How Effective Altruism & FTX -a Philosopher King Billionaire named Nicolas Berggruen and Philanthrocapitalism tie together.

[ Too long for Email so click on Title for whole thing]

Modern Philanthrocapitalism is the foundation for the transformation of Capitalism from Monopolistic Financial Capitalism to Klaus Schwabs and Larry Finks ESG based Stakeholder Capitalism and a Secular World Religion of Transhumanism and Sustainability with Billionaire Philanthrocapitalist Elites and Futurist Philosophers like Elon Musk, Nicolas Berggruen , William MacAskill, and Yuval Noah Hariri as its high priests. Note that some wear two hats (Billionaire + Philosopher)

The term Philanthrocapitalism was coined by Matthew Bishop and Michael Green in their book Philanthrocapitalism: How the Rich Can Save The World. The book was endorsed by Bill Clinton, who wrote in its foreword that this concept drives the Clinton Foundation

Since then, a significant visibility in charity spending by other organizations such as the Bill & Melinda Gates Foundation and Chan Zuckerberg Initiative. Not to Mention the Clintons, Epstein’s, Soros, Rockefellers and Wexners Foundations and their alleged nefarious activities

Philanthrocapitalism has been compared and contrasted with altruism due to the similar stated goals of the movements’ advocates.

There are many criticisms of philanthrocapitalism beginning with the limited transparency and accountability involved, and the loss of tax revenue for governments. There is concern that the wealth of a few may be able to determine what organizations receive the most funding.

Many current and past philanthropists amassed their fortunes by predatory business practices whose companies profits are enhanced the very social problems their philanthropy is intended to alleviate. Finally there are concerns of the existence of ulterior motives that can range from business owners avoiding capital-gains taxes by donating their company's excess stock instead of selling it to collusion with other billionaires and organization to reengineer society in the interests of the Elites and gain control over local and national governments.

Over the course of the last couple of years we have seen the damage caused by foundations like BMGF, Welcome Trust and Rockefeller Foundations. Not to say some of the money has not been used for good but 40% or more of this money is pilfered from government coffers and its use is determined by unelected people, some of which are spawns of Satan himself (or herself)

Most government entities are subject to public scrutiny, but private philanthropies are accountable only to their own self-selected boards. Just a few executives make major decisions that affect millions of people. In North America (and various other jurisdictions), corporate and individual contributions to non-profit entities are tax deductible, removing an estimated $40 billion from U.S. public coffers each year.6At least one-third (depending

on the tax rate) of private philanthropies’ endowments thereby is subsidized by the tax-paying public, which has no say in how such organizations’ priorities are set or monies spent.

https://archive.globalpolicy.org/component/content/article/270-general/52947-us-philanthrocapitalism-and-the-global-health-agenda-the-rockefeller-and-gates-foundations-past-and-present.html

Longtermism and effective altruism, the former being a variant of the latter, are an evolution of Philanthrocapitalism much like Christianity evolved and spread from a small group of Apostles. None of this has really been on my radar, but FTX on top of the last 30 months of Billionaires and their political puppets which they control with their Dark Money telling us all how to live has changed that, and I think I see a connection

Lets start with Effective Altruism. We can call that Part I. Part II below will cover Nicolas Berggruen and his Institute and his pal Bill Ackman and Part III we will elaborate on Philanthrocapitalism and its Vampires

Whitney Webb touches upon Effective Altruism as it related to FTX/SBF this in a podcast.

https://rokfin.com/stream/25855/Pranksters-VS-Macron-Garland-Nixon-Censored-Whitney-Webb-Interview

The movement developed during the 2000s, and the name effective altruism was coined in 2011. Prominent philosophers influential to the movement include Peter Singer, Toby Ord, and William MacAskill (his fathers last name was Crouch but he changed his name-moro on this later) . Several books and many articles about the movement have since been published, and the Effective Altruism Global conference has been held since 2013. As of 2022, several billion dollars have been committed to EA causes.

Peter Albert David Singer AC (born 6 July 1946)[1] is an Australian moral philosopher, currently the Ira W. DeCamp Professor of Bioethics at Princeton University

Singer's ideas have contributed to the rise of effective altruism. He argues that people should try not only to reduce suffering but to reduce it in the most effective manner possible.

His own organisation, The Life You Can Save, also recommends a selection of charities deemed by charity evaluators such as GiveWell to be the most effective when it comes to helping those in extreme poverty. TLYCS was founded after Singer released his 2009 eponymous book, in which he argues more generally in favour of giving to charities that help to end global poverty

Since November 2009, Singer is a member of Giving What We Can, an international organization whose members pledge to give at least 10% of their income to effective charities.

In 2021, Singer was awarded the US$1-million Berggruen Prize,

and decided to give it away. He decided, in particular, to give half of the prize money to his foundation The Life You Can Save, because "over the last three years, each dollar spent by it generated an average of $17 in donations for its recommended nonprofits". (He added he has never taken money for personal use from the organization.) Moreover, he plans to donate more than a third of the money to organizations combating intensive animal farming, and recommended as effective by Animal Charity Evaluators

Toby David Godfrey Ord (born July 1979)is an Australian philosopher. He founded Giving What We Can in 2009, an international society whose members pledge to donate at least 10% of their income to effective charities, and is a key figure in the effective altruism movement, which promotes using reason and evidence to help the lives of others as much as possible. He is a Senior Research Fellow at the University of Oxford's Future of Humanity Institute, where his work is focused on existential risk

In 2011, Giving What We Can and 80,000 Hours decided to incorporate into an umbrella organization and held a vote for their new name; the "Centre for Effective Altruism" was selected.

William David MacAskill (né Crouch; born 24 March 1987) is a Scottish philosopherand author, along with being one of the originators of the effective altruism movement. He is an Associate Professor in Philosophy and Research Fellow at the Global Priorities Institute at the University of Oxford, and Director of the Forethought Foundation for Global Priorities Research. MacAskill is also the co-founder of Giving What We Can, the Centre for Effective Altruism and 80,000 Hours. He is the author of the 2015 book Doing Good Better, the 2022 book What We Owe the Future, and co-author of the 2020 book Moral Uncertainty.

The "Effective Altruists" Facebook group was set-up in November 2012.The Effective Altruism Global conference has been held since 2013. As the movement formed, it attracted individuals who were not part of a specific community, but who had been following the Australian moral philosopher Peter Singer's work on applied ethics, particularly "Famine, Affluence, and Morality" (1972), Animal Liberation (1975), and The Life You Can Save (2009). Singer himself used the term in 2013, in a TED talk titled "The Why and How of Effective Altruism"

Popular cause priorities within EA include global health and development, social inequality, animal welfare, and risks to the survival of humanity over the long-term future. EA emphasizes impartiality and the global equal consideration of interests when choosing beneficiaries. This has broad applications to the prioritization of scientific projects, entrepreneurial ventures, and policy initiatives estimated to save the most lives or reduce the most suffering.

https://en.m.wikipedia.org/wiki/Effective_altruism

MacAskill says that if we assume that our population continues at its current size and we last as long as typical mammals, that would mean “there would be 80 trillion people yet to come; future people would outnumber us 10,000 to one”.

The moral argument is that, by sheer weight of numbers, our descendants’ needs should loom large in our deliberations. With alarming signs that the climate crisis is already upon us, MacAskill states the obvious and urgent need for decarbonisation. This problem, however, is not the main focus of his book. Rather he employs the climate crisis as a proof of longtermism: “We all contribute to a problem that literally has effects for hundreds of thousands of years,” he says

https://www.theguardian.com/world/2022/aug/21/william-macaskill-what-we-owe-the-future-philosopher-interview

Elon Musk quote-tweeted a plug for William MacAskill’s then forthcoming book What We Owe the Future. “It makes the case for longtermism,” the Oxford philosopher wrote, “the view that positively affecting the long-run future is a key moral priority of our time.” Incidentally, MacAskill was also a mentor to Bankman-Fried, and advised FTX on the mystical path of effective altruism.

“Worth reading,” Musk responded, breaking from his usual vague self-descriptions. “This is a close match for my philosophy.”

A very nice summary can be found here

Émile Torres the philosopher says longtermism is

“....the world’s most dangerous secular credo......Longtermism might be one of the most influential ideologies that few people outside of elite universities and Silicon Valley have ever heard about,.....The crucial fact that longtermists miss is that technology is far more likely to cause our extinction before this distant future event than to save us from it.”

Longtermism and effective altruism start with a few mosquito nets for starving kids in Africa and end with all-seeing smart dust gathering under your bed.

Musk in a TED interview said “SpaceX, Tesla, Neuralink, and the Boring Company are philanthropy....,.Tesla is accelerating sustainable energy. This is a love—philanthropy. SpaceX is trying to ensure the long-term survival of humanity with a multiple-planet species. That is love of humanity. You know, Neuralink is trying to help solve brain injuries and existential risk with AI. Love of humanity”

Sam Altman, the gay tech magnate who co-founded OpenAI with Elon Musk, has invested in the company Genomic Predictor, which screens out unwanted zygotes, and another called Conception. According to a fascinating Business Insider exposé, the latter startup “plans to grow viable human eggs out of stem cells and could allow two biological males to reproduce.”

Along similar lines, Vitalik Buterin (the co-founder of Ethereum cryptocurrency, a notable FTX booster, and yet another node in the effective altruism movement) recently suggested that babies should be gestated in plastic bio-bags to safeguard women’s rights:

The thinking behind effective altruism as a whole, was inherited from philosopher Peter Singer. In the early 90’s, Singer famously argued that infants—especially the disabled—are fair game for abortion up to thirty days after birth. The premise was this would reduce the suffering of both overburdened parents and their potentially retarded children. It’s just a matter of moral calculation.

“The only justifiable stopping place for the expansion of altruism is the point at which all those whose welfare can be affected by our actions are included within the circle of altruism,” he wrote in his 1981 book The Expanding Circle. “This means that all beings with the capacity to feel pleasure or pain should be included.”

Today, as the Fourth Industrial Revolution unfolds across the planet, Singer has extended his altruistic extremism to artificial life as well. He recently explained this position on a Big Think episode

“If we created robots who are at our level, then I think we would have to give them, really, the same rights we have. There would be no justification for saying, “Ah yes, but we’re a biological creature and you’re a robot.” I don’t think that has anything to do with the moral status of the being.

To recap, newborns deserve less moral status than farm animals, while robots deserve human rights. You can’t stop progress!

Regarding the moral value of artificial minds, MacAskill makes similar arguments. In his 2021 paper “The case for strong longtermism,” co-authored with Hilary Greaves for the Global Priorities Institute, he estimates that “digital sentience” should expand the pool of future minds exponentially, maxing out around 10^45—or a quattuordecillion—digital souls expanding out across the Milky Way.

