I should probably make this a standalone, but nah.

When I read the words sustainable or sustainability I hear the words “Stick them Up. This is a robbery.”

For years if not decades the Fed has been telling us the debt is not a problem. I have tended to agree with this for the following reasons

Our debt is in our own currency which we can print without limit

Our debt is held by mostly Americans and intra-governmental agencies and the Federal Reserve

The Federal Reserve returns to the US Treasury (less expenses/dividends) the interest on the Treasuries they hold

Interest rates are low

To put things in perspective the interest on the public debt for fiscal year 2021 is $413 billion -most of it paid to US entities

Fed sent $107.4 billion back to Treasury in 2021 (I don’t know if the 413 billion in interest paid deducted what was sent back or not, if not all the better but assume its $413 billion after deducting $107.4 billion)

https://www.reuters.com/world/us/fed-sent-1074-billion-treasury-2021-2022-01-14/

Government Collected 4 trillion in revenue.

GDP was 22 trillion.

So it doesn’t seem to be a huge problem now. Unfortunately they seem to want to demolish the economy by raising interest rates which do nothing to combat inflation caused by high energy prices and food prices caused by supply side disruptions not to mention collusion by WEF /Round Table affiliated companies on board with the Sustainable Great Reset Agenda

What higher interest rates on top of high inflation will do is devastate the working and retired classes and no doubt cause the massive derivative and housing market bubbles to implode.

That will of course create a perfect storm to do a Great Reset and push through the CBDC which will give us programmable money and all the Fed to stop transactions of any individual (sanctions are coming to the homeland and will target those who violate the new Ministry of Truths edicts as well as those with low Social Credit Scores)

So where did this idea the Debt is not on a Sustainable Path come from? I’ll get to that but keep in mind Sustainable is a major component of the Climate Change Scam and the UN 17Sustainable Goals for which we need a Great Reset to fulfill Agenda 2030

In August 2019 Black Rock met with Central Banks around the world at Jackson Hole Wyoming to tell them

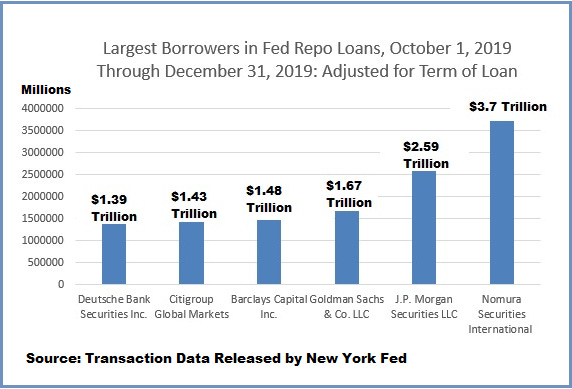

Their solution was to Go Direct with the Fed putting money into the banking system quickly and at low cost to cover overnight loans. These were the recipients over the next 3 months (of course the loans get paid back with new loans). The Fed’s repo loans stretched from September 17, 2019 through July 2, 2020

The same month as the Repo Market Crisis (Exercise ) the White House Council of Economic Advisors (CEA) finds that in a pandemic year, depending on the transmission efficiency and virulence of the particular pandemic virus, the economic damage would range from $413 billion to $3.79 trillion. Fatalities in the most serious scenario would exceed half a million people in the United States

https://edition.cnn.com/videos/business/2020/07/17/economist-cea-report-pandemic-warning-tomas-philipson.cnnbusiness

In January 2020 before Davos meeting and as COVID news was breaking out China

BlackRock founder and CEO Larry Fink published a newsletter jumping aboard the sustainable climate investing train big time.

He wrote in a closely read letter that guides numerous corporations seeking investment from some of BlackRock’s $7 trillions, “Climate change has become a defining factor in companies’ long-term prospects.”

Citing recent climate protests, Fink states, “awareness is rapidly changing, and I believe we are on the edge of a fundamental reshaping of finance. The evidence on climate risk is compelling investors to reassess core assumptions about modern finance.”

