The Ongoing Controlled Demolition Of The Economy

So last year I warned of the Controlled Demolition of the Economy. It hasn’t proceeded quite as fast as I anticipated, perhaps because CBDC is coming along slower than expected, but it is proceeding.

Frankly, we have been in a controlled deindustrialization since the 1970s starting with the Bilderberger -OPEC Executed Oil Shocks in 1973 followed by Trilateral Commissions man Volcker and his War on Inflation, and further exacerbated by Reagan’s neoliberal economic policies and the War on Unions and Deregulation, which broke up monopolies but created cartels by not prosecuting collusion.

He also gifted Big Tech the DARPA created Internet funded by the taxpayers.

[Note-I voted for Reagan after Registering as a Republican. Boston was True Blue at the time and my Dad called me a disgrace for doing so. He later joined me. Today I am politically homeless, with no allegiance to the two sects of the Uniparty who engage in Fake Wrestling on behalf of the Globalists. I like to consider myself a liberal conservative. End Note]

Collusion was simply renamed Conscious Parallelism which means companies just follow the leader when it comes to pricing and do not compete with each other on price. This is clearly BS.

Increased regulation started in the 70’s . These are mostly written by Industry leaders lobbyists (not Congress, hell, they don’t even read them) for the purpose of creating a burden on smaller companies as compliance costs are high, as well as legal cover. The myth that large corporations hate regulation is just that, a myth. They hate competition far more than regulation.

Another myth is that an increase in the money supply creates inflation on Main Street. In a world where the increase in money supply is equally distributed, and demand increases more than supply, this may be true. However, the increase in the money supply since the 2008 Global Financial Crisis was hardly equally distributed. The bottom 90% got left out of that party. The biggest beneficiaries were the top 1%. And for a decade we had little inflation as measured by the lie that is CPI.

So what did that increase in the money supply coupled with low interest rates bring us? It brought us more mergers and acquisitions that reduced competition, financed companies moving production off shore, increased asset prices such as real estate and stocks, stock buy backs and of course increased prices on luxury items like yachts, private planes, islands, jewlery, mansions, etc

Bill Gates and his pals only wear one pair of pants at a time and only eat 1 pizza or burger at a time, and they can only consume a small fraction of the energy and fuel supply no matter how much money they have.

So we had no significant inflation on Main Street for 10 years although inflation was higher than measured by CPI because CPI has been almost as bogus a stat as most COVID Data. Its been a Lie since the early 80’s when it was manipulated to reduce the cost of COLA’s so as to suppress wage increases and social security benefits.

CPI does not properly adjust for increased housing costs, property taxes and insurance (health and property), nor does it cover incredible tuition prices made possible by an endless supply of government backed student loans.

If the price of steak goes up too much CPI substitutes steak with an equivalent protein source that did not increase in price like hamburger or chicken, and probably bugs in the near future

If the cost of your TV stays the same, and products made outside US did remained stable due to competition in consumer product manufacturing, CPI will reduce inflation by saying the product is improved but priced the same, so they estimate the value of the improvement and claim thats price deflation. Of course, they don’t factor in the fact that products that used to last 20-30 years now break down in 5-10 years.

In any event, supply for most everything except cartel controlled Oil and Gas have remained stable until COVID. At first the supply disruptions were written off as pandemic related, and for much of 2020 this was accepted. Of course, we had little inflation aside from Ralph Baric offering to sell his stockpile of toilet paper for $10 a roll in March 2020

However, lets flash forward to 2022. Before the War between Ukraine and Russia even started we were seeing prices increase and being blamed on controlled supply shortages and an increase in the money supply. This was used to justify the Feds increase in interest rates which do nothing to control collusion and the excess money in Bill Gates and his friends pockets.

In fact, increases in interest rates increase inflation since the cost of business increases. Furthermore, since the discussion in MSM and social media never addressed the root cause of inflation, it increased inflation expectation. This gave open season to businesses to increase prices, some of that was collusion and there was also some conscious parallelism among smaller businesses.

