Chief Villain Jerome Powell was first appointed Fed chairman by former President Trump in 2017 and his term extended by President Biden. Before that, he was a member of the Federal Reserve Board of Governors, a position he was nominated to by former President Obama . Popular guy.

Whatever you think about Trump this OPERATION was kicked off on his watch. I will only focus on the financial aspects here. For a broader picture read this.

Fed head Jerome Powell and Black Rock black hat Larry Fink know each other well. Even after Powell gave BlackRock the hugely lucrative no-bid “go direct” deal, Powell continued to have the same BlackRock manage an estimated $25 million of Powell’s private securities investments as of 2020

Powell is a former investment banker at the Wall Street firm, Dillon Read; a former partner at the controversial private equity and leveraged buyout firm, the Carlyle Group, which has spent over $1 billion over the past decade lobbying the federal government; and a former lawyer at Davis Polk, a Big Law firm that played a key role advising the government and Treasury in the 2008 Wall Street bailout.

Boy oh boy, is he associated with the scum of the earth. Ask Catherine Austin Fitts about Dillon Read

https://www.dunwalke.com/resources/documents/Article-pdf-txt/Dillon_Read_as_07182006.pdf

In 2019 Larry Fink joined the Board of the Davos World Economic Forum, the Swiss-based organization that for some 40 years has advanced economic globalization.

Fink, who is close to the WEF’s technocrat head, Klaus Schwab, of Great Reset notoriety, now stands positioned to use the huge weight of BlackRock to create what is potentially, if it doesn’t collapse before, the world’s largest Ponzi scam, ESG corporate investing.

Fink with $9 trillion to leverage is pushing the greatest shift of capital in history into a scam known as ESG Investing.

BlackRock since 2018 has been in the forefront to create a new investment infrastructure that picks “winners” or “losers” for investment according to how serious that company is about ESG—Environment, Social values and Governance.

For example a company gets positive ratings for the seriousness of its hiring gender diverse management and employees, or takes measures to eliminate their carbon “footprint” by making their energy sources green or sustainable to use the UN term.

How corporations contribute to a global sustainable governance is the most vague of the ESG, and could include anything from corporate donations to Black Lives Matter to supporting UN agencies such as WHO. Recently they added weapon manufacturers to ESG investments since they kill Russians. Totally arbitrary

2019- CEO’s head for the Exits.

In 2019, a record number of 1640 CEOs resigned from major corporations. For January 2020 alone, the number was 219, indicating that CEO departures could reach an even higher number this year.

Prominent CEOs to leave or announce their departures in 2020 include the CEOs of Match Group, L Brands, Outdoor Voices, MasterCard, Fastly, Harley Davidson, IBM, T-mobile, LinkedIn, and Disney, among many others.

Why are so many CEOs resigning and why has the number been increasing recently?

The reasons seem to vary. Some analysts talk about a management restructuring, some say it’s because of a failure to meet the company’s goals, others definitely have stepped down because of sexual harassment scandals or because of a failure to address sexual misconduct within their companies. But it cannot be necessarily a coincidence that CEOs are departing at an increasing rate.

https://therealnews.com/why-boom-ceo-resignations-management

2019, August BlackRock’s strategic importance and political weight were evident when four BlackRock executives, led by former Swiss National Bank head Philipp Hildebrand, presented a proposal at the annual meeting of central bankers in Jackson Hole, Wyoming, for an economic reset that was actually put into effect in March 2020 after what appears to be a simulation or false flag in the Repo Market in September

Acknowledging that central bankers were running out of ammunition for controlling the money supply and the economy, the BlackRock group argued that it was time for the central bank to abandon its long-vaunted independence and join monetary policy (the usual province of the central bank) with fiscal policy (the usual province of the legislature).

An unprecedented response is needed when monetary policy is exhausted and fiscal policy alone is not enough. That response will likely involve “going direct”: Going direct means the central bank finding ways to get central bank money directly in the hands of public and private sector spenders. Going direct, which can be organised in a variety of different ways, works by: 1) bypassing the interest rate channel when this traditional central bank toolkit is exhausted, and; 2) enforcing policy coordination so that the fiscal expansion does not lead to an offsetting increase in interest rates.

An extreme form of “going direct” would be an explicit and permanent monetary financing of a fiscal expansion, or so-called helicopter money. Explicit monetary financing in sufficient size will push up inflation. Without explicit boundaries, however, it would undermine institutional credibility and could lead to uncontrolled fiscal spending.

A practical way of “going direct” would need to deliver the following: 1) defining the unusual circumstances that would call for such unusual coordination; 2) in those circumstances, an explicit inflation objective that fiscal and monetary authorities are jointly held accountable for achieving; 3) a mechanism that enables nimble deployment of productive fiscal policy, and; 4) a clear exit strategy. Such a mechanism could take the form of a standing emergency fiscal facility. It would be a permanent set-up but would be only activated when monetary policy is tapped out and inflation is expected to systematically undershoot its target over the policy horizon.

https://www.blackrock.com/us/individual/insights/how-central-banks-might-deal-with-the-next-downturn

On September 17, 2019 the free market suddenly wanted to price repo loans at 10 percent thanks to JP Morgan .JP Morgan took liquidity (130 billion) out of the system to fund share buybacks and dividends.

That’s when the New York Fed jumped in with both feet with a pile of money priced at fictitious interest rates.

