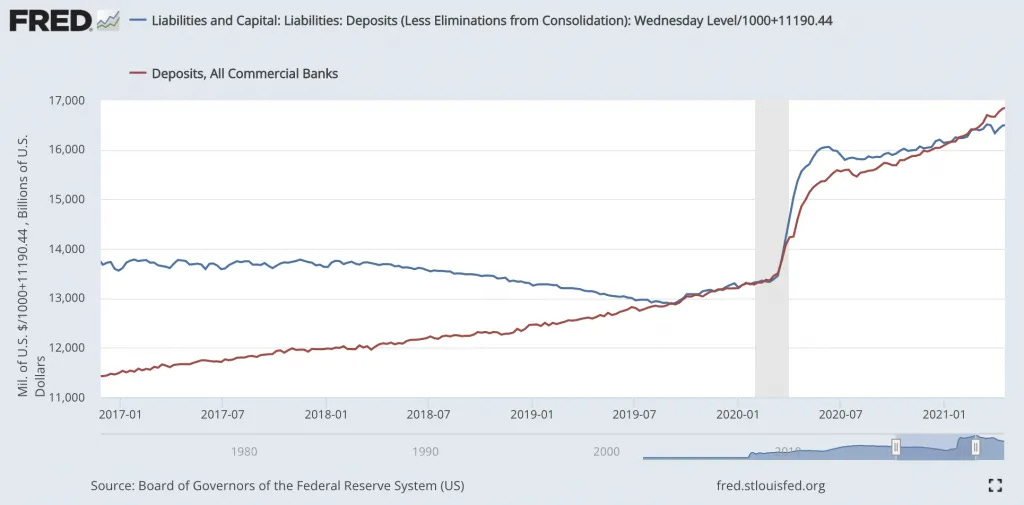

John Titus thinks this happened starting in September. He shows the below to make his point because Feds liabilities and assets started tracking with commercial bank deposits, but as you can see bank deposits were just inflating at the same rate they had been for the last decade until March.

Nothing to do with the Fed really as deposits can come from repatriation of funds from overseas by companies and individuals to pay tariffs and taxes, and money laundering. US is one of the biggest tax havens in the world and a favorite for money launderers

However, what the increase in Fed assets and liabilities did was inflate banks Reserve Balances in preparation for the great inflation of the money supply in March

However, they needed Black Rock to help get the money direct to non banks. In March 2020 the Federal Reserve hired BlackRock to manage three separate bailout programs: its commercial mortgage-backed securities program, its purchases of newly issued corporate bonds and its purchases of existing investment-grade bonds and credit ETFs.

Before I get to that something else happened in September 2019 that is worthy of mentioning

In September, 2019 Trumps White House Council of Economic Advisers did an estimate on the cost of a future Pandemic and found it could cost as much as 4 trillion (current tab is 5 trillion). This was just after the Pandemic Exercise -Crimson Contagion was releasing its draft report, and a month before transferring the Pandemic Stockpile from CDC to BARDA (exempt from FOIA’s).

https://www.nytimes.com/2020/03/31/business/coronavirus-economy-trump.html

Now lets see what happened starting in March, 2020 at the start of the Pandemic

BlackRock was hired by the Federal Reserve to implement key features of the plan.

Trump and the U.S. Congress handed over $454 billion of taxpayers’ money to the Fed, without any meaningful debate, to eat losses on toxic assets produced by the Wall Street banks it supervises. The Fed plans to leverage the $454 billion into a $4.54 trillionbailout plan, “going direct” with bailouts to the commercial paper market, money market funds, and a host of other markets.

The BlackRock plan further explains why, for the first time in history, the Fed has hired BlackRock to “go direct” and buy up $750 billion in both primary and secondary corporate bonds and bond ETFs (Exchange Traded Funds), a product of which BlackRock is one of the largest purveyors in the world.

Adding further outrage, the BlackRock-run program will get $75 billion of the $454 billion in taxpayers’ money to eat the losses on its corporate bond purchases, which will include its own ETFs, which the Fed is allowing it to buy in the program.

Helicopter money is also spelled out in the BlackRock plan, which explains why simultaneously with the $454 billion Congress carved out for the Fed under the CARES Act, fiscal stimulus was also “going direct” with $1200 checks and direct deposits to the little people of America and Paycheck Protection Program loans and grants “going direct” to small businesses.

According to Michael Hudson

But it’s certain, the money that the Fed gave to individual families under the CARES Act, almost all of that was used to pay down debt.

Because the way the Treasury made the payments was to credit either their credit cards or their bank accounts. And that most Americans are overdrawn on their bank accounts, or they owe money on their credit cards.

And the money went right out of their hands to reduce the volume of debt they had. And essentially, it was a debt repayment to the bank.

That was what happened to most of the CARES Act. It wasn’t spent on goods and services, and so it wasn’t inflationary.

https://www.nakedcapitalism.com/2022/01/michael-hudson-what-is-causing-so-much-inflation.htm

Fed Assets

Bank Deposits

Perfect Match

Below you see how $1 bn UST are transferred from a Non-Bank to the Fed which results in $1 bn in New Reserves which becomes the Old Timey Banks Asset, allowing them to create $ 1 bn in liability which is the Non-Banks checking account deposit. The Fed created the Reserve Money that the Bank used to create Bank Money for the Non-Bank providing the new Fed Assets. That is Going Direct

During the last Banking Crisis in 2008 the Fed bought Junk Bank Assets (eg subprime mortgages) and created Reserve Money. This did not directly create Bank Money, although the new Reserves replacing the Junk Assets on their balance sheet allowed Banks to create more Money via Loans over time, a slower process

But whereas many Commercial Bank Loans and subsequent Bank Deposits go to those on Main Street, these mega Asset Purchases by the Fed from Non-Banks starting in March 2020 went disproportionately into the Bank Accounts of Wall Street and Corporate Giants . They would be used to prop up their stock price, pay executives bonuses and invest in property or overseas.

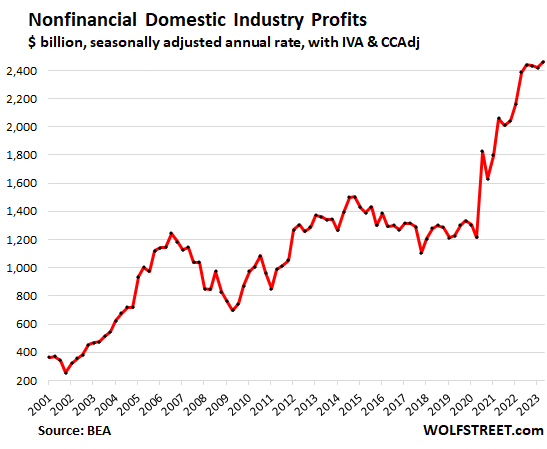

While some inevitably trickled down to Main Street, contrary to popular opinion it was not a main driver of inflation on Main Street. That inflation was due to Collusion and Price Gouging resulting in higher Corporate Profits

You see those price increases were not just going to pay higher costs, most of it went to their bottom line, meaning higher profits. Back when corporations had to pay higher tax rates they took care to minimize profits and plough the money back into the company to expand or upgrade equipment, much like CEO’s used to limit their salaries when they had to pay higher rates and settle for capital gains down the road. Now they can take higher salaries and profits too, and you pay for it with higher prices.

But wait a minute you say, they have to compete with other companies, so that limits what they can charge and they cant collude because thats illegal.

Oh boy, 🙄 We will cover this in a bit

But first, here is the breakdown of the increase in Deposits from March 2020 as of January 2022

Data from Titus video

Deposit

Households. Increase. Relative

Bottom 50%. 167.2 billion. 1.

50-90%. 784.5 billion. 5.9.

90-99%. 1.1 trillion. 36.6

Top 1%. 1.11 trillion. 329

. Per Household

Households. Deposit Increase.

Bottom 50%. 2,486

50-90%. 14,942

90-99%. 93,451

Top 1%. 838,000

Increase %. Share%

Bottom 50%. 150%. 6%

50-90%. 200%. 26%

90-99%. 270%. 34%

Top 1%. 500%. 34%

Bottom 50% got 1/2 slice of the pizza, 50-90% got 2 slices, top 10% got 5 1/2 slices. Top 1% got half of those 5 1/2 slices (its been almost 5 years since I had a decent Pepperoni pizza as I am exiled in a land where pineapple and shrimp pizza rules)

There are only so many beers, pizza , pants and groceries the top 10% and Fat Bankers can buy, or how many miles they can drive , so that money isn’t causing much inflation on Main Street. It might and did cause some stock and real estate inflation. And yachts, luxury cars, private planes, Tickets to Space, etc might get more expensive too, but Fat Banker Deposit Inflation doesn’t affect the price of eggs and hamburger, or the price of gasoline.

So whats up next. What were the Central Bankers at Jackson Hole cooking up this year?