If you weigh this overpopulated cybernetic future against our present-day needs and desires, that’s a whole lotta moral concern.

“Assuming that on average people have lives of significantly positive welfare,” MacAskill and Greaves write, “according to a total utilitarianism the existence of humanity is significantly better than its non-existence, at any given time. Combining this with the fact that both states are persistent, premature human extinction would be astronomically bad.”

The implication is horrific. If our moral purpose is to benefit the greatest number of possible beings, then it’s our moral duty to avoid extinction—such as asteroid impacts or malign artificial superintelligence—by any means necessary.

Taken to its logical conclusion, such moral reasoning would justify anything from starving out present-day populations in order to feed the Machine for future digital minds, to wiping out the huddled masses who are too stupid to understand how important this Machine really is.

After all, what are the 8 billion dumdums living today worth when weighed against the quattuordecillion digital souls who are yet to be born?

FTX was hyped by everyone from Sequoia Capital and established Oxford professors to island-hoppers like Bill Clinton and Tony Blair. Even as the lies unravel before our eyes, the New York Times and the Wall Street Journal continue to spin the entire affair as a series of unfortunate business decisions. Presently, Bankman-Fried is still scheduled to speak at the NYT DealBook Summit alongside Janet Yellen, Mark Zuckerberg, and Volodymyr Zelensky.

Pronatalism is an ideology centred on having children to reverse falling birthrates in European countries, and prevent a predicted population collapse – is “taking hold in wealthy tech and venture-capitalist circles”, with the aid of hi-tech genetic screening.

Musk has championed pronatalist ideas publicly. Privately the Tesla co-founder is, in his own words, “doing my part”; he has 10 children known to the public, two of whom are twins he fathered with an AI expert who serves as an executive for his Neuralink company. But the ideas go beyond Musk and into the canyons of Silicon Valley; the world’s richest and most powerful people see it as their duty, to “replicate themselves as many times as possible”.

Effective altruism, longtermism (which prioritises the distant future over the concerns of today), and transhumanism (the evolution of humanity beyond current limitations via tech), are complementary philosophies. The concept of legacy is key to understanding our tech pioneers.

https://www.theguardian.com/commentisfree/2022/nov/25/big-tech-business-model-silicon-valley-twitter

Jeffrey Epstein clearly was a Pronatalist.

Epstein reportedly had plans to make a baby-making factory where he would inseminate victims.

Computer scientist and writer Jaron Lanier told the New York Times that he once spoke to a scientist who related how Epstein’s goal was to have 20 women at a time impregnated at the 33,000-square-foot property, named Zorro Ranch and located outside Santa Fe.

https://nypost.com/2022/11/25/perv-jeffrey-epsteins-unsellable-new-mexico-ranch-gets-9-5m-price-slash/

A Dangerous Philosophy (Malthusian Eugenics)

Evangelizing that future people matter just as much “could create an injustice to people who are currently living,” including the 1.3 billion people in global poverty,says Ted Lechterman, assistant professor of philosophy at IE University in Madrid, previously a research fellow at the Institute for Ethics in AI at Oxford, who’s written extensive criticisms of EA. Those “trade-offs with present and near-term concerns . . . are difficult to justify.” He appreciates the way the movement challenges common-sense morality, and that it’s generally open to debating its ideas, but thinks they’re “overvaluing the future”

Lately, EA’s pocketbooks have become more plentiful, as two tech billionaires have infused the movement with funds. Along with his wife, Cari Tuna, Facebook cofounder Dustin Moskovitz, who’s worth a reported $15.7 billion, launched the nonprofit Open Philanthropy, which a spokesperson told me committed more than $450 million in grants last year, and $500 million so far this year, to a variety of EA causes, including vaccine development, criminal justice reform, the welfare of carp, tilapia, and shrimp, and “adversarial robustness research.”

(Fast Company reached out to Bankman-Fried for an interview but did not receive a response. Moskovitz politely declined.)

Even Lechterman, the critic, says political spending may be justified in this case, for “preventing the horrible candidate from coming to power.” He says denying not only Trump, but also other recently elected global leaders, by funding opposition candidates could have saved “a dramatic number of lives,” while also improving standards of life and reducing social injustices, which are moral improvements in the EA mold.

In his book, MacAskill does endorse reproduction, he says to counter an expanding worldview “that it’s immoral to have kids because of your carbon impact.” He stops short of recommending it for everyone because he respects personal reproductive choices, but he believes failing to breed could cause future technological stagnation. Even if the generations ahead don’t face a calamitous extinction event, they could go through another Dark Ages, deprived of tech innovation, and an existential brain-drain could exacerbate those sluggish eras and collapse society.

But the transhumanism obsession began inside the Oxford halls, particularly from the mind of Nick Bostrom. He has researched “genetic enhancement of intelligence” via embryo selection, to engineer designer babies with high IQs, which he has acknowledged is reminiscent of eugenics.

Transhumanism goes further, in “changing the very substrate of persons from carbon-based biological beings to persons based in silicon computers,” wrote philosopher Mark Walker. Bostrom has suggested that if we venture into transhumanism, we could create vastly huge numbers of future people. He is also a fan of space expansion, claiming in his Astronomical Waste paper, retweeted by Musk, that we waste 100 trillion human lives for each second that we do not colonize space.

The stagnation concern raises some worry about the fate of the future global poor—initially the very individuals that the EAs deemed most worthy of our help. Beckstead, who is now CEO of the FTX Foundation, wrote in 2013 that “saving a life in a rich country is substantially more important than saving a life in a poor country” because wealthy nations have more potential to innovate. For Lechterman, the critic, the main source of EA disapproval is that the movement has power over the poor, with a “heroic, elitist mentality that our global problems are things that smart, wealthy people can solve on their own.”

[Take this one step further. Sacrificing a life today could mean giving life in the future to many more lives. This is the Elites Moral Justification for Culling the Elderly and General Depopulation and Reduction in Life Expectancy as well as Reducing Living Standards]

Deciding what’s right for poorer countries creates a dangerous power dynamic, he says. Cash transfers may be better than bed nets and deworming drugs because they’re less paternalistic, and allow people autonomy to spend money as they see fit, but they’re still incentives for societies to put off addressing the root causes of poverty. He says the movement should prioritize investing in advocacy groups and grassroots movements, to put resources in the hands of the people suffering the most, and give them the power to effect long-lasting systemic change.

“It can be terribly hubristic for an elite few to make important decisions on the world’s behalf,” Lechterman says, “even if their motivations are, in fact, pure, and their beliefs are correct.” That’s paramount now, as billionaires are flocking to the operation without the same philosophical introspection as the Oxfordian thinkers. “That’s where things can especially go awry.

In a few short years, effective altruism has become the giving philosophy for many Silicon Valley programmers, hedge funders and even tech billionaires. That includes not just Mr. Bankman-Fried but also the Facebook and Asana co-founder Dustin Moskovitz and his wife, Cari Tuna, who are devoting much of their fortune to the cause.

“Advising billionaires on how to give away their money and encourage them to give more is definitely not where I saw my life going,” Mr. MacAskill, a professor of philosophy at Oxford, said in an interview. But he sees the utility in it, from the central effective altruist commandment of doing the most good possible.

“If I can help encourage people who do have enormous resources to not buy yachts and instead put that money toward pandemic preparedness and A.I. safety and bed nets and animal welfare that’s just like a really good thing to do,” Mr. MacAskill said.

Mr. Musk has not officially joined the movement but he and Mr. MacAskill have known each other since 2015, when they met at an effective altruism conference. Mr. Musk spoke at the EA Global conference in 2015, appearing on a panel about the risks posed by artificial intelligence.

With an estimated $220 billion fortune, Mr. Musk could single-handedly make effective altruism the leading movement in philanthropy.

Mr. MacAskill was one of the founders of the group Giving What We Can, started at Oxford in 2009. Members promised to give away at least 10 percent of what they earned to the most cost-effective charities possible

Mr. Moskovitz and Ms. Tuna’s net worth is estimated at $12.7 billion. They founded their own group, Good Ventures, in 2011. The group said it had given $1.96 billion in donations. In 2017, Open Philanthropy, its collaboration with another early and influential effective altruism organization, GiveWell, began operating independently and is now the main vehicle for their funding.

https://www.nytimes.com/2022/10/08/business/effective-altruism-elon-musk.html

Now lets look at Effective Altruism and FTX

The Beginning:

Ten years ago, [at the age of 25], William MacAskill came to MIT in search of converts.

The Scottish philosopher was already one of the world’s most prominent proponents of “effective altruism” (or “EA”), a social movement dedicated to ”using evidence and reason to figure out how to benefit others as much as possible.”

In 2012, MacAskill believed that many idealistic young people had misconceptions about how they could best improve the world. Specifically, such individuals had a tendency to seek low-paying jobs at philanthropies and progressive nonprofits even though, in many cases, such institutions had no great need for their labor. To the contrary, such jobs often attracted a superabundance of qualified applicants. Therefore, a young idealist would make virtually no positive contribution to the world by taking such a position; in their absence, another similarly skilled person would perform the same role roughly as well.

In truth, highly effective charities didn’t need more idealistic workers; they needed more deep-pocketed donors. An effective altruist who went into finance, earned $200,000, and then devoted $50,000 of that sum to purchasing bed nets for the global poor would do far more good than one who elbowed past equally gifted Ivy League grads for an entry-level job at UNICEF.

The former strategy was called “earning to give.” And MacAskill hoped to guide MIT’s aspiring altruists onto that path. While in Cambridge he learned of an especially promising candidate for the cause, an undergraduate named Sam Bankman-Fried.

