Trumps basically running on immigration and the economy. His lies on both have created a hyperreality or Sorcerers Circle (MAGA means Sorcery in Latin) for those buying into them.

Having already posted on immigration its time to tackle the economic claims and promises.

https://pete843.substack.com/p/immigration-lies-and-more-fema-port

First off as I post this inflation is running at 2.5%, stock market hitting record highs, unemployment 4.1%, interest rates are dropping. Of course, the deficit and debt are at record highs although half of the deficit is from interest on the debt thanks to the Feds futile and damaging high interest rate policy which does not combat inflation caused by supply line disruptions and collusion.

Trump presents his plans in rambling speeches with little detail or facts. Harris provided hers in writing.

https://www.npr.org/2024/09/24/g-s1-24359/trump-economy-speech-savannah-georgia-tariffs-steal-jobs

Lets start with Trumps. It really comes down to tax cuts for the rich and tax increases for the poor with him. Somehow this will create an economic expansion and pay for itself with the help of tarrifs.

TARRIFS

They get paid by Americans, mostly the final customer. Furthermore, these higher prices then get matched by American made product. Study after study shows this to be true. Washing Machines a good example

Its unclear what Trumps tariff policy will be. He started off at 10%, then 20% across the board with 60% on Chinese made goods. Now recently added 100% on any country abandoning the dollar. That probably wont include his pals the Saudis.

This wont bring a return of much manufacturing to US but might cause some Chinese manufacturing to relocate outside China with CCP permission

Since we import over $3 trillion a year, with 500 billion imports from China you can see we will collect $800 billion in tariffs. About $700 billion more than present.

Thats about $2000 per person. Yikes

A report from the Peterson Institute estimates that Trump's tariff regime would impose an additional annual cost of $1,700 for the average middle-income family. And Oxford Economics estimates that Trump’s combination of tariffs, immigration restrictions and extended tax cuts could also increase inflation and slow economic growth

Of course, maybe people buy less because they can not afford it and we import less

The Committee for a Responsible Federal Budget, a nonpartisan group that seeks lower deficits, found that Mr. Trump’s various plans could add as much as $15 trillion to the nation’s debt over a decade. That is nearly twice as much as the economic plans being proposed by Vice President Kamala Harris.

And an analysis from the Institute on Taxation and Economic Policy, a liberal think tank, found that Mr. Trump’s tax and tariff plans would, on average, amount to a tax increase for every income group except the top 5 percent of highest-earning Americans.

On the high end, Mr. Trump’s plans would cost $15 trillion over 10 years, while Ms. Harris’s would cost $8 trillion. In a midrange scenario, the former president’s second-term agenda would cost $7.5 trillion and Ms. Harris’s plans would cost $3.5 trillion. And at the low end, Mr. Trump’s plan would add $1.45 trillion to the debt by 2035 while Ms. Harris’s would add nothing, making it “deficit neutral.”

Overall, Mr. Trump’s plans would provide a tax cut worth, on average, 1.2 percent of overall income for the richest 1 percent of Americans, while the rest of the top 5 percent would see a 1.3 percent boost. Every other income group would lose money because of the higher costs created by the tariffs, with the bottom 20 percent experiencing a loss worth 4.8 percent of their income on average.

https://www.nytimes.com/2024/10/07/us/politics/trump-economic-plans-debt-costs.html

TAX CUTS

But Trump will also cut taxes. First and foremost income tax for the rich (many pay an effective tax rate in single digits), lower the corporate tax rate (40% pay none and most of the rest have effective tax rates in single digits) , eliminate the death tax (for those leaving $13 million or $26 million (couples) behind.

He may also remove the current $10,000 cap on deducting state/local tax

But there is more, Trump will repeal Reagans tax on Tips, Social Security and also on Overtime, and allow tax deductions for interest on car loans

Most of those relying on tips don’t pay much tax. They don’t earn enough. Same with those relying entirely on Social Security for their income. Overtime is generally only paid to union workers who are diminishing in numbers in the private sector and non union jobs paying over $40,000 are exempt from OT. As for car loan interest, it wont amount to much for most once interest rates drop. So these are crumbs for the working class

No tax on tips could be a bonanza for highly paid executives though. These guys are customers of the Corporate Board who buys their services with a salary. Those big bonuses (7 figures) may be called tips. Yay-no tax.