Hedge funds were the ones in dire need of liquidity, not commercial banks. The hedge funds had opened record levels of over-leveraged positions; they need the extra liquidity or they won’t be able to cover positions with excessive leverage

The Fed implemented BlackRocks “Going Direct” plan (good timing Larry) and began funneling a cumulative total of $6.6 trillion to some of the 24 trading houses on Wall Street that are known as its “primary dealers.” The giant sum has been sluiced to Wall Street in the form of repurchase agreement (repo) loans without any details being provided to the elected representatives in Congress as to which firms are getting the money or what it’s being ultimately used for. The stock market set new highs since the program launched leading some veteran market watchers to believe the Fed is fueling a Ponzi-like rally in stocks.

So JP Morgan forced the central bank to fund hedge funds and keep their over-leveraged positions open. As long as these hedge funds have access to liquidity, the extended bull market will likely continue. In other words, the Fed (through hedge funds) helped drive up the price of JP Morgan shares.

A trading unit of JPMorgan Chase borrowed $6.19 trillionfrom the Fed’s repo loan program from September 17, 2019 through March 31, 2020. (Those are cumulative, term-adjusted figures.) A significant chunk of that money was borrowed at interest rates as low as 0.10 percent. The loans were collateralized with mostly treasury securities and agency mortgage-backed securities (MBS).

https://wallstreetonparade.com/2022/04/while-jpmorgan-chase-was-getting-trillions-of-dollars-in-loans-at-almost-zero-percent-interest-from-the-fed-it-was-charging-americans-hit-by-the-pandemic-17-percent-on-their-credit-cards/

Black Rock owns 6% of JP Morgan

You cant make this stuff up

The Feds balance sheet had stood at $3.76 trillion in September and inflated to $4.16 trillion in February 2020. So much for Quantitative Tightening. That was over with. They had much bigger plans though. That was just an Exercise to get ready for the Big Game

The same month as the Repo Market Crisis (Exercise ) the White House Council of Economic Advisors (CEA) finds that in a pandemic year, depending on the transmission efficiency and virulence of the particular pandemic virus, the economic damage would range from $413 billion to $3.79 trillion. Fatalities in the most serious scenario would exceed half a million people in the United States

https://edition.cnn.com/videos/business/2020/07/17/economist-cea-report-pandemic-warning-tomas-philipson.cnnbusiness

Never fear, Black Rocks Larry Fink and his pal Jerome Powell will be ready. Just give the word boss (Donald Trump, CEO of US Inc, which will soon to be added to the list of his many bankruptcies)

In January 2020 before Davos meeting and as COVID news was breaking out in China BlackRock founder and CEO Larry Fink published a newsletter jumping aboard the sustainable climate investing train big time.

He wrote in a closely read letter that guides numerous corporations seeking investment from some of BlackRock’s $7 trillions, “Climate change has become a defining factor in companies’ long-term prospects.”

Citing recent climate protests, Fink states, “awareness is rapidly changing, and I believe we are on the edge of a fundamental reshaping of finance. The evidence on climate risk is compelling investors to reassess core assumptions about modern finance.”

Declaring that, “climate risk is investment risk,” Fink then asks an impossibly difficult question of how climate risks will impact entire economies. He has the answer, we learn. Referring to what he calls “a profound reassessment of risk and asset values” Fink tells us, “because capital markets pull future risk forward, we will see changes in capital allocation more quickly than we see changes to the climate itself.

In the near future – and sooner than most anticipate – there will be a significant reallocation of capital.”

http://www.williamengdahl.com/englishNEO27Jan2020.php

Thats a pretty good prediction Larry. It all went right to the top starting in March.

A week later President Donald Trump would attend the WEF Davos meeting for the 2nd time in his Presidency , the first President to attend more than one time and the only President other than Clinton to attend. Maybe him and Klaus bond over their common German heritage

2020-January

Two years after his administration passed a massive tax cut for corporations meant to spur economic growth, the verdict is in, and the results are embarrassing.

The plan did not — by any stretch of the imagination — "pay for itself with growth and reduced deductions," as Treasury Secretary Steve Mnuchin said it would back in 2017. In fact, the US budget deficit has grown by 50% since Trump took office.

Corporations paid [ $91] billion less in taxes in 2018 than the year before.

Trump and his allies claimed that with this tax windfall corporates would unleash a tide of investment into the economy, but that never materialized. There was a record-setting $1 trillion in stock buybacks in 2018. Growth in business investment was lackluster in 2019,

Center for Public Integrityfound that the number of companies that paid zero in tax about doubled from 2017 to 2018.

https://www.businessinsider.com/trump-gop-tax-cuts-economic-gdp-business-investment-failure-2020-1?op=1

Under the tax law, income generated by American companies abroad face tax rates that are half the new top corporate rate of 21 percent. Some companies may be able to avoid tax altogether on tangible investments made offshore. This further incentivizes companies to move tangible assets, such as factories and machinery, overseas.

In 2018 the richest 400 families in the US paid an average effective tax rate of 23% while the bottom half of American households paid a rate of 24.2%, University of California at Berkeley economists Emmanuel Saez and Gabriel Zucman calculate in their new book, The Triumph of Injustice.