Declaring that, “climate risk is investment risk,” Fink then asks an impossibly difficult question of how climate risks will impact entire economies. He has the answer, we learn. Referring to what he calls “a profound reassessment of risk and asset values” Fink tells us, “because capital markets pull future risk forward, we will see changes in capital allocation more quickly than we see changes to the climate itself.

In the near future – and sooner than most anticipate – there will be a significant reallocation of capital.”

Thats a pretty good prediction Larry. It all went right to the top starting in March.

Flash forward to March 2020. Excerpts from this article

The BlackRock plan calls for blurring the lines between government fiscal policy and central bank monetary policy – exactly what the U.S. Treasury and the Federal Reserve are doing today in the United States. BlackRock has now been hired by the Federal Reserve, the Bank of Canada, and Sweden’s central bank, Riksbank, to implement key features of the plan..

The authors wrote in the white paper that “in a downturn the only solution is for a more formal – and historically unusual – coordination of monetary and fiscal policy to provide effective stimulus.”

We now understand why, for the first time in history, the U.S. Congress handed over $454 billion of taxpayers’ money to the Fed, without any meaningful debate, to eat losses on toxic assets produced by the Wall Street banks it supervises. The Fed plans to leverage the $454 billion into a $4.54 trillionbailout plan, “going direct” with bailouts to the commercial paper market, money market funds, and a host of other markets.

The BlackRock plan further explains why, for the first time in history, the Fed has hired BlackRock to “go direct” and buy up $750 billion in both primary and secondary corporate bonds and bond ETFs (Exchange Traded Funds), a product of which BlackRock is one of the largest purveyors in the world.

Adding further outrage, the BlackRock-run program will get $75 billion of the $454 billion in taxpayers’ money to eat the losses on its corporate bond purchases, which will include its own ETFs, which the Fed is allowing it to buy in the program.