DEFICIT-DEBT

Of course, Trump never tells you how much revenue this will cost the Federal Govt. He hardly mentions the deficit or debt as he promises to deport millions of illegal migrants (which could cost $1 trillion) and rebuild the military and infrastructure

He says he will increase efficiency with the help of Musk as a Czar but what does that mean exactly. Buy less? Cut prices? Fire a bunch of Federal Employees?

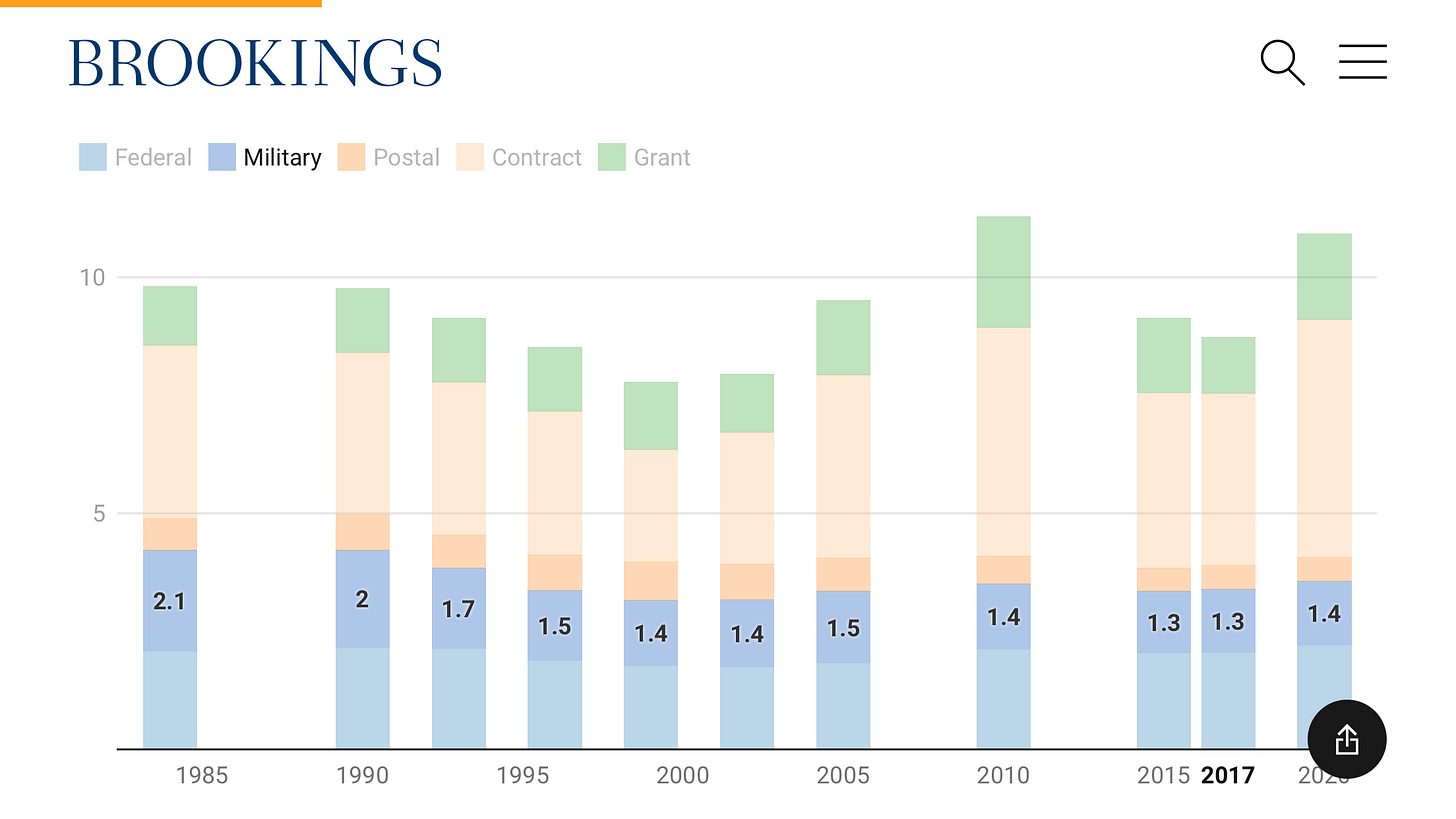

Last time Trump was in office

Despite campaign promises to the contrary, Trump opened the contract and grant spigots instead, adding more than 2 million jobs to the blended federal workforce, including 1 million in the Departments of Defense, Transportation, and Health and Human Services alone.