As of October 13, 2020, the combined fortunes of the nation’s 644 billionaires totaled a jaw-dropping $3.88 trillion — up 40.7 percent since 2017, the year before the tax cuts went into effect.

https://www.forbes.com/sites/camilomaldonado/2019/10/10/trump-tax-cuts-helped-billionaires-pay-less-taxes-than-the-working-class-in-2018/?sh=f50f0dc3128f

Four days after a Pandemic is declared on March 15, 2020, the Federal Reserve Board reduced reserve requirement ratios for transaction accounts to zero percent effective March 26, 2020. This action eliminated reserve requirements for all depository institutions.

A Fiat currency with no reserve requirement is a ticking bomb. Well done.

https://www.federalreserve.gov/monetarypolicy/reservereq.htm

March 17, 2020 Fed chairman Jerome Powell named BlackRock to manage

the Feds commercial mortgage-backed securities program and its $750 billion primary and secondary purchases of corporate bonds and ETFs in no-bid contracts.

The asset manager seems to have been selected beforehand as there was no process for other companies to bid for the role, the WSJ reported.

BlackRock is not subject to the regulatory scrutiny of even smaller systemically important financial institutions.”

BlackRock-run program will get $75 billion of the $454 billion in taxpayers’ money to eat the losses on its corporate bond purchases, which will include its own ETFs, which the Fed is allowing it to buy…”

Many of the programs it introduced qualify as classic lender-of-last-resort efforts. Listed below

Commercial Paper Funding Facility

Money Market Mutual Fund Liquidity Facility

[ both ensure healthy borrowers aren’t suddenly starved of cash]

Primary Dealer Credit Facility.

Term Asset-Backed Securities Loan Facility

Main Street lending program, which will buy up to $600 billion in loans from banks. Lenders will retain a 5% share of the debt, selling the remaining 95% to the Fed.

$349 billion Congress designated for Small Business Administration lending, which operate through banks around the country. By serving as a backstop buyer of these assets -- through the Paycheck Protection Program Liquidity Facility -- the Fed helps free up banks’ capacity to make more of these loans to small businesses.

The Fed’s Municipal Liquidity Facility will buy up to $500 billion in short-term notes issued by large cities and counties and states.

Primary Market Corporate Credit Facility, will buy debt or loans directly from corporations. .

Secondary Market Corporate Credit Facility -- will buy corporate debt in secondary markets, including exchange-traded funds that specialize in high-risk, high-yield debt.

On April 24, 2020, the Federal Reserve Board announced that Regulation D would no longer impose limits on the number of transactions or withdrawals permitted on savings deposit accounts. According to this ruling, if a bank suspends enforcement of the six-transfer limit on a savings deposit, the bank may report that account as a “transaction account” on its FR 2900 reports. However, the bank may instead, if it chooses, continue to report the account as a “savings deposit”