Obviously, sanctions on Russia and supply disruptions that resulted hurt, as expected, but Europe bore the brunt of that.

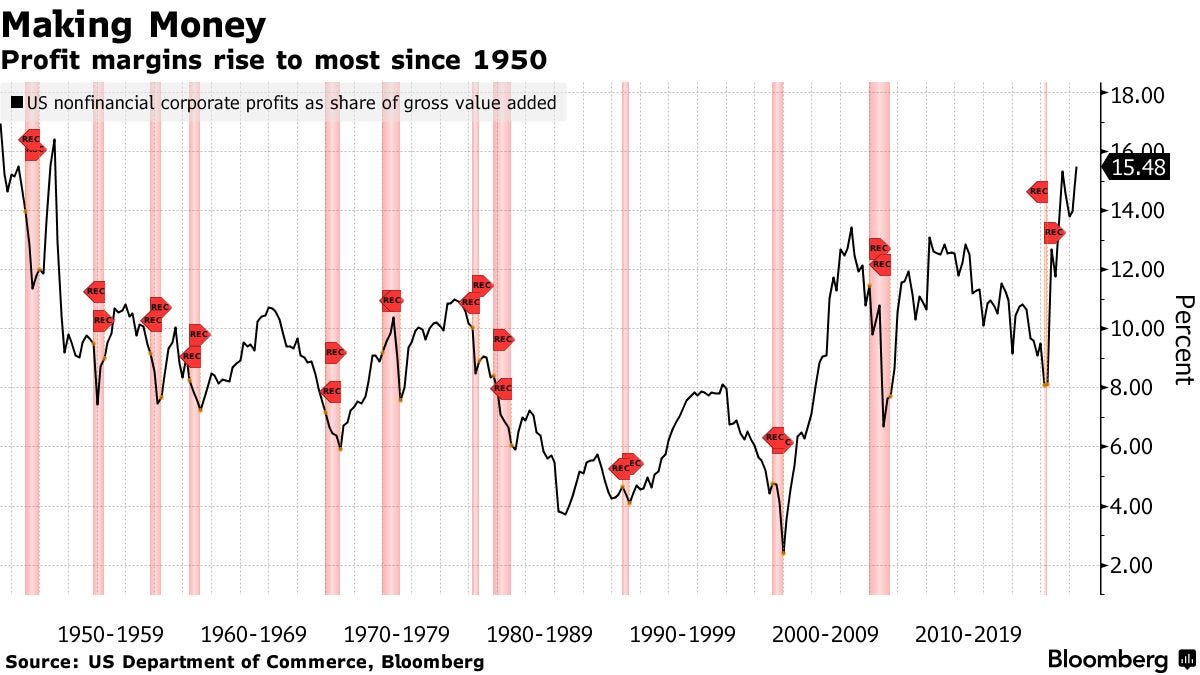

Overall, 2022 was a great year for non-financial Corporate Profits. Inflation is supposed to have a neutral effect on profits, maybe even a negative effect unless there is price (profit) gouging. Price gouging is not possible without monopolies or cartels.

Following a two-quarter dip in 2020, quarterly profits have surged by more than 80 percent over the last two years, from around $1.2 trillion to more than $2 trillion, adding weight to arguments that the private sector is driving inflation by exploiting consumer expectations to keep prices elevated.

Companies have passed higher costs on to customers. But they have also taken advantage of circumstances to expand profit margins. The broadening of inflation beyond commodity prices is more profit margin expansion than wage cost pressures,” he wrote, adding that “resilience in demand has given companies the confidence to raise prices faster than costs.

Here is a good example

Cal-Maine Foods, which controls about 20% of the U.S. egg market, announced last week that its revenue for the quarter ending Feb. 25 rose 109% to $997.5 million, while profit for the same period skyrocketed 718% to $323.2 million.