https://www.brookings.edu/articles/the-true-size-of-government-is-nearing-a-record-high/

From 9 to 11 million. Wow. These include civil servants, postal workers, active duty military, contractors, and grantees

Having a lot more unemployed people probably doesn’t boost the economy much. Neither does reducing spending as much of goes to either to employees or government contractors

Trumps supporters say the Economy will go boom and so government will collect more revenue despite the tax cuts. But that didn’t hold true for Reagan, Bush Jr or Trumps last cuts. Voodoo economics doesn’t work

We all know what Trumps got his eye on. Even though he disavows anything to do with Project 2025 the real goal is privatization and gutting Social Security and Medicare. Thats not going to win him an election so doesn’t say.

HOUSING PRICES

He promises to solve the housing crisis by removing regulations adding to the cost to build new homes but these regulations are mainly from state and local entities. And why would builders build more if it means they earn less due to price drops

This is the same issue with energy prices. Drill Baby Drill wont work because Oil companies are not stupid. It costs money to drill. If prices drop

they voluntarily stop drilling new wells until prices rebound

INFLATION

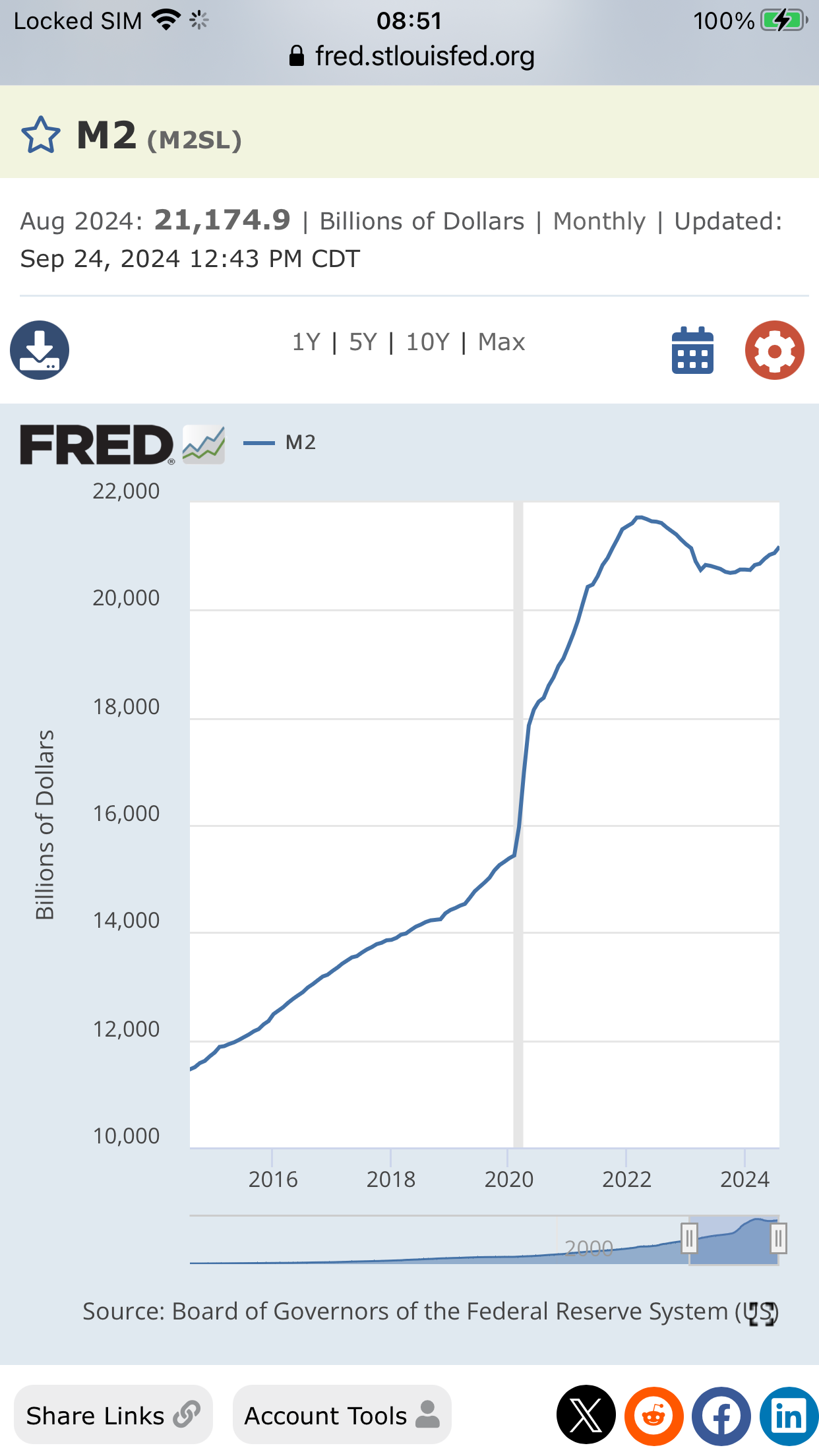

This has become an oversimplified issue written off as being a function of only government spending and money supply. The government only spends money that has been created by commercial bank lending, since the Fed Reserve Banks are not allowed to buy them direct. An exception was made in 2020 by Trump and Congress, and the Feds infusion led to over $5 trillion increase in the money supply (stimulus checks amounted to 600 billion in 2020, most of that coming in the second half).

Obviously, this led to some inflation after Trump left office when everything opened up. Supply disruptions that occurred after things opened up also led to price increases, and some of that was out and out price gouging due to tacit collusion. Furthermore thousands of small business closings due to lockdowns due to reduced competition led to higher prices as well.

A lot of this is attributed to Actions occurring in 2020 and as part of Trumps fiscal year 2021 budget that Biden also supplemented to alleviate the damage done.

We also had an issue with refineries closing in 2020 due to the Pandemic. Once closed they don’t reopen or get rebuilt. This leads to insufficient refinery capacity during peak periods and with less competition tacit collusion is inevitable. This drives up prices at the pump. Releasing Oil Reserves cant get past the Refinery Bottleneck, that just fattens Refineries profits.

