Did You Know We Had a Wealth Tax During the Years Trump Described as The Richest Period in the History of the United States(1870-1913)

Recently I posted on Tariffs to correct Trumps Misinformation. However, I found myself wanting more information on how government was funded during these Golden Years (1870-1913).

Many Americans today are under the false impression Americans paid no tax beyond tariffs in those days.

First of all we have to understand that in those days the US was not trying to be an Empire and the Federal Government did not spend much. They pretty much let the States handle a lot of things and the States let the local governments (City, Town, County) handle many things.

So like today each level of government had its own way of generating revenue which included taxes. Between *1870-1900 states and local government collected twice as much revenue (6-8% of GDP) as the Federal Government (3-4% GDP). Today it’s reversed, but Federal Govt revenue is 20% of GDP and state and local revenue collection excluding revenue from Federal Government is about 10% of GDP.

*I exclude 1901-1912 because as a result of the Spanish American War and subsequent Occupation of Philippines and Cuba and decision to expand our Navy and build the Panama Canal our spending increased which resulted in a desire for new revenue sources that led to the Income Tax.

So basically government revenue being collected today as a % of GDP is about 3x higher and 2/3 of that is collected by the Federal Government.

So thats just for context.

I then became curious how the states and local governments were getting their revenue. It wasn’t the Federal Government and it wasn’t from Tariffs and few if any had an income tax.

Guess what? They had a Wealth Tax. It was called the US General Property Tax (GPT) . It was a comprehensive tax on all property, including personal and financial wealth, in addition to real estate and real assets including financial assets. This feature essentially made it one of the first “wealth” taxes.

For 90 years, the GPT remained a central tenet of the US political and economic system, representing a substantial share of all state and local governments’ revenues. The GPT was characterized by its very local nature, with multiple jurisdictions potentially competing for the same tax base and relatively uniform and high effective tax rates on all property.

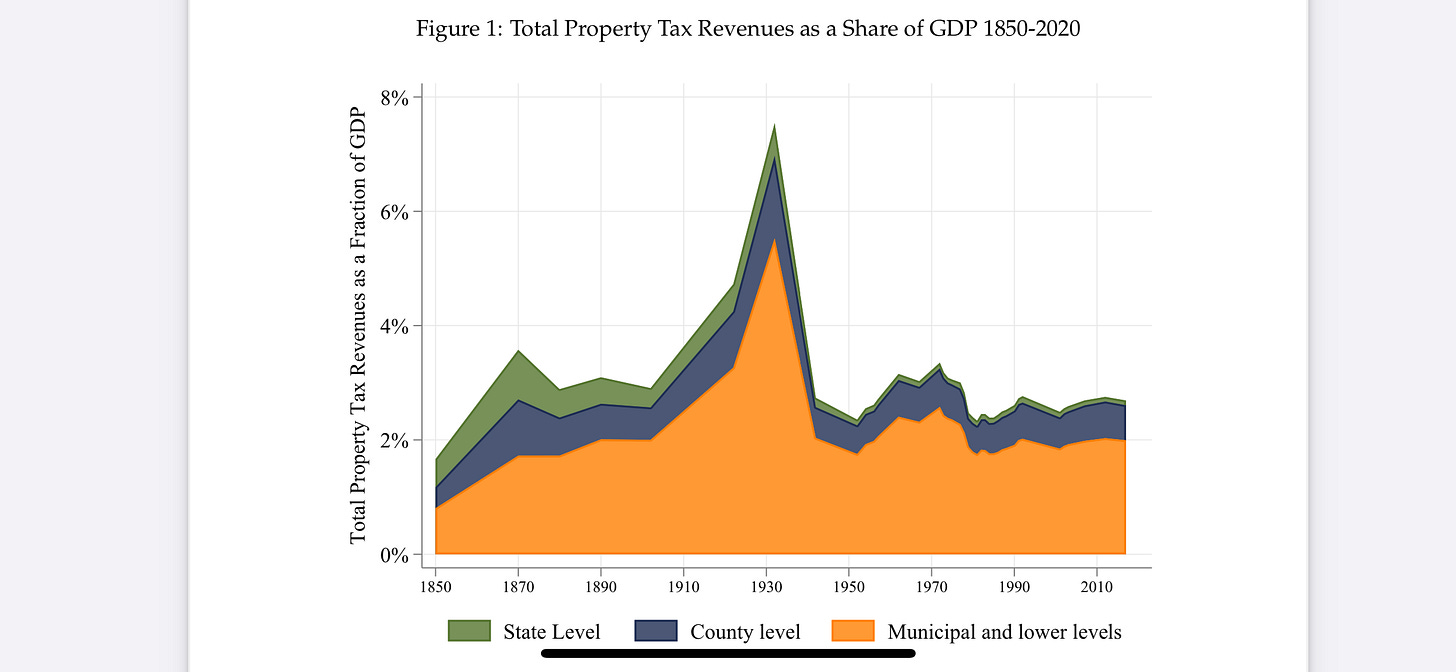

As a result, compared to European countries, the US relied heavily on the local taxation of wealth to fund its government expenditures, investments, and public goods. Only after the 1930s did the importance of the property tax decline, and newer forms of taxation and sources of revenues replaced it.