John Titus reports

Like 2019, this year’s Jackson Hole conference includes a paper that has the earmarks of a plan for large-scale thievery a la BlackRock’s “Next Downturn” crony crime classic. Indeed it’s not a stretch to consider this year’s blueprint emission as an extension of BlackRock’s 2019 plan.

This year’s plan is called (yawn), “Resilience redux in the US Treasury market,” by Darrell Duffie.*

Duffie is a professor in Stanford’s Graduate School of Business, which ranks high enough on the prestigious meter for caste members to just gloss over the paper’s complicated-looking math equations, or even read the paper at all. Hell, the Fed even included a Cliff Notes fluff piece to plump Duffie’s paper. It was written by a Harvard Professor, so you know that when he says the paper is awesome, rube, you’re to adopt that opinion as your own and parrot it elsewhere.

In any event, what unites BlackRock’s paper to Duffie’s is their blueprint for inflation. However, whereas BlackRock’s paper uses the word “inflation” 75 times,** Duffie avoids the word “inflation” altogether, even though the inflationary effects that are inherent in his paper’s plan will dwarf those in BlackRock’s paper.

My new video walks through why that’s the case.

If I’m right, the U.S. dollar is gonna float up into the stratosphere over the next few years, which is a big reason, I suspect, for the central bank obsession with CBDC, as the video explains.

Here is the video where he explains

If you don’t have time to watch let me explain. They are planning to have the Fed buy Treasuries Direct because with the higher interest rates they are going to have to pay a lot more interest and print a lot more Treasuries to pay off the interest.

Now John seems to think this is a bad thing. Perhaps he does not realize the Fed must return the interest on the securities to the treasury. I see this as a good thing in moderation

https://www.stlouisfed.org/on-the-economy/2018/september/fed-payments-treasury-rising-interest-rates

Up until 1981 the Fed could buy securities directly, although they did so in limited quantities because they have to return the interest and the principal dealers (their shareholders) made less money when they did so.

But the real issue is why are we accepting that interest rates will be high for long? High Interest Rates do nothing to combat inflation caused by the lack of competition in the market place. In fact they increase inflation by increasing cost of doing business due to higher interest payments.

Inflation

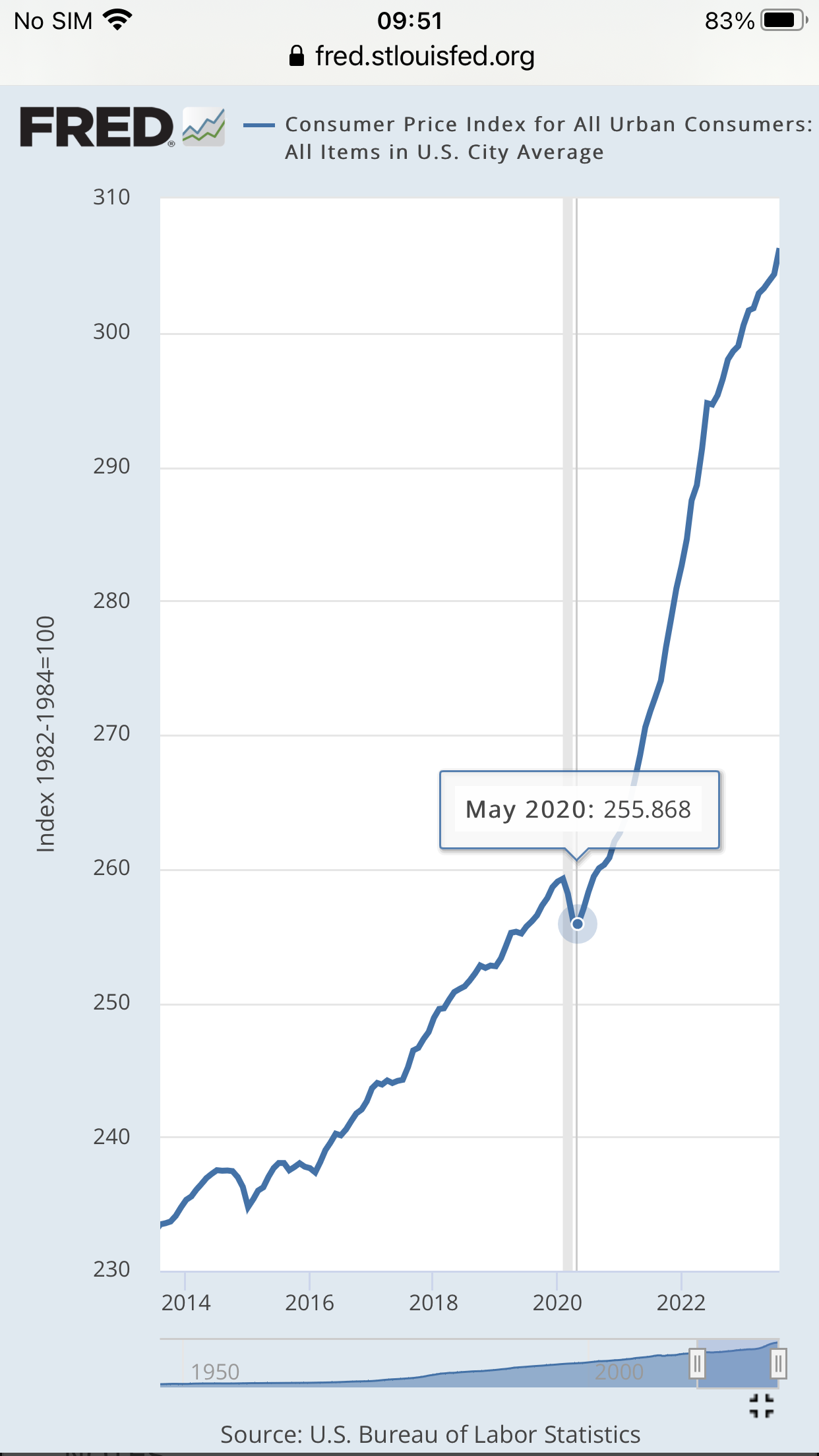

Starting in May , 2020 shortly after nationwide lockdowns ended inflation began, blamed initially due to supply disruptions due to lockdowns in US, Europe and China

When Biden took over, price increases which had been ongoing for 8 months became more noticeable. After 20 months it became even more noticeable. So starting in February 2022, with war in Ukraine about to break out and sanctions against Russia which exacerbate inflation, the Fed began increasing interest rates knowing full well these would do little to dampen inflation, and would likely exacerbate inflation while precipitating a financial crisis

These higher rates would demolish whats left of the Middle Class and Main Street Economy. They put their Propaganda Partners at work in MSM and Alt Media to juice Inflation Expectations. Many said it was due to increased Money Supply, and these increased expectations would beget more inflation.