Then we had the Fed jacking up interest rates. This led to higher costs for companies to service their debt, which like tariffs they pass on to customers. Tarrifs also contributed to some of this albeit in a minor way

The Russian-Ukraine War and Sanctions also spiked energy and food prices. This is on Biden.

So high inflation just wasn’t one issue, but a constellation of issues which resulted from Operation COVID in 2020

While prices rarely go back down again except for commodities, price inflation is now back down to 2.5%. Wage increases will need to close the gap, but this can also be inflationary

Deportation

Trump's promised to carry out "the largest domestic deportation operation in American history" not unlike President Eisenhower’s Operation Wetback

The governmental infrastructure required to arrest, process, and remove 13 million undocumented immigrants would cost nearly $1 trillion over 10 years and would deal a "devastating" hit to economic growth, according to a report published last week by the American Immigration Council (AIC). The think tank estimates that a mass deportation plan would shrink America's gross domestic product by at least 4.2 percent, due to the loss of workers in industries already struggling to find enough labor.

https://reason.com/2024/10/07/trumps-deportation-plan-would-cost-nearly-1-trillion/

Beyond the cost we would literally need to be turned into a Police State. Consider what it would take.

Trump promised to invokes the Alien Enemies Act of 1798, which was used during the war of 1812 and to inter American citizens of Japanese ancestry during WWII.

Trump pledged to launch “Operation Aurora,” a plan to deploy the military on U.S. soil to seize, detain, and deport immigrants he deems dangerous. “Can you imagine? Those were the old days when they had tough politicians, have to go back that long,” he told a rally on Saturday. “Think of that, 1798. Oh, it’s a powerful act. You couldn’t pass something like that today.”

https://www.brennancenter.org/our-work/analysis-opinion/alien-enemies-act-rears-its-head

You then need to

build massive concentration camps capable of holding over ten million people. Remember when those of us on the right would become alarmed over reports about hidden FEMA camps being built

Large sections of the detention camps may be reserved for “the enemy within,”

As Trump told Fox “News”:

“We have the outside enemy, and then we have the enemy from within, and the enemy from within, in my opinion, is more dangerous than China, Russia and all these countries.”