Over lunch, Bankman-Fried told MacAskill that he had recently become a vegan and wanted a job in which he could advance the cause of animal welfare. MacAskill suggested that he would reduce animal suffering far more if he tried to make a lot of money and then donated it to relevant charities. Bankman-Fried took his advice.

https://nymag.com/intelligencer/2022/11/effective-altruism-sam-bankman-fried-sbf-ftx-crypto.html

Mr. Bankman-Fried makes his donations through the FTX Foundation, which has given away $140 million, of which $90 million has gone through the group’s Future Fund toward long-term causes.

https://www.nytimes.com/2022/10/08/business/effective-altruism-elon-musk.html

After Bankman-Fried established the philanthropic Future Fund, MacAskill became an adviser, helping distribute funds for maximum impact. After the collapse of Alameda and FTX, MacAskill announced that he had resigned, saying the role had been unpaid. Staff of the Future Fund have also resigned, announcing that many grants already promised to organizations will now go unfulfilled because of the blowup.

https://www.nasdaq.com/articles/who-is-william-macaskill-the-oxford-philosopher-who-shaped-sam-bankman-frieds-worldview

Another Effective Altruist who co founded Alameda with SBF in 2017 is Tara Mac Aulay

Tara Mac Aulay, said on Twitter that she helped found Alameda but resigned in April 2018 along with other colleagues, “in part due to concerns over risk management and business ethics.

https://www.semafor.com/article/11/18/2022/effective-altruism-group-debated-sam-bankman-frieds-ethics-in-2018

In 2016 Tara Mac Aulay was the head of operations in the Centre for Effective Altruism. But just two years earlier she was working as a pharmacist. How and why did she make this transition? Her career path is sufficiently fascinating it’s worth telling the story form the start.

https://80000hours.org/stories/tara/

After leaving Alameda Tara Mac Aulay founded and became the CEO of Lantern Ventures.

https://lynettebye.com/blog/2020/4/4/tara-mac-aulay-on-happiness-and-work-self-experimentation-and-prioritization

[From a young Pharmacist to founder and CEO managing 1/4 billion dollar in assets for a Digital Currency Trading Firm in the blink of an eye-You got to be kidding me]

Lantern Ventures is a digital currency trading firm with over $250 million under management. Lantern was founded on philanthropic principles, and 50% of founder profits are donated to high-impact charitable causes.

https://www.conferencecast.tv/speaker-68910-tara-mac-aulay#.speakerPage-about

Now, it has emerged that Bankman-Fried has an unexpectedly deep connection to the troubled crypto savings platform Celsius, which filed for bankruptcy on Wednesday.

That connection comes in the form of Alameda Research, Bankman-Fried's trading firm, which is owed $12.7 million as Celsius's 13th largest creditor. But it emerged on Thursday, he also has ties to a mysterious entity called Pharos USD Fund, which is owed $81.1 million and is Celsius's largest creditor by far.

As Bloomberg reported Thursday, the only email linked to Pharos on the bankruptcy filing is registered with Lantern Ventures, a British cryptocurrency trading firm—and whose CEO and biggest shareholder is Tara MacAulay, a co-founder of Alameda Research. (An SEC filing confirms that Pharos is an affiliate of Lantern Ventures, holding about $400 million under management).

Lantern Ventures' website contains scant information beyond stating that the firm was "founded on philanthropic principles and 50% of founder profits are donated to high-impact charitable causes." Those ideals echo those of Bankman-Fried, who has frequently espoused a philosophy of altruism.

Bankman-Fried's overlap with Lantern/Pharos doesn’t end with MacAulay. Victor Xu, a current Lantern employee, was a head trader at Alameda in 2018 for nine months. Three others who work at Lantern previously worked with Centre for Effective Altruism or its affiliate Giving What We Can, which Bankman-Fried is also involved with.

It's unclear whether Lantern and Alameda Research coordinated on any of their investments into Celsius, which gained prominence last year by offering eye-popping interest rates of 9% or more to retail investors. The company began to unravel, however, in the wake of the collapse of the Terra stablecoin, and is it became clear Celsius could meet its obligations to depositors.

While some big creditors could be partially repaid through the bankruptcy proceedings, retail investors are likely to lose everything they put in. More details of Celsius's collapse—and potentially Bankman Fried's involvement with the company and with Pharos—are likely to emerge in the course of court proceedings under way in New York.

https://fortune.com/2022/07/14/bankrupt-crypto-firm-celsiuss-biggest-creditor-linked-to-ftx-founder-sam-bankman-fried/

Alameda Research made enough unsecured loans to Celsius Network to become one of its biggest creditors. Alameda Research [cofounder] also manages the “Pharos Fund,” which became Celsius’ biggest creditor.

https://protos.com/ftx-and-tether-were-closer-to-celsius-than-anyone-realized/

Unusual and mysterious crypto movements from Celsius’ main DeFi wallet began moving liquidity at 18:00 ET on June 12. The liquidity was moved to FTX as it removed WBTC from its main AAVE staking and lending platform. Celsius had earned interest on its deposits, mainly stored in its DeFi wallet.

Users claim 9,500 WBTC tokens worth $247 million have been moved from Aave to FTX exchange. The movement of liquidity has been unknown and not specified by the Celsius network.

In addition, apart from moving WBTC, Celsius has also moved 54,749 Ethereum worth $74.5 million to FTX, alleged users. Users allege that the Celsius board is not transparent with their dealings and is demanding answers for the fund’s movement.

Overall, Celsius has been accused of $320 million worth of liquidity to the FTX exchange while pausing withdrawals for its users.

https://watcher.guru/news/celsius-token-moved-320-million-liquidity-to-ftx-after-pausing-withdrawals

Not being an expert on Crypto Markets I got to say at first glance they are looking more like organized Racketeers

Note this prediction of Celsius collapse in December 2021

https://www.inflation.us/content/truth-about-ftx-alameda-celsius-and-tether

Last month, Coindesk reported that Sam Bankman-Fried is allocating 98% of his time to FTX and only 2% to Alameda Research, in a desperate attempt to distract from the tens of billions in newly printed USDT that Alameda supposedly "bought" over the past year at a time when Alameda didn't have any access to the traditional banking system. We have a feeling that sometime in the next week or so we will see Tether print another $500 million or more in USDT and transfer approximately (but not exactly) $1.5 billion USDT to FTX. There's no law that says a private company like FTX/Alameda isn't allowed to receive venture capital investments in USDT, but we hope to see CNBC, Forbes, and other sellouts in the mainstream media accurately report FTX's post-transaction valuation as being $40 billion USDT not $40 billion USD. Considering that USDT itself is likely backed by a combination of Bitcoin, Altcoins, Alameda Research commercial paper, FTX shares, and other forms of illiquid securities/derivatives in privately held Crypto companies including the Celsius high-yield ponzi scheme (there's no evidence to suggest that Tether owns commercial paper in China’s Evergrande Group), Forbes should remove Sam Bankman-Fried from its list of the world's wealthiest entrepreneurs, but we're sure they will be cheerleading as his net worth increases as a result of Tether printing more USDT.

There is no such thing as a magical Defi Trading Bot that creates risk free yield for investors. Desperate to stop withdrawals from their ponzi scheme, Celsius this morning has jacked up the yields they offer on Bitcoin. If you know anybody who has invested with Celsius, you should tell them to remove their money immediately before it is too late!

While he didn’t predict the demise of FTX he nailed it on Celsius

I am no expert on Crypto Banking myself, and while many express shock at the shenanigans pulled off by SBF at FTX and others are really just taking a page out of the S&L playbook and banking in general in the post Glass - Steagall World . The main difference is they don’t have the backing of the Fed Reserve and are not Too Big Too Fail

Crypto Banking

Unlike traditional finance and investment banking, crypto finance platforms have no reserve requirements and are not subject to the usual banking regulatory oversights. Similar to conventional banks, crypto finance platforms pool deposits to provide loans to customers. However, in contrast to traditional banks, which had been offering near-zero yield to depositors, centralized crypto platforms were promising superlative payouts, APYs 7-20 %.

For centralized crypto platforms to stay solvent, they had to consistently generate high returns to fulfill the promised hefty payouts to depositors, forcing them to make risky bets with the deposited monies. Centralized crypto platforms engage in opaque lending, i.e., loaning to unidentified third parties and institutions for aggressive bets to generate outsized returns. Any cash-flow deficits were likely masked by the incoming streams of new capital continuing to chase high yields.

The big bankrupt platforms in 2022: Terraform Labs, Voyager, Celsius CEL +3.4%, and FTX, started as businesses trying to provide above-market returns. However, the promised superlative returns, possibly designed to attract capital, forced companies into taking excessive risks by utilizing backdoors (designed by company insiders) to commingle and funnel clients' money into their trading partners. The usual "fake it till you make it" mantra was forced into failure by the unraveling of financial markets, including crypto, resulting from Federal Reserve's recent aggressive interest rate hikes. The fierce bear market of 2022 halted the game of musical chairs, unmasking the bleeding balance sheets, torpedoing companies into committing fraud, and marching towards outright Ponzi schemes.

The decade of near-zero/negative global interest rates and easy money increased risk appetites, fueling a speculative investment frenzy into crypto start-ups while bypassing traditional due diligence and oversight mechanisms. Slick fast-talking entrepreneurs were given billions of dollars with carte blanche to make risky bets, enabling them to mask failures

Centralized crypto exchange FTX's core business was to facilitate buying and selling digital currencies while taking a small cut of transactions. In traditional finance, regulators require brokerages to segregate customer funds from trading capital to remove conflicts of interest from an exchange attached to a trading business. Instead, behind the curtain, FTX tapped into its $16 billion in customer assets and loaned more than half, north of $8 billion, to fund risky trades by Alameda Research.

These crypto market failures underscore the dangers of unregulated finance without any backstops. The centralized custodian crypto platforms obscure any proof of reserves or transparency into how the company allocates finances, necessitating regulatory guardrails to safeguard assets. These market failures could delay institutional crypto adoption by years and may initiate draconian measures from regulators.

https://www.forbes.com/sites/roomykhan/2022/11/17/massive-bankruptcies--terraform-labs-voyager-celsius-and-now-ftx-necessitating-the-reinvention-of-centralized-crypto-finance/?sh=298d026156d9

Why was SBF Taken Down? Couldn’t his Effective Altruism Elite Buddies save him? Its Politics. The Elites are not homogeneous, there are different factions

Bankman-Fried has since said he will contribute more than $100 million to the 2024 election. Perhaps north of $1 billion, if he has to stop Donald Trump from winning again. Speaking on the podcast What’s Your Problem, he said: “I would hate to say [a billion is a] hard ceiling because who knows what’s going to happen between now and then.”

The most hard money any individual has spent in any election cycle was $218 million in 2020 by the late Republican casino mogul Sheldon Adelson and his wife, Miriam, according to Open Secrets.

The Adelsons have competed in recent years to be the biggest donors in the country with Democratic billionaires Michael Bloomberg and Tom Steyer, who have each spent between $75 and $150 million in the last three elections (not including the money they spent on their own presidential campaigns in 2020).

Liberal billionaire George Soros earlier this year committed to spending $125 million toward this year’s midterms.

Remember, Musk is now a Republican and his Twitter Investor Binance-CZ sent out the tweet that started the run. If not for that run SBF could have kept up the fraud for as long as Enron and Madoff did (years).

But maybe not. Afterall, FTX going down is going to allow them to push through Crypto Regulations which will give the Federal Reserve control over all Crypto Exchanges and pave the way for them to monopolize Crypto with their own CBDC

Remember, JP Morgan started the banking panic of 1907 which led to support for the Federal Reserve.