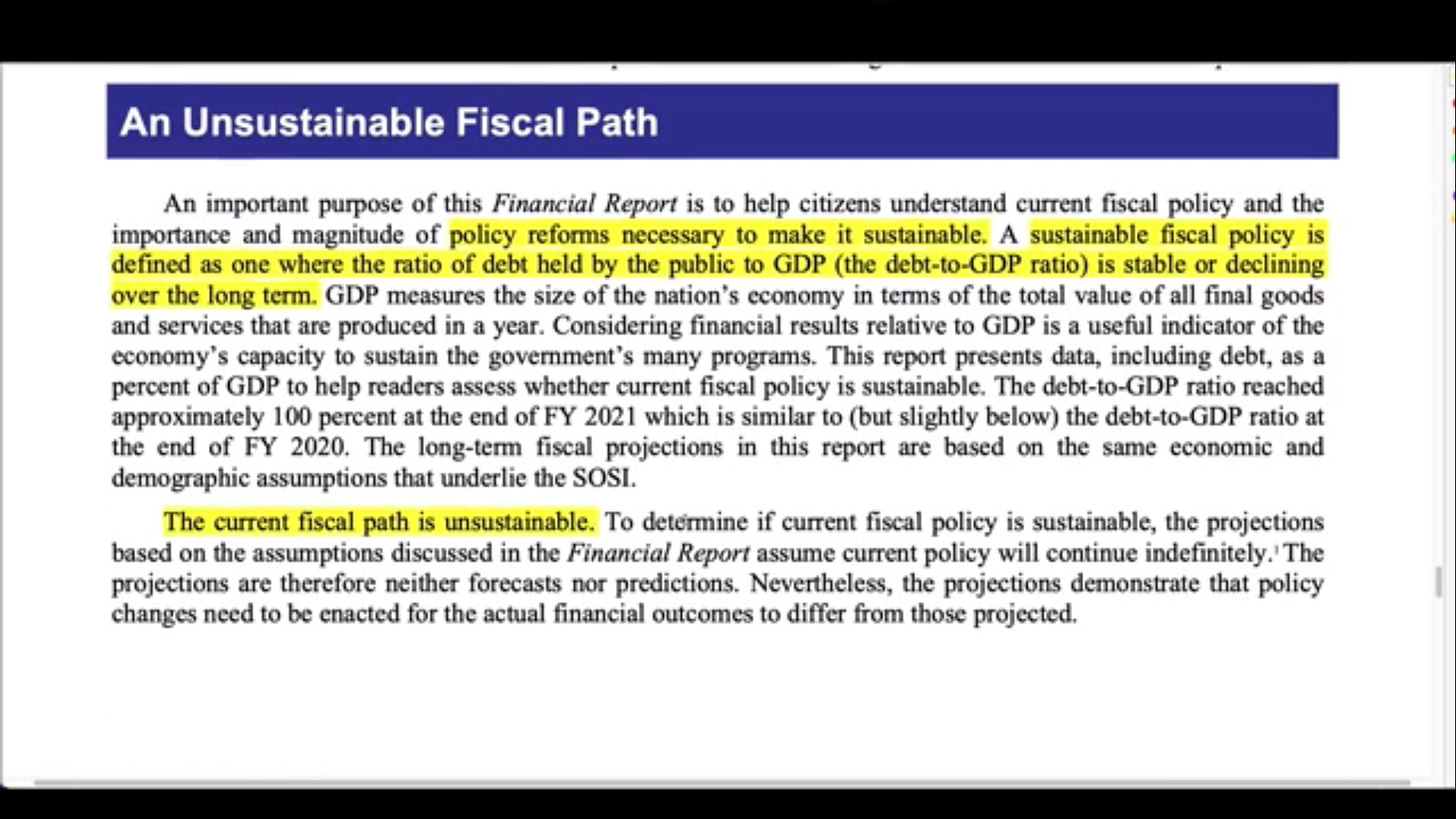

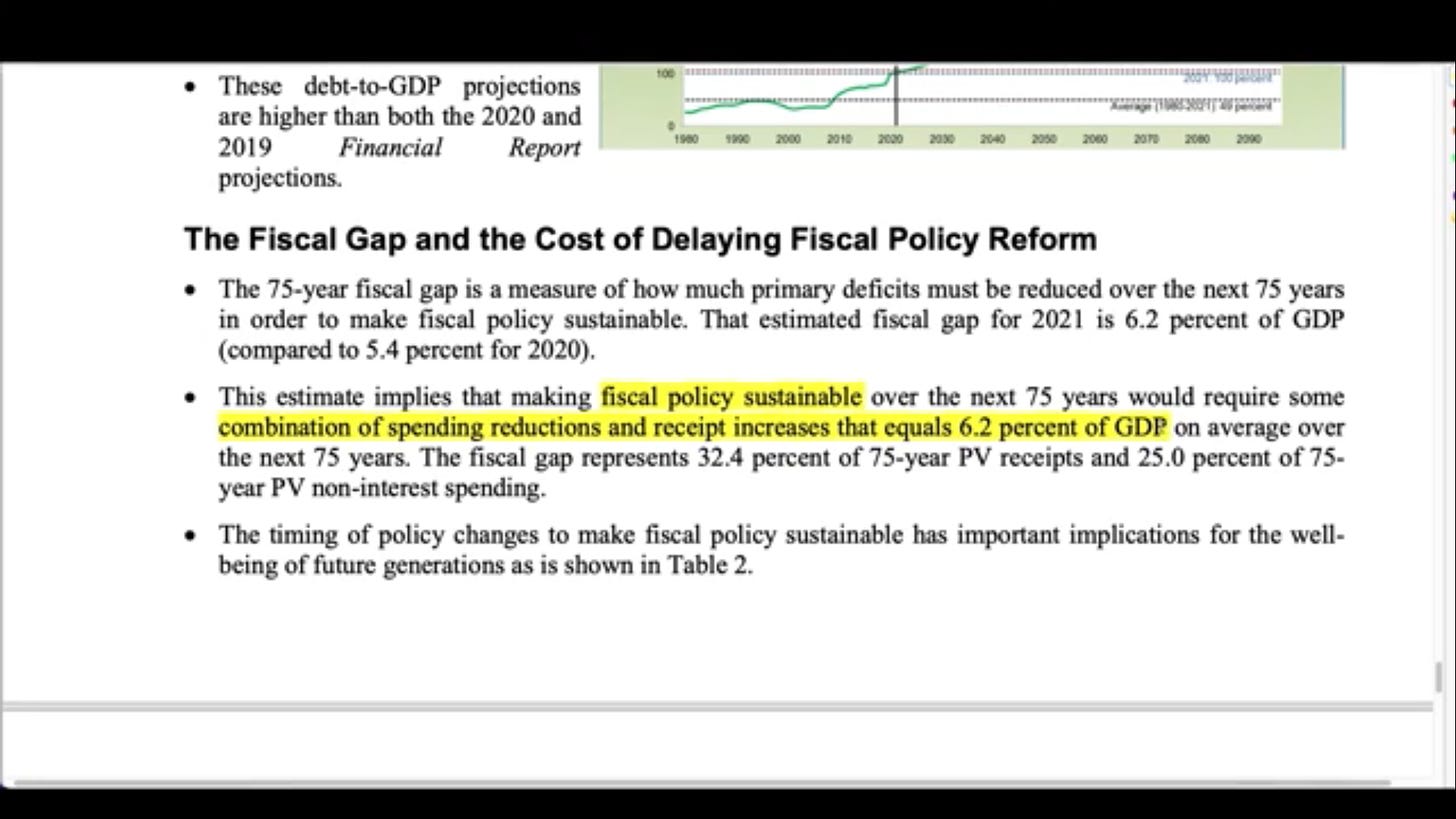

So lets flash forward to Janet Yellens annual report at the US Treasury

And whats her solution? More taxes and cuts in social benefits. Sounds like IMF Austerity measures we force on 3rd World Nations

Now heres Fed Chairman Powell

Powell acknowledged the debt -- currently $22.96 trillion -- "is growing meaningfully faster than the economy and that's by definition unsustainable over time."

https://www.barrons.com/amp/news/current-us-debt-level-very-sustainable-fed-s-powell-01618428316

Maybe stop borrowing from anyone but the Federal Reserve who will return the interest and prevent them from inflating the money supply with non-productive loans. Or better yet, take this guys advice

Is the light bulb on yet?

More Musings

Japanese encephalitis has been detected in 30 NSW piggeries, pork supply in Australia set to plunge. The hits just keep on coming. This is global economic and biological warfare. Its more appropriate to call it Global Terrorism since its directed against civilian populations

Some people dream of suing Klaus and the WEF. Unfortunately, in 2015 WEF gained formal status under the Swiss Host-State Act, confirming the role of the Forum as an International Institution for Public-Private Cooperation

International organizations are not subject to national jurisdiction of any State while taking ownership of the property located in different countries or by making property-related deals with citizens of different nationalities. Furthermore, international organizations could not be prosecuted as a respondent in the national courts