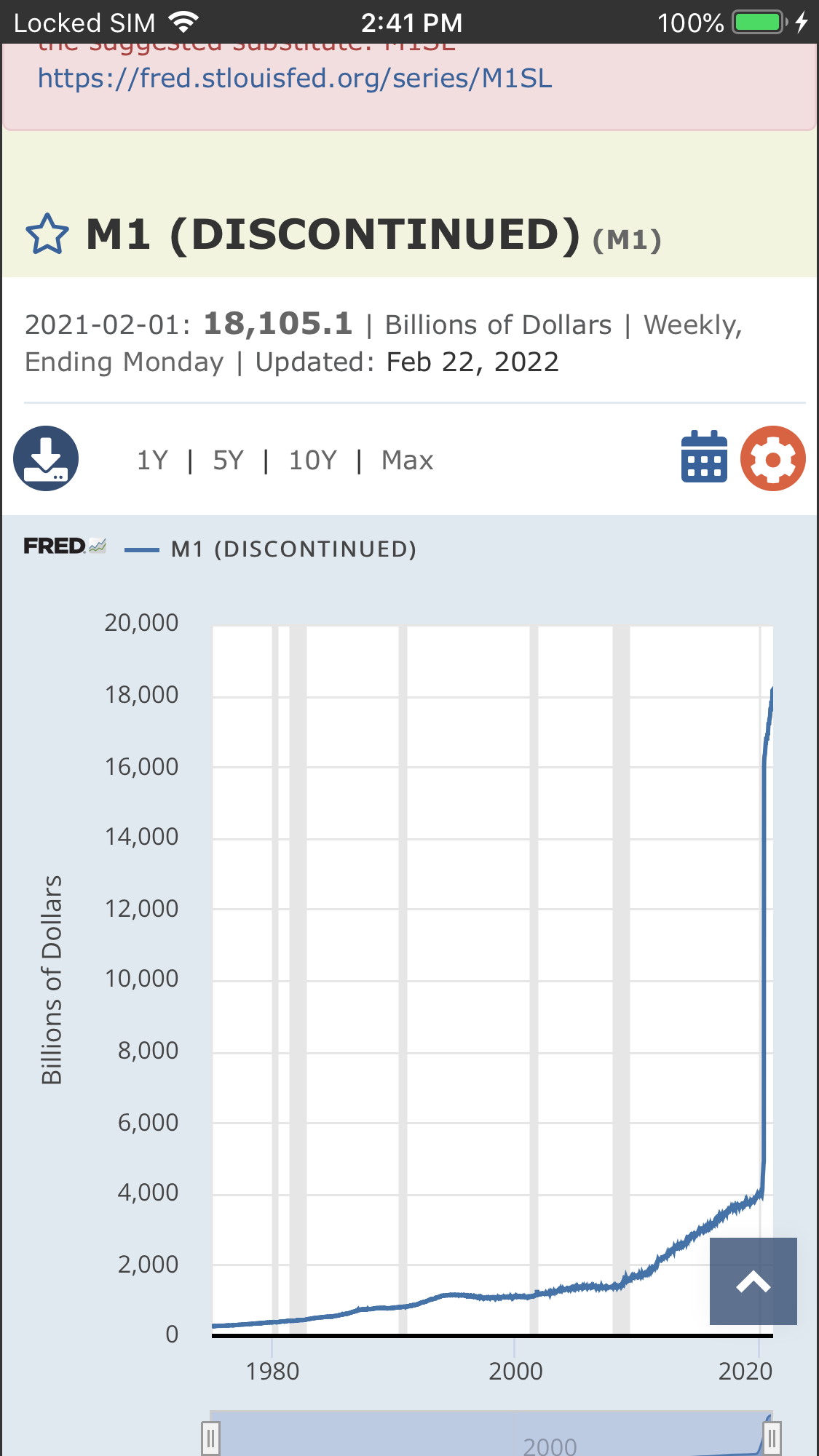

This allows much of the savings deposit money to move to M1 money supply effectively corrupting the M1 data and rendering it almost indistinguishable from M2.

M1 was considered a more accurate predictor of inflation and transactions and its sudden inflation due to this change lead some analysts to blame inflation on the increase in M1 supply.

M1 measures money that’s readily available – mostly paper cash, coins, and checking accounts. It used to exclude savings accounts due to transaction limits

Another measure called M2 is a little broader. It included money in savings accounts and retail money market accounts.

The difference between a checking and savings account is how often you can access your money.

If you put money in a checking account, regulators made banks set aside a cushion as reserves in case they get into trouble. But if you put money into a savings account, regulators tell banks they don’t have to reserve anything. The catch is that it’s only considered a savings account if the consumer is allowed to make no more than six withdrawals per month.

It’s worked that way for years.

But then Covid hit, and regulators realized that having trillions of dollars in savings accounts with limited withdrawals was a burden as 22 million people lost their jobs.

So last April the Fed changed the rules and eliminated the six-withdrawal limit on savings accounts. It wrote:

The interim final rule allows depository institutions immediately to suspend enforcement of the six transfer limit and to allow their customers to make an unlimited number of convenient transfers and withdrawals from their savings deposits at a time when financial events associated with the coronavirus pandemic have made such access more urgent.

It was an obvious and nearly risk-free way to help people. Just let them have easier access to their savings.

But it changed the relationship between M1 and M2.

Savings accounts were measured in M2 and left out of M1. But once the six-withdrawal rule was removed, every savings account suddenly became, in the eyes of regulators and people who make these charts, a transaction account like a checking account.

Another thing making the transition of savings accounts to M1 like checking accounts was the elimination of reserve requirements for transaction accounts in March. By making savings accounts transaction accounts banks would not be required to add reserves

So M1 exploded higher. Not because the Fed printed a bunch of money, but because trillions of dollars in savings accounts were reclassified as checking accounts.

How much money are we talking about? The Fed explained in a footnote:

Recognizing savings deposits as a transaction account as of May 2020 will cause a series break in the M1 monetary aggregate. Beginning with the May 2020 observation, M1 will increase by the size of the industry total of savings deposits, which amounted to approximately $11.2 trillion.

Of the $14 trillion increase in M1, $11.2 trillion (80%) came from an accounting rule change that shifted money from savings accounts to checking accounts.

https://www.collaborativefund.com/blog/the-fed-isnt-printing-as-much-money-as-you-think/

At the end of 2021 here is what was spent

with the percentage of what was allocated that was spent.

Economic Impact Payments

$813 (94%)

Paycheck Protection Program

$803 (99%)

Federal Pandemic Unemployment Compensation

$441 (100%)

Coronavirus State and Local Fiscal Recovery Fund

$249 (69%)

Economic Injury Disaster Loans

$309 (100%)

Elementary and Secondary School Emergency Relief Fund

$187 (98%)

Provider Relief Fund

$158 (89%)

Pandemic Unemployment Assistance

$130 (89%)

Coronavirus Relief Fund

$150 (100%)

HHS COVID-19 Appropriations

$150 (100%)

Pandemic Emergency Unemployment Compensation

$84 (100%)

Medicare Accelerated and Advance Payments

$100 (100%)

FEMA Disaster Relief Fund

$84 (92%)

Higher Education Emergency Relief Fund

$75 (99%)

Infrastructure Grants

$70 (100%)

Economic Injury Disaster Loan Advances

$27 (48%)

Rental Assistance

$37 (80%)

Restaurant Revitalization Fund

$29 (100%)

Shuttered Venue Operators Grant

$14 (83%)

Other Emergency Unemployment Funding

$14 (100%)

Governor's Emergency Education Relief Fund

$11 (38%)

Homeowner Assistance Fund

$1 (7%)

Total

$3,934 (94%) billion (3.93 trillion)

School Districts have gotten hundreds of millions each for going along with CDC guidelines

CMS allows hospitals to bill a patients expenses at 20% premium to standard Medicare prices if they test positive (even if not treated for COVID), and an additional 20% if they use Remdesivir to treat patients. Hospitals with the most cases and deaths received the most Federal Dollars

Hospitals were allocated $100 billion from the CARES Act and another $75 billion from the Paycheck Protection Program and Healthcare Enhancement Act. They received $50 billion in a general allocation and another $60 billion has been given out in targeted allocations for hot spot hospitals, tribal, rural, skilled nursing, safety net hospitals, sole Medicaid providers and to reimburse claims for COVID-19 treatment for uninsured patients.