In a statement, Cal-Maine president and CEO Sherman Miller attributed the company’s soaring profits to “the ongoing epidemic of highly pathogenic avian influenza which has significantly reduced the nation’s egg-laying capacity.”

According to the U.S. Department of Agriculture, “U.S. egg inventories were 29% lower in the final week of December 2022 than at the beginning of the year,” while “more than 43 million egg-laying hens were lost to the disease itself or to depopulation since the outbreak began in February 2022.”

Sanders — who took on agricultural monopolies while campaigning for president in 2016 and 2020 — questioned Cal-Maine’s narrative in a tweet arguing that “we must break up Big Ag and enact a windfall profits tax.”

You all heard of refinery closures that were blamed on COVID.

Top refiner Marathon Petroleum (MPC.N) is forecast to show a $5.70 per share profit, compared to $1.27 a year ago, while Phillips 66 could deliver a $4.46 per share, compared to $2.88 a year ago, according to Refinitiv. Both are scheduled to report on Jan. 31.

"Refiners are tied as the best energy sub-sector in 2022," alongside oilfield services, wrote Jason Gabelman, a research analyst at Cowen, in a recent note.

Happy Days for Refineries. Nice jump in profits there.

The collusion is rampant in many Industries. I believe its orchestrated by the Business Round Table which was formed in 1973

1973 was the same year as Rockefeller Trilateral Commission was formed that would go on to declare a Crisis in Democracy-we had so much of it government was a actually listening to the people. Something had to be done, and they did something about it. Project Democracy. It was also the year of the Oil Shocks ,Roe vs Wade, Deep Throat and Woodwards Watergate meetings and the end of the Vietnam War that left almost 60,000 Americans dead for nothing. In a bad inflation year gas was 40 cents a gallon and my 1969 Chrysler Newport got 7 mpg, and eggs were 45 cents a dozen and the milkman still delivered.

[Man, 1973 was a bad year. Maybe as bad as 1913 , 1929, 1963 and 1992 but not quite as bad as 2001, 2008, and 2020. Each really bad year sets the table for the next bad years.]

Jamie Dimon of JP Morgan (a serial felon) is Chairman of the Business Round Table, as well as being a CFR member. He is Whitney Webbs target over his connection to Jeffrey Epstein who did his banking at JP Morgan until 2013 when he was forced to head over to Deutsche Bank (Trumps bank) after JP Morgan kicked him out

Her first article in the series here

https://unlimitedhangout.com/2023/03/investigative-series/the-rise-of-jamie-dimon/

Anyways, inflation has dropped a bit to ~5% due to lower energy prices, and this will soon be reversed once OPEC+ supply cuts take effect. And remember that 5% is on top of the 8% hike a year earlier. Its like Compound interest.

And annual Payroll Growth has been slowing for the last fourteen months, from 5.3% in February 2022 to 2.7% in March 2023. Exactly as planned.

Remember, one of the reasons for the interest rate hikes was to suppress wage growth. Recessions do a wonderful job at that, and reducing the money supply always cause recessions. Some of the worst recessions and depressions in history were caused when we were on the gold standard when money creation required finding more gold to keep up with the demand of a growing economy.

So what comes next? I wish I had a crystal ball but I don’t. The Fed has put on the brakes in reducing money supply and reversed a bit, at least for now trying to contain a manufactured banking crisis engineered by CFR’s -Jamie Dimon and Bilderbergers-Peter Thiel. The demolition will still continue, brick by brick or maybe a catastrophic demolition like the 3 WTC Towers on 9/11.

I have a hunch attention may be diverted somewhat from the Ukraine War and Conflict over Taiwan to the Middle East. With Bibi back in the saddle there will be blood spilled. Especially since our buddy Saudi Arabia who was our partner in the crime of 9/11 and our patsy (along with OPEC) for high oil prices when we wanted inflation, or low prices when we wanted to hurt the Soviet Union or Russia, has switched Fake Wrestling Teams and is now on the side of the Heel (including Russia , Iran and China).