So lets recap. SBF blew up and will provide support for Crypto Regulations that will give CBDC a monopoly in Crypto, hence the backing of SBF. The run on FTX was started by CZ -Binance on Twitter. CZ is one of Musks Twitter investors. Binance was founded in China. I wonder if anyone shorted FTX?

CZ dropped a bombshell on Twitter: Binance would sell off its entire FTT holding. He claimed the intention was to sell “in a way that minimizes market impact,” but the announcement led to a steep drop in the price of FTT (the token has lost almost 90 percent of its value) and a surge in withdrawals at FTX as customers began to panic about the safety of their crypto.

https://www.wired.com/story/ftx-collapse-binance-crypto-deal/

CZ is smart enough to know that if you want to dump a load of crypto or shares you do it quietly to maximize the price you get. My bet is he must have shorted FTX enough to compensate for his loss on his FTT sales

Binance was founded by Changpeng Zhao, a developer who had previously created high frequency trading software. Binance was initially based in China, but later moved its headquarters out of China shortly before the Chinese government imposed regulations on cryptocurrency trading.

In 2021, Binance was put under investigation by both the United States Department of Justice and Internal Revenue Service on allegations of money laundering and tax offenses. The UK's Financial Conduct Authority ordered Binance to stop all regulated activity in the United Kingdom in June 2021.[9]

In 2021, Binance shared client data, including names and addresses, with the Russian government.

https://en.m.wikipedia.org/wiki/Binance

Binance invested $500 million in Twitter with Elon Musk and brought down the FTX Ponzi scheme thwarting SBF’s intention to donate as much as 1 billion to the DNC to defeat Trump in 2024. Musk had reinstated Trump on Twitter a day after Trump announced his candidacy less than a week following FTX bankruptcy. This is Effective Altruism at work (of course if your a Trump fan you cheer)

PART II

OK, now for the interesting stuff. The HIDDEN HANDS. The billionaires behind Effective Altruism movement

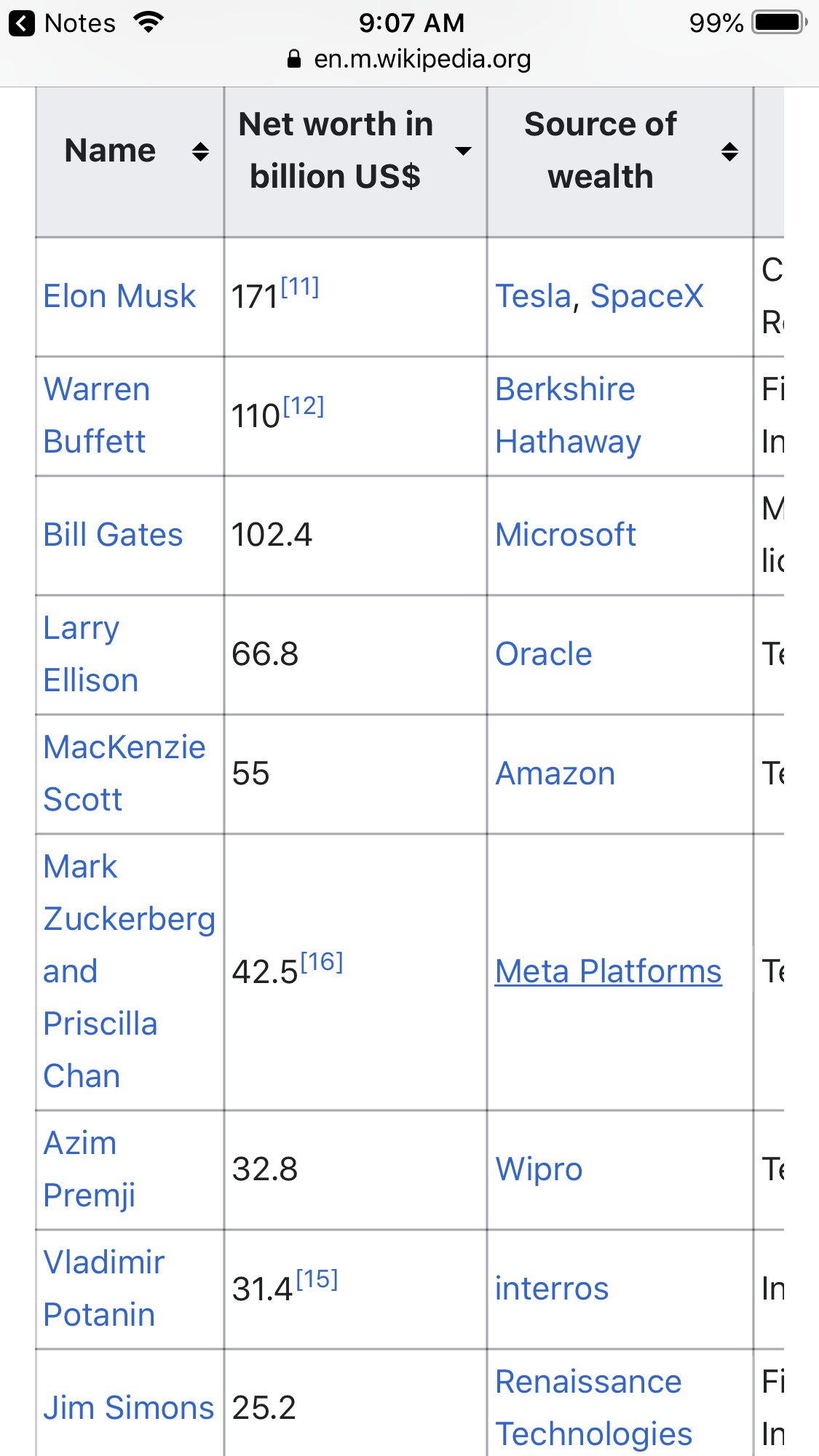

Remember the Giving Pledge which was also started in 2010?

1/

2/

3/

4 /

https://en.m.wikipedia.org/wiki/The_Giving_Pledge

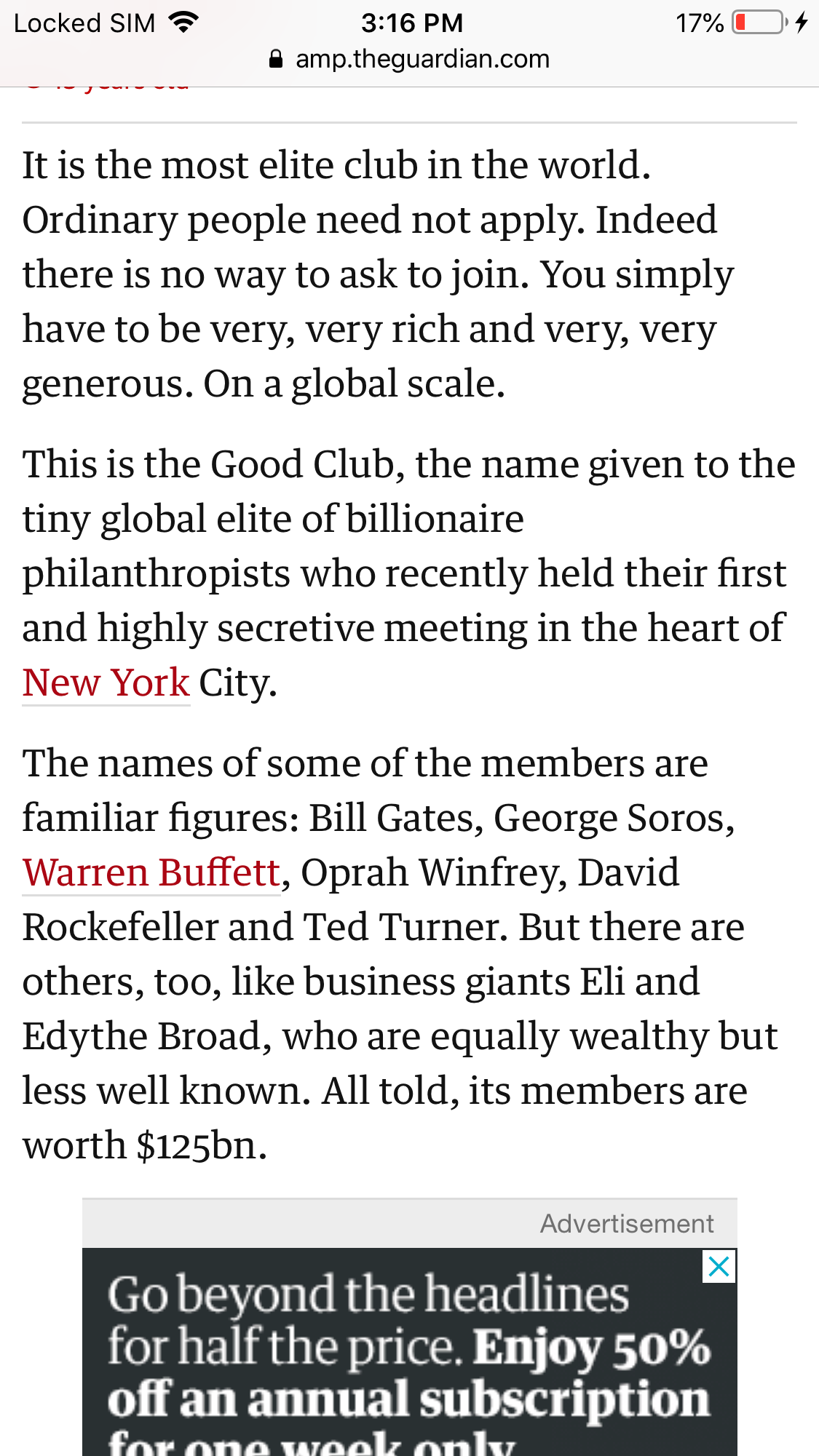

And the Good Club in 2009 (perhaps we should call them the Apostles of the Effective Altruism Religion).

https://amp.theguardian.com/world/2009/may/31/new-york-billionaire-philanthropists

Many of these names are familiar. Not so Hidden. The billionaire you probably never heard of: Nicolas Berggruen

Didn’t he act in the Game of Thrones. Lol. To be fair, the lady whose name escapes me is 6 ft 2 inches and is in heels.

He is the Philosopher King, or at least one of them. A Futurist who wants to renovate Democracy much like Deng Xiao Ping renovated Socialism by letting the Party Elite get rich. His connection to the Effective Altruism movement is perhaps not so direct, aside from an award to Peter Singer in 2021 which will be discussed later, and the Berggruen Institute is headquartered in Bahamas like FTX, but Nicolas may be just as influential as guys like Jacques Attali and Yuval Noah Hariri, but with billions to back up his futurist ideas to remake Capitalism, Democracy and Man himself.