https://www.weforum.org/press/2015/01/world-economic-forum-gains-formal-status-in-switzerland

The are not immune from international law but since they became a partner of the UN in 2019 international courts is a UN organization, good luck with that

https://www.weforum.org/press/2019/06/world-economic-forum-and-un-sign-strategic-partnership-framework

At the end of March, the Russian central bank said it would purchase gold at a fixed price of 5,000 rubles a gram until June 30.

Gold is priced in USD.

Since that announcement, the rouble has strengthened sharply against the dollar. Five thousand roubles was worth around $62 on February 23 (about 1 gm gold), $52 (1 gm Gold worth 70$) on March 25 and around $63 on April 7. Gold was $1932/oz or $69/gm on April 7 . I expect nobody wanted to sell Gold at 5000 Rubles/gram outside of Russia and probably not even in Russia so….On April 7 Russia's central bank said on Thursday that due to a "significant change in market conditions" it would buy gold from commercial banks at a negotiated price from April 8.

They wont exchange Rubles for gold or limit how much Rubles are in circulation based on the quantity of Gold they have so I never saw it as a Gold standard at all, but boy did the Gold Bigs get excited.

Also, the Russian Central Bank is a BIS and IMF member and free of government interference by the Constitution which was written by US backed interests

IMF does not permit a central bank to tie its currency exchange rate to Gold (h/t Edward Slavsquat)

So basically, Russia is not on the Gold Standard.