Refinery Capacity Woes-Another Black Rock Caper?

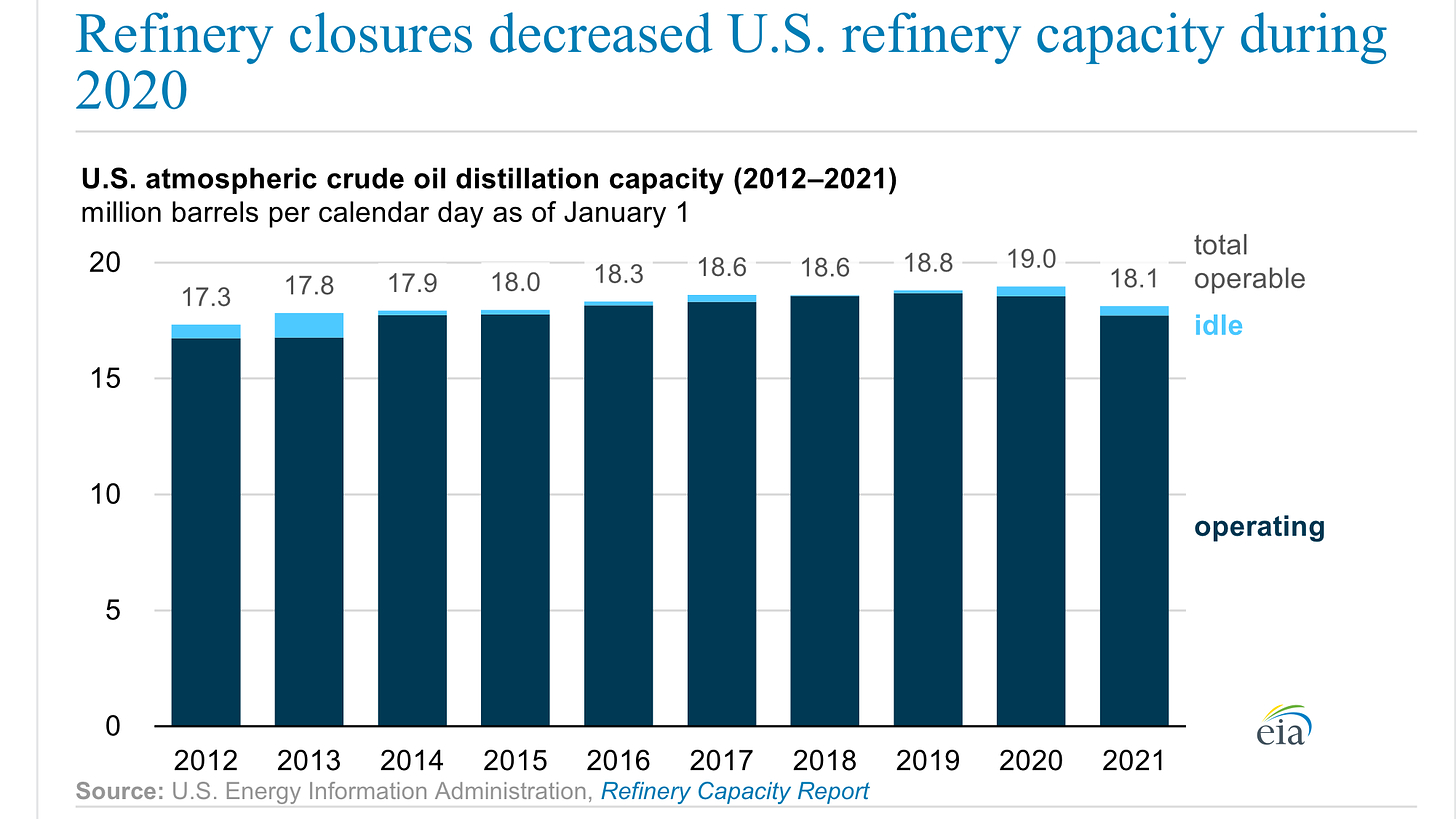

My understanding of the high gasoline prices in US is that its partly or mostly related to a drop in Refining Capacity that occurred in 2020 and beyond.

You don't decide to lose refining capacity overnight, certainly not over a temporary drop in demand given how costly and how much time it takes to increase capacity . Not unless you know your competitors wont follow suit.

Its clear Trumps focus on increasing oil supply while ignoring refinery capacity to handle demand was a major blunder. Why were not measures put in place to incentivize increasing or maintaining refinery capacity?