Wikipedia has a nice summary

In 2010, he joined Bill Gates and Warren Buffett's The Giving Pledge to address some of society’s most pressing problems. [For some reason he is not on Wikipedia list]

In the same year Nicolas Berggruen founded the Berggruen Institute, an independent think tank aiming to reshape political and social institutions on governance, economic systems, globalization, geopolitics, and technology. To address these issues, Berggruen invested US$100 million into the Institute, subsequently endowing it with an additional US$500 million in 2016.

Through the Institute, Berggruen has launched several government reform projects, including the 21st Century Council, which is focused on global governance challenges, the Council for the Future of Europe, to support work on European integration. Members of the Institute's 21st Century Council include several former heads of state and government, Tony Blair, Gerhard Schröder, Helle Thorning Schmidt, Fernando Henrique Cardoso, and Nicolas Sarkozy, amongst others.

In 2015, Berggruen announced the launch of the Berggruen Philosophy and Culture Center. In collaborations with Peking, Stanford, New York, and Oxford Universities, amongst others, the Center brings together leading thinkers from around the world to ponder how culture and philosophy inform political thinking. The Center offers a fellowship program between Chinese and American universities and an annual $1 million philosophy prize awarded by an international jury.

Berggruen has committed to giving the majority of his wealth through the Nicolas Berggruen Charitable Trust.

Berggruen is a member of the Council on Foreign Relations, Director on the Board of the Pacific Council on International Policy, a member of Foro Iberoamericano, a member of the Helena Group, and a member of the Commission on Global Ethics and Citizenship. In 2013 he was appointed by Harvard's Center for European Studies as its first non-resident Senior Fellow. He was named a member of the Brookings Institution's International Advisory Council and the NYU President's Global Council.

In 2014 he was named a member of the Leadership Council at Harvard Kennedy School's Center for Public Leadership, a member of Harvard University's Global Advisory Council, and a trustee of the Asia Society.

He is also a member of the World Economic Forum.

[Of course he is]

In the early 2000s, Berggruen was dubbed "the homeless billionaire" when he sold off his residential properties and belongings. At 40 years old, he did not own a house, a car, or a watch; instead, he traveled – staying in different hotels with only a small bag of clothes and his BlackBerry. He retained his Gulfstream IV private jet, noting that it is too "practical" to dispense. In an interview with Bloomberg, Berggruen stated: "I'm not that interested in material things. As long as I find a good bed that I can sleep in, that's enough".

From 2012, Berggruen purchased several apartments in the Sierra Towers, where he lived for several years In 2016, he had two children born from one egg donor and two surrogates. He lives with them in Los Angeles. Berggruen bought a 20,000 sq ft (1,900 m2) home in Holmby Hills for $42 million in 2017.In 2021, he acquired the Gordon Kaufmann-designed, 29,000 sq ft (2,700 m2) Hearst estate in Beverly Hills for $63.1 million, at the time the most ever paid for a home at an auction.

[Boy, he sure made up for his homeless days]

https://en.m.wikipedia.org/wiki/Nicolas_Berggruen

And from Alison McDowell

The Berggruen Prize was instituted in 2016 in the spirit of a Nobel Prize, but for philosophy. A jury selects one individual annually.

In 2021 Peter Singer, an Australian whose work centers “effective altruism” won the prize. How perfect for the new imposed ethos of social impact investing, right?

In 2015 Nicholas Berggruen’s Institute began to sponsor fellowships for dozens of independent scholars pursuing research in the United States and China in partnership with Harvard, NYU, Stanford, USC, Oxford, Peking and Tsinghua Universities.

The first year it solicited “cross-cultural” and “interdisciplinary” proposals from thinkers on the following: the Autonomous Self and the Relational Self; Harmony and Freedom; Equality and Hierarchy; Democracy and Political Meritocracy; Humans and Technology; and Sustainable Innovation. All topics grounded in systems engineering of individuals and societies. There are over 110 alumni of the fellowship program, among them are:

Terra Lawson-Remer – social change entrepreneur focused on bio-tech and socio-genomic research, also member of CFR and advisor to the US Treasury Department

Stuart Candy – foresight strategist working with the UN, WEF, Ashoka, NASA, JPL, and US Conference of Mayors, Director of Situation Lab at Carnegie Mellon

Marco Ferrante – scholar of Sanskrit and Indian Philosophy researching metaphysics, language and action in early Brahmanical philosophy, and deontic logic (permissible, forbidden, required)

Gabriel Kahan – LA-based artist and technologist working on collective intelligence tied to civic participation and urban design management

Michael McCarthy – Economic Democracy Activist writing “Master’s Tools: Using Finance Against Capitalism”

Prior awards were made to Baroness Onora O’Neill, public discourse; Ruth Bader Ginsberg, gender equality; Martha Nussbaum, social liberalism; Paul Farmer, global health; and Charles Taylor, hermeneutics and social webs of relationship. You will note how the interests of the winners interlock and align with the roll out of one-world government for the global good, the UN Sustainable Development Goals, and blockchain impact finance.

Last year a fellowship was awarded to Saule Omarova, a Kazakh-born Cornell Law Professor who specializes in financial regulation and received considerable push-back on her nomination to become Comptroller of the Currency last winter.

She’d floated the idea of a “People’s Ledger” where the Federal Reserve could involve itself in consumer banking, which was alarming for many given widespread concerns around Central Digital Currency and programmable money.

John Titus explains

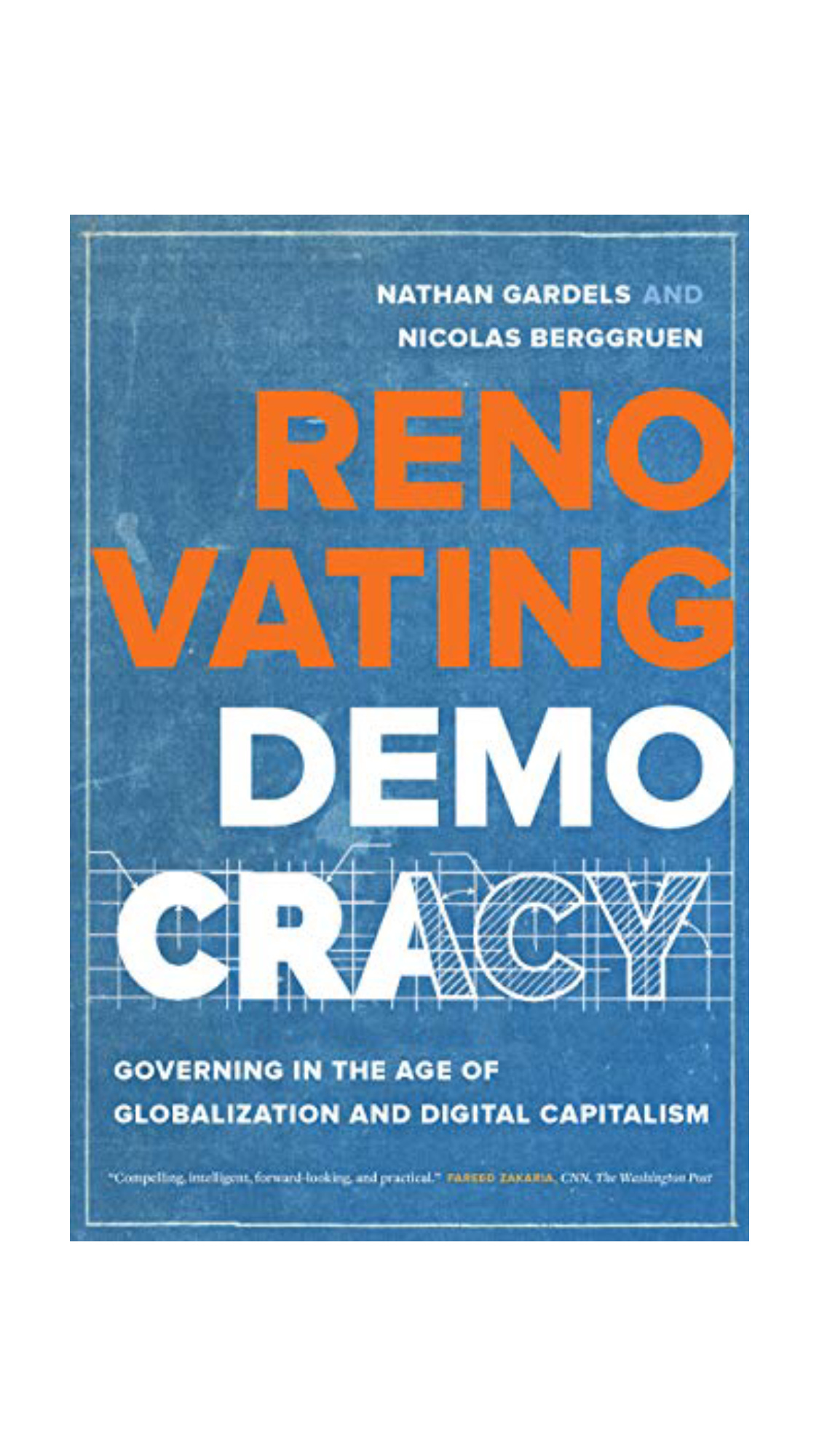

This is important, because Berggruen is looking to [redesign Democracy and capitalism itself. Actually he refers to it as Renovation in his latest book]

Nicholas Berggruen, the would-be monastic benefactor, grew up steeped in the Parisian modern art scene, made a fortune with his hedge fund rehabilitating Burger King among other undervalued companies, went on to study the Hermetica, and now seeks to bridge east and west through a global governance system grounded in non-dualism.

Zhao Tingyang, a Berggruen affiliate and member of the Chinese Academy of Social Sciences, lays out a Theory of Tianxia, or “All Under Heaven.” In ancient China the concept embodies a physical, psychological and political convergence towards harmony and a permanent peace. Harmonized digital citizens are the goal of IEEE.

Berggruen is a suave operator who’s spent the past decade courting G-20 influencers, Henry Kissinger, and Xi Jinping to join this effort, he needs an anchor point from which to launch this vision. I believe that intended anchor is California. This planned Trust Network of decentralized ledgers for avatar management must, however, be put in place before digital convergence can commence in earnest.