Does anyone besides me not see that Saudi Arabia switching sides is impossible without our permission? Is there any country Americans would be more likely to support a war against?. Seizing their assets and sanctions on rich Saudis would yield a bounty of wealth (over 1 trillion is my guess) , and we can always open up 9/11 and blame them , something we have not done because they have plenty of evidence of our own complicity. The basic difference is we have dominance over the Information Space. Total control of Western MSM and much if not total control over Social Media. Nobody is going to hear or believe the Saudis story.

The way I see it is Saudi Arabia has agreed to be a patsy. No harm will come beyond nasty words. They will make a ton of money with high Oil Prices, discounted heavily for China but they will do fine. The high oil prices to come will help speed the demolition and bring on the Great Reset.

Real or not, the conflict with Russia and China and now Saudi Arabia is manufactured by the Globalists for the purpose of Economic War against the Western Population (ex ELites) to lower living standards, cull the elderly (forcing them to choose between food and medicine), bring on a CBDC and social credit control that will enable them to achieve Net Carbon Zero.

Enjoy living in the Digital Gulag, herded into 15 minute Smart Cities connected to the Global Brain thanks to ELons Neurolink brain chips that will be injected as part of your annual COVID shot or some other Pandemic Vaccine shot. Think bad thoughts and your programmable CBDC gets suspended.

Saudi Arabia being allowed to turn turtle also has another benefit, which they may or may not have anticipated.

This leaves the US and Israel free to go all out against Iran w/o asking their permission to attack their neighbor. Saudi Arabias biggest fear was Iran turning on them in such a War. Now that Saudi Arabis has made nice with Iran and is no longer so friendly with the US they may feel Iran leaves them alone if they are attacked.

Such a War would not be limited to Iran but also Syria, Lebanon and maybe Iraq if they don’t fully cooperate

Maybe I am wrong, but its something to keep an eye on

Israeli Prime Minister Benjamin Netanyahu is even framing Israeli targeting of military facilities in Iran as a way for Israel to help the Western war effort against Russia (although such measures are unlikely to offset Western concerns about Israel’s hesitancy to provide direct military support to Ukraine). The United States may not assist in Israel’s more audacious strikes within Iran, and it denied having a hand in the Isfahan attack, but in the current climate, Washington is less likely to signal opposition. As the war in Ukraine drags on, taking an assertive deterrence posture toward Iran becomes more appealing to Washington and Western allies seeking to degrade Russian capabilities.

At the same time, U.S. military coordination with Israel is expanding, another sign that Washington is not only accepting Israel’s confrontation with Iran but actively supporting it. Late last month, the U.S. military engaged in a joint exercise with Israel that simulated offensive long-range strikes; it was the largest such exercise the two sides had ever carried out together.

The exercise may have been designed to showcase U.S. capabilities to quickly respond to regional crises even as the United States seeks to reduce its permanent force presence in the Middle East. The display of force was meant to reassure U.S. partners of the United States’ continuing security commitment. But it would also not be difficult to interpret the drill as a deterrent message to Iran, a trial run to demonstrate the continued viability of U.S. military options.

With senior Biden administration officials signaling that the nuclear negotiations are no longer a priority, the timing of the exercise suggests an unmistakable turn to deterrence as the country’s default policy. Military options may not be the desired choice, but they seem to be back on the table

Regional wariness about increased military confrontation with Iran among at least some U.S. partners is unlikely to sway Israel or the United States to reverse course. With the diplomatic track on ice and economic sanctions falling short of changing Iran’s increasingly hard-line and dangerous nuclear and regional postures, the Biden administration appears more inclined to back Israel’s military actions, including direct attacks within Iran on military personnel and facilities.

https://www.foreignaffairs.com/israel/israels-dangerous-shadow-war-iran