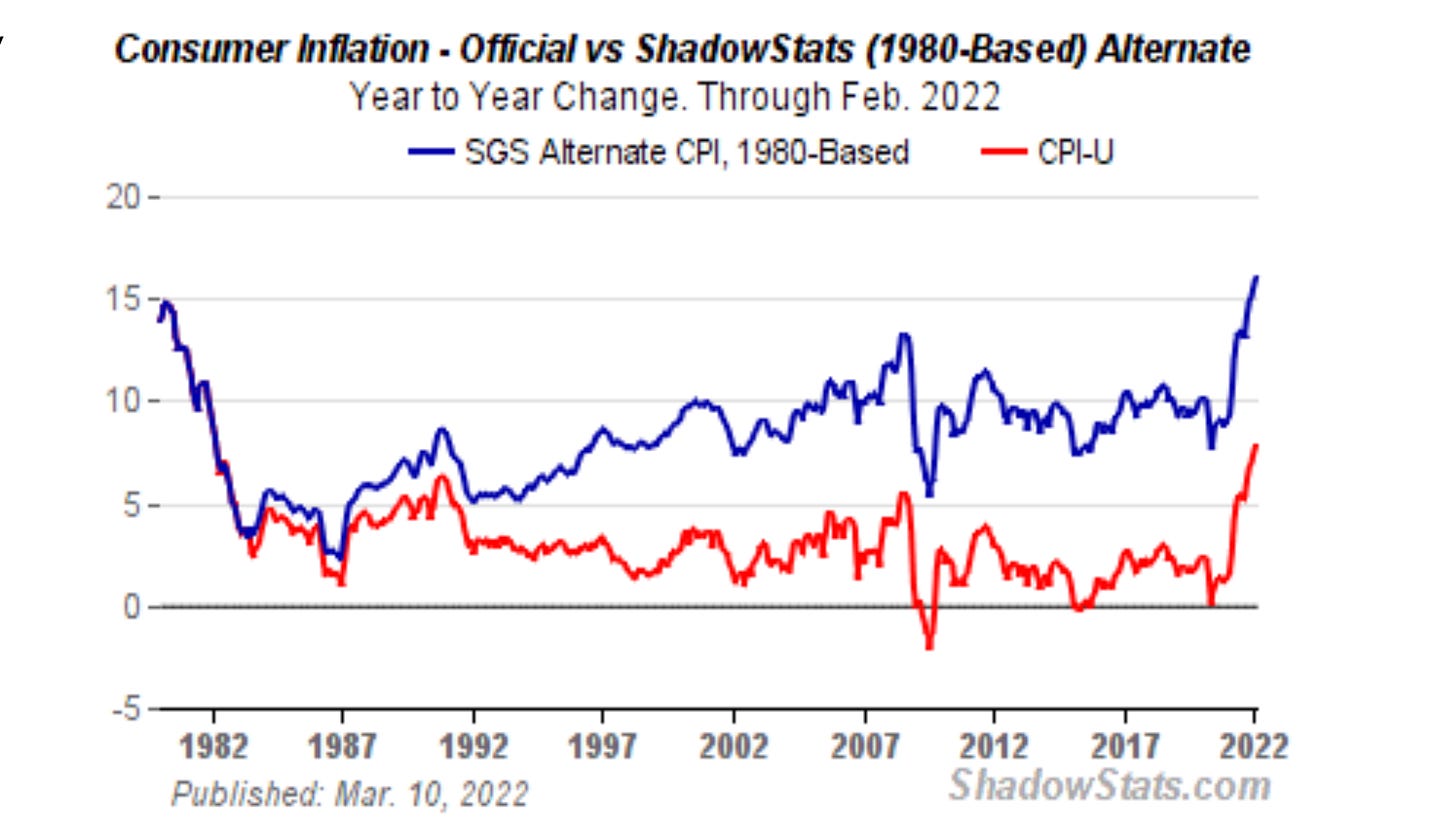

Now I don’t want to get too deep into the weeds in how inflation is calculated but its been way understated for over 40 years, as Shadow Stats shows in the below link.

http://www.shadowstats.com/article/no-438-public-comment-on-inflation-measurement

The purpose was to reduce wage inflation and COLA’s for Social Security, which means real income has been declining for 40 years

BLS is better named the Bureau of Lies with Statistics. The lies didn’t start with COVID. CPI has been almost as bogus a stat as most COVID Data. Its been a Lie since the early 80’s when it was manipulated to reduce the cost of COLA’s so as to suppress wage increases and social security benefits.

CPI does not properly adjust for increased housing costs, property taxes and insurance (health and property), nor does it cover incredible tuition prices made possible by an endless supply of government backed student loans. I wont even mention Health Care Costs.

If the price of steak goes up too much CPI substitutes steak with an equivalent protein source that did not increase in price like hamburger or chicken, and probably bugs in the near future

If the cost of your TV stays the same, and products made outside US did remained stable due to competition in consumer product manufacturing, CPI will reduce inflation by saying the product is improved but priced the same, so they estimate the value of the improvement and claim thats price deflation.

Of course, they don’t factor in the fact that products that used to last 20-30 years now break down in 5-10 years.

In any event, supply for most everything except cartel controlled Oil and Gas remained stable until COVID. At first the supply disruptions were written off as pandemic related, and for much of 2020 this was accepted. Of course, we had from guys like Ralph Baric offering to sell his stockpile of toilet paper for $10 a roll in March 2020. Somehow he knew to stockpile toilet paper

At around 2 minutes

https://asm.org/Podcasts/TWiV/Episodes/Coronavirus-update-with-Ralph-Baric-TWiV-591

However, lets flash back to 2022. Before the War between Ukraine and Russia even started we were seeing prices increase and being blamed on controlled supply shortages and an increase in the money supply. The War was used to justify the Feds increase in interest rates which does nothing to control collusion and the excess money in Bill Gates and his friends pockets, or engineered supply disruptions.

In fact, increases in interest rates increase inflation since the cost of business increases. Furthermore, as mentioned, since the discussion in MSM and social media never addressed the root cause of inflation, it increased inflation expectation. This gave open season to businesses to increase prices, some of that was collusion and there was also some conscious parallelism (tacit collusion) among smaller businesses. I will explain that later.

Obviously, sanctions on Russia and supply disruptions that resulted hurt, as expected, but Europe bore the brunt of that.

Overall, 2022 was a great year for Corporate Profits. Inflation is supposed to have a neutral effect on profits, maybe even a negative effect unless there is price (profit) gouging. Price gouging is not possible without monopolies or cartels.

In case you don’t trust my take, here is Michael Hudson

So there are a number of reasons why prices have gone up.

The big reason is, if you look at the prices that have gone up, they’re monopoly prices. The monopolies have been able to charge more because they’re monopolies, and because there’s less and less competition, and because the government is not really enforcing anti-monopoly legislation

https://www.nakedcapitalism.com/2022/01/michael-hudson-what-is-causing-so-much-inflation.htm

National Debt

Ok, now before I get on to talking about Collusion and Anti-Trust lets talk about the Debt and the imminent collapse of the dollar

If I had a nickel for every time the dollar was supposed to collapse I’d be rich. This is not to say that it won’t happen, but it won’t happen for the reasons you think.

There is nothing wrong with the dollar as it is. The debt is not a big deal , at least it would not be if they lowered interest rates back to where they should be. Again, interest rate hikes do nothing to stop inflation caused by collusion and market manipulation.

Most of the debt is owed to ourselves, like the social security trust fund which is at 3 trillion surplus , except for the fact the government already spent it in exchange for IOU’s, handing it over to the Military Intelligence Industrial Everything Complex.

Thats why they want to trash Social Security since they dont want to pay back that $ 3 trillion. Social Security is still running at a surplus and COVID just knocked off 1 million recipients. I estimate in 2021-2023 Excess Deaths have saved Social Security almost $50 billion to date, and god only knows how much the Pension Funds saved.

Last I checked the breakdown was something like $8 trillion intra-governmental, $8 trillion foreign and $17 trillion US investors (banks, pension funds and investors). The Federal Reserve holds about $4 trillion of that $17 trillion and the banks hold $ 5 trillion.

Except for the foreign investors we could just dump the load on the Feds Balance Sheet where the Fed is required by law to return the interest. Since 1981 the Fed is not permitted by law to buy Treasuries direct, as it used to be able to do, so that must be changed for the Fed to Go Direct with Treasuries

How much debt is too much for a country the US size? When you look at how much is too much for a household or corporation you look at income and assets. The US has 25 trillion GDP. So the public debt is a bit more than 1 year income. Many households and corporations who are considered solvent are well over that.

Of course, households and corporations have collateral for their loans. When you look at US assets, if you include land, resources, tax potential (the rich and big corporations are undertaxed, far below their potential to pay), military assets, intellectual property, etc its probably well over $100 trillion. If our assets are valued using Trumps methodology its over $500 trillion. 😂So the debt is fine.

For the US as a whole

The financial position of the United States includes assets of at least $269.6 trillion(1576% of GDP) and debts of $145.8 trillion (852% of GDP) to produce a net worth of at least $123.8 trillion (723% of GDP)

https://en.m.wikipedia.org/wiki/Financial_position_of_the_United_States

Besides, Households and Corporations cant print their own money. All of our debt is owed in USD which we can print.

But what about the value of the dollar, wont it lose its value? Exchange rates are controlled by BIS, which was one of Hitlers Banks along with Deutsche Bank. BIS is the central banks controller, based in Basel Switzerland . They control exchange rates through central bank collusion.

For those wanting to know more of BIS and Deutsche Bank. These two books are recommended

BIS

DB

Exchange Rates are no longer determined by free market forces as commonly thought, as the central banks acting collectively can counter any threat from the market. Any country trying to attack the dollar w/o BIS approval knows what will happen to it.

The Fed is a major shareholder of BIS and has been since 1994. Actually, they don’t actually hold any shares but they have the voting rights for the 1930 US issue of shares. Its unclear who owns these shares today but when Congress blocked the Fed from joining in 1930 a consortium of shareholders of the Fed joined (J. P. Morgan, the First National Bank of New York, and the First National Bank of Chicago) .

https://fraser.stlouisfed.org/files/docs/publications/FRB/pages/1990-1994/33473_1990-1994.pdf

COLLUSION-ANTI TRUST-MONOPOLY CAPITALISM

Now lets get to Collusion. Hardly anyone talks about it anymore because they pretend it does not exist.

Collusion is when companies get together and agree on stuff like pricing and wages so they don’t get into price wars where they lower prices on goods and services to undercut the competition and over pay for labor talent for the same reason

Collusion is not possible unless there are only a few players dominating the market or industry, and since its illegal care is taken not to leave a paper trail

The owner of a company I worked for told me how he and the other 2 major players in our small Industry would book a suite in a famous Hong Kong Hotel once a year, kept free of any personal electronics and they hashed out such details over a weekend. It was a gentleman’s agreement. If anyone violated it that meant war, which was what the agreement meant to prevent.