Hospitals and Pharmacies were told they wont have liability protection if they use or prescribe drugs that are not listed as CounterMeasures defined by PREP Act (FDA EUA or FDA Approved for use)

Inflation

For more information on inflation read this

Consumer prices soared in October 2021 They were up 6.2% from a year earlier – higher than most economists’ estimates and the fastest increase in more than three decades

The Federal Reserve, which would be responsible for fighting inflation if it stays too high for too long, insisted again on Nov. 3, 2021, that it’ll be temporary, in large part because it’s tied to the supply chain mess bedeviling economies, companies and consumers

At the same time, supply chains remain a mess – and were getting worse

Bottlenecks have piled up all across Asia, putting great strains on the capacity of supply chains to deliver in a timely fashion.

And severe global shortages of drivers and other workers made it difficult to expand capacity or fix other problems plaguing the supply chains.

This creates a shortage of products getting through that limit competition, causing price increases. Yet nothing was done

Supply-chain chaos has caused shortages of a wide variety of items across the country, leading to prices of some goods to go up to match the increased demand. Hard-to-find at-home COVID-19 tests are a good example of this. When demand surges due to shortages, prices go up to match what consumers are willing to pay. But some corporations across the economy are taking advantage of the broader supply-chain crisis to raise prices significantly — even where no bottleneck or shortage seems to exist. Some companies, like Procter & Gamble, even brag about it openly to their shareholders.

Basic economics tells us that market power allows firms to raise prices. When there is a small number of companies producing a product, it's easier for them to move in lockstep to raise prices without losing many customers to one another or to other products. Two companies can do this more easily than four companies, and four can do it more easily than eight. A temporary bottleneck or shortage can give consolidated firms the ability to raise prices significantly more than when the market had more active participants.

The beef industry is one of the more egregious offenders. A White House briefing report from September shows that half of the spike in grocery bills in the last year came from higher meat prices — beef prices alone have risen by 14% since the pandemic started. But is this increase due to higher prices paid to farmers? The data shows that wholesale prices have risen even as prices paid for cattle have at best stagnated. So the increase isn't caused by farmers charging processors more for cattle.

Another possibility is that prices increased not because meat-packers had to pay farmers more, but because the cost of processing meat increased due to COVID shutdowns and workers getting sick. But that doesn't track either: Profits for meat processors hit record highs last year. One of the largest meat-processing companies, Cargill, saw a net income increase of 64% in 2021— the most profitable year in its history. Profit margins for beef-packing companies also hit record highs during COVID.

https://www.businessinsider.com/inflation-monopolies-mega-corporations-inflating-high-prices-antitrust-2022-2?op=1

Corporate profits are way up, inflation and supply shortages not bothering them a bit. Pricing is outpacing wage growth and outside of high intensive capital industries wages are the biggest obstacle to profits. You would think in a competitive market labour shortages would lead to increased wages. But no, collusion between corporations in the same industry does not just involve pricing it involves wages as well.

2021

PAY GAP

Employee compensation, including health care and pensions, is 54.9% of GDP, close to the long-run average. But wages and salaries, at 45.1% of GDP, are still below the historical norm.

TAX CUT

Corporate income tax payments added up to 1.7% of GDP in the third quarter—up from pandemic lows, but well below the 5% average of the 1950s and 4% of the ’60s.

CLOSE, BUT

At 12.7% of GDP, pretax corporate profits are just a little short of the all‑time record of 13.1% set in 1950.

https://www.bloomberg.com/news/articles/2021-12-06/stock-market-u-s-corporations-hit-record-profits-in-2021-q3-despite-covid

As working-class Americans struggled with high inflation, corporate profits soared to a record high in 2021, reaching nearly $3 trillion.

Data from the Department of Commerce’s Bureau of Economic Analysis shows that pre-tax profits over the whole year increased by a whopping 25 percent, reaching $2.8 trillion. The annualized rate of profit from the fourth quarter was even higher, at $2.94 trillion.

The boost in profits exceeds the 7 percent inflation for consumer prices, bolstering arguments that companies are raising prices beyond inflation rates in order to pad their profits.

Meanwhile, hourly wages for U.S. workers increased by about 4.7 percent last year, which is equivalent to a pay cut of about 2.4 percent.

https://truthout.org/articles/corporate-profits-reached-record-high-of-nearly-3-trillion-in-2021/

The White House report says it best: "While factors like consumer demand and input costs are affecting the market, it is the lack of competition that enables meat processors to hike prices for meat while increasing their own profitability." Forty-five years ago, the four largest beef-packing companies controlled a quarter of the market — today they control more than 80%.

In the meantime, as Jeffrey Meli, the global head of research at Barclays, told Bloomberg, inflation due to monopolistic power over the market "will grow over time as companies with market power feel increasingly comfortable raising prices."

It comes as little surprise that overall US corporate profitsincreased to $1.7 trillion during 2021. Operating margins for the companies that make up the S&P 500 remained at near-record highs through most of 2021, and corporate profit margins explodedduring the Omicron surge.

Price increases of 100%, 200%, and even more due to collusion have been thoroughly documented. The best modern scholarship demonstrates that US cartels — groups that aim to reduce competition and keep prices high — raise prices an average of 49%, but even very conservative scholars believe that antitrust enforcers catch only 20% to 30% of illegal cartels in the US.