A bit of digging reveals this

24 Nov, 2020

Investors return to US refiners in Q3, with BlackRock placing big bets

For those who aren’t aware of Black Rock and its CEO Larry Fink I pulled this from a 2020 William Engdahl article. Unfortunately the link seems nowhere to be found now.

BlackRock is no ordinary investment fund. Based in New York, BlackRock is the world’s largest asset manager with some $7 trillion, yes, trillion, under management invested in over 100 countries.

[thats 10 trillion as of January 2022]

That’s more than the combined GDP of Germany and France.

On January 14, 2020 just days before the Davos meeting featuring climate change, Fink published an unusual annual newsletter to corporate CEOs. BlackRock founder and CEO Larry Fink has jumped aboard the climate investing train big time.

He wrote in a closely read letter that guides numerous corporations seeking investment from some of BlackRock’s $7 trillions,

“Climate change has become a defining factor in companies’ long-term prospects.” Citing recent climate protests, Fink states, “awareness is rapidly changing, and I believe we are on the edge of a fundamental reshaping of finance. The evidence on climate risk is compelling investors to reassess core assumptions about modern finance.”

Fink tells us, “because capital markets pull future risk forward, we will see changes in capital allocation more quickly than we see changes to the climate itself. In the near future – and sooner than most anticipate – there will be a significant reallocation of capital.”

Black Rock plans to demand that companies it invests its $7 trillion into show proof that they are green compliant by, “making sustainability integral to portfolio construction and risk management; exiting investments that present a high sustainability-related risk, such as thermal coal producers; launching new investment products that screen fossil fuels; and strengthening our commitment to sustainability and transparency in our investment stewardship activities.”

Translated, if you don’t follow the demands of the UN IPCC and related groups including McKinsey & Co., you lose big money.

So how is closing these Refineries and reducing capacity working for the Refinery Industry?

Chevron's CEO doesn't believe the U.S. will ever build another new refinery.

Mike Wirth, the CEO of oil giant Chevron (CVX4.18%), says he doesn't believe there will ever be another new oil refinery built in the U.S. He made that comment during a recent interview with Bloomberg TV discussing what the country can do to ease record prices at the pump. Even if oil producers like Chevron increased their production, there's not enough refining capacity to meet the demand for petroleum products like gasoline, jet fuel, and diesel.

That means prices will remain elevated even if oil companies pump more crude oil.

In Wirth's view, the U.S. won't ever build another refinery. That's because it's impractical for an energy company to consider building a refinery due to the current environment. Wirth said,

"You're looking at committing capital 10 years out, that will need decades to offer a return for shareholders, in a policy environment where governments around the world are saying, 'We don't want these products to be used in the future.'"

So even if a company like Chevron was willing to commit the time and capital to build a refinery, it doesn't make sense given the shift toward cleaner alternative energy.

Chevron's U.S. downstream business in the first quarter. The company reported $486 million of earnings, reversing a $130 million year-ago loss. Chevron cashed in on higher demand by increasing its refinery run to capitalize on higher margins for refined products.

Meanwhile, energy companies focused on refining made even more money. For example, leading independent refiner Marathon Petroleum (MPC4.66%) generated $1.4 billion in adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) from refining and marketing in the first quarter. That's up from a mere $23 million in the year-ago period.

Marathon benefited from higher margins -- $15.31 per barrel in the first quarter of 2022 versus $10.16 per barrel in the prior-year period -- and higher utilization (Marathon used 91% of its available capacity, compared to 83% in the first quarter of 2021).

https://www.fool.com/investing/2022/06/05/chevrons-ceo-says-no-more-us-oil-refineries-what-s/

It looks like its working out pretty damn well for them.

You cant tell me the President and his Secretary of Energy in 2020 could not have seen this coming and intervened to prevent these closures (using a carrot or a stick, or both)

Not a fan of Biden by any means and he must accept a lot of the responsibility, but he has this right (thanks to an upcoming election no doubt)

President Joe Biden told U.S. oil refiners that unprecedented profit margins are unacceptable and called for “immediate action” to improve capacity as the soaring price of gasoline feeds record inflation and fears of a recession.

“At a time of war, refinery profit margins well above normal being passed directly onto American families are not acceptable,” Biden said in a letter sent Wednesday to top oil companies.

Firms that received Biden’s letter included Exxon, as well as Marathon Petroleum Corp., Valero Energy Corp., Phillips 66, Chevron Corp., BP Plc, and Shell Plc.

Not holding my breath, its just for show.

https://www.law.com/dailybusinessreview/2022/06/15/biden-tells-us-oil-refiners-record-profits-are-not-acceptable/?slreturn=20220524231106