So basically to have Collusion the industry must have a defacto Monopoly . This may be a single company controlling 80% of a market, 2 companies (duopoly) or even a half dozen or more companies (oligopoly) working in a cartel-like fashion

In 1982, President Ronald Reagan’s Federal Trade Commission and Department of Justice stopped enforcing the anti-monopoly laws, so we have a lot of it today

To make matters worse courts have since repealed laws that made it a crime for corporations to contribute “any thing of value” to political campaigns, even though voters overwhelmingly support limits on campaign contributions. Now Corporate donors are essential to winning any election and politicians represent Corporations first , while paying lip service to the voters

Most of the key industries in the US are defacto cartels. Health insurance, banking, airline industry, agriculture, internet, cable, oil, smart phones (ios or android) , computer os , pharmaceuticals, search engines, defense industries, etc.

Many of them are self regulatory with a revolving door of industry employees appointed to head the government regulatory commision of their industry for a few years before returning to industry , with a golden parachute on departure and golden handshake on return. Regulations are desired to reduce competition with the big companies able to pass regulatory compliance costs to consumer while smaller companies and startups are overwhelmed

Much of the below is taken from Thom

Hartmann book Monopolies with some editing for brevity

The “Progressive Era” of Teddy Roosevelt’s presidency saw numerous laws passed that were designed to restrain bad corporate behavior. The Tillman Act of 1907, made it a felony for corporations to give money to federal politicians’ campaigns.

But 1921 Republican Warren G. Harding successfully ran for president on a platform of tax cuts, deregulation, and privatization.

When elected, he lowered the top tax rate from 91% to 25%, producing a huge sugar high for the economy. It led straight to the Great Crash of 1929, which was made much worse by Harding’s successful deregulation of the banks and brokerage houses.

During the Great Depression of the 1930s, failing small- and medium-sized companies were easy pickings for larger enterprises that were still cash rich and could buy the struggling companies out of near-bankruptcy.

Since the Crash of 2020, we’ve seen big corporations get massive bailouts and trillions in loans from the Fed, while small enterprises struggled and failed by the millions. The result was further consolidation

On Wall Street, the 20 biggest banks own assets equivalent to 84% of the nation’s entire gross domestic product (GDP). And just 12 of those banks own 70% of all the banking assets.

And consider our food industry. Just four companies control 90% of the grain trade. Just three companies control 70% of the American beef industry. And just four companies control 58% of the US pork and chicken producing and processing industries. And just four companies produce 75% of our breakfast cereal, 75% of our snack foods, 60% of our cookies, and half of all the ice cream sold in supermarkets around the nation

Just four health insurance companies—UnitedHealth Group, WellPoint, Aetna, and Humana—control three-quarters of the entire health insurance market. And, as a 2007 study by the group Health Care for America Now uncovered, in 38 states, just two insurers controlled 57% of the market. In 15 states, one insurer controlled 60% of the market.

In the cellular phone market, just four companies—AT&T Mobile, Verizon Wireless, T-Mobile, and Sprint Nextel— control 89% of the market. And in the internet arena, just a single corporation—Comcast—controls more than half of the market.

By 1950, the yearly average worker income in the United States was clipping along at around $3,000 (household income was $3,300, but most households had a single wage earner), or $31,465 per year in today’s dollars.

As people returning from World War II were finishing trade school and college and entering the workforce, and the stimulative effect of the GI Bill was raising demand for goods and services, that number had grown to $5,700 a year in 1960, or $48,600 a year per household (there were still few multiple-worker households) in 2019 dollars.

Productivity continued to increase, as did wages, hitting a peak in 1970 of $9,430 per year, or $61,400 in today’s dollars. Employers were making more and more money and, trying to avoid paying the top marginal tax rate of 91% (up until 1967 and 73% thereafter), they were plowing that money back into their companies and their employees.

Workers had good union jobs, good benefits in addition to that substantial paycheck, home and car ownership, and annual vacations; they could send their kids to college and even own a small summer home. These were all parts of being “middle class” in America.

Then came Reagan’s massive tax cuts of the 1980s, which explicitly encouraged employers and CEOs to drain as much money out of their companies as they could rather than reinvest it or pay their employees well.

Since the 1970s, productivity has increased by 146%, but wages have actually either stagnated (if looking at household incomes; today many more are two-wage-earner households) or fallen (looking at individual incomes).

CEO compensation has rocketed from 30 times the average worker’s to hundreds of times, in some industries even thousands of times (for example, Coca-Cola’s CEO, James Quincey, gets paid $16.7 million per year—or 1,016 times the typical employee’s pay).

The Census Bureau reports that 2016 average household income was $57,60018—the combined income of (generally) at least two workers, or one worker working more than a single full-time job—a significant fall from its 1970 peak of $61,400 (in today’s dollars) for an individual worker with a single full-time job.

Because of Reaganomics, today it takes two or more people working in a household to maintain the standard of living that one worker could sustain prior to the 1980s. From 1950 to 1970, both wages and productivity pretty much doubled, an increase of around 100% (it was in the high 90s, but let’s round off to keep things simple).

Using 1950 as a benchmark, between 1970 and 2019 wages went up from around 97% to 114%, but productivity went from 98% above the 1950 number to 243%. That 130% increase in productivity while holding wages steady led to a massive increase in corporate profits.

According to the Federal Reserve Bank of St. Louis (which compiles these statistics), the total profit of all American corporations in 1960, was $55 billion, or $469 billion today. The year 1970 saw total corporate profits at $86 billion, or $560 billion in today’s money.

By 1990, corporate annual profits were at $1,652 billion, or $3.19 trillion in today’s dollars.

In 2000, they hit $4.52 trillion in todays dollars. In 2018, corporate profits were at $2.223 trillion a quarter, nearly $9 trillion a year or almost half of the entire nation’s GDP.

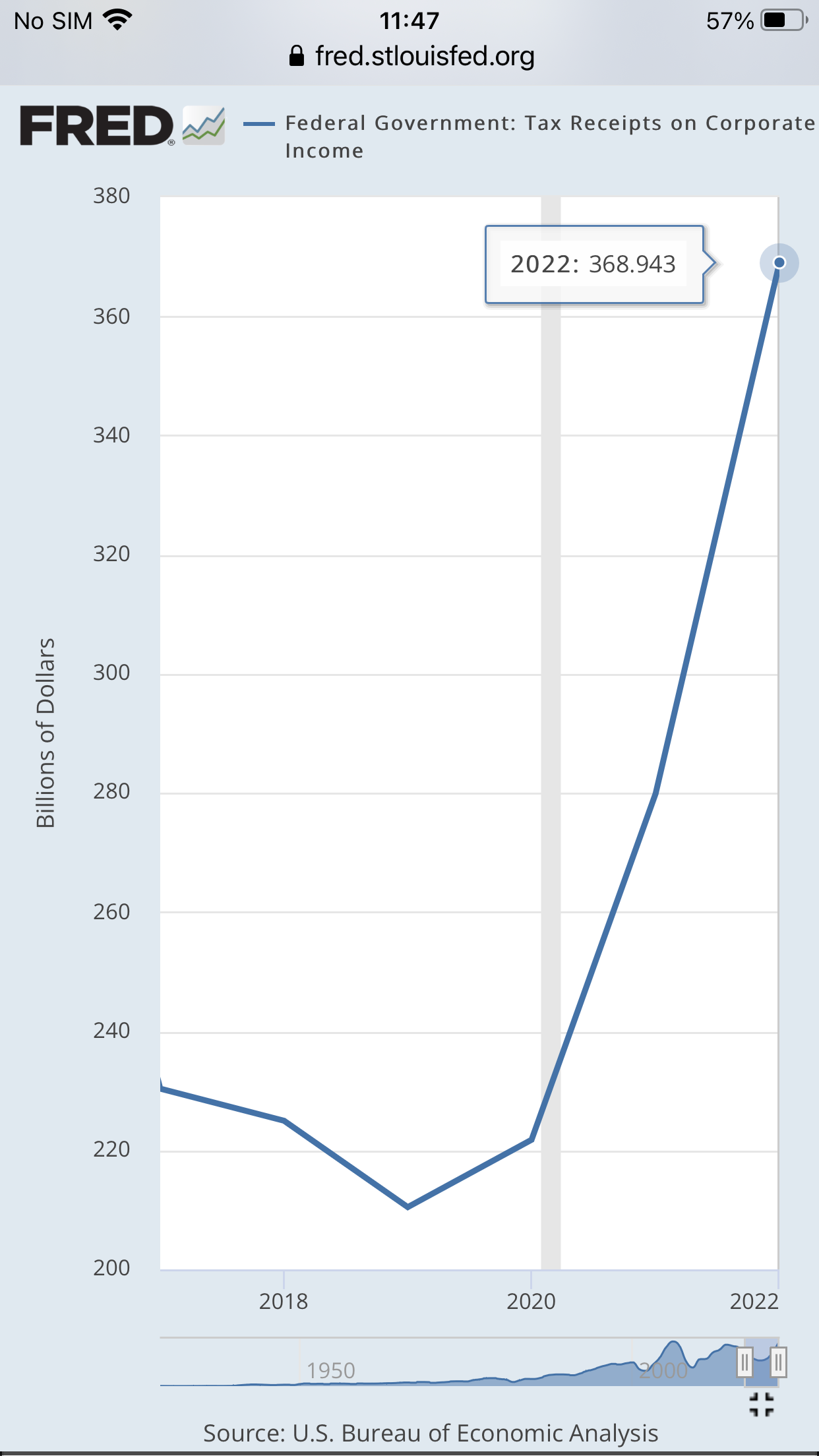

In 2022, they exceeded $12 trillion in profits before taxes, and paid less than $370 billion (3%), accounting for about 7.5% of federal revenue (for context its 43% in Taiwan)