A dual US-German citizen, Nicholas was raised in France where his father Heinz operated a lucrative book shop and gallery space. Galerie Berggruen and Cie sold modernist prints in the 7th arrondissement two blocks from the Seine. Heinz was an avid collector, and amassed a large personal collection of Picasso, Klee, Matisse and Giacometti. A native of Berlin, he arrived in the United States in 1936 to study art history at Berkeley and married Lillian Zellerbach of the San Francisco paper dynasty. Heinz later worked at the San Francisco Museum of Art, pulling together an exhibit of Rosicrucian painter Diego Rivera’s works while engaging in an affair with Frida Kahlo. I did a couple of interesting presentations on Rivera with the What’s Left? podcast that you can listen to here and here

Make no mistake. We are in the middle of an information war. Narrative frameworks are weapons to be strategically deployed to mold consensus reality and social norms. It is not surprising that a man who founded Alpha Investment Management, a profitable hedge fund, would seek the counsel of philosophers as the big game transitions into the noosphere. Through forecasting and spell casting there’s a fine art in crafting perceived reality to ones advantage. Berggruen’s sees his network of aligned thinkers as valuable assets in his campaign to makeover life on earth, worthy of considerable investment of financial and social capital. I picture the Berggruen Institute rather like a mini-World Economic Forum, but covert and nimble.

https://wrenchinthegears.com/2022/08/29/disgruntled-neighbors-oppose-berggruens-mountaintop-monastery-synthetic-pretenders-part-14/

Transformation of the Human and Nicolas comparing his ideas to that of Socrates , Jesus Christ, Karl Marx, Spinoza and Confucius

Nathan Gardels, a veteran California political figure and foreign-affairs commentator who co-founded the institute with Berggruen and serves as Noema’s editor in chief, says the organization is “more sympathetic to the left than the right” but strives to be “post-ideological.” It wants to help make democratic governments more effective and responsive.

Dawn Nakagawa, the institute’s executive vice president, says its mission has evolved in recent years; the institute is now “a lot more unique and philosophical. The new horizon of our work is really to try to poke our nose into the unknown.”

Nakagawa cites something called the Transformations of the Human project, which developed as part of the institute. ToftH, as it is known, was initially conceived by Tobias Rees, who believed that artificial intelligence and biotechnology were redefining what it meant to be human and who wanted to foster conversations among technologists, philosophers and artists about where all of this innovation is taking us as a species. ToftH has facilitated such exchanges at Facebook, Google and other tech companies and also provided assistance on projects.

According to Nakagawa, the emphasis these days is on nurturing revolutionary ideas. “If we develop one idea that actually changes and shifts the way the world thinks, that is success,” she says. “But success may not come until long after we’re dead,” she adds, noting that “this work requires patient capital.” Berggruen, the source of that capital, seems to be very patient. He says it can take decades, even centuries, for ideas to catch on and that he is fine waiting.

Transformative insights are often not “obvious or popular” at first, and some of the greatest thinkers were persecuted. “Socrates was poisoned,” Berggruen says. “Jesus Christ ended up on a cross, right? Karl Marx was exiled. Spinoza exiled. Confucius, in effect, exiled.” He says the institute needed to show some concrete achievements or otherwise “we won’t be able to engage people.” There are, however, no near-term metrics for gauging the efficacy of what he sees as its most consequential work. We live in a “super result-oriented society,” Berggruen says, but “the one area you cannot measure” is that of fundamental ideas.

https://www.nytimes.com/2022/04/06/magazine/nicolas-berggruen-philosophy.html

The New Global Governor wants to Digitize Humans

The old one [Global Governor] is of course George Soros, who needs no introduction. He has no doubt that the world should be one big Open Society – in a word, globalization – in which borders and nation States dissolve into a kaleidoscopic mix of cultural identities in which major decisions are taken by brilliant financial oligarchs like himself.

The younger one is Nicolas Berggruen, the dashing 59-year-old Paris-born son of a leading German-Jewish art collector. Nicolas enjoys double U.S.-German citizenship and membership in the Council on Foreign Relations, the NYU Commission on Global Citizenship, the Brookings International Advisory Council, the Leadership Council at Harvard Kennedy School‘s Center for Public Leadership, the World Economic Forum – and on and on.

He helped get Emmanuel Macron elected President of France and has friendly relations with Ursula von der Leyen, head of the European Union Commission.

The billionaire has his own “think and action tank”, the Berggruen Institute, to promote his interests which center on “global governance”. He is particularly interested in technological ways to shape and guide the world of the future. The future for Berggruen belongs to digitalization and above all transhumanism. In a short video, he muses over whether or not the digital age makes us “less human”.

[just evolution, he suggests]

https://www.chromographicsinstitute.com/2020/09/so-who-is-pulling-the-strings/

A French Perspective

He made his fortune in the United States and now wants to "reform" Europe and capitalism. His think tank paid Sylvie Goulard when she was an MEP. But who is billionaire Nicolas Berggruen really? Inquiry.

"Democracies are in crisis. They need to be reformed." So says Nicolas Berggruen, 58, in impeccable French, at Radio France's investigation cell from his Los Angeles office.

Today, the German-American businessman's fortune is estimated at $1.6 billion, according to Forbes magazine, but his background and ideas remain largely unknown to the general public.

Nicolas Berggruen tries to become in his own way what George Soros is: a statesman without a state, explains one of his relatives, Alain Minc. In political life, there is power and influence. Berggruen wants to be on the side of influence."

And Nicolas Berggruen thinks big. In a promotional video posted on December 2, 2019, the businessman is seen walking around his Los Angeles offices. "Look at this," he said, pointing to a wall full of post-it notes. This is what we are working on: the transformations of the human being. Big questions for humanity. Where are we going? Who are we? What do we want to become?" It sounds very ambitious," says a voice behind the camera. "You have to be ambitious, if you want to change things," replies Nicolas Berggruen, sure of himself, before rushing into an elevator with lifter.

Since 2016, the Berggruen Institute has awarded an annual prize "for philosophy and culture" of one million dollars (better endowed than the Nobel Prize). In 2019, this award was presented to an American judge, a member of the Supreme Court.

It is not only the world of entertainment that Nicolas Berggruen rubs shoulders. "He has always been a pillar of economic forums like the one in Davos," says Pascal Lamy, who frequented him in the 80s when he was chief of staff to the President of the European Commission, Jacques Delors. He has always been close to European leaders, especially German and French."

Since 2010, Nicolas Berggruen wants to "change the world" with "ideas", says the website of his institute.

The Berggruen Institute is organized around several circles: first there is an American group responsible for working on "Californian governance" including former Google CEO Eric Schmidt or former Secretary of State in the Bush administration, Condolezza Rice. "California is a good laboratory for renovating democracy," said Nicolas Berggruen in an interview with the Nouvel Économiste (reading reserved for subscribers).

Then there is a second circle devoted to Europe: a group called the Council for the Future of Europe in which we find almost all the former European leaders of the conservative or "social democratic" family, in the manner of the English Tony Blair. They include France's Jacques Delors, Italy's Mario Monti, Belgium's Guy Verhofstadt, Germany's Gerhardt Schröder, Spain's Felipe González and Sweden's Carl Bildt..

The meetings of this Council for the Future of Europe are most often held in London, Paris, Rome or Berlin.

Some economists are also part of this council such as Jean Pisani-Ferry, a close friend of Emmanuel Macron. Or the American Joseph Stiglitz, Nobel Prize winner in economics, one of the few Keynesian personalities present at the Berggruen Institute.

"It is an institute committed to the market economy and liberal democracy intended to promote European unification, summarizes Alain Minc, member of the various Berggruen committees. But the Council's influence on the future of Europe should not be overestimated. We meet once or twice a year, Berggruen pleads the ideas that come out of his institute to the political leaders... It doesn't break a duck's leg!"

The Berggruen Institute has another structure called the 21st Century Council, which meets once a year in New York. They include many figures already present in the Council for the Future of Europe, with other political or business personalities such as former head of state Nicolas Sarkozy, American director James Cameron, the boss of Space X and Tesla, Elon Musk, the CEO of Free, Xavier Niel, or the former director general of the World Trade Organization, Pascal Lamy.

Most of these names are also on the board of WorldPost, a publication funded by Nicolas Berggruen.

"Our discussions are very free because they are confidential, testifies Pascal Lamy. We talk about big topics such as technology, the future of artificial intelligence, biotechnology, the United States, China and Africa. It obviously serves to influence things, given that power is influence plus annoyance, and that influence is power without annoyance."

In addition to its various circles, the Berggruen Institute has an impressive list of "members and advisors". On the French side, we find the former advisor to François Mitterrand, Jacques Attali, who spoke at the conference at Sciences Po Paris in May 2013 at the invitation of "his friend" Nicolas Berggruen, the former Minister of National Education Luc Ferry, or the philosopher Bernard-Henri Lévy..

[Attali is another Futurist-here is a twitter thread on him

1/1981 Bilderberger Jacques Attali interview on his 1979 book-Cannibalism and Civilization: Life and Death in the History of Medicine. Its in French and excerpts translated.end ]

Nicolas Berggruen is not only a businessman who wants to influence the progress of the world. He also presents himself as a "philanthropist".

In 2010, the businessman joined a campaign launched by billionaire Warren Buffet and Bill Gates to encourage wealthy people to give their money for philanthropic actions: "The Giving pledge".

Within The Giving Pledge, we also find the name of the financier Michael Milken, whose institute (The Milken Institute) organized in May 2019 a debate in a large hotel in Beverly Hills on the theme: how to "reform capitalism" to avoid "revolution" or "socialism"?

Asked about the exact role played by his trust dedicated to "charitable" actions, the spokesperson of the Berggruen Institute replied as follows: "Nicolas Berggruen's charitable trust finances many educational and cultural activities, such as the Berggruen Museum in Berlin [a museum that brings together the private collection of paintings bequeathed by the father of the businessman, Heinz Berggruen, Editor's note]. It facilitates and reinforces Nicolas Berggruen's involvement in The Giving Pledge. Most of Berggruen's investments are donated to charity. Nicolas Berggruen is a long-time member of the Giving Pledge, which encourages wealthy individuals to donate more than half of their assets to philanthropic or charitable works during their lifetime, or in their will."

"The common point of the members of the Giving Pledge is not to question a system that has led 1% of the world's population of which they are part to own half of the wealth, says Lionel Astruc, author of a book-investigation on the Bill and Melinda Gates Foundation. By creating, with Warren Buffet, The Givin Pledge, Bill Gates provides them with a communication tool that gives them the image of major donors through what is called philanthrocapitalism. These wealthy philanthropists thus strengthen their position and ideology.."

READ ALSO – The offshore galaxy of Nicolas Berggruen

This "philanthrocapitalism" goes hand in hand with frequent recourse to tax havens.

According to documents consulted by Radio France's investigation unit, many companies used by Nicolas Berggruen in his business and in the context of his institute are domiciled in offshore places. The Berggruen Institute is domiciled in Bermuda, as is its charitable trust.

[Gee, I wonder if they are neighbors with SBF and the rest of the FTX Mafia]

A friend of Lord Jacob Rothschild and China, and perhaps a Pronatalist too?

He was a swashbuckling financier famous for living out of a private plane while dating a parade of beauties, but he gave it all up for single parenthood and his very particular California dream.