So how do you go about catching them?. If you have a foreign accent or are not white you may be asked proof of citizenship on the street. Worse, anyone living within 100 miles from the coast or a border (2/3 of Americans do) you could be subject to warrantless house searches and seizures

https://www.aclu.org/know-your-rights/border-zone

Perhaps they take the technology used to build a virtual wall at the border and use them at state border checkpoints or in cities, all the while continue to collect biometric data on citizens

With the help of Elon and other Billionaire Owned Social Media sites verifying your ID and guys like Peter Theil helping government to match up your social media identity with your real identity and biometrics, almost everyone will be able to be tracked, not just illegal aliens, and those deemed an enemy from within detained.

USMCA

“We are looking at the USMCA, NAFTA 2.0 trade deal. That would be very important and would add a half a point of GDP and 180,000 new jobs per year if we get that through.”

— Larry Kudlow, director of the White House National Economic Council, in an interview on “Fox News Sunday,” Aug. 18

https://www.washingtonpost.com/politics/2019/08/26/will-revised-nafta-deal-add-jobs-every-year/

Auto firms and suppliers are choosing to forgo USMCA’s preferential treatment and export to the U.S. under World Trade Organization rules. This is because USMCA’s zero-tariff isn’t worth incurring the cost of rejigging supply chains to meet the rules of origin.

Since the U.S.’s most favored-nation car tariff is 2.5 percent, the concern has long been that USMCA’s rules of origin would just lead Canadian and Mexican companies to export to the U.S. under the WTO tariff rate. That’s exactly what’s happening.

For example, the U.S. International Trade Commission found that imports from Canada and Medico paying the U.S. most-favored-nation rate “increased significantly” after USMCA replaced NAFTA. The Office of the U.S. Trade

Representative observed this same trend, stating that the “evidence suggests that suppliers are not attempting to claim USMCA preference for a growing share of automotive parts trade.”

https://thehill.com/opinion/international/4919653-auto-workers-trade-policy-usmca/amp/

AUTOMOTIVE JOBS

Before COVID during what Trump described as the greatest economy

Before the pandemic’s March 2020 onset, auto and parts manufacturing employment rose by 27,900 jobs under Trump.

During Biden’s presidency, employment in auto and parts manufacturing rose by 127,800 jobs through December 2023, or about half of the 250,000 jobs Biden claimed in his UAW speech

During Trump’s presidency, the number of manufacturing and dealer jobs collectively declined by 86,600, which qualifies as "tens of thousands." Before the pandemic, the number of jobs under Trump grew by 67,100.

So far for the Biden presidency, the combined job gains in these two categories have been 259,200, close to what Biden told the UAW.

It could be argued those gains were a result of USMCA but its a long way from what was promised

In conclusion Trump takes credit for an economy that had been improving each year since 2013 following that last Republican economic disaster known as the Great Financial Crisis. He points out we had the greatest economy ever before COVID but in late 2019 the Fed was pumping $ billions of dollars into the Repo Mkt due to the September Repo Market Crisis and by December we were in a Manufacturing Recession

Despite promising to eliminate NAFTA he simply renamed it. Jobs continued to flow to Mexico. He was going to rebuild Infrastructure but we didn’t see much of that beyond a partially built wall built in part from funds he took from FEMAS disaster fund. Mexico didnt pay a penny, meanwhile Fentanyl Deaths increased by 3 x

The rate of overdose deaths involving fentanyl spiked by 279% between 2016 and 2021 from 5.7 per 100,000 to 21.6 per 100,000, according to a report published early Wednesday by the National Center for Health Statistics' National Vital Statistics System -- which looked at death certificate records.

Trumps plan for a 2nd term would be an outright disaster. The cost of Tarrifs and Mass Tax Cuts and Deportations would be the end of the US.

Harris Economic Plan

She lays it all out here

https://kamalaharris.com/wp-content/uploads/2024/09/Policy_Book_Economic-Opportunity.pdf

Here is a brief extract with some editing for brevity

TAXES

Harris will lower taxes for the middle class and ensure no one earning under $400,000 pays more in taxes

After Trump slashed corporate taxes during his presidency, the effective tax rates for large U.S. companies sank below 10 percent. They didn’t pass on the benefits of these very tax cuts to workers or meaningfully increase investment in the United States. In fact, some companies moved jobs and profits overseas.