Over time, the property tax base shrank to eventually become the current US property tax, which is no longer “general” and falls only on (a fraction of) real estate wealth

https://www.nber.org/system/files/working_papers/w31080/w31080.pdf

I decided to check what ChatGBT said about it.

Chat GBT

The General Property Tax (GPT) was a major revenue source for many local governments in the United States during the 19th and early 20th centuries. It was a broad-based tax that applied to both real and personal property, including land, buildings, livestock, household goods, and business inventories.

Key Features of the GPT

1. Comprehensive Tax Base – The GPT was intended to cover all forms of wealth, not just land and buildings. Personal property, such as tools, machinery, and even financial assets, was also subject to taxation.

2. Locally Administered – The tax was levied and collected at the state and local levels, often by county or municipal tax assessors.

3. Uniformity Principle – Many state constitutions required that all property be taxed at the same rate, regardless of type or use. This principle was meant to ensure fairness but often led to practical enforcement challenges.

4. Assessment Challenges – Because personal property is harder to track than real estate, tax assessors faced difficulties in accurately valuing and collecting taxes on personal assets. Many taxpayers underreported or concealed their wealth to reduce their tax burdens.

5. Decline in the 20th Century – Over time, the GPT became less effective, particularly as industrialization and economic changes made personal property taxation more difficult to enforce. Many states began shifting toward more specialized tax systems, such as income taxes, sales taxes, and corporate taxes, to replace lost GPT revenues.

Why Did the GPT Decline?•

Difficulty in Assessing Personal Property – Unlike land and buildings, which are fixed and publicly visible, movable goods and financial assets were easier to hide or undervalue.•

Economic Shifts – As the U.S. economy moved from agriculture to industry and services, wealth became less tied to tangible property and more to intangible assets (stocks, bonds, patents), which were harder to tax.•

Equity Concerns – The uniform tax rate often placed a disproportionate burden on farmers and small business owners, while wealthier individuals with financial assets could more easily evade taxation.•

Rise of Alternative Taxes – The adoption of state income taxes, corporate taxes, and sales taxes provided more stable and enforceable revenue streams.

By the mid-20th century, the General Property Tax had largely evolved into the modern property tax, which focuses mostly on real estate rather than a broad base of wealth. However, remnants of the GPT still exist in some jurisdictions, particularly in local property taxation.

During the period from 1873 to 1900, there was a stark contrast in the amount of revenue collected by the federal government versus state and local governments in the U.S. The balance of taxation during this time was very different from today, with state and local governments collecting far more revenue than the federal government.

1. Federal Government Revenue (1873-1900)

The federal government primarily relied on: •

Tariffs (Customs Duties) – The largest source of federal revenue, often making up 50-60% of total federal income.•

Excise Taxes (“Sin Taxes”) – Taxes on alcohol, tobacco, and some luxury goods, which contributed around 30-40% of federal revenue.•

Other Minor Sources – This included land sales and fees, but these were relatively small.•

No Income Tax – The federal income tax had been briefly implemented during the Civil War but was struck down by the Supreme Court in 1895 (Pollock v. Farmers’ Loan & Trust Co.).

Total Federal Revenue:• In the late 19th century, the federal government typically collected about 3-4% of GDP in total revenue, far less than today.

2. State and Local Government Revenue (1873-1900)

Unlike today, state and local governments were the dominant tax collectors in this period. Their primary revenue sources included:

• General Property Tax (GPT) – The single largest source of revenue at both the state and local levels, taxing both real and personal property.• Fees and Licenses – Including business licenses, vehicle fees, and professional licensing.

• State Excise Taxes – Some states levied additional taxes on alcohol, tobacco, and other goods.•

Local Assessments & Special Taxes – Used for infrastructure, schools, and public services.

• No State Income Tax or Sales Tax – State income taxes did not exist, and sales taxes would not appear until the 20th century.

Total State & Local Revenue:• State and local governments collected an estimated 6-8% of GDP, roughly twice the revenue of the federal government.

Comparison of Revenue Share (Approximate)

Level of Government Share of Total Tax Revenue

Federal Government ~30-40% (Mostly from tariffs & excise taxes)

State & Local Governments ~60-70% (Mostly from property taxes)

Key Takeaways:

1. State and local governments collected more revenue than the federal government – a complete reversal of today’s tax system.

2. Property taxes dominated state and local finance, while the federal government relied mostly on tariffs and excise taxes.

3. The federal government had a small fiscal footprint, as it was not involved in social programs like Social Security or Medicare, which didn’t exist yet.

4. This balance shifted in the 20th century, especially after the 16th Amendment (1913) allowed for a permanent federal income tax, which became the dominant revenue source for Washington, D.C

End ChatGBT

So what Trump and his Billionaire friends fail to tell you is that what Made America Great in the 19th Century and early 20th Century (and we did quite well until Reagans Tax Cuts and Neoliberal Economic) were not Tariffs it was a Wealth Tax, something far more scary to the Billionaires than an Income Tax since they can minimize their Income by taking Capitol Gains or borrowing money at rates far less than the Maximum Income Tax ( this is something Elon Musk did a Tesla) .

Now I am not recommending a wealth tax. As I mentioned in a previous post I favor a Transaction Tax, but I do think its important to know our True History and not the Lie being promoted by some.

End