Profits are a pretty reasonable indicator of things, as they’re more independent of overall economic activity than most metrics like GDP. From 1970 to today, we’ve seen a more than 400% increase in money going to the top as profits, compared with a rise in household income of around 15% (and a drop in individual income).

Since profits represent what’s left over after all the other bills are paid and investments made, for profits to have risen so dramatically since roughly the Reagan years, what happened?

The ’70s and ’80s were the years of great change, with the end of Bretton Woods (the 1944 international conference that established the modern system of monetary management, including rules for commercial and financial relations among the United States, Canada, Western European countries, Australia, and Japan) and many tariffs in the 1970s, and Reagan’s massive tax cuts (and anti-union crusades) in the 1980s.

In 1980, the year before Reagan kicked off his “revolution,” the 40-hour work week was standard all across America, although since then the hours that workers put in have steadily risen as the rate of unionization has fallen from around a third of all workers when Reagan was inaugurated to around 6% of the private workforce today.

In 1963, the top marginal income tax rate was 90%. What that did was encourage CEOs to keep more money in their businesses: to invest in new technology, to pay their workers more, to hire new workers and expand.

After all, what’s the point of sucking millions and millions of dollars out of your business if it’s going to be taxed at 90% (or even the 70% that President Lyndon Johnson lowered it to in 1966)?

But when Reagan dropped that top tax rate down to 28%, everything changed. Now, as businesses became far more profitable, there was a far greater incentive for CEOs to pull those profits out of the company and pocket them, because they were suddenly paying an incredibly low tax rate. And that’s exactly what they did.

Suddenly, the symmetry in the productivity/wages chart broke down. Productivity continued increasing, since technology continued improving, and revenues and profits kept increasing with it. But wages stayed flat.

Those trillions of dollars that would have gone to workers? They went into the estates and stock portfolios of the top 1%.

Today, workers’ wages as a percentage of GDP are at an all-time low. Yet, corporate profits as a percentage of GDP are at an all-time high. The top 1% of Americans own 40% of the nation’s wealth. In fact, just 400 Americans own more wealth than 150 million other Americans combined, and they pay lower taxes than anybody in the bottom half of American families economically.30

In 1987 Reagan suspended the Fairness Doctrine (which required radio and TV stations to “program in the public interest,” a phrase that was interpreted by the FCC to mean hourly genuine news on radio and quality prime-time news on TV, plus a chance for “opposing points of view” rebuttals when station owners offered on-air editorials), and then in 1996 President Bill Clinton signed the Telecommunications Act of 1996, which eliminated most media-monopoly ownership rules. That same year, billionaire Rupert Murdoch started Fox News, an enterprise that would lose hundreds of millions in its first few years but would grow into a powerhouse on behalf of the monopolists.

So what’s the problem with profits and Oligopoly? Read on

Oligopolies and Monopolies result in higher prices that translate into higher profits. Now this might be Ok if they were paying more taxes or ploughing the money back into the company with higher wages and better services, but they don’t, especially since Reagans and Trumps tax cuts

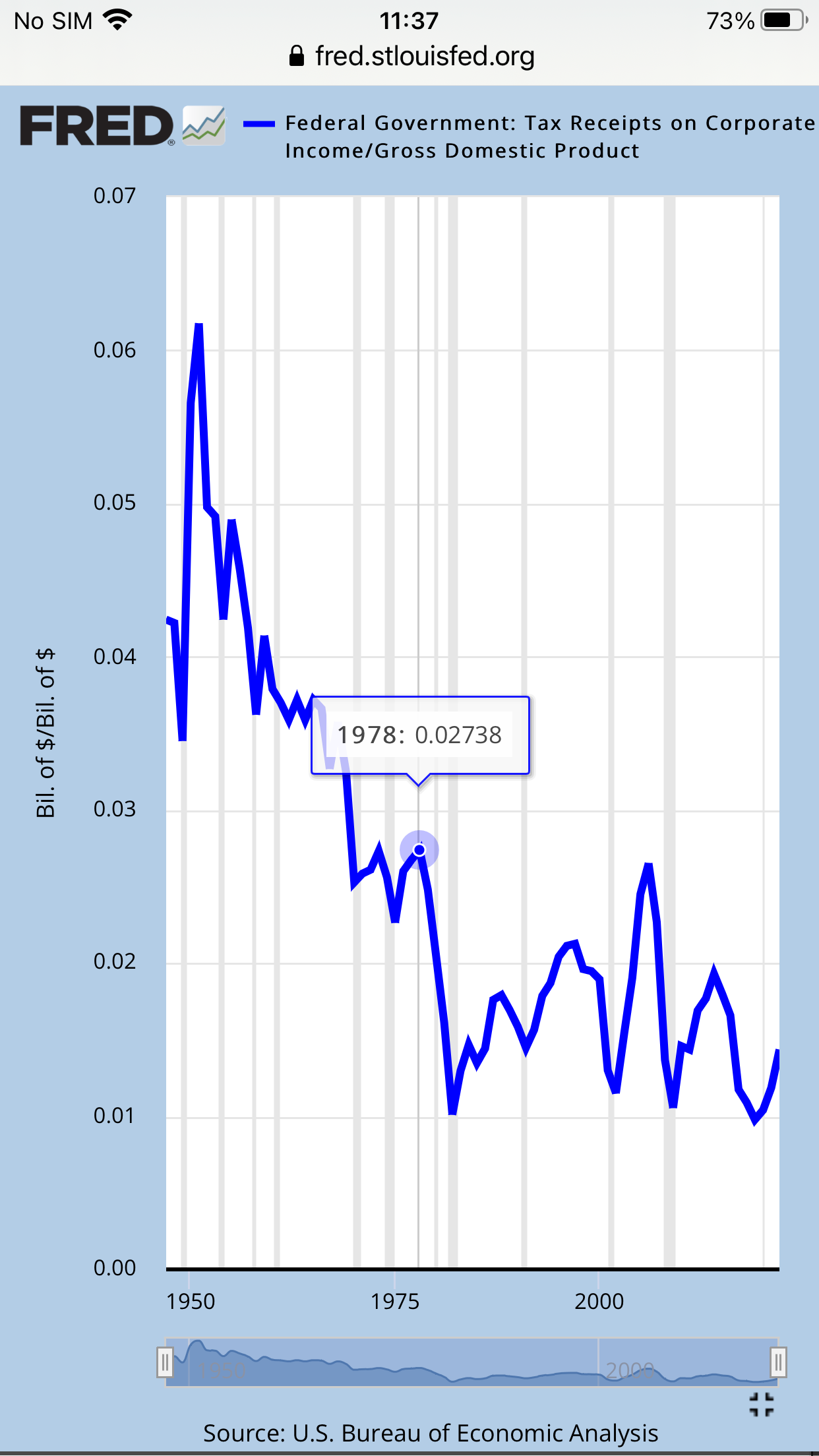

Corporate taxes as a % of GDP is 1/2 of what it was in 1978 and less than 1/4 what is was in 1952

The way they take these excessive profits is via Collusion, over both price and wages, albeit not necessarily overt or illegal Collusion. Its called Conscious Parallelism

Conscious parallelism occurs when competitors “restrain trade by intentionally imitating their competitors’ actions with reasonably high expectations of a responsive imitation that will lessen the rigors of competition.”

The phenomenon is sometimes called “tacit collusion,” given that “communication is indirect, as firms infer rivals’ intentions from their actions or from market outcomes.”

Overt or tacit collusion has the same consequences for the consumer, which may be one or all of the following; higher prices, less services, lower quality , fewer choices.

