Reciprocal Tariffs and VAT

So Trump is changing tactics and going with Reciprocal Tariffs rather than just Unilateral First Strike Tariffs like 20% on everything and everyone. I approve in the sense it is easier to defend this action.

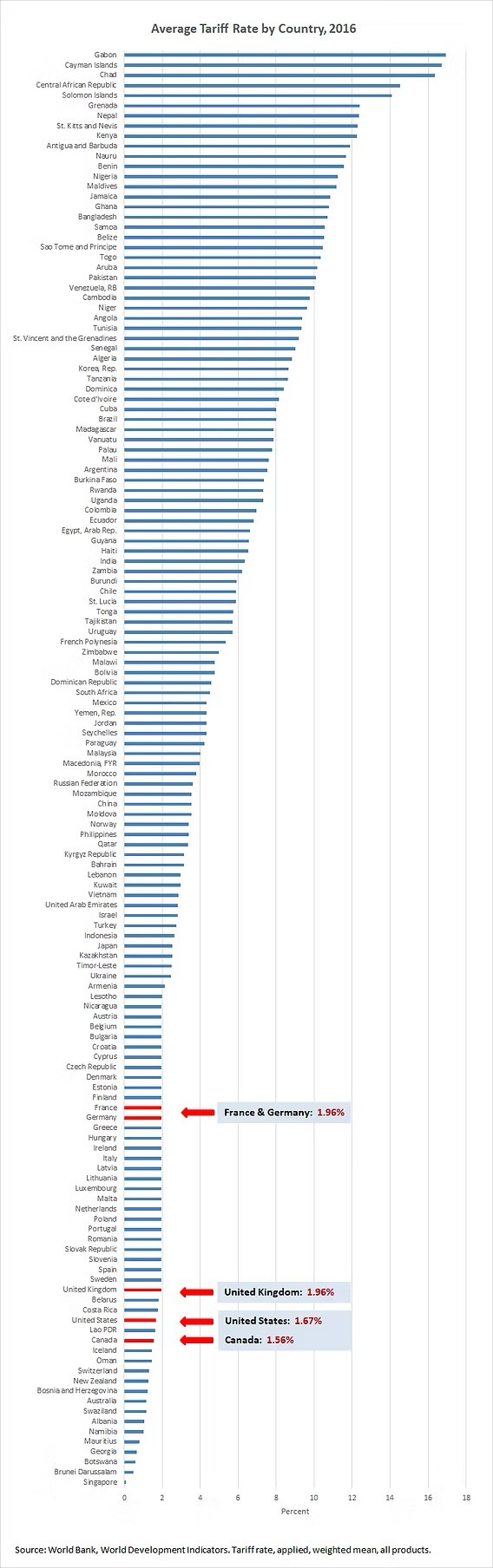

One problem is that tariffs by our major trading partners are low with few exceptions.

weighted averages in above chart

India for example has 18% tariffs (simple average*). Most of our drugs come from India so thats going to hurt if we tariff them,

*weighted average is around 6% which means they import much less of items that have high tariffs

Taiwan where I live has relatively high tariffs on some product’s. Up to 30%. Electronics are way more expensive than in US due to tariffs. For example an iphone loaded with TSMC chips that accounts for much of its value is way more expensive than US. So anyone who says tariffs wont raise prices is nuts.