The reality is that collusion affects much of our economy today, raising prices for consumers by many billions of dollars each year, and the offenders rarely get caught.

Astonishingly enough, price fixing is usually profitable even if the colluding firms are caught. An analysis in the "Iowa Law Review" of 71 US price-fixing cartels showed that only 14 were caught and forced to compensate their victims fully. In other words, 57 illegal cartels walked away having made money after they were successfully taken to court. In fact, the median payout was only 37% of the overcharges — and that doesn't even consider how many cartels are never caught.

https://www.businessinsider.com/inflation-monopolies-mega-corporations-inflating-high-prices-antitrust-2022-2?op=1

On February 17, 2022, the Department of Justice (DOJ) announced that it would be cracking down on those taking advantage of the ongoing supply chain crisis by colluding to raise prices.

[Don’t hold your breath, this is all theater to make it look like they are on your side ]

https://www.winston.com/en/competition-corner/doj-cracks-down-on-inflation-related-collusion.html?utm_source=Mondaq&utm_medium=syndication&utm_campaign=LinkedIn-integration

In conclusion, high corporate concentration, and the anticompetitive conduct it facilitates, does contribute to inflation. And there is no doubt that inflation is high right now. In March , inflation jumped to 7.9%. In some industries, prices have surged even higher. But these increases cannot be fully explained by "normal"increases in the costof raw material, production, labor, transportation, or by increased demand.

In the US, many industries are controlled by just a few massive companies, and when only a few companies control a single industry, they have the power to push up prices arbitrarily because consumers have few other options for these goods.

And while greed may serve as a good enough explanation for some, it should be clear their is a larger agenda at play. The added profits, lower taxes and easy money for corporate bonds give corporations an incentive to partner with government and go along with WEF nonsense like COVID measures, Wokeness, and Net Zero Carbon using ESG accounting to provide corporate social credit scores to see who is worth of BlackRock Larry’s investments

Where is the money and the coming Age of Sustainable Austerity

The Feds balance sheet stood at $4.16 trillion in February 2020 and would inflate to $7.36 trillion by the end of the year. Today its at $9 trillion and expected to drop. That whooshing sound you will soon hear is cash flowing out of Main Street causing a Depression while doing nothing to stop inflation

The M2 money supply inflated from 15 trillion in Sep 2019 to 15.45 trillion in February 2020, 19.1 trillion by end of December 2020 and $21.8 trillion in March 2022, a net increase of $5.3 trillion since COVID began.

Note that the money supply increased more under Trump from September, 2019 to December 2020 than under Biden, although Bidens sanctions on Russia might prove to be more damaging in terms of inflation going forward

https://fred.stlouisfed.org/series/M2SL

Interestingly enough, global billionaires wealth increased $ 5 trillion during this period🤔

Actually, looking at only US billionaires the number is lower but keep in mind this money creation spreads globally and not locked within US bordetd

On March 18, 2020, at the beginning of the formal lockdown, U.S. billionaires held a combined $2.947 trillion. On May 4, 2022, as the U.S. crossed the 1 million death mark, according to an analysis by NBC, 727 U.S. billionaires were worth $1.71 trillion more, according to Forbes.

Elon Musk, who had wealth valued just under $25 billion on March 18, 2020, has seen his wealth increase to $255 billion as of May 4, 2022.

Between March 18, 2020 and May 4, 2022, the following increases in wealth have occurred:

Jeff Bezos saw his wealth rise from $113 billion to $150 billion.

Bill Gates experienced a wealth increase from $98 billion to $129.8 billion.

Three members of the Walton family — Jim, Alicem and Rob — have seen their combined assets rise from $163.1 billion to $207.7 billion.

https://inequality.org/great-divide/updates-billionaire-pandemic/

It looks like most of that money created is in the hands of the global elite. The elite don’t contribute much to inflation in the price of hamburgers and bleach.

More evidence of the redistribution of wealth. Higher tax revenues in the wake of a Pandemic and Recession

Despite a pandemic, a recession and a slew of tax cuts, federal tax receipts are booming.

Revenues jumped 18 percent in the fiscal year that just ended, analysts say — the biggest one-year increase since 1977.

That translates into $627 billion more than in [fiscal year ] 2020 [October 1 2019-September 30, 2020] according to the nonpartisan Congressional Budget Office, which estimates that, for the first time, total government revenues topped $4 trillion.

.....the increase is being driven by levies primarily paid by the well-to-do. For example, corporate tax receipts leapt 75 percent, CBO says. At $370 billion, they easily top where they were immediately before Republicans slashed the corporate rate as part of the Tax Cuts and Jobs Act.

[this is due to massive increases in Corporate Profits due to predatory pricing]

It is highly unusual, though, for the government to see a big wave of revenue in the wake of an economic downturn. Typically, receipts crash following recessions because, as people’s incomes fall, they owe less to the Treasury.

The coronavirus downturn was much more bifurcated, however, with higher-income people, who pay most federal taxes, doing far better than low earners.

“Usually revenues get hit hard in the year after a recession,” said Booth. “This time it is the opposite.”

Payments by big companies had plunged in the wake of Republicans’ 2017 tax cuts, falling by almost a third to $205 billion the following year.

CBO repeatedly revised upward its estimates, and still came in too low. At $370 billion, the corporate tax haul would be the biggest, at least in nominal terms, since 2007.