Conscious parallelism is parallel behavior that typically appears in markets with small numbers of sellers. It is not the result of an explicit agreement. It occurs because in markets with few sellers, firms take the reactions of competitors into account when deciding how much to produce or what price to set. Although it is hard to find a precise definition of it, the term conscious parallelism refers to a form of tacit collusion in which each firm in an oligopoly realizes that it is

within the interests of the entire group of firms to maintain a high price or to avoid vigorous price competition, and the firms act in accordance with this realization.

It is no coincidence that “[o]ligopolistic markets are characterized frequently by higher prices and lower outputs than competitive markets.” After all, sellers are trying to “maximize joint profits (or, minimize joint losses)” rather than vigorously compete for customers.

Firms engage in parallel behaviour in order to gain collusive profits. A cartel is not set up explicitly; instead, firms establish parallel conduct understanding the accomplishment of a common purpose.

The fact that there is no explicit agreement seemingly creates an enormous problem for antitrust law, which tends to focus on explicit collusion. Under conventional interpretations, conscious parallelism does not meet the “contract,” “combination,” or “conspiracy” requirement of section 1 of the Sherman Act.

The Supreme Court has held that conscious parallelism simply reflects rational behavior by independent firms that correctly perceive and act upon competitive interdependencies without reaching any sort of agreement or mutual understanding with their rivals. Thus . . . conscious parallelism is not reachable under Section 1 of the Sherman Act because such behavior does not entail any act of agreement.

Conscious parallelism might be addressed via the antimonopolization provision of section 2 of the Sherman Act. At its core, the argument is that oliopolists’ behavior can be analogized to that of monopolists:

Parallel behavior of several “competing” firms, especially when such behavior influences the price structure in the market, often has the same harmful effects on the market as the exercise of monopoly power by a single enterprise . . . . Thus business practices that are forbidden to monopolists because of their size can and should be forbidden to oligopolists whose collective market power, wielded through conscious parallelism, approaches that of a single firm monopolist.

Even the Supreme Court has analogized conscious parallelism to shared monopoly:

Tacit collusion, sometimes called oligopolistic price coordination or conscious parallelism, describes the process, not in itself unlawful, by which firms in a concentrated market might in effect share monopoly power, setting their prices at a profit-maximizing, supracompetitive level by recognizing their shared economic interests and their interdependence with respect to price and output decisions.

In drafting the Sherman Act, Congress’s “basic objective was to preserve competitive pricing.” After all, as the Supreme Court observed, The Sherman Act . . . rests on the premise that the unrestrained interaction of competitive forces will yield the best allocation of our economic resources, the lowest prices, the highest quality and the greatest material progress, while at the same time providing an environment conducive to the preservation of our democratic political and social institutions. But even were that premise open to question, the policy unequivocally laid down by the Act is competition.

As such, restraints of trade such as conscious parallelism can and should be deemed violations of the Act. Put bluntly, the “focus of the Sherman Act thus must be shifted from a preoccupation with conspiratorial behavior to a greater concern for harm to the public and injury to competition.”

The Clayton and FTC Acts present additional possibilities of addressing conscious parallelism. The most important provision in the Clayton Act of 1914, section 7, prohibits mergers that have an anticompetitive effect.

The provision’s import in the context of conscious parallelism is quite straightforward: to the extent the merger would increase concentration it would facilitate conscious parallelism; as such, section 7 permits courts to interdict changes in market structure that would facilitate coordination.

A former Chairman of the FTC even suggests that “conscious parallelism remains a prime consideration under coordinated effects analysis because the enforcement agencies’ reviews of mergers under Section 7 of the Clayton Act look to prospective effects and do not require a prediction of illegal conduct to justify a challenge.”

The central point here is that the Clayton Act can be used to stop or modify mergers that might engender conditions propitious to conscious parallelism—whether the agencies have in fact done this adequately is beside the point.

Finally, the FTC Act of 1914 could be profitably used as a tool against conscious parallelism. Its central prohibition, articulated in section 5, is simply that “[u]nfair methods of competition in or affecting commerce, and unfair or deceptive acts or practices in or affecting commerce, are hereby declared unlawful.”

Most specifically the purpose of this Article, section 5 does not require agreement or conspiracy

In addition, the FTC Act’s exclusive reliance on civil remedies could provide a lower-risk environment within which to craft doctrines responsive to conscious parallelism.

Congress conferred FTC power broadly because it wisely recognized in 1914 that businessmen were ingenious, so that if Congress merely established a laundry list of unfair practices, businessmen would always devise ways to avoid them. There would then be a constant need for new legislation or other corrective action.

The flexibility that the FTC received under section 5 allowed it to issue a complaint and at least test whether a particular fact pattern constituted unlawful or anticompetitive behavior.

It is therefore no surprise that “[s]ection 5 has been a continuing source of attraction to the FTC and commentators as a means of attacking facilitating practices and forms of interfirm coordination that may defy characterization as an agreement for Sherman Act purposes.”

Indeed, in maintaining the breadth of the FTC Act, the FTC has tried to use section 5 to combat conscious parallelism but has faced significant political pressure to back down.

In the end, it is very tempting to argue that antitrust laws—drafted back in the late nineteenth and early twentieth centuries—are antiquated and thus incapable of dealing adequately with conscious parallelism.

https://digital.sandiego.edu/cgi/viewcontent.cgi?article=2677&context=sdlr

The Bork Factor

Congress enacted the Sherman Act to ensure the public would be the master of these state-chartered entities and not their servant. Senator John Sherman made the stakes clear in a speech on the Senate floor and declared, “If we will not endure a king as a political power, we should not endure a king over the production, transportation, and sale of any of the necessaries of life.”

In an 1895 decision, the Supreme Court held that, under its then-narrow interpretation of Congress’ power to regulate interstate commerce, the Sherman Act did not prohibit even monopolistic mergers in the manufacturing and mining sectors. With this judicial green light to control markets through consolidation, corporations went on a merger frenzy that transformed the US economy.

New federal antitrust statutes, including the Clayton and Federal Trade Commission Acts, barely dented this concentrated economic structure. This period birthed many of the giants (think Du Pont, General Electric, Nabisco, and US Steel) that dominated American industry for much of the twentieth century.

Beginning in the late 1930s and following a burst of great policy experimentation, the federal government stepped up antitrust prosecutions of big businesses. For the next four decades, businesses had far less autonomy to control markets through mergers and predatory practices and were compelled to grow through product improvements and investment in new plants. While capital was constrained, labor had substantial autonomy and faced a diminished threat from antitrust

In a 1972 case, Justice Marshall, speaking for a high court majority, stated, “Antitrust laws . . . are the Magna Carta of free enterprise. They are as important to the preservation of economic freedom and our free-enterprise system as the Bill of Rights is to the protection of our fundamental personal freedoms.”

As conservative attacks on the New Deal gained traction starting in the mid-1970s, antitrust was an early target. Corporate executives resented how antitrust law and New Deal regulations in general restricted their freedom of action

Robert Bork, a law professor at Yale, would be a savior. He had been concocting the theories by which corporations would overthrow the antitrust fetters of the postwar period.

Bork offered a radical reinterpretation of antitrust law. Inventing a legislative history out of whole cloth, he argued that Congress enacted the Sherman Act only to protect “consumer welfare” and not to control the broader economic and political power of corporations.

Further, based on hypotheses with little or no empirical support, he asserted that mergers and trade restraints allowed businesses to lower costs and improve services and thereby benefit consumers.

The Supreme Court, starting in the Nixon years, and the Department of Justice and Federal Trade Commission, beginning with Reagan, were eager to read the theories of Bork into case law and policy. (In 1982, Reagan appointed Bork as a court of appeals judge and gave him the opportunity to directly rewrite antitrust doctrine.)

For instance, in a 1979 decision, the Supreme Court, quoting Bork’s Antitrust Paradox and relying on his fabricated account of congressional intent, stated “Congress designed the Sherman Act as a ‘consumer welfare prescription.’”

Due to few limits on consolidation and monopolization, markets and industries across the economy have become highly concentrated. This systemic market concentration means Americans pay more for essentials, earn less at work, and have fewer opportunities to start businesses. While the internet once promised decentralization and dispersal of power, Amazon, Facebook, and Google have established online bottlenecks over commerce, social media, and search and wield extraordinary power. Corporate power is not restricted to the marketplace: large corporations rule our politics. Their political preferences shape Congressional decision-making, while the views of ordinary Americans hardly register at all.

As it defers to corporate power, the Federal Trade Commission, in particular, has applied Bork’s directive to root out collusion everywhere. It has sued associations of independent contractors (who, unlike workers in traditional employment arrangements, do not have an antitrust exemption) and attacked laws granting them collective bargaining rights. For example, it has targeted concerted activity among publicdefenders, home health workers, and music teachers. Workers in the gig economy have not been spared.