The Harris plan will raise the corporate tax rate to 28 percent—still well below the rate that was in place before the Trump tax cuts

Harris plan will also quadruple the tax rate on corporate stock buybacks to encourage businesses to invest in growth and productivity. If you remember stock buybacks used to be illegal until Reagan overturned it

Those who earn $1 million a year or more, the tax rate on their long-term capital gains will increase from 20 percent to 28 percent—the same rate previously put in place in the 1986 bipartisan tax reform

Trump’s 2017 tax law gave huge tax breaks for the very wealthy and the largest corporations. By 2020, Trump’s final year in office, 55 of the largest U.S. companies that were making $40 billion in profits paid no federal tax and instead received billions in tax rebates.

One study found that, between 2010 and 2018, the top 400 billionaire families in the United States paid an average of about 8 percent in federal income tax.

Harris proposed to restore the expanded Child Tax Credit and to make it a permanent law. It will provide a tax credit of up to $3,600 per child for the middle class and the most working families with children.

Harris’s plan includes an expansion of the Child Tax Credit: providing $6,000 in tax relief for middle-income and low-income families for the first year of their child’s life.

Harris is proposing an expansion of the Earned Income Tax Credit to cover individuals and couples in lower-income jobs, who are not raising a child in their home, to cut their taxes by up to $1,500.

INFLATION

Harris will crack down on unfair mergers and acquisitions that give big food corporations the power to jack up food and grocery prices and focus on investigating and prosecuting price-fixing

up and down food supply chains

Under the Biden-Harris Administration, the Sergeant First Class Heath Robinson to Address Comprehensive Toxics (PACT) Act has expanded screenings, health care, and benefits for millions of veterans, with more than one million claims approved.

Harris worked with cities and states through the American Rescue Plan to eliminate $7 billion of medical debt for nearly 3 million Americans.

Harris will:

• Extend the $35 cap on insulin and $2,000 cap

on out-of-pocket costs to all Americans, not just seniors.

• Accelerate the speed of Medicare prescription drug negotiations to allow Medicare to negotiate the price of prescription drugs and cut the cost of some of the most expensive and most commonly used drugs by approximately 40 percent to 80 percent starting

in 2026.

HOUSING

The most significant existing federal policy lever to address the affordable housing crisis is the Low-Income Housing Tax Credit (LIHTC), a tax credit that helps make it financially viable for private and non-profit developers to build affordable rental housing. This program works by helping developers cover the large upfront costs that come with building affordable units. Harris will expand this tax credit to significantly expand affordable rental supply by more than 1.2 million new affordable homes, which will reduce rental prices.

Harris would create a new Neighborhood Homes Tax Credit, which would support the new construction or rehabilitation of over 400,000 owner-occupied homes in lower income communities. The credit would only be available for single-family affordable homes that will be occupied by the owner,—not supporting private equity homebuyers that simply seek to turn a profit.

Moody’s finds that, even as the building of new homes reached record levels in 2023, “homebuilding has been at the higher end of the housing market. Demand by higher-income and wealthy households has been much stronger, and the higher house prices and rents that builders can charge these households have been a strong incentive to build more.

The margins that builders could get from building affordable housing have been too low to incent the investment, with pricing too low to adequately clear the high fixed costs of building.”

Harris is proposing a tax cut specifically targeted at encouraging homebuild- ers to build affordable homes for first-time homebuyers.

State and local regulations can be a barrier to building more. Vice President Harris’s plan include financing the construction of new housing paired with efforts to reduce regulatory burden and cut red tape, employing innovative building and construction techniques to lower costs

Large corporate landlords have increasingly used private equity–backed price-setting tools to dramatically raise rents in communities across the country. During the pandemic, many landlords of large multi-family units used these price-setting tools to institute dramatic rent increases. They can increase profit margins by raising rents, even if it means more apartments are vacant.

Harris is calling on Congress to pass the Preventing the Algorithmic Facilitation of Rental Housing Cartels Act, to crack down on companies that contribute to surging rent prices by making these unfair practices illegal under antitrust laws.

The “share of investor purchases” made by large investors with portfolios of 100 properties or more grew from 14 percent in September 2020 to 26 percent in September 2021, according to the Joint Center for Housing Studies. In 2021, large institutional investors bought 28 percent of homes in Texas and 19 percent in Georgia (including 25 percent of purchases in Atlanta). Research from the Urban Institute finds that large corporate investors “may file for eviction more frequently than local owners with smaller portfolios.”