Another big increase — 33 percent — came with “non-withheld” receipts, which include a variety of taxes that are not subject to withholding by employers.

CBO did not provide a breakdown of those levies. But big changes there are usually driven by capital gains realizations and payments by unincorporated businesses.

[inflated stock prices thanks to the Fed and BlackRock lead to higher capital gains]

And the agency previously upped its estimates of capital gains taxes over the past year.

Individual income taxes were up 27.5 percent, CBO estimates. Those too are disproportionately paid by the well-to-do, with 80 percent of the increase coming from the top 10 percent of earners.

The overall revenue increase wasn’t only an anomaly compared to 2020, when receipts fell by just 1.2 percent to $3.420 trillion. Revenues in 2021 still rose 17 percent even when compared to 2019 levels, before the pandemic hit.

https://www.politico.com/news/2021/10/12/tax-revenue-surge-pandemic-515792

Roughly 3.5 million fewer people are employed now compared to February 2020. Inflation is outpacing wage growth and savings interest. Mortgage rates are moving toward 6% . Much of Main Street is starved of cash or will soon be, so a continuation of the engineered supply disruptions/shortages, collusion by WEF/Business Round Table members, terror attacks of food processing and distribution centers, paying farmers not to grow food, and inflation expectation generated by MSM psyops is responsible .

Thats part of the WEF agenda to reduce consumption and move to Net Zero Carbon. Sustainable is Code for Austerity and Lower Living Standards

Words from the past:

1992 Maurice Strong stated after the Rio Earth Summit :

“ Current lifestyles and consumption patterns of the affluent middle class involving high meat intake, use of fossil fuels, appliances, air-conditioning, and suburban housing are not sustainable”

Whats to come?