Who is he? "He is very unusual, very unpredictable," says British financier Lord Jacob Rothschild, who has known Berggruen all his life.

Another wing of the Institute has technologists like Elon Musk and Twitter co-founder Jack Dorsey, as well as former treasury secretary Larry Summers. Its main focus is China, a country that clearly holds a personal fascination for Nicolas. "China's rise means the West will have to coexist with it if the world is to prosper safely," he says.

Elon Musk was the person who first raised the idea of children with Nicolas. A father of five, Musk told Nicolas, "You must!"

[In 2016, he had two children born from one egg donor and two surrogates. Only two, so he is no Jeffrey Epstein. I bet he made sure the egg donor was tall]

https://www.townandcountrymag.com/society/money-and-power/a5994/nicolas-berggreun-interview/

That last part leads us to the Ideology of pronatalism espoused by some elites

Black writes that pronatalism – an ideology centred on having children to reverse falling birthrates in European countries, and prevent a predicted population collapse – is “taking hold in wealthy tech and venture-capitalist circles”, with the aid of hi-tech genetic screening.

Musk has championed pronatalist ideas publicly. Privately the Tesla co-founder is, in his own words, “doing my part”; he has 10 children known to the public, two of whom are twins he fathered with an AI expert who serves as an executive for his Neuralink company. But the ideas go beyond Musk and into the canyons of Silicon Valley; the world’s richest and most powerful people see it as their duty, Black claims, to “replicate themselves as many times as possible”.

Black’s subjects also namecheck effective altruism, longtermism (which prioritises the distant future over the concerns of today), and transhumanism (the evolution of humanity beyond current limitations via tech), as complementary philosophies. The concept of legacy is key to understanding our tech pioneers. As one interviewee tells Black, “The person of this subculture really sees the pathway to immortality as being through having children.”

https://www.theguardian.com/commentisfree/2022/nov/25/big-tech-business-model-silicon-valley-twitter

From Berggruens latest book

In the fall of 2016, Sigmar Gabriel, then Germany’s vice-chancellor, concisely captured the backlash roiling politics in his country and the rest of Europe. “As the average citizens see it,” he said, “first the authorities spent billions on bailing out the banks, and now are spending generously on refugees from war-torn Syria and elsewhere—meanwhile cutting back on pensions, unemployment payments and other social benefits through austerity policies. ‘What about us?’ they ask.” When people retreat into their own suffering, better angels lose their wings. That attitude may not make saints of citizens, but neither does it make them sinners. In the 2016 US presidential race, Donald Trump tapped into this kind of disaffection. His mantra that the cosmopolitan caste had opened the doors wide to immigrants and the globalizing theft of manufacturing while failing to first provide security, protect jobs, and promote the interests of ordinary citizens was convincing enough to win the day. And he is not entirely wrong.

[yes of course, to win an election you tell the voters what they want to hear and then you do whatever your corporate and elite backers want while making excuses why you cant deliver on your promises]

A Berggruen Institute working group that included participants from Facebook and Google as well as Ghonim and others met in Silicon Valley in 2017 to address the risks that social media and the deteriorating health of our information ecosystem pose to democracy. The group concluded that large social network platforms must indeed be considered “media” outlets with editorial responsibilities. Algorithms are, after all, editorial decisions. Their design determines what is published and promoted and what is not. As such, algorithms must be subject to rules of transparency and accountability.

The main conflict in sorting out this issue is the existential threat to democratic governance from self-referential silos of fake news, alternative facts, and hate speech that are at odds with the bottom-line business model of social media platforms based on monetizing attention through engagement and virality, whatever the truth content of information. In this regard, philosopher Onora O’Neill is right to criticize what she calls “cyber romantics,” who defend absolute free speech as the be all and end all. The truth content and verified trustworthiness of information and sources, she contends, is equally important in “the ethics of communication.”

In European countries and China, governments have few qualms about stepping in and making the rules. China has deployed hundreds of thousands of censors to track social media and delete troubling posts.

[so the solution is we must become like China]

In 2019, he and Nathan Gardels published the book "Renovating Democracy" . Governance in the era of globalization and digital capitalism proposes three new ideas: no participation of populism, universal basic capital and active nationalism.

The book proposes that the best way to deal with inequality is to "distribute justice in advance" instead of eliminating inequality by taxing wealth and redistributing it.

The specific method is through universal basic capital and sovereign wealth funds. "Rather than waiting for the company to succeed and use taxes to share wealth, why not make everyone a successful stakeholder from the beginning? The specific operation can be: When an entrepreneur starts a new company, he only owns 70 % Or 80% of the shares, and the other 20-30% is contributed to a sovereign foundation belonging to the society, which is jointly owned by all citizens. Singapore already has a similar sovereign foundation.

This concept can play a good role in China. Districts Blockchain technology makes operations feasible and transparent. China is the easiest place to implement this solution. This is actually a socialist idea, but it does not destroy the vitality of the economy."

https://www.nicolasberggruen.com/writings-blog/interview-with-nicolas-berggruen-thought-changes-the-world

Berggruen has recruited so many prominent names to the institute’s roster of supporters and advisers — Eric Schmidt, Reid Hoffman, Arianna Huffington and Fareed Zakaria are among those listed on the organization’s website — that it has been described as his own personal Davos.

His name also appears on the institute’s annual $1 million Berggruen Prize for Philosophy and Culture. Last year’s recipient was Peter Singer, the moral philosopher and bioethicist.

Tobias Rees, a German American philosopher whose work has been supported by the Berggruen Institute, suggests that Berggruen might best be thought of as a kind of latter-day Medici. He is, Rees says, a wealthy patron trying to stimulate a “philosophical and artistic renaissance or spring for our times.”

Berggruen made most of his money in private equity. According to Forbes, he has a current net worth of $2.9 billion.

https://www.nytimes.com/2022/04/06/magazine/nicolas-berggruen-philosophy.html

The Ackman Connection. Although there is no direct relation between Berggruen and Epstein or Trump , or even Crypto, there is a rather tenuous connection through his fellow billionaire Bill Ackman

Bill Ackman, the well-known hedge-fund manager, met Berggruen in the early 1990s. At the time, Ackman says, Berggruen seemed “mature beyond his years.” The two of them have been partners in a number of deals. He describes Berggruen as “extremely smart and sophisticated” and an excellent investor — patient, in for the long haul, “good in up-and-down situations.”

But when I met with Berggruen one afternoon at Sierra Towers, he told me that he had found little fulfillment in his career in finance. He said he was “never that excited about it or proud about it” and that he had greater respect for people “who build something.” We sat in an alcove set back from the floor-to-ceiling windows that offered a commanding view of Los Angeles. It was an unseasonably chilly day, but the sun still cast a warm glow over the city.

“Even today, a winter day, you have this light — it’s very energizing,” Berggruen said. As we talked, he nibbled on Swiss chocolate. He said he wished that he’d had the talent to start a business or to be a creator of some kind. Instead, he had just been “skilled at a game.”