Harris is calling on Congress to pass the Stop Predatory Investing Act, by removing key tax benefits for major investors that acquire large numbers of single-family rental homes

Harris’s plan starts to expand the supply of entry-level homes, she will, during her first term, provide working families who have paid their rent on time for two years and are buying their first home up to $25,000 in down-payment assistance

NEW BUSINESS

New business applications averaged 430,000 per month in 2024, 50 percent more than in 2019. Harris is working to provide these businesses access to capital, including by launching the largest-ever direct Federal investment in small business incubators and accelerators

The Harris-Walz plan would:

• Set goal of 25 million new business applications

• Call for expanding the startup expense deduction

from $5,000 to $50,000

• Cut red tape, including by making it easier for small businesses to file taxes and removing unnecessary or excessive occupational licensing requirements

MANUFACTURING

Harris worked with President Biden and Congress to pass the most monumental set of investments in American manufacturing in generations. Collectively, the Bipartisan Infrastructure Law, the CHIPS and Science Act, the Inflation Reduction Act, and the American Rescue Plan have catalyzed more than $900 billion of investments in manufacturing and related sectors.

U.S. has already added over 700,000 manufacturing jobs under Vice President Harris, with many more to come as additional projects come online. Construction of new manufacturing facilities has already doubled

Harris transformational America Forward tax credit will be targeted at investment and job creation in key strategic industries. It will be structured as tax credits that prioritize doing right by American workers, protecting the right to organize and supporting investments that take place in longstanding manufacturing, farming, and energy communities.

Trump abandoned American manufacturing and established himself as one of the biggest losers of American manufacturing in our history. He failed to pass an infrastructure plan that could have increased demand for American manufacturing industries like steel. He ceded the production of the cars of the future to China. He passed a $2 trillion tax law that gave the largest multinational companies enormous tax cuts and created new incentives to ship jobs overseas. He passed no manufacturing legislation. He took no action to stop auto plant closures in places like Lordstown, Ohio.

The result: close to 200,000 American manufacturing workers lost their jobs under Trump’s watch.

WAGES-DEBT RELIEF

Harris will fight to raise the minimum wage, end the sub-minimum wage for tipped workers and people with disabilities, and eliminate taxes on tips for service and hospitality workers.

Harris has helped deliver the largest investment in public education in American history, provide nearly $170 billion in student debt relief for almost five million borrowers

Conclusion-while also not really addressing the deficit it is clear Harris is focused more on helping the working and middle classes. Big Corporations and Billionaires already have it pretty good. They need little help.

Its obvious reducing Military Spending has nothing to do with her or Trumps plans.

Recently she decided she needed to go after the Black Mens Vote. Call it Panic or Political Suicide , you decide.

Vice President Harris will build an Opportunity Economy where everyone has the opportunity to not just get by, but to get ahead. She knows that Black men have long felt that too often their voice in our political process has gone unheard and that there is so much untapped ambition and leadership within the Black male community. Black men and boys deserve a president who will provide the opportunity to unleash this talent and potential by removing historic barriers to wealth creation, education, employment, earnings, health, and improving the criminal justice system. Black men deserve a president who will deliver on promises and equip them with the tools and resources to make their aspirations a reality.

https://kamalaharris.com/wp-content/uploads/2024/10/FMfcgzQXJZxzLGgcKmSNQSXCRKXShwxJ.pdf

The absolute stupidity of this just reinforces my belief that the Democrats have tanked this election from Day 1. Black men make up 6% of the population and many are in jail or ineligible to vote due to felony convictions. They are not deciding the outcome of this election. This alienated not only non-black men, but black women as well.

Their insistence that the best way to fight racism is more racism and making

people hyperaware of racial categories — in the diversity, equity and inclusion way —seems intended to keep racism alive. After all, funding to combat racism like combating anti-semitism requires that there be racism and anti-semitism. So lets make more of it.

Kind of like the Wars on Drugs, Crime and Illegal Immigration. These are all now profitable industries. We have far more of all of them than before we went to War against them.

One exception is Crime because we have 20% of the Global prison population despite only 5% of the population. Up to 30% of all Americans have a criminal record, in certain states some felons cant vote even after they served their sentence

So there we have it. Kamala plan sans Black Men Trumps Trumps Plan, but its clear my 2023 prediction of a Trump Win was correct.

I doubt God will have mercy on a Nation Voting for the Greater Evil and supporting Genocide but Good Luck

This will probably be my last pre-election post barring something new coming up. Going to enjoy the last 19 days of Democracy , or at least the illusion of it.