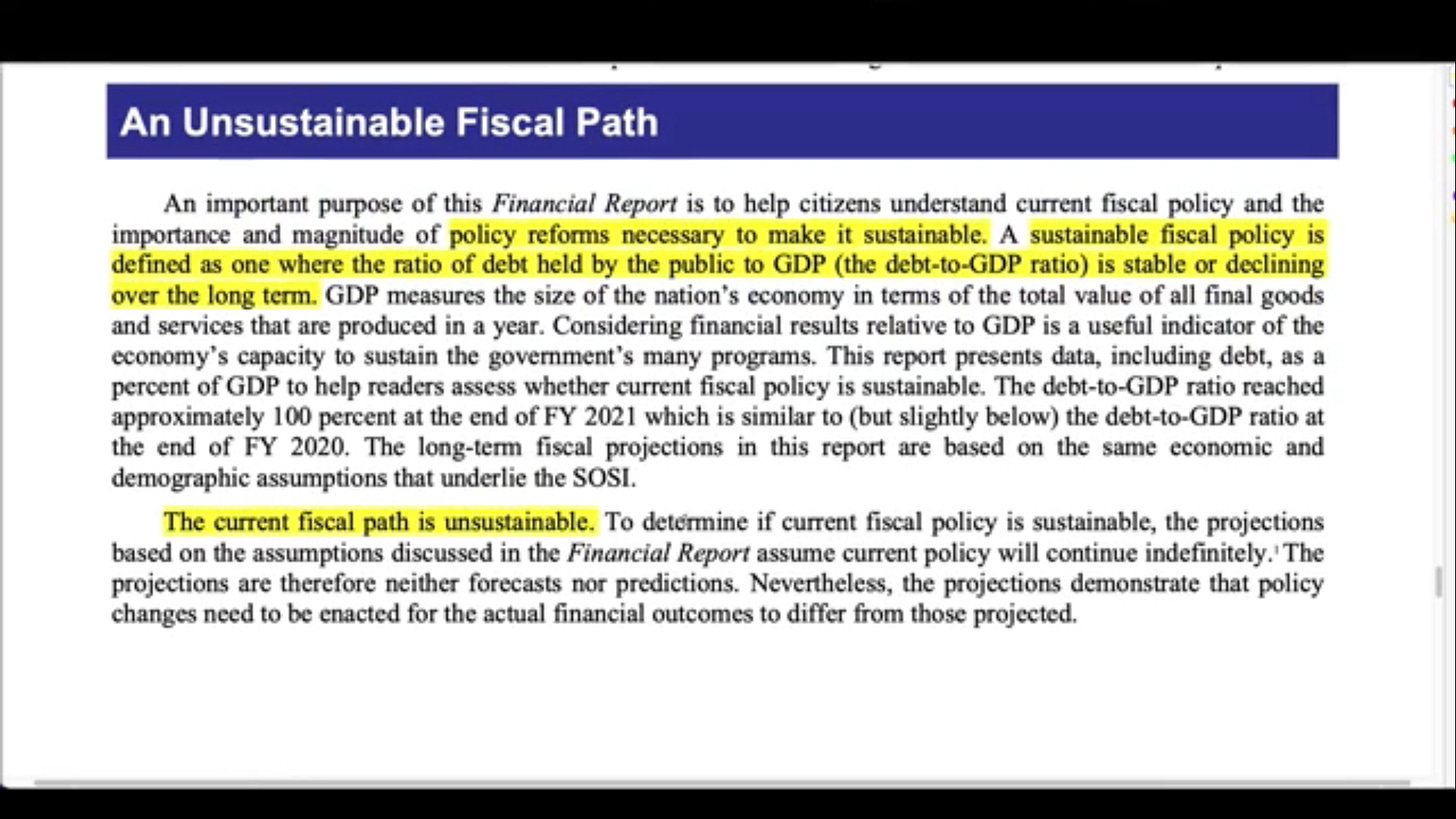

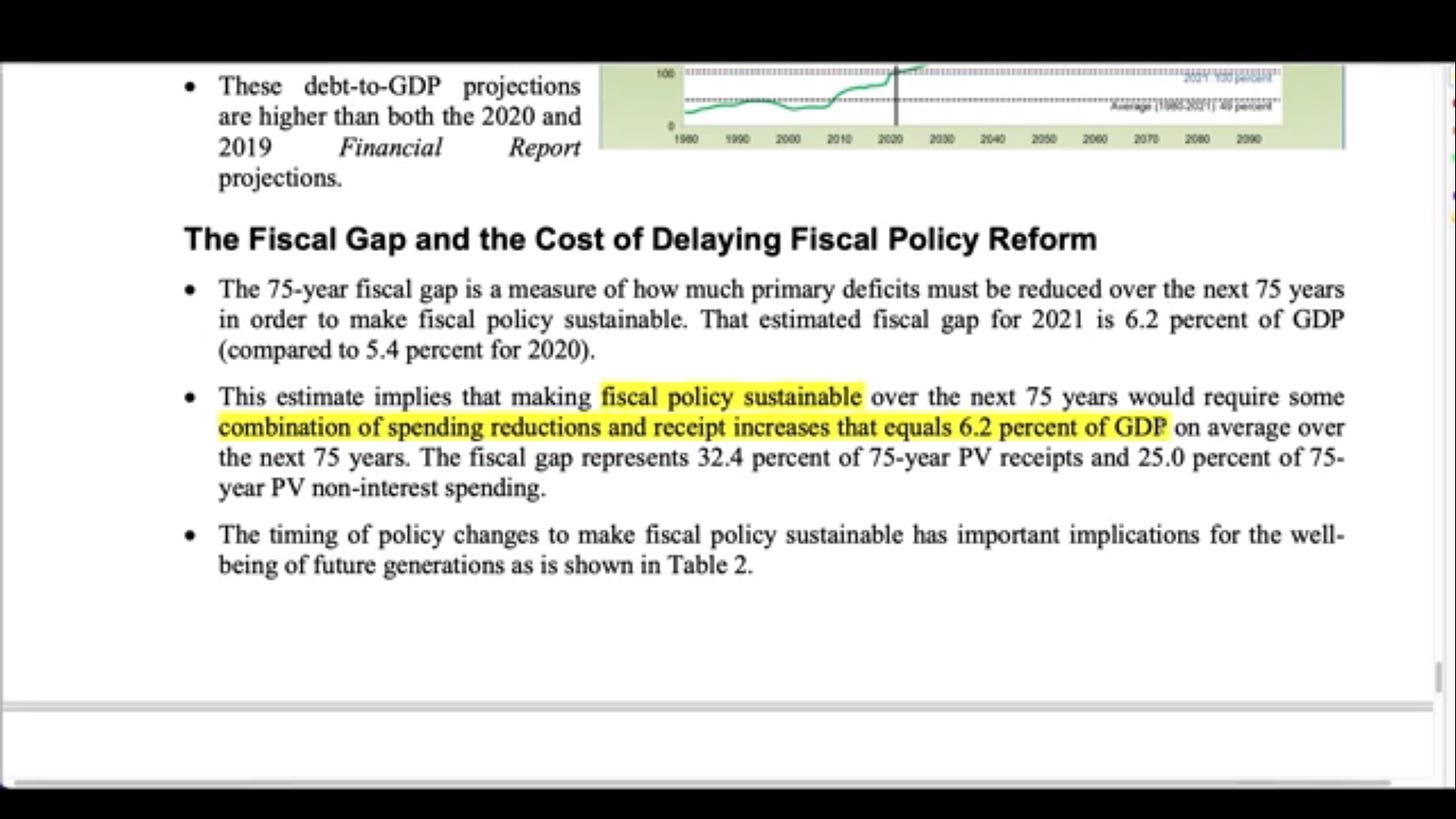

So lets look at Janet Yellens annual report at the US Treasury on January 2022

And whats her solution? More taxes and cuts in social benefits. Sounds like IMF Austerity measures we force on 3rd World Nations

Now heres Fed Chairman Powell

Powell acknowledged the debt -- currently $22.96 trillion -- "is growing meaningfully faster than the economy and that's by definition unsustainable over time."

https://www.barrons.com/amp/news/current-us-debt-level-very-sustainable-fed-s-powell-01618428316

Interesting times ahead.

Uncle Klaus says “You will own nothing , but you will be happy.”

A prediction the past

1961-In a lecture to the California Medical School, in San Francisco, Aldous Huxley explained:

There will be, in the next generation or so, a pharmacological method of making people love their servitude, and producing dictatorship without tears, so to speak, producing a kind of painless concentration camp for entire societies, so that people will in fact have their liberties taken away from them, but will rather enjoy it, because they will be distracted from any desire to rebel by propaganda or brainwashing, or brainwashing enhanced by pharmacological methods. And this seems to be the final revolution.

So thats it. This is the Final Revolution (aka Fourth Industrial Revolution, Great Reset). Most don’t even see it happening or prefer to ignore it, and many will welcome it, but the losers wont get another chance at Freedom.

This will be the End of History.