The Federal Trade Commission and Department of Justice, partnering with the Chamber of Commerce in court, stopped Seattle from granting collective bargaining rights to Uber and Lyft drivers. In a 2015 blog post, an FTC official made clear in that these worker cases are not anomalies but represent agency policy—under a Democratic administration at that. The threat of antitrust investigations and lawsuits hangs over the organizing efforts of millions of workers.

Reagan FTC appointee Terry Calvani once said he was happy with only two companies in any market. For the Soviets, even one is enough. If Jeffersonian small shop doctrine is “left”, and Hamilton/Bork/Friedman/Rand are “right”, the only economic school further to the “right” is Soviet economic doctrine. Another antitrust paradox.

https://www.d-kart.de/en/blog/2021/08/25/revisiting-bork-the-antitrust-warrior/

Powell Memo and Business Round Table

Many believe the WEF based in Davos Switzerland is responsible for the Corporate Evils of today. Best look closer to home

Written in 1971 to the U.S. Chamber of Commerce, the Lewis Powell Memo was a blueprint for corporate domination of American Democracy.

Just a few months before he was nominated by President Richard Nixon to the US Supreme Court, Powell had written a memo to his good friend Eugene Sydnor Jr., the director of the US Chamber of Commerce at the time.

Powell’s most indelible mark on the nation was not to be his 15-year tenure as a Supreme Court justice but instead that memo, which served as a declaration of war against both democracy and what he saw as an overgrown middle class. It would be a final war, a bellum omnium contra omnes, against everything FDR’s New Deal and LBJ’s Great Society had accomplished.

It wasn’t until September 1972, 10 months after the Senate confirmed Powell, that the public first found out about the Powell memo (the actual written document had the word “Confidential” at the top—a sign that Powell himself hoped it would never see daylight outside of the rarified circles of his rich friends).

Jack Anderson did, and he exposed it in a September 28, 1972, column in the Washington Post titled, “Powell’s Lesson to Business Aired.” Anderson wrote, “Shortly before his appointment to the Supreme Court, Justice Lewis F. Powell Jr. urged business leaders in a confidential memo to use the courts as a ‘social, economic, and political’ instrument.”

Pointing out that the memo hadn’t been discovered until after Powell was confirmed by the Senate, Anderson wrote, “Senators . . . never got a chance to ask Powell whether he might use his position on the Supreme Court to put his ideas into practice and to influence the court in behalf of business interests.”

In the nearly 6,000-word memo, Powell called on corporate leaders to launch an economic and ideological assault on college and high school campuses, the media, the courts, and Capitol Hill. The objective was simple: the revival of the royalist-controlled “free market” system.

As Powell put it, “[T]he ultimate issue . . . [is the] survival of what we call the free enterprise system, and all that this means for the strength and prosperity of America and the freedom of our people.”

The first front that Powell encouraged the Chamber to focus on was the education system. “[A] priority task of business—and organizations such as the Chamber—is to address the campus origin of this hostility [to big business],” Powell wrote.

Powell proposed a list of ways the Chamber could retake the higher-education system. First, create an army of corporate-friendly think tanks that could influence education. “The Chamber should consider establishing a staff of highly qualified scholars in the social sciences who do believe in the system,” he wrote.

Next, Powell turned to the media. Reaching the public generally may be more important for the shorter term.” Powell added, “It will . . . be essential to have staff personnel who are thoroughly familiar with the media, and how most effectively to communicate with the public.” He advocated that the same system “applies not merely to so-called educational programs . . . but to the daily ‘news analysis’ which so often includes the most insidious type of criticism of the enterprise system.”

Following Powell’s lead, in 1987 Reagan suspended the Fairness Doctrine (which required radio and TV stations to “program in the public interest,” a phrase that was interpreted by the FCC to mean hourly genuine news on radio and quality prime-time news on TV, plus a chance for “opposing points of view” rebuttals when station owners offered on-air editorials), and then in 1996 President Bill Clinton signed the Telecommunications Act of 1996, which eliminated most media-monopoly ownership rules. That same year, billionaire Rupert Murdoch started Fox News.

In 1972-three business organizations merged to form the Business Roundtable, the first business association whose membership was restricted to top corporate CEOs. In part at the urging of Bryce Harlow, lobbyist for Procter & Gamble, this new organization combined two groups focused on relatively narrow business issues with an informal organization called the March Group.

The March Group had grown out of a meeting with top Nixon administration officials and prominent executives and was designed to bring together many of the nation’s most powerful CEOs.

Within five years the new mega-organization had enlisted 113 of the top Fortune 200 companies, accounting for nearly half of the economy.

The Business Roundtable quickly developed into a formidable group, designed to mobilize high-level CEOs as a collective force to lobby for the advancement of shared interests. President Ford’s deputy treasury secretary Charls Walker, a leading corporate organizer about whom we’ll say more in a moment, later put it this way: “The Roundtable has made a lot of difference. They know how to get the CEOs into Washington and lobby; they maintain good relationships with the congressional staffs; they’ve just learned a lot about Washington they didn’t know before.

Today the Business Round Table is led by JP Morgans Jamie Dimon

THE GOAL -CBDC and You Will Own Nothing

So if the dollar is trashed IMO it will be because the Fed and BIS and the ELITE stakeholders are trashing it for a purpose, and a new digital currency that will require a digital ID and track your deposits and spending would be a wonderful thing for our Elite and Technocrat Controllers.

Even better, is the currency can be programmed so your spending can be controlled or shut off for stuff like criticizing the government, using too much carbon (calculated from your spending data), etc.

So I can see it coming, but before they can get the support to do so we will need another major event, something that would make the last Global Financial Crisis look small by comparison, something that might result in people not having any access to banking services for a long while it gets straightened out. Except for the government who will be able to get cash from the Fed in return for Treasuries. You have to pay the Soldiers and Cops if you want to maintain Power over the Herd.

The Next Financial Crisis will lead to the loss of Your Wealth, which includes Bank Deposits, Mortgaged Homes, Securities and Pensions, which will be transferred to the Secured Creditors and SIFI’s (Significant International Financial Institutions designated as such by BIS and its Central Banks members)

Bank Deposits-Unsecured Creditors

2010 Dodd Frank Act, which eliminated taxpayer bailouts by requiring insolvent SIFIs to recapitalize themselves with the funds of their creditors. “Creditors” are defined to include depositors, but deposits under $250,000 are protected by FDIC insurance.

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 states in its preamble that it will “protect the American taxpayer by ending bailouts.” But it does this under Title II by imposing the losses of insolvent financial companies on their common and preferred stockholders, debtholders, and other unsecured creditors, through an “orderly resolution” plan known as a “bail-in.”

Depositors are classed as “creditors.” A general deposit is a loan made to a bank. This means that the bank is the general depositor’s debtor, but that the bank has legal title to the funds deposited; these funds may be commingled with the bank’s other funds. All the general depositor has is a general, unsecured claim against the bank …. The bank is free to use the deposit as it sees fit.

But what about FDIC?

The Deposit Insurance Fund (DIF) of the Federal Deposit Insurance Corporation (FDIC) was $128.2 billion as of December 31, 2022. The FDIC is required to fund the DIF to 1.35% of insured deposits. The DIF can be exhausted, and indeed has been totally depleted twice—in the Savings and Loan Crisis and in the Global Financial Crisis. In these instances, the FDIC was allowed to borrow funds from the Federal Financing Bank. The FDIC has a line of credit with the Treasury for up to $100 billion. If this credit line were fully utilized, total resources would be $228 billion (roughly 2% of insured deposits).

So, if the entire banking system is insolvent, “insured” depositors get 2 cents on the dollar. That will not go far in a widespread banking crisis, or if the deposit-taking subsidiary of a major bank is bankrupted, e.g., Bank of America and JP Morgan have over $2 trillion, and $2.5 trillion in deposits, respectively.

So basically depositors will be bailing out the banks.

But its worse than this, far worse. I recently learned this from an online book recommended by Ellen Brown, author of Web of Debt

He says essentially all securities “owned” by the public are in custodial accounts. Pension plans and investment funds are now encumbered as collateral underpinning the Quadrillion dollar ($1000 trillion ) derivatives complex,

In 1994 the Uniform Commercial Code (UCC) was amended. In 2005, less than two years before onset of the Global Financial Crisis, “safe harbor” provisions in the U.S. Bankruptcy code were significantly changed.

“Safe harbor” sounds like a good thing, but again, this was about making it absolutely certain that secured creditors can take client assets, and that this cannot be challenged subsequently. This was about “safe harbor” for secured creditors against demands of customers to their own assets.

The safe harbors cover a wide range of contracts that might be considered derivatives, including securities contracts, commodities contracts, forward contracts, repurchase agreements, and, most importantly, swap agreements. The latter has become a kind of ‘catch-all’ definition that covers the whole of the derivatives market, present and future . . .

A protected contract is only protected if the holder is also a protected person, as defined in the Bankruptcy Code. Financial participants—essentially very large financial institutions—are always protected.