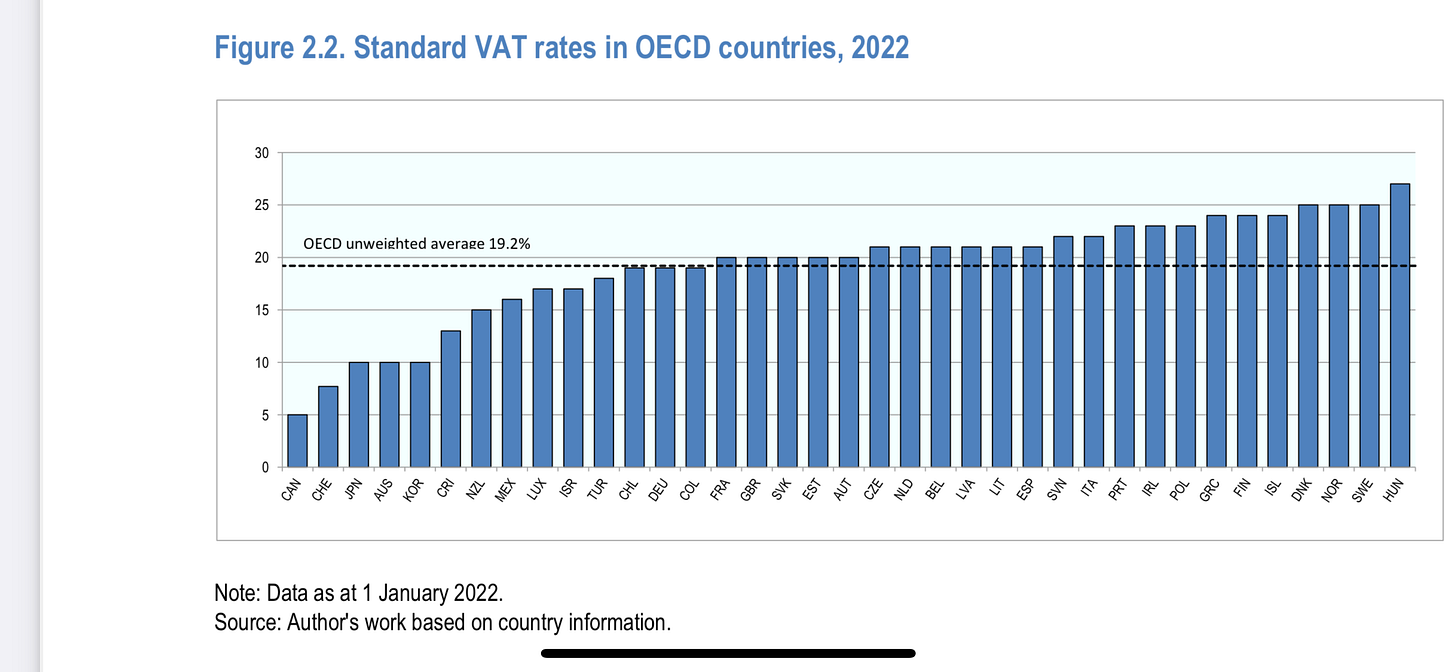

For places like Europe and Canada Reciprocal Tariffs wont get you very far since Tariffs are low so thats why Trumps adding VAT and exchange rates to the mix for calculating them.

Lets start with exchange rates. Having countries appreciate their currency against the USD to make their goods more expensive to help our manufacturers compete is inflationary.

As for VAT, most Americans don’t know what VAT (Value Added Tax) is or how it works, so let me help explain.

For the consumer its just a sales tax. Depending on the country you pay anywhere from 5 to 25% extra for the product you buy. No refunds unless you are a Visitor and leaving the country with your purchase.

For businesses you collect the VAT from your customer and give that to the government after deducting the VAT you paid on purchases needed to run the business and provide the product or service to your customer. The difference is a tax on the value added, hence the name Value Added Tax.

So if the VAT is 20%, a business/manufacturer collects 20% from its $ 2,000 sale, which is $400.

While making that $2,000 product it had to pay VAT on the $1,600 they paid for materials, supplies, equipment used to make the product. Thats $320 VAT paid for their inputs. The difference between VAT collected and paid is $80. Thats what they pay to government. This comes out to 4% of their total sale. Not so bad considering none of it is the companies money. The consumer, if buying direct, pays $400. Ouch

If a manufacturer exports the product, they get to get a refund on the VAT paid for inputs, which in this example is $320. In other words they didn’t pay a tax their US competitor in US also did not pay. Its not a subsidy. Government gave them nothing more than an exemption on a tax meant for domestic consumption only.

Now this is where it gets complicated. Some might think they can sell it to US for $1,680, 16% lower than its domestic price. This is incorrect. Their domestic price of $2,000 was predicated on the fact they would collect 400 VAT to offset their $320 VAT inputs, so VAT did not affect the domestic price, so their export price would be the same, based on their target for profit.

Some might argue the VAT input refund gives the manufacturer a competitive advantage over the US manufacturer. This is nonsense, as you can see.

For the US product being sold in the VAT country, the importer then sells the product where he collects a 20% VAT tax from consumer. Same as the domestic made product. The VAT does hurt US sales, but to the same degree as it hurts domestic sales by the mfr in the VAT country.

The VAT manufacturer sells his goods to the US where it then sells direct to the consumer who pays a sales tax levied in all but 5 states . This can be anywhere from 4-10%. Thats not great for the consumer either but it beats 20%.

I fail to see that VAT country manufacturer has any advantage. Would they prefer export their product than sell to the domestic market? Of course, consumers in the US don’t have to pay a 20% tax so can buy more. But that does not mean this is an advantage for them selling in the US over the US company.

The fact of the matter is the VAT hurts their ability to sell domestically. 20% is a lot. Many people will choose not to buy or if the product can fit in their luggage they buy it in the US on a visit and then bring it home and claim its personal goods or is under the exemption limit (probably not for a $2,000 product).

The VAT encourages smuggling and selling of a foreign competitors product on the black market.

So the VAT rebate for foreign manufacturers does not give them a competitive advantage over the US manufacturer. The VAT hurts domestic sales making exports to non-VAT states more attractive.

But anyways, by using VAT as an excuse you can jack up tariffs on countries who have low tariffs and exchange rates that you don’t want to alter and pretend its all about Fairness. Its easier to sell it that way to people who don’t know any better.

Either way, high tariffs and/or a weaker dollar mean higher prices.

And those higher prices will not be limited to imports as domestic producers will seize the opportunity to raise their prices, as we saw with washing machines as a result of Trumps first term tariffs.

For those saying “but its worth it so manufacturers come back to US.”., I got news for you, they aren’t coming back unless you pay them , and even then they might not come back. Manufacturers sell to the global market. US with 5% of the population only accounts for 15% of global trade. What use is evading US tariffs if you face reciprocal tariffs on 85% of the global market.

So whats Trump up to here? For one thing he can sell the increased tariff revenue as grounds for deeper tax cuts for his billionaire friends, and he will do the same for his spending cuts (real and imagined).

So higher prices if he goes through with this are a certainty.

This leads to the effect reducing the size of the Federal Workforce. We have 2.3 million Federal Civilian employees, not much different from Reagan’s last year in office. 80% live and work outside DC all over the country. In addition to them we have 5 million contracted employees working for government contractors. Reducing spending and cutting the government workforce by 20% leaves about 1.5 million without a job. That bumps up the unemployment rate at least 1 % and reduces annual income much of which is spent into the economy by $ 75 billion (assuming 50 k salary which is probably low).

Furthermore, Federal Spending accounts for up 25% of GDP. You cut $2 trillion and you reduce GDP by 7%. That coupled with higher prices has to trigger a major recession or worse.

Is this intentional?. Who profits the most from financial disasters? The billionaires. They get to buy up distressed assets cheap. Is this why Elon is so excited? I don’t know.

End