https://www.nytimes.com/2022/04/06/magazine/nicolas-berggruen-philosophy.html

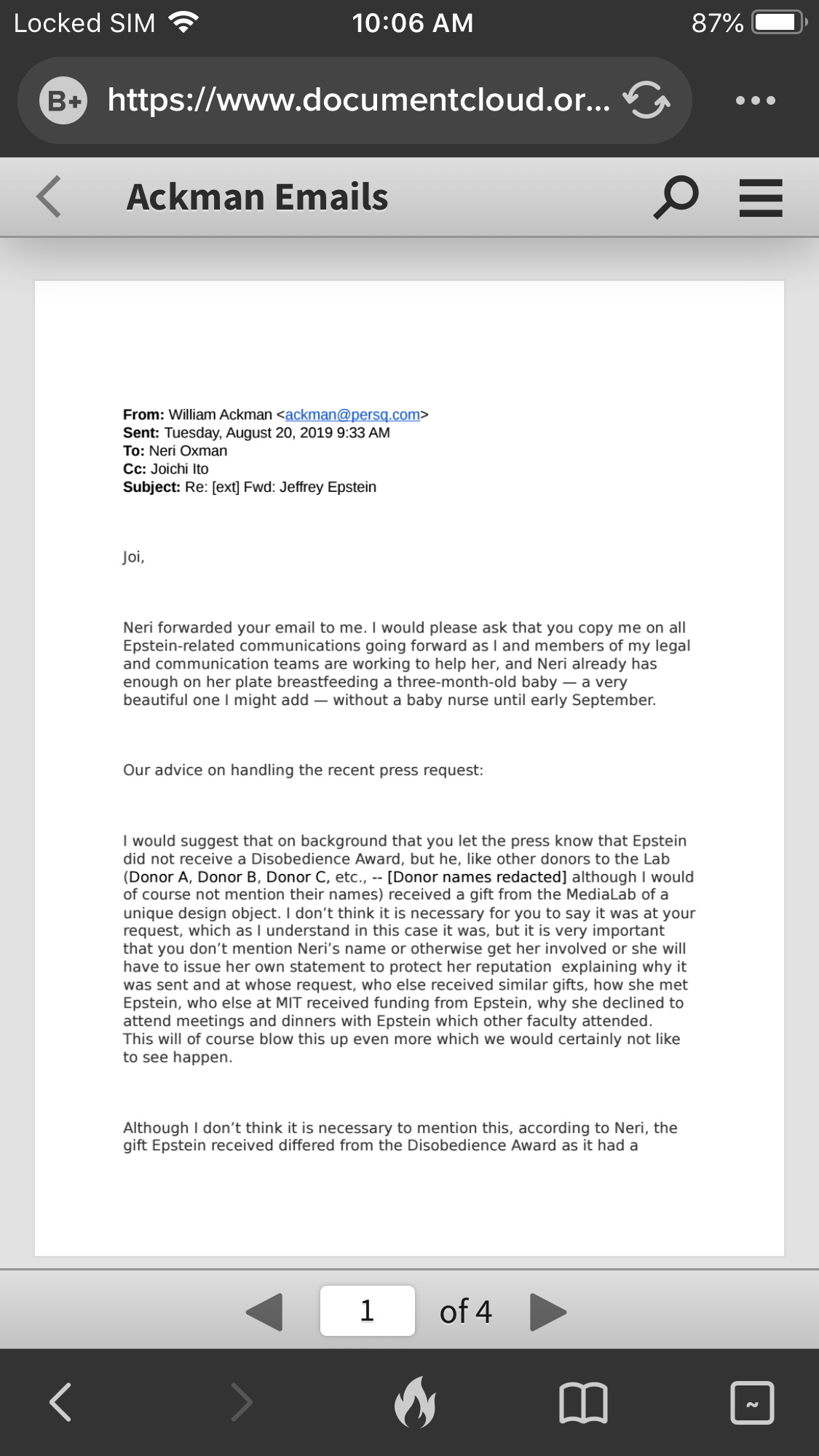

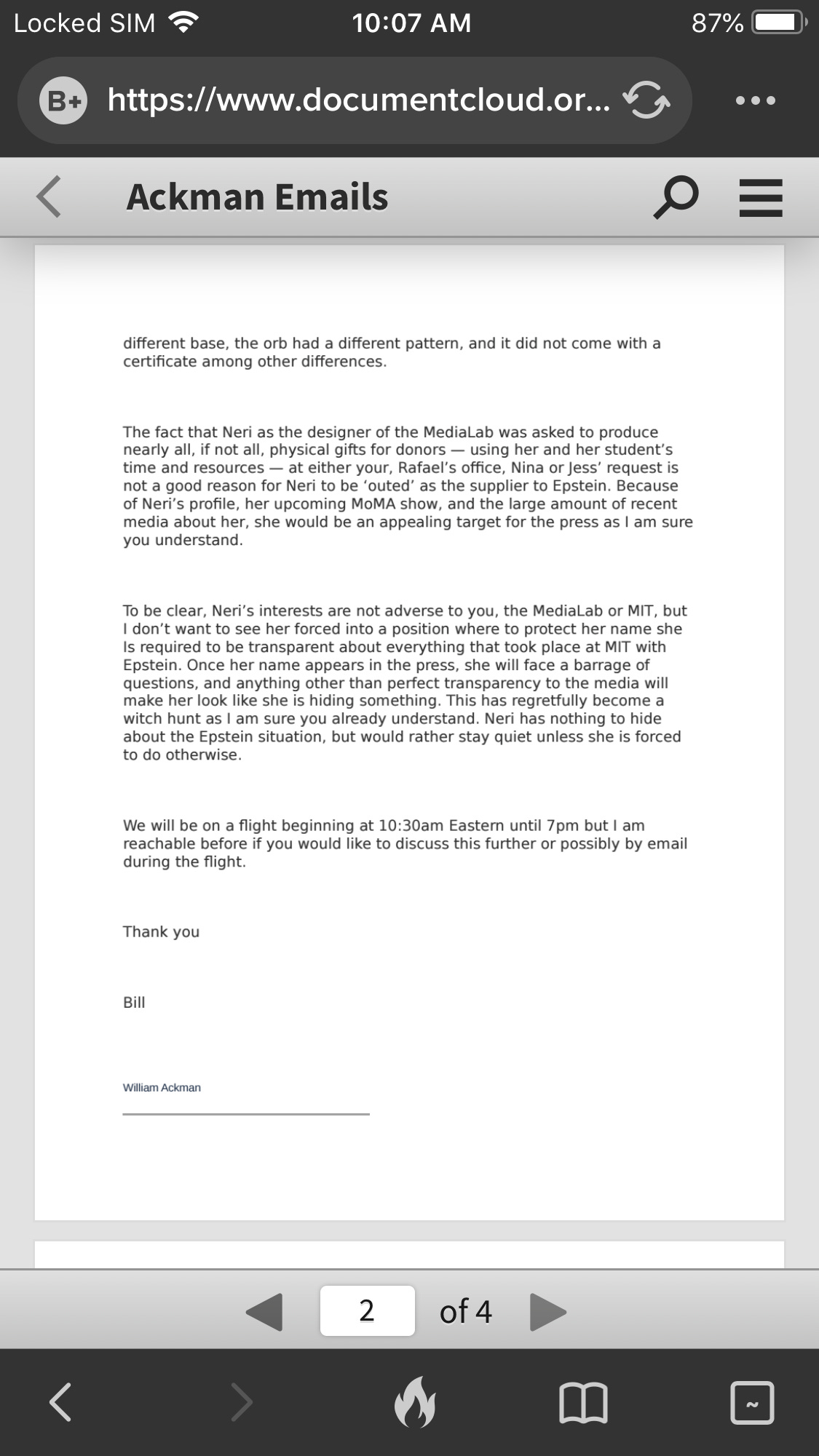

In newly revealed emails, hedge fund manager Bill Ackman urged former MIT Media Lab director Joi Ito to avoid naming his wife — MIT professor Neri Oxman — when discussing Jeffrey Epstein, the Boston Globe reports.

The state of play: In 2017, Oxman produced a gift for Epstein after he donated $125,000 to her lab. In Oxman’s statement to the Globe, she said MIT required Epstein’s gifts to her lab be kept confidential. Per email records, Ito asked Oxman how to respond to media queries and Ackman then raised concerns about his wife's name being tied to Epstein.

"...it is very important that you don't mention Neri's name or otherwise get her involved ... I don't want to see her forced into a position where to protect her name she Is required to be transparent about everything that took place at MIT with Epstein."

— Bill Ackman, in an email to Joi Ito and Neri Oxman on Aug. 20

The big picture: Epstein made at least $7.5 million in donations anonymously or circuitously to the MIT Media Lab.

LinkedIn founder Reid Hoffman — and MIT professor Neri Oxman, in a statement obtained by the Globe — said they only came into contact with Epstein through Ito for Media Lab fundraising. Ito resigned from the lab last week.

https://www.axios.com/2019/09/14/joi-jeffrey-epstein-ties-mit-media-lab-professor

[Basically the email implied Ackmans wife had some damaging information related to MIT’s relationship with Epstein that she would disclose of named]

1/

2/

Ackman made a $2.6 billion profit on just a $27 million investment in credit hedges in March 2020 when the spread of Covid-19 tanked markets.

https://www.forbes.com/profile/william-ackman/?sh=1594c886298d

Longtime hedge fund manager Bill Ackman on Wednesday advised President Donald Trump to shut down the U.S. for one month in an effort to contain the novel coronavirus and said financial markets would rally in response to such decisive action.

Ackman, who founded Pershing Square Capital Management, called on the president to both close the nation’s borders as well as offer Americans a one-month rent, interest and tax holiday to help offset an expected deceleration in U.S. GDP growth.

“Mr. President, the only answer is to shut down the country for the next 30 days and close the borders. Tell all Americans that you are putting us on an extended Spring Break at home with family,” Ackman wrote on Twitter.

“The moment you send everyone home for Spring Break and close the borders, the infection rate will plummet, the stock market will soar, and the clouds will lift,” he added.

https://www.cnbc.com/2020/03/18/bill-ackman-advises-trump-to-shut-down-us-says-market-would-soar.html

Hedge fund manager billionaire Bill Ackman, the CEO of Pershing Square Capital, opened up about his morning after Election Day.

“I woke up extremely bullish on Trump. My thinking is as follows — the United States is the greatest business in the world and it’s been under-managed for a long time. We now have a businessman as president and he has power because the Republicans control Congress and the Senate,” Ackman said at the DealBook Conference.

https://finance.yahoo.com/news/bill-ackman-i-woke-up-extremely-bullish-on-trump-001724057.html

Ackman is a signatory of Bill Gates’s The Giving Pledge, committing himself to give away at least 50% of his wealth to charitable causes. In 2006, Bill and Karen Ackman founded The Pershing Square Foundation to support innovation in the areas of economic development, education, healthcare, human rights, arts and urban development. Since it was founded, the Foundation has committed over $160 million in grants and social investments.

https://jewishbusinessnews.com/2013/02/03/the-fighter-%D7%9C%D7%99%D7%A0%D7%A7-%D7%91%D7%99%D7%9C-%D7%90%D7%A7%D7%9E%D7%9F/

Billionaire investor Bill Ackman has performed an about-face on his previously icy attitude towards crypto, saying that it is “here to stay.”

The founder and CEO of hedge fund management company Pershing Square revealed that he is now a “small direct investor” in several crypto projects, including Dimo, a vehicle data-collection platform, Origyn, an art certification platform, and Goldfinch Finance.

https://news.yahoo.com/billionaire-bill-ackman-does-u-123400481.html?guccounter=1&guce_referrer=aHR0cHM6Ly9kdWNrZHVja2dvLmNvbS8&guce_referrer_sig=AQAAABQmhYZSjgvpvdRrOB8iDQPFeajc2zJEkv2pnS7aiHe-fiDGroCzjcpT9wagENacy18W8t0E7QXVbIsw_ViBmtoJlDTdZ-PxDow_nlvbsK30AeQT-Mb-U9TU_cSz9KUVwrTPiM1i5SK4CysjnpCUcQ9nmTB3yqF_zRk8WLfyWDfy

In a tweet Ackman said “I was a very fortunate day one investor in @Coupang. (South Korean e-commerce company based in Seoul, South Korea, and incorporated in Delaware, United States.) As a result of its incredible success, 26.5 million shares of its stock will benefit humanity.” He went on to say that he was donating the shares — worth nearly $1.34 billion as of Monday’s closing price of just over $50 a share — to his Pershing Square Foundation, and to an unnamed donor-advised fund and a nonprofit. A representative for Ackman declined to comment.

https://www.forbes.com/sites/anastassiagliadkovskaya/2021/03/15/billionaire-bill-ackman-donates-13-billion-of-his-coupang-shares-to-philanthropy/?sh=683133da1073

[so he makes 1.4 billion in 2020 and donates almost as much in shares in Coupang to his foundation which he will still control. This effectively means no tax on his 1.4 billion profits. The wonders of Philanthrocapitalism]

Supposedly Ackman had some business dealings with Trump in the 90’s but I cant find any links to details on what they may have been

Part III- Philanthrocapitalism

What all of this corruption and human and social engineering has in common is Philanthrocapitalism. This is Capitalism on Steroids because it takes the Evil of Capitalism and packages it as Good.

Well Regulated Competitive Capitalism is Good. It provides innovation and distributes wealth based on Merit. Properly regulated it allows enough for society to take care of the poor. Whether thats from taxing surplus profits and wealth, printing money out of thin air, or just good old charity direct to the needy without any profit incentive.

The Evil in Capitalism is seen when the Government and Regulators partner with the Rich Capitalists and use regulation to increase their Monopolies and Profits at the expense of the bottom 90% , without paying their fair share.

Over the last 30 years the wealth inequality has increased tremendously, and living standards for the bottom 90% have plummeted, although this is partly hidden behind statistical manipulations of GDP, CPI, Unemployment and Average Income and by conflating the health of the economy with the Stock Market which is propped up by the Fed Money Pump and Corporate buybacks.

People were starting to wake up, especially after the 2008 Financial Crisis that was a result of fraud and corruption on a scale that’s dwarfs SBF /FTX petty theft. Not a single Bankster went to jail. On the contrary, they got trillions in bail outs as many homeowners lost their homes and savings, dupes much like FTX customers, fooled into thinking prices only go up and interest rates will never rise again