The new safe harbor regime was cemented into case law with the court proceedings around the bankruptcy of Lehman Brothers. In the lead-up to the failure, JP Morgan (JPM) had taken client assets as a secured creditor while being the custodian for these client assets! Under long- standing bankruptcy law this would clearly have been a constructively fraudulent preference transfer benefitting an insider. And so, JPM was sued by clients whose assets were taken. The clients lost.

These are the key facts:

• Ownership of securities as property has been replaced with a new legal concept of a "security entitlement", which is a contractual claim assuring a very weak position if the account provider becomes insolvent.

All securities are held in unsegregated pooled form. Securities used as collateral, and those restricted from such use, are held in the same pool.

• All account holders, including those who have prohibited use of their securities as collateral, must, by law, receive only a pro-rata share of residual assets.

• “Re-vindication,” i.e. the taking back of one’s own securities in the event of insolvency, is absolutely prohibited.

• Account providers may legally borrow pooled securities to collater- alize proprietary trading and financing.

• "Safe Harbor" assures secured creditors priority claim to pooled securities ahead of account holders.

• The absolute priority claim of secured creditors to pooled client securities has been upheld by the courts.

Account providers are legally empowered to “borrow” pooled securities, without restriction. This is called “self help.”

Central Clearing Parties (CCPs) take on counterparty risk between parties to a transaction and provide clearing and settlement for trades in foreign exchange, securities, options, and most importantly derivative contracts. If a participant fails, the CCP assumes the obligations of the failed clearing participant. The CCP combines the exposures to all clearing members on its balance sheet.

The Depository Trust & Clearing Corporation (DTCC) operates CCPs, which have been designated in the U.S. as Systemically Important Financial Market Utilities (SIFMUs).

The Depository Trust & Clearing Corporation (DTCC) is the parent company of various operating subsidiaries, including The Depository Trust Company (DTC), National Securities Clearing Corporation (NSCC), Fixed Income Clearing Corporation (FICC), DTCC ITP LLC (ITP), DTCC Deriv/SERV LLC (Deriv/SERV), DTCC Solutions LLC (Solutions (US)), DTCC Solutions (UK) Limited (So- lutions (UK)), Business Entity Data, B.V. (BED); Collectively, the

“Company” or “Companies.”

This is all of DTCC, consolidated, i.e., the whole enchilada.

As of March 31, 2023, the consolidated Total Shareholder’s Equity was a tad over $3.5 billion (that’s with a “b”).

Now realize that this is the entire capitalization underpinning the Central Security Depository and CCPs for the entire U.S. securities market and derivatives complex.

(N.Y. Fed): . . . an investor is always vulnerable to a securities intermediary that does not itself have interests in a financial asset sufficient to cover all of the securities entitlements that it has created in that financial asset . . .

If the secured creditor has “control” over the financial asset it will have priority over entitlement holders . . .

If the securities intermediary is a clearing corporation, the claims of its creditors have priority over the claims of entitlement holders.

So, there we have it. In the event of a collapse of the clearing subsidiaries of DTCC, it is the secured creditors who will take the assets of the entitlement holders.

Unless you hold the asset certificate (home, stock, bond, etc) in your hand, you are an entitlement holder.

That will be messy to say the least. Martial Law will be a given

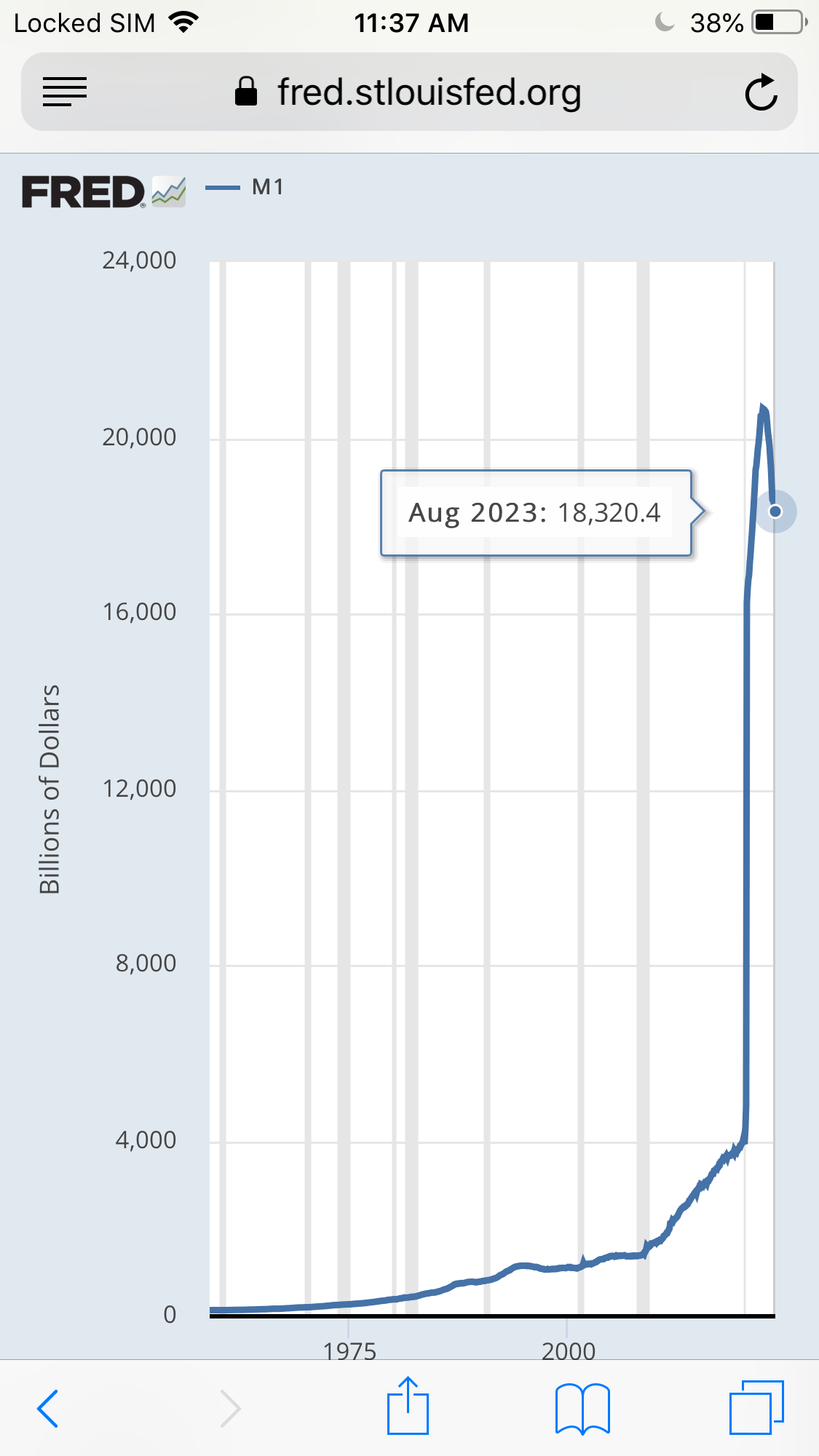

Interesting but the M1 Money Supply has lost over 10% (over $2 trillion the last 18 months) .M1 consists of (1) currency outside the U.S. Treasury, Federal Reserve Banks, and the vaults of depository institutions; (2) demand deposits at commercial banks (excluding those amounts held by depository institutions, the U.S. government, and foreign banks and official institutions) less cash items in the process of collection and Federal Reserve float; and (3) other liquid deposits, consisting of OCDs and savings deposits (including money market deposit accounts).

M2 has dropped almost $1 trillion. Biggest percentage drop recorded in over 60 years

Bad things happen when money starts disappearing.

Consider also Twitters new CEO prediction the end of the dollar will come in September 2024

When it does get straightened out and your deposits are recalculated and replaced with the new CBDC, Americans will be a lot poorer, and some other countries will be a lot richer. This is the solution for the Global inequality that currently exists and is the main obstacle to achieving a Global Government, which will be a Global Republic of semi-autonomous nations/regions

The ELITES will have a heads up so they will manage their assets and cash to ensure they are holding more of the currencies that will appreciate. Hard assets/resources will maintain their value so it will just take more US currency and less foreign currency to buy them, assuming they don’t already own them after seizing them from entitlement holders (you)

Man, I hope I miss all of that fun but If I had to guess, I would say the collapse will come sooner rather than later. The one thing that may delay that is another war. However, War with Russia is out because it has become politicized. War with China is out because it is suicide and would accelerate the collapse.

War to defend Israel would have bipartisan support but there needs to be an event similar to 9/11 to precipitate it. Such events on US soil typically happen under Republicans so it would have to happen on Israel soil (not prophetic, I just read the news).

I’ll end this beast here for the AI who is probably the only one who made